How To Invest In Genomics And Immunology

Ca-ssis/iStock via Getty Images

There is a complex code to human biology that, when properly understood, can be harnessed to treat, and perhaps even cure, many of the world’s most devastating diseases. Genomics and immunology companies are now breaking this code, stoking a healthcare revolution that is giving us a groundbreaking upper hand in fighting disease.

Genomics is the study of the complete ordered set of our genes (our genome) and how variations in them contribute to the likelihood of developing illnesses. This in turn can lead to the development of more precise and effective treatments.

Immunology refers to the study of immune systems. Recent immunology breakthroughs offer roadmaps to immune systems that are giving way to new immunotherapies that augment or initiate immune responses.

Genomics and immunology share similar tailwinds, including technological innovation, particularly in genome sequencing and A.I. and demographic drivers like the mounting burden of disease amid aging global populations.

Investors are taking notice of the transformative potential these sciences hold. Global venture capital biotech investment totaled $78 billion across 2020 and 2021, $13 billion more than the prior four years combined, while biotech ETFs saw $7 billion of net flows.1,2

And these investments are driving significant value creation – the enterprise value of all biotech companies, public and private, reached an estimated $2.0 trillion in 2021, 4.1x that of 2017.3

Genomics is uncovering why we get diseases and how we can eradicate them

Over 10,000 diseases are the result of just one mutated gene, and are therefore potentially treatable by targeting that single culprit.4 This fact offers perspective on the potential genomics offers to treat a wide range of disorders.

Diseases with more complicated genetic links could be next. 70% of Alzheimer’s cases are genetic, but instead of a single gene, the disease can be attributed to a wider variety that grows by the year. Genomics provides insight into the roots of diseases, giving way to genetic medicines which could move diseases like Alzheimer’s into the rearview.

Genome sequencing is the key to unlocking our genetics

Genome sequencing is fundamental to innovation in biotechnology. Sequencing technologies make sense of our genomes and produce the genetic codes used to uncover genetic links to disease and develop targeted therapeutics and treatments, a concept otherwise known as precision medicine.

The impact of these technologies is more than just conceptual. The pandemic served as a testing ground for genome sequencing with researchers publishing the genome sequence of SARS-CoV-2 just 12 days after global fears of the novel virus first arose – similar efforts took more than seven months during 2003’s SARS outbreak.5

Without the advances made in genome sequencing over the past two decades, none of this would have been possible. The first whole human genome sequence took 13 years and nearly $5 billion to sequence, and was, as recently discovered, also incomplete.6,7

Today’s technologies can sequence a useable genome in about an hour for a little over $550, and, just last year, finally completed our genome for the first time.8,9

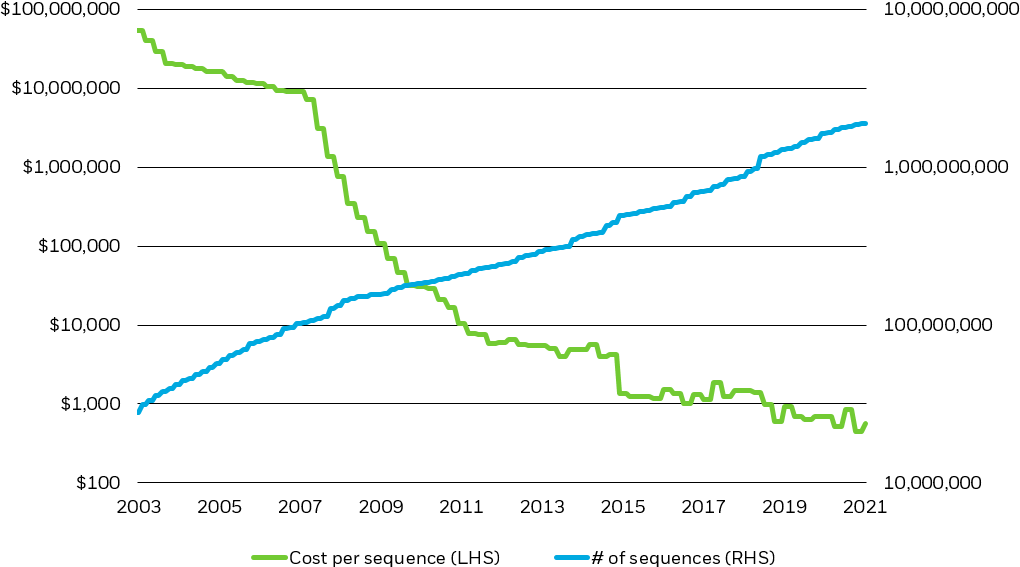

Technological advances drastically lowered the cost of genome sequencing, catalyzing today’s genomics and immunology-led healthcare revolution

