Apple (AAPL Stock) computers trade idea, how to play the short-term trend accelerating higher

introduction

Volatility Markets offers trend-following trading ideas for momentum traders. The Volatility Markets Newswire measures a security’s direction and acceleration, then structures a trading idea to capitalize on the trend. While the past 100 years have shown that trends exist in the markets, they do no guarantee of future asset prices. You should take these ideas lightly and at your own risk. X Loading…

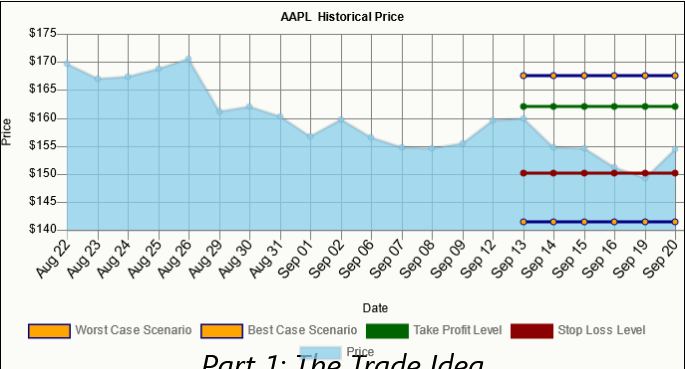

