How to Invest in Startups in September 2022

Want to know how to invest in startups? Startup investing can be hugely lucrative. But it is not easy. It means finding a company at its earliest stage – before it has gone into business, let alone listed on the stock market. The investor will be committing funds to a project with many uncertainties but many possibilities.

Below we look at two brokers where investors can buy shares in companies that were startups not long ago. We look into how to invest in companies before they go public. And we review six exciting startup projects – including, best of all, perhaps one of the most exciting crypto startups in 2022.

How to Invest in Startups – 4 Easy Steps

- Step 1: Research – Find a startup opportunity. Find ten! Maximise your options and do financial due diligence. Do not take action yet.

- Step 2: Speak to an Independent Financial Advisor (IFA) – Have you found the next Apple? Talk it through with an investment professional to avoid making a big mistake.

- Step 3: Engage with the startup – Try and get face-to-face with the startup team, if possible. Do more research before committing.

- Step 4: Invest only with money you can afford to lose – When it comes to the crunch, make sure your back is covered. And be sure to keep an eagle-eye on the startup as it progresses.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

Choose a Broker to Start Investing in Startups

If the investor is researching how to invest in startups before IPO (Initial Public Offering), then brokers exist which specialise in matching investment angels with private equity opportunities.

But how to invest in companies pre IPO is not a question most investors should be asking, unless their appetite for risk is massive. Having said that, when it comes to crypto presale opportunities – like the current presale of Tamadoge (TAMA) – can be hugely lucrative and reassuringly well-structured.

Arguably there is a point at an equity startup’s journey where the balance between risk and potential reward is best. That point is not when the company is brand new, but rather when it has just come to the markets post-IPO.

At this point, investors can be sure that the professionals agree that this is one of the better startup investments.

Full-service brokers – like Capital.com and eToro reviewed below – regularly offer exposure to the best new stocks – as well as penny stocks which can satisfy investors asking how to invest in small companies.

1. Capital.com – Popular CFD Trading Platform with Zero Commission on Stocks

![]() 5,600 markets are available to trade with Capital.com – including stocks, ETFs, forex, commodities and indices.

5,600 markets are available to trade with Capital.com – including stocks, ETFs, forex, commodities and indices.

With offices in nine countries, this broker serves over 400,000 investors. Capital.com is well-regulated, featuring coverage by the FCA, CySEC, FSA, and ASIC.

This broker charges zero commission on stock transactions (although spread fees apply). All transactions with Capital.com are handled as Contracts-For-Difference. This means that investors can go short on stocks as well as leverage trades. On CFDs like this, overnight fees apply.

Capital.com has a good reputation for being swift to bring shares to market which have just been released. This is a real boon for investors wanting to know where to invest in startups that have already shown some form:

- After its spectacular IPO in 2021, for example, electronic vehicle manufacturer Rivian was quick to feature on Capital.com’s list of available shares. (Investors can buy Rivian stock with Capital.com as well as eToro).

For investing on the move, Capital.com offers a free smartphone trading app. This has achieved a score of 4.2/5 on Google Play and an excellent 4.8/5 on the Apple App Store.

Read more about this broker with our full Capital.com review.

| Approx Number of Stocks | 1,000+ |

| Pricing System | No commission but spread fee |

| Deposit fee | NA |

| Payment Methods | Wire transfer, credit card, Apple Pay, Worldpay and Trustly |

| Top 3 Features |

Zero commission on stocks, excellent market news analysis, best cheap stocks |

Pros

- Wide spread of financial assets, including the most undervalued stocks

- Go short on stocks and other assets with CFDs

- Free smartphone trading app

- Leverage trades

- Regulated: FCA, ASIC, CySEC, NBRB, FSA

- 70+ technical charting indicators and tools

Cons

- Not available in the US

- CFDs only

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – Popular Social Trading Platform with Zero Commission on Stocks

Founded in 2007, eToro has served almost 29m investors in its 15 year history. It is regulated by SEC, the FCA, CySEC and ASIC.

Founded in 2007, eToro has served almost 29m investors in its 15 year history. It is regulated by SEC, the FCA, CySEC and ASIC.

Like Capital.com, eToro is a well-established full-service broker that offers zero commission on stocks. If an investor is figuring how to invest in new companies, both brokers offer a way to achieve this immediately post-IPO. eToro often features the best future cryptocurrency, for example – as well as stocks which will satisfy those researching how to invest in tech startups.

eToro offers:

- 3,000+ Stocks: 16 international stock exchanges and 17 business sectors covered.