Cost per genome sequence ($, LHS) & Cumulative Number of Sequences Recorded (RHS)

Note: Chart is scaled logarithmically.

Source: National Human Genome Research Institute, Gen Bank, BlackRock, 2022.

Chart description: Line chart plotting the cost per genome sequence and the cumulative number of genome sequences over time on a logarithmic scale. This chart shows how the cost of genome sequencing dropped exponentially over the past two decades, driving exponential growth in the number of genome sequences completed.

As new technologies continue to produce novel genomic insights and the pandemic-driven adoption of sequencing expands our genomic knowledge, potentially benefitting genome sequencing companies, we expect to see an accelerated positive impact on downstream applications like precision medicine.

mRNA treatments: Potential beyond the pandemic

Perhaps the best-known example of genetic medicine – and of where genomics and immunology overlap – mRNA (messenger RNA) therapeutics combat diseases by inducing our immune systems to raise its defenses.

These drugs deliver disease-specific code to our cells’ protein factories, or ribosomes, to simulate illness, then inducing the natural production of neutralizing antibodies.

Key to this is the use of new-age nanoparticles that overcome past challenges of getting mRNA molecules, which are somewhat large, into our cells. Nanoparticles can easily travel through cell walls and this attribute makes them the perfect chaperone for delivering mRNA.

The success of mRNA vaccines in combatting COVID-19 is a case study of how genome sequencing can lead to efficient and precise drug development. Among many biopharma companies, we are already witnessing the emergence of robust mRNA pipelines that target many of the world’s most deadly and prevalent diseases.

Of note, human clinical trials for an HIV mRNA vaccine kicked off this past January. Up to 45.1 million people are currently living with HIV and there is no cure for the deadly disease.10 If successful, such a vaccine could deliver transformative social good, while disrupting the $28.8 billion market for existing interventions.11

With many already approved, gene-silencing drugs could offer treatments for prevalent diseases

Gene silencing is the most proven genetic medicine approach, with over a dozen drugs that use this mechanism already on the market.12 This approach combats disease by intercepting the instructions, or mRNA, disease-related genes send out and cause disease.

Gene-silencing drugs can be segmented into two primary classes: those that bind to and mute culprit mRNA (antisense oligonucleotides a.k.a. ASOs); and those that degrade culprit mRNA and render them ineffective (short interfering RNA or microRNA a.k.a. siRNA or miRNA).

