Natural Gas Drilling Slides, GOM Gains in BKR’s Latest Tally

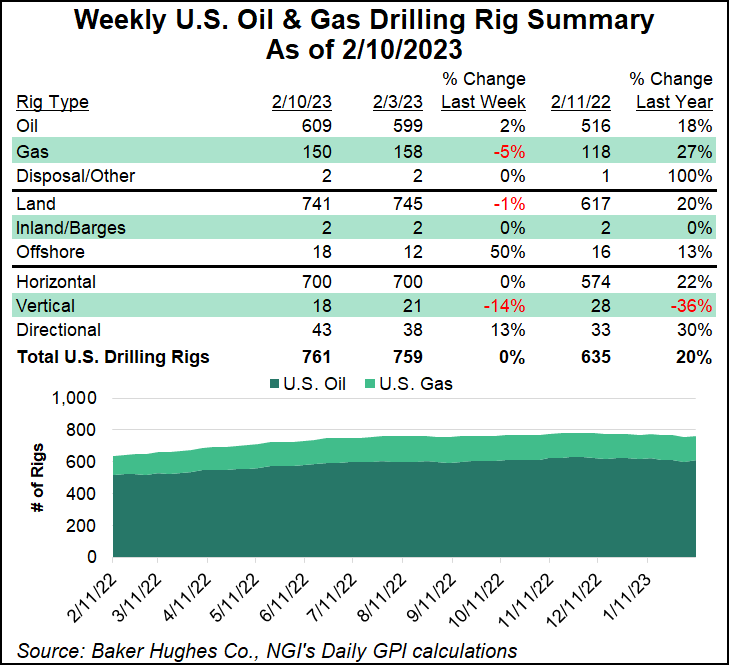

The U.S. natural gas rig count fell eight units to 150 for the week ended Friday (Feb. 10), while an increase in oil-driven drilling by 10 rigs pushed the total domestic rig count by two units to 761, according to updated figures from Baker Hughes Co (BKR).

Land drilling fell four units domestically, while GOM added six rigs week-over-week to finish at 18, up from 16 in the same period last year. Directional drilling increased a total of five units while vertical drilling decreased three rigs; Overall horizontal rigs stayed the same week after week.

The combined 761 active US rigs as of Friday compares to 635 rigs operating in the same period last year, according to BKR figures, which are based in part on data from Enverus.

The Canadian rig count, meanwhile, rose one unit to end the period at 250, up from 219 in the same period last year. Changes there included an increase in oil drilling by two rigs and the reduction of one natural gas-driven rig.

In terms of change by principal drilling region, BKR recorded decreases of four rigs at Ardmore Woodford and two rigs at the Permian Basin. The Barnett, Eagle-Ford, and Marcellus shales each lost one rig from their respective totals. On the other side of the ledger, two rigs were added at Cana Woodford, while Haynesville Shale added one rig week in and week out.

Counting by state, Louisiana added six rigs, while New Mexico added four. California added one drill rig for this period. Texas, meanwhile, recorded a seven-rig drop, while Oklahoma and West Virginia each dropped one rig, according to BKR data.

Onshore exploration and production (E&P) in the Lower 48 has plateaued for now due to multiple constraints while the international and offshore segments gain momentum, NOV Inc. CEO Clay Williams said during a recent discussion of the Oilfield service provider earnings results.

“After a strong increase in the first half of the year, the number of oil rigs in the USA has increased [has] have now found a near-term ceiling, just under 800 rigs, constrained by labor availability, among other factors,” Williams said. “North American E&Ps cite service availability as the biggest risk to meeting their production targets, but our oilfield service customers tell us crew availability is the real reason.”

Williams cited that “US oilfield wages in West Texas and North Dakota have increased by 20% to 50%,” along with higher daily rates, bonuses and overtime. “Chronically understaffed” crews are working overtime to fill vacancies, he said. “The new hires are hard to find and the crews that are successful in hiring new ‘green hands’ are less secure and demonstrably less efficient.”