- 264 Exchange-Traded Funds (ETFs): ETFs are a popular way of spreading risk by investing in many stocks at once.

- 68+ crypto coins plus crypto trading pairs: Investors can buy Bitcoin, Ethereum, and other major blockchain coins as well as less well-known low market cap crypto.

- Indices: 16 major indices may be traded using Contracts-For-Difference (CFDs).

- Forex: 48 pairs – focusing on the popular pairs like USD/EUR.

As a Social Trading specialist, eToro aims to make trading easy for beginners:

- CopyTrader: Investors may copy other, more experienced, traders for free.

- Smart Portfolios: 75 strategic positions available to buy into with a minimum investment of $500.

| Approx Number of Stocks | 3,000+ |

| Pricing System | No commission but spread fee |

| Deposit fee | NA but currency conversion applies if not depositing USD |

| Payment Methods | Buy stocks with Paypal (Europe only), credit card, wire transfer, and some payment wallets |

| Top 3 Features |

Zero commission on stocks, Copy Trader, top trending cryptos |

Pros

Cons

- $5 flat withdrawal fee

- Free crypto wallet a little cumbersome

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Research Startup Stocks

‘Startup stocks’ can be a confusing term. We might assume that it covers an enormous range of startup investment opportunities, including ‘crowdfunding’ initiatives for example. But if an investor wants to earn a return on their investment, they will need to rule out some initially-attractive options.

Crowdfunding – Do not Expect an Investment Return

There are over 450 conventional crowdfunding sites online. The two big players are Indiegogo and Kickstarter.

Indiegogo.com

Since its foundation in 2008, Indiegogo has funded more than 650k business ideas with over $1bn. Every month, 10m people visit the online platform and 19,000 campaigns are launched.

Kickstarter.com

![]()

Kickstarter.com is a huge player specializing in funding creative projects. Over 226k projects have been funded, with over $6bn committed in over 6m pledges.

Investors asking how can I invest in startups? should understand straight away that conventional crowdfunding is unsuitable for achieving personal investment goals.

Conventional crowdfunding projects do not generally offer a financial return on investment.

Rather, investing in a project will either not be rewarded at all, or rewarded with promotions or products relating to the startup business.

How to invest in startups boils down to equity crowdfunding, or investing directly in emerging companies immediately post-IPO.

How Does Investing in Startups Work?

Arguably the easiest way to invest in startups is to focus on:

- Equity startups (which have not listed on the markets with an Initial Public Offering).

- Emerging companies which have had an IPO and are listed as part of the micro-cap or low-cap markets like the US’s Russell 2000 and NASDAQ Capital, as well as the UK’s FTSE AIM.

Equity Startups

Equity startups are companies which have yet to have shares listed in an IPO (Initial Public Offering).

How to invest in startups like these is a question that must be answered differently according to the country we are talking about.

Equity Startups in the US

Until 2015, for example, US law restricted opportunities for private investors to commit funds to startups.

This tough approach was in place to try and ensure that the over-investment of the dot-com bubble and the financial crisis of 2007-2008 was not repeated.

But in 2015, the JOBS Act was passed. This made it easier for private investors to get access to equity startups. Companies can now raise up to $5m from crowdfunding – which means any US investor can get involved.

Now equity crowdfunding is divided by law into:

- Regulation A+ – non-accredited investors can invest a maximum of 10% of their annual income/net worth (whichever is the greater).

- Regulation Crowdfunding – non-accredited investors with annual income/net worth less than $107k may invest a maximum of 5%.

Further distinctions exist. So it is important for investors to do their research.

Accredited investors are classed as people with more than $1m in net worth (excluding their house) or having an annual income above $200k. This class of investors is generally given more leeway.

Equity Startups in Europe

Crowdfunding opportunities exist in Europe for equity startups.

Crowdcube – European Equity Crowdfunding Specialist

![]()

Crowdcube.com offers ready-made investment opportunities in European startups. It has funded over 1,000 businesses, with €1.2bn invested in all. This platform is rated 4.5/5 on Trustpilot.

How to Find the Best Startups to Invest in

The two biggest startup investing platforms available in the US are Wefunder and StartEngine.