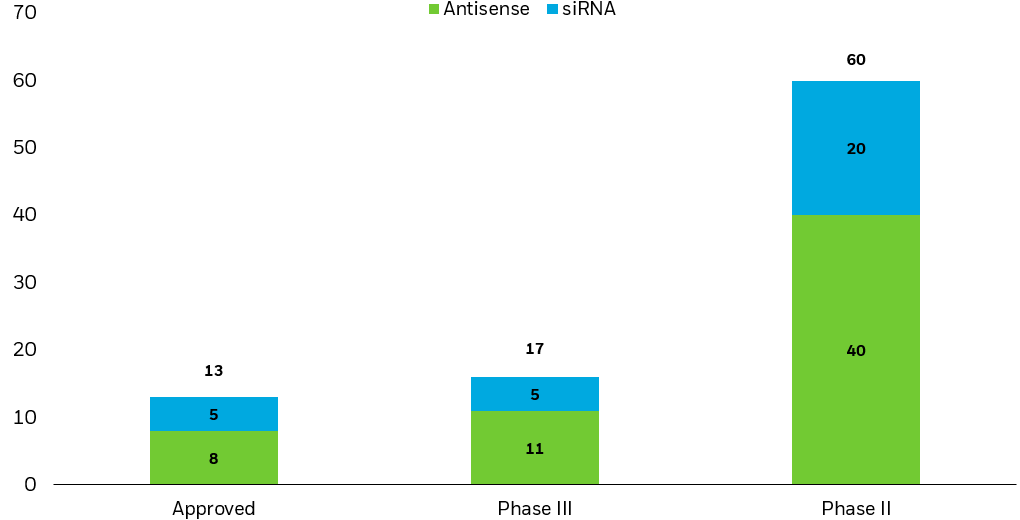

Gene-silencing drug approvals could bode well for success of robust existing pipeline

Gene-silencing drugs by development stage (# of drugs, by class)

Note: ASOs, or antisense oligonucleotides, are drugs that bind to and mute disease-related mRNA, while short interfering RNA and micro RNA, or siRNA/miRNA, are drugs that degrade it.

Source: Moumné et al., “Oligonucleotide therapeutics: from discovery and development to patentability.” Pharmaceutics 14.2 (2022): 260.

Chart description: Stacked column chart showing the number of gene-silencing drugs that are approved or in phase 2 or 3 clinical trials, across ASO, or antisense oligonucleotide, drugs and siRNA, or short interfering RNA, drugs. The chart shows how gene-silencing drugs have a meaningful number of approvals and drugs in late-stage clinical trials.

While many of the approved gene-silencing drugs treat rare conditions, their development and approval should be seen as proof of concept. There is a large pipeline of drugs in late-stage clinical trials (phase 3) across a wide range of conditions including various cancers, cardiovascular disease, ALS, Huntington’s disease, hemophilia, and more.13 Further, the before-mentioned success of lipid nanoparticles should help these drugs overcome past limitations in drug delivery.14

Gene therapy and gene editing could offer permanent cures to once-incurable diseases

Gene therapy and gene editing go a step further. They permanently knock out culprit genes by replacing them with healthy copies of the gene, in the case of gene therapy, or removing them entirely, in the case of gene editing.

As of today, there are only four FDA-approved gene therapies, though approvals are accelerating – two of the four came in August and September of 2022.15

There are also many in late-stage clinical trials, including a number of oncological gene therapies that seek to inhibit the metastases of cancer cells at the genetic level.16

Gene editing drugs are earlier on in development, but, encouragingly, a drug for a type of genetic blindness entered clinical trials last year, marking the first instance of in-vivo, or in-the-body, gene editing.

Increased scale, technological advances, and growing regulatory appetite in genome sequencing, some of which can be attributed to COVID-19, should act as a tailwind for this segment and the genomics companies within it, uncovering new genetic links to disease and what it takes to optimize one’s health.

Immunology taps into our own immune systems to fight disease

The body’s natural immune system could hold the key to fighting off deadly diseases. Equipped with knowledge detailing why one successfully or unsuccessfully combats illness, biotechnology companies are developing immunotherapies that either augment or simulate successful immune system responses.

Cell therapies: Using our own cells to combat and recover from illness

Cell therapies fight diseases using reengineered human cells. Some cell therapies work with the immune system to attack diseases head-on. Adoptive cell therapies, for example, use genetically altered immune system cells with disease-fighting “superpowers” to target and attack diseased cells.

They include CAR (chimeric antigen receptor) T cell therapies, TIL (tumor-infiltrating lymphocyte) therapies, engineered T cell receptor therapies (TCR), and NK (natural killer) cell therapies.

Notably, CAR T cell therapies are already having notable success in fighting cancer. Last year, treatments targeting lymphoma and leukemia became available in the US.

Outside of adoptive cell therapies, other cell therapies treat diseases by introducing healthy cells that are modified to reverse disease progression, or that simply replace dead or missing cells.

Traditionally, these include bone marrow transplants and blood transfusions, but today, they also include treatments for physical injuries and age-related wrinkles.17

Antibody treatments mimic and augment our immune systems to fight disease

Antibody treatments, for example monoclonal antibodies, are a type of immunotherapy that stand out for their ability to effectively combat disease and be rapidly developed and deployed to fight new threats like COVID-19.

