MOO ETF: Agriculture Stocks Sport Value As Shares Consolidate

Clara Bastian/iStock via Getty Images

The VanEck Agribusiness ETF (NYSEARCA:MOO). crops, oil palms, sugar cane, tobacco leaves, grapevines, etc.) and trade in agricultural products.

MOO ETF has an elevated expense ratio of 0.52% considering it’s a basic industry ETF. The fund brings in a fraction of over 2% with assets of $1.3 billion. Despite being a large ETF, the volume is small, with just 35,000 shares traded daily. MOO owns 52 stocks and rebalances them quarterly, but don’t expect big changes for this fund as the industry’s components include some blue-chip names.

VanEck is a great marketer and is positioning this ETF as a play opportunity global population growth leading to increased food demand and the need for improvements in farming technology. Only companies that generate at least 50% of their turnover from the agricultural industry are admitted to the index and ETF. MOO has a 4-star rating from Morningstar for its performance and fees. The tradability is decent with a 30-day bid-ask spread averaging 11 basis points.

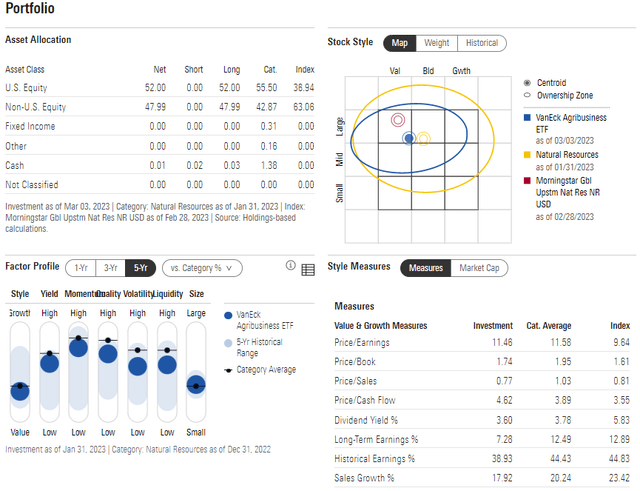

On closer inspection of the portfolio, the fund falls into the large-cap value quadrant in the top right of the Morningstar Style Box, but is not far from a mid-cap mixed fund. Still, the factor view shows that MOO is poised for value with moderate yield and increased momentum and volatility.

Trading at under 12 times earnings, with a solid long-term earnings growth rate, I see the fund as a sensible valuation play.

MOO portfolio and factor profiles

Morningstar.com

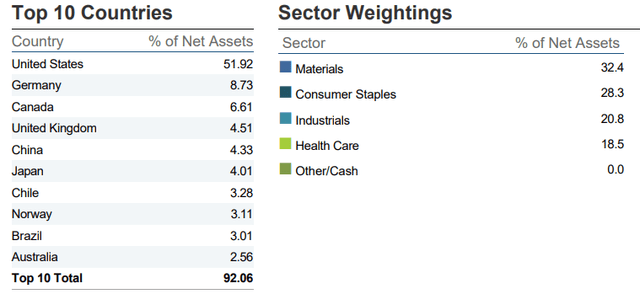

MOO is internationally diversified, while sector positioning focuses on four areas with a significant overweight relative to the S&P 500 in the resource-intensive commodities sector. Staple foods provide some beta ballast, while agriculture-focused industrials and healthcare round out the portfolio. So it’s not just a resource/stock game.

MOO country and industry presence

Van Eck

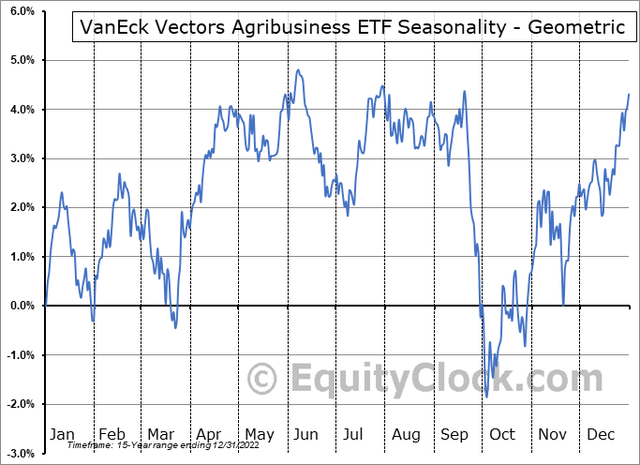

According to Equity Clock, MOO struggles from mid-April to mid-September. So we are nearing the end of the usual uptrend of the season from early October to mid-April.

MOO Seasonality: Some near-term upside

equity clock

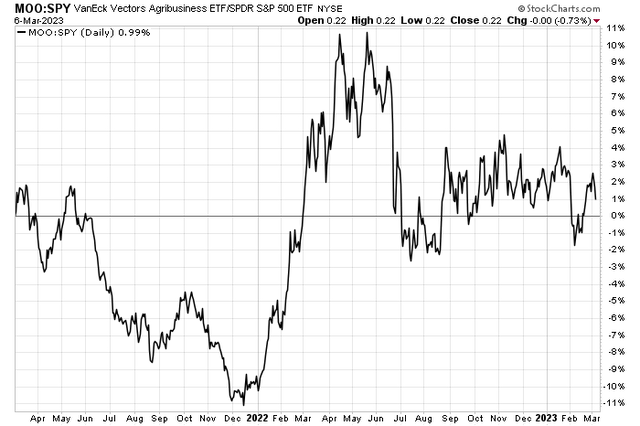

Relative to the broader market, MOO has meandered around the commodity boom that coincided with Russia’s invasion of Ukraine since the third quarter of last year after a big boost higher from late 2021 to early second quarter last year. So the relative strength is not impressive at the moment.

MOO Relative Strength Neutral since Q3 2022

stock charts.com

The technical recording

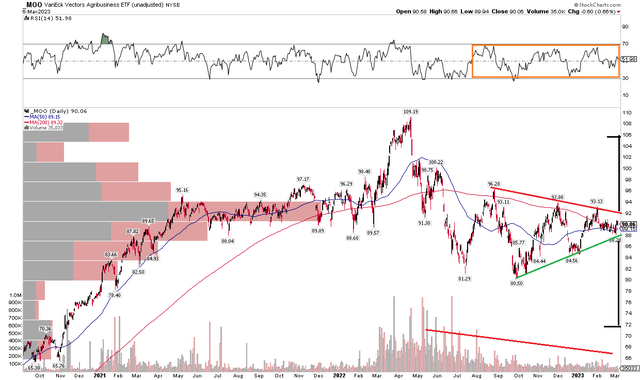

With a good valuation, cautious seasonality, and lackluster relative strength, I see a fundamental coil consolidation pattern on the chart. Notice in the chart below that stocks have made a series of lower highs and higher lows since last summer. The symmetrical triangle is formed as the RSI pulse meter is in the neutral range of 30 to 70. If the fund moves above $93, a measured price target near $106 would be in play.

A bearish breakdown would give a target of $74. The consolidation case is also underpinned by the volume profile, which shows a decline in traded shares since the second quarter of last year. Watch out for a large volume breakout or collapse from this wedge. Broadly speaking, this consolidation is expected to unravel on the downside as it comes after a dip from the $109 peak.

MOO: Coil pattern, looking for a breakout or collapse

stock charts.com

The final result

Ag stocks continue to disappear from the headlines. With a good valuation but a slightly worrying chart, there are mixed signals. Overall, however, I am bullish but am watching the $84-$88 area on the chart.