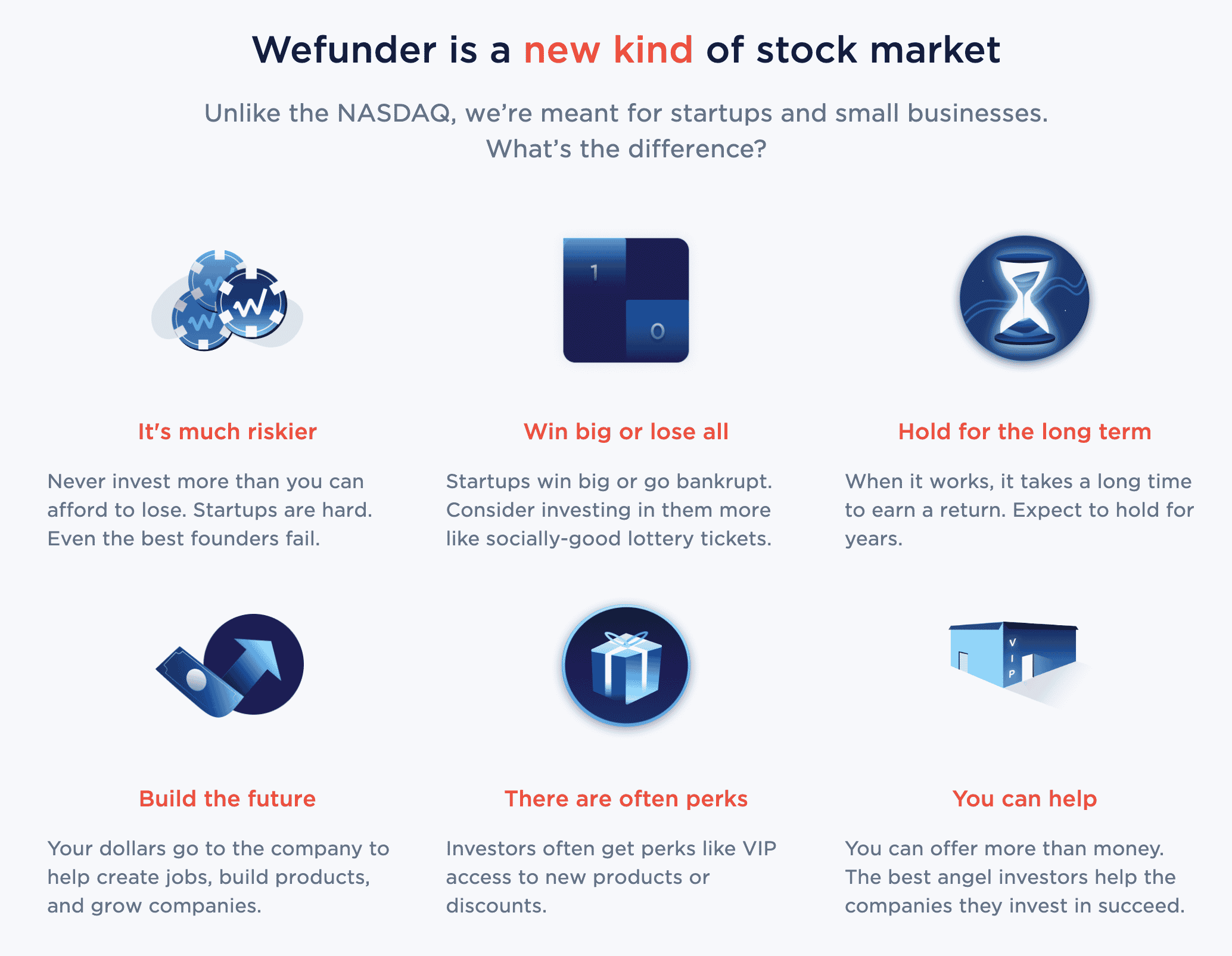

Wefunder – US Equity CrowdFunding Platform with $532m Invested

Wefunder claims over a third of the total US equity crowdfunding space. It has funded over 2,000 new companies with over 1.5m investors getting involved. Startups which began on Wefunder have gone to raise $5bn between them.

Potential investors can browse through investment options usefully grouped in categories: ‘VC and Notable Angel backed’, ‘New this Week’, ‘Closing Soon’ and others.

Plain-speaking Wefunder make some key points which apply to startup investing in general:

- ‘Startups win big or go bankrupt’.

- ‘Startups are hard. Even the best founders fail’.

- ‘When it works, it takes a long time to earn a return.’