Informed by one’s own immune system, these treatments feature lab-created antibodies that latch on to viruses or diseased cells to stop them from spreading.

In many cases, this buys time for immune systems to kick into gear and fight back; however, for diseases like cancer, where the immune system often falls short without help, antibody drug conjugates (ADC) go a step further.

ADCs work with antibody treatments to not just buy time, but also proactively attack diseased cells while leaving healthy ones intact. At the end of 2021, there were 14 approved ADCs globally across a range of cancers.18

Targeted exposure to the genomics and immunology value chains

Investors seeking exposure to genomics and immunology stocks and advances in each field may want to consider ETFs targeting companies that generate the majority of their revenue from related therapeutics and technologies. These include:

- Genome sequencing and genetic diagnostic technologies: Sequencing devices, components, and services, as well as those related to genetic testing

- Genetic medicines: mRNA therapeutics, gene-silencing drugs (ASOs, siRNA, miRNA), gene therapies, and gene editing therapeutics

- Immunotherapies: Adoptive cell therapies (CAR-T, TIL, TCR, NK therapies), regenerative cell therapies, monoclonal and polyclonal antibodies, and antibody drug conjugates

Conclusion

Genomics and immunology are bringing about an age of precise and preventative medicine that is transforming our approach to care and driving positive outcomes across the healthcare system.

Drug developers are embracing this potential: There are over 6,000 drugs in active clinical trials, 67% more than in 2016, with 65% of such drugs coming from emerging biopharma companies – the majority of these leveraging innovations in genomics and immunology.19

If recent successes are an indicator of what’s to come, we expect a wave of curative therapeutics in the coming years. In our view, investors looking to invest in genomics and immunology may want to consider ETFs that provide exposure to pure-play stocks across their value chains.

|

© 2022 BlackRock, Inc. All rights reserved. 1 Dealroom.co, “2021, a breakthrough year for Healthtech & Biotech,” January 2022. 2 ETF flow data provided by Bloomberg, 12/31/19 – 12/31/21; ETF classifications provided by BlackRock Global Business Intelligence, with aggregate flows representing the sum of flows for ETFs classified as such. 3 Dealroom.co, “Health and Biotech – A European showcase,” May 2021. 4 Your Genome, “What are single gene disorders?,” accessed August 2022. 5 EMJ Microbiol Infect Dis. 2020;1[1]:34-37. 10.33590/emjmicrobiolinfectdis/20F10601. https://doi.org/10.33590/emjmicrobiolinfectdis/20F10601. 6 Genome.gov, “The Cost of Sequencing a Human Genome,” November 2021. 7 Nature, “Closing in on a complete human genome,” February 2021. 8 Genome.gov, “Fact Sheet: Human Genome Project,” August 2022. 9 Nature, “Closing in on a complete human genome,” February 2021. 10 United Nations, “Global HIV & AIDS statistics – Fact Sheet,” 2022. 11 Fortune Business Insights, “The global HIV drugs market is projected to grow from $30.46 billion in 2021 to $45.58 billion in 2028 at a CAGR of 5.9% in forecast period, 2021-2028,” June 2021. 12 Moumné et al., “Oligonucleotide therapeutics: from discovery and development to patentability.” Pharmaceutics 14.2 (2022): 260. 13 Ibid. 14 Nature, “Let’s talk about lipid nanoparticles,” February 2021. 15 BioPharma Dive, “Back-to-back gene therapy approvals give Bluebird shot at survival,” September 2022. 16 Clinicaltrials.gov 17 FDA.gov, “Approved Cellular and Gene Therapy Products,” September 2022. 18 Fu, Zhiwen, et al. “Antibody drug conjugate: the “biological missile” for targeted cancer therapy.” Signal Transduction and Targeted Therapy 7.1 (2022): 1-25. 19 Iqvia Institute, “Global Trends in R&D: Overview through 2021,” February 2022. Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Companies in the healthcare sector may be affected by government regulations and programs, changes in the cost of medical products and services, changes in the demand for medical products and services among other factors. Healthcare companies are subject to competitive forces that may result in product obsolescence. This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision. This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above. Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. © 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. iCRMH1022U/S-2457542 |

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.