A dive into the latest inflation results…too soon to celebrate?

On the surface, the CPI figures for January seem to confirm that inflation has finally been defeated. But rising food prices and mortgage rates continue to weigh on household finances.

The CPI annual growth rate was 5.9% – the first time it has been below 6% since last February – and key inflation measures continue to ease.

However, observers point to continued price pressures on multiple fronts, driven mainly by food prices and high mortgage rates, that will need to be monitored in the coming months.

Mortgage costs are rising while housing prices are falling

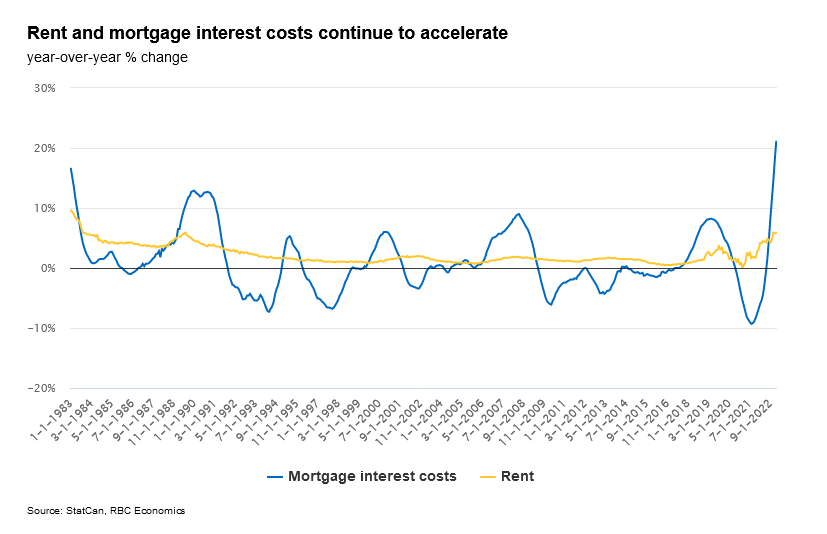

Mortgage interest costs continued to rise given the current high-yield environment. The mortgage interest cost index rose 21.2% year-on-year from a pace of 18% in December. That was the largest increase since September 1982, Statistics Canada found.

However, overall accommodation prices rose more slowly in January, at an annual rate of 6.6% compared to 7% in December.

This was thanks to slower growth in homeowner replacement costs (+4.3%), which is related to the cost of new homes, and other own accommodation expenses (+1.1%), which include property commissions.

Why the release is not as restrained as at first glance

Markets reacted to signs of weaker inflation, namely a weaker-than-expected month-on-month CPI growth rate as well as a slowdown in year-on-year indicators.

However, Scotiabank economist Derek Holt explained in a research note why he thinks the January inflation report is less dovish than some think.

“First, ignore the year-over-year readings as they offer little if anything useful given how heavily impacted they are by prior-year base effects. For example, [one] A year ago, Russia prepared to invade Ukraine and did so, sending multiple commodity prices higher,” he wrote.

“Second, the trimmed mean and weighted median CPI of core inflation remained firm at 3.7% m/m SAAR [seasonally adjusted annual rate] and 3.6% m/m SAAR in January, consistent with December levels,” he added. “They’re faster readings than November when they both fell to 3%, but not by much, and they’re still cooler than early last year when rates were double and higher.”

Bottom line, these core inflation rates are marginally “cooler, but not cool,” stressed Holt.

Others, such as Marc Desormeaux, principal economist at Desjardins, pointed out that while inflation indicators are moving in the right direction and the January reading was “one of the most optimistic since the start of our current inflationary predicament”, inflation is still “on country” is miles away from the 2 percent target.”

“We are encouraged by the continued easing of several core inflation measures, although it is far too early to declare victory,” he noted.

What it means for the Bank of Canada’s next decision

The Bank of Canada’s next interest rate decision on March 8th will take into account the latest inflation figures as well as the employment figures released last week.

“The Bank of Canada has now received two very different signals from the month of January,” Desormeaux noted.

He said that, on the one hand, robust employment suggests more work may be needed from the Bank of Canada. On the other hand, January’s inflation data, coupled with signs of slowing wage growth, suggest that “the painful medicine of much higher interest rates is having the desired effect”.

“The bank has stressed that in order to drop current plans to halt rate hikes, it needs a ‘gathering of evidence’ that inflation is not cooperating,” he added. “[Yesterday]The imprint of s indicates that further rate hikes may be avoided.”

But as Bank of Canada Governor Tiff Macklem confirmed before Parliament last week, the bank stands ready to give up a pause on interest rates if inflation proves stubborn and doesn’t return to the 2% target.

“This process of normalization is one of the most important things we’re watching to assess whether we’ve raised interest rates enough to bring inflation back on target,” Macklem said.

“And if we don’t see it continue to normalize, then we need to do more.”