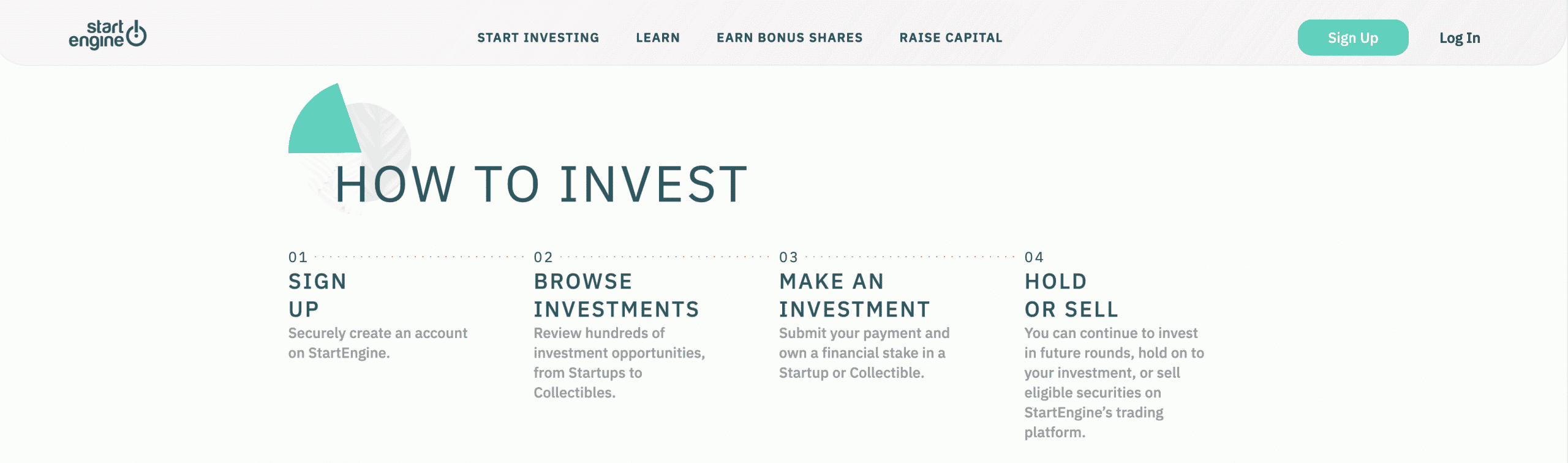

StartEngine – US Equity CrowdFunding Platform with 400k Investors

![]()

Like Wefunder, StartEngine offers real investment opportunities with potential financial rewards.

Investors can invest in stocks as well as convertible notes and rights to revenue share. If a company does well, these assets may be tradable later on conventional stock exchanges. In the meantime, StartEngine features its own marketplace for trading assets.

Other US equity startup platforms include Seedinvest, Republic, Microventures, and EquityNet.

If an investor wants to specialize in the best upcoming IPOs, then EquityZen is a relevant and popular trading platform.

5 Most Popular Startups to Watch in 2022

With such a choice of startups, where does an investor start? Here are 5 startups to invest in 2022 which have caught our eye.

1) FlexTal – Job Matching Platform with Venture Capital Backing

![]()

For investors newly figuring out how to invest in startups, one way to get some momentum is to follow the money. In other words, check out startups which professional venture capital firms are already backing.

Backed by investments from ID Ventures, Unicorn Ventures and Studio VC, FlexTal is a startup tech platform. The company is in recruitment, offering new efficiencies in hiring permanent, temporary and freelance staff. Reassuringly, CEO D. Beckett has experience in plenty of big firms like IBM, Intel and Uber.

The firm reaps an average revenue of $100k a month and has so far raised over $1m. FlexTal is available for investment with Seedinvest. A minimum investment of $5k applies. Investors receive a ‘SAFE’ note. This ‘Simple Agreement for Future Equity’ is convertible to equity further on down the company roadmap.

2) Groundfloor – Real Estate Investment Provider with 200,000 Users

![]()

Available with Wefunder at a minimum investment of $100, fintech firm Groundfloor has raised more than $38m from ‘notable angels, VCs and over 6,375 individual retail investors.’

The firm is an online platform that offers investment in short-term, high-yield real estate opportunities. Groundfloor already has upwards of 200k users and has won over 20 industry awards.

Groundfloor is the only company qualified by the SEC to issue payment-dependent real estate notes. It is on track to rake in revenues of $23m in 2022.

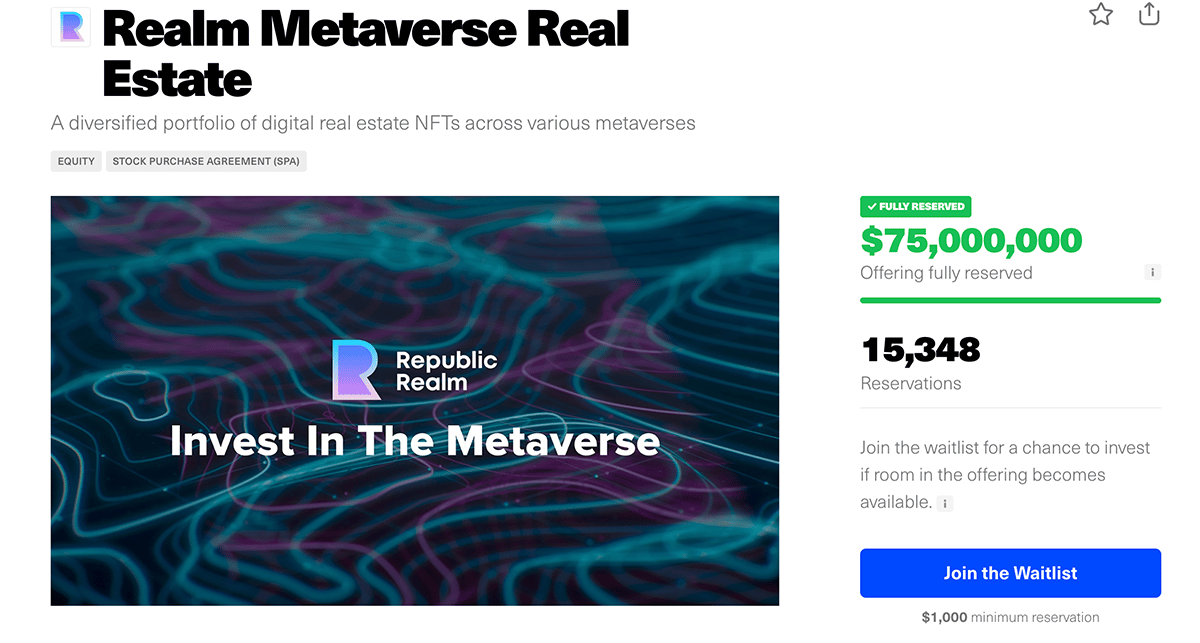

3) Realm Metaverse Real Estate – Diversified NFT Portfolio

![]()

An unusual offering this – a startup fund which invests in NFT assets across 13 virtual metaverses online.

For investors interested in how to invest in NFT companies, the most obvious route is to directly invest in popular NFT stocks.

Realm Metaverse, on the other hand, allows investors to commit funds to a spread of NFT assets in top metaverses like Sandbox, Axie Infinity and Decentraland.

Investing in a spread of NFT assets is a sensible way of reducing the risk of individual NFT investment – and involves a lot less hassle too.

Investors prepared to commit upwards of $1,000 can join the waiting list for Realm Metaverse at Republic, an equity startup platform specializing in crypto, video games and more conventional startups too.

Eagle-eyed crypto investors, of course, already have their eye on Tamadoge (TAMA) – billed to be the next Dogecoin.

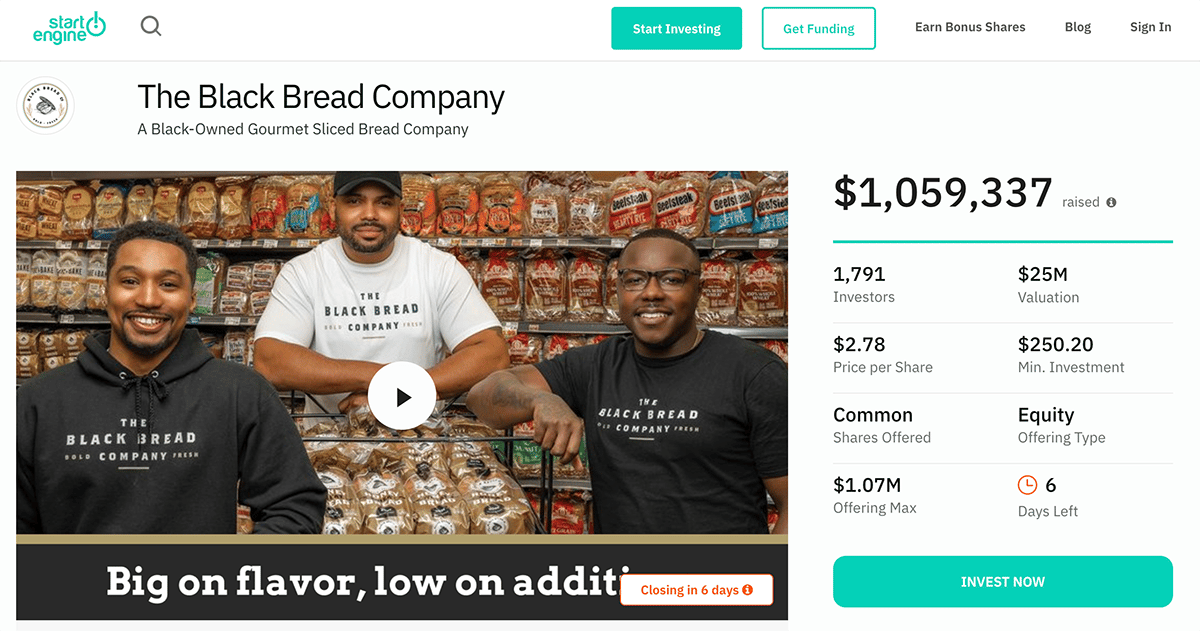

4) The Black Bread Company – Offered at $2.78 a share

An emerging business available to invest in with StartEngine, the Black Bread Company ‘taps into the under-represented segment of the bread industry that features black-owned businesses.’

The company provides bread that is additive-free and has racked up $263k sales revenue in the last 12 months. The firm has featured in the national press, which may account for its 45k followers on social media.

Common shares are available for investment, with a tiered range of investment incentives from $250 to $20,000.

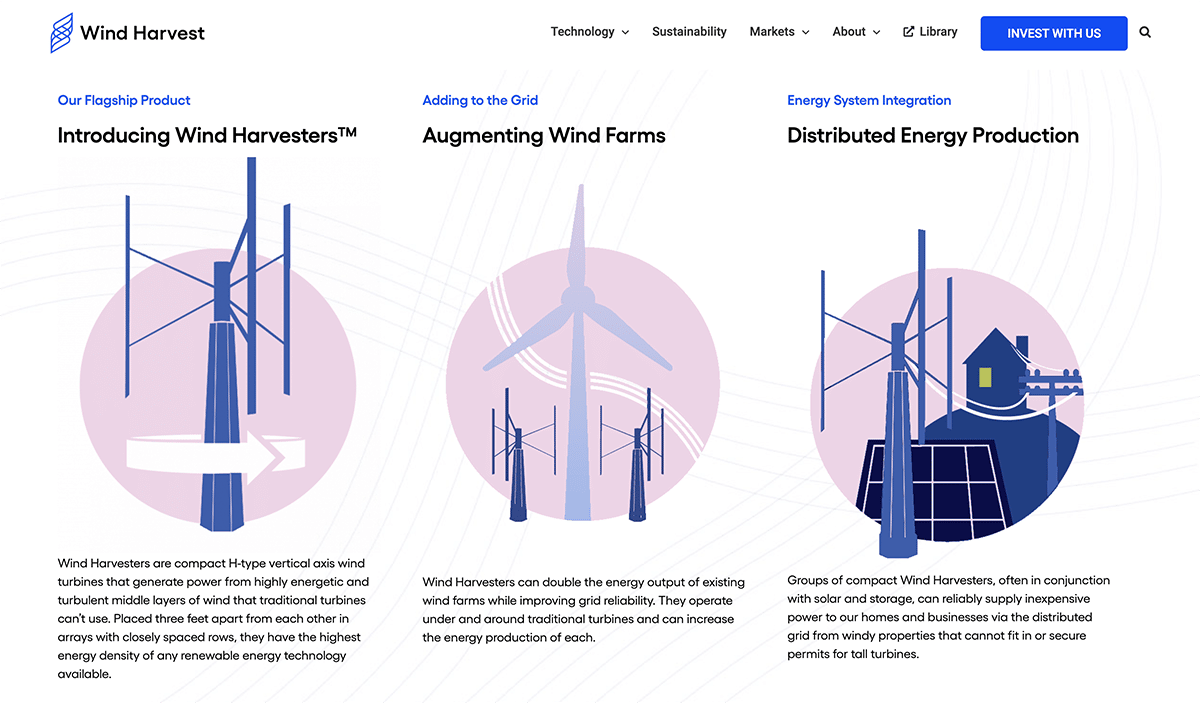

5) Wind Harvest – Startup Eco Investment

This company is about sustainable design innovation. It has designed a new way of harvesting wind energy. This involves ‘Wind Harvesters’ which can use turbulent, high-powered wind that conventional wind turbines cannot handle.

Wind Harvest is available for investment with Wefunder with a minimum investment of $100. Investors can expect an 8% return on their investment annually as part of a 5-year promissary note, as well as equity opportunities.

The company has already raised $14m through a variety of methods, including almost $1.5m from their previous crowdfunding campaign.

This is a tech project at a relatively early stage of development in a competitive field.

Are Startups a Good Investment?

Before an investor begins to work out how to invest in private companies, it is worth asking whether startups are worth it.

As an investment class, ‘startups’ is a woolly term taking in everything from one person working from their garage with a great business idea, to companies established on micro-cap indices like the FTSE AIM.

We would urge investors to consider more established startups first. It is very tempting to think that angel investing in local business opportunities, for example, is a viable form of investment. But the risks are ridiculously high.

People say that buying cryptocurrencies is risky. But, compared to investing in business ideas from the ground up, some might judge that crypto coins with the most upside present a more sensible way forward.

Startups vs Presale Cryptocurrencies – Which is the Better Investment in 2022?

Investors researching how to invest in companies before IPO (Initial Public Offering) should take a moment … and think about investing in crypto before ICO (Initial Coin Offering).

Buying coins pre launch can offer spectacular returns – even in the short-term.

In line with other markets, the crypto sector has endured a harsh winter since the new year. But the volatile nature of the sector means that, when the next crypto to explode is available, it pays to think about getting involved.

Billed as the next Dogecoin, the brand-new crypto Tamadoge (TAMA) is available right now in its exciting presale phase. It is exciting because TAMA wrapped up its $2m Beta presale phase way ahead of time. And now the price of TAMA is rising as the clock ticks down to launching on CEX LBank and then Uniswap.

Tamadoge matches the cutesy appeal of doggy crypto like Dogecoin and Shiba Inu with formidable play-to-earn and NFT mechanics. Centered around of the best Play-to-Earn games under development, the Tamadoge metaverse hosts players who each own a unique virtual pet. Players compete for TAMA by training and accessorizing their pets – and enjoy a casual but compelling gaming experience in the meantime.

Investors on the hunt for the hottest crypto right now will be aware that ‘all that glitters is not gold’. Sometimes, hot new startup opportunities are even scams. But experts have guaranteed that this is not the case with Tamadoge. Its smart contracts have been audited by specialists Solid Proof, and its team vetted by Coinsniper.

In order to buy Tamadoge right now, investors need to:

- Get hold of a Metamask or Trust crypto wallet.

- Buy some ETH or USDT to trade for TAMA.

- Connect the wallet at the online Tamadoge platform.

- Reserve TAMA before it all sells out.

| Min Investment | 1,000 TAMA (∼$10+ gas fee) |

| Max Investment | NA |

| Purchase Methods | ETH or USDT now; fiat currency soon |

| Blockchain | Ethereum (ERC-20 token) |

| Presale Ends | Q4 2022 |

Conclusion

When it comes to how to invest in startups, the opportunities really are endless. Hundreds of new projects come online every week.

A great place to start is with one the best crypto presales opportunities we have ever seen, which is the presale of Tamadoge (TAMA) – the meme/utility coin hybrid offering both NFT and play-to-earn potential.

Tamadoge (TAMA) – Next Big Meme Coin

- Presale 80% Sold Out – $13M Raised

- Deflationary, Low Supply – 2 Billion

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets – Potential for Mass Adoption

- Play to Earn Utility – Rewards Token

FAQs

What is the minimum investment in startups?

Which startups is best to invest in?

Is investing in a start-up a good idea?

Can you invest in private startups?

Where can I find startups to invest in?

Do startups pay dividends?

Does Warren Buffett invest in startups?

Disclaimer

It is vital to always invest responsibly in awareness of all risks involved. Markets can be extremely volatile, so you should conduct extensive research before investing. Our site provides regular updates and diligently verifies all platforms it recommends, but you should form your own opinion and invest only what you can afford to lose. There is never any guarantee of a return on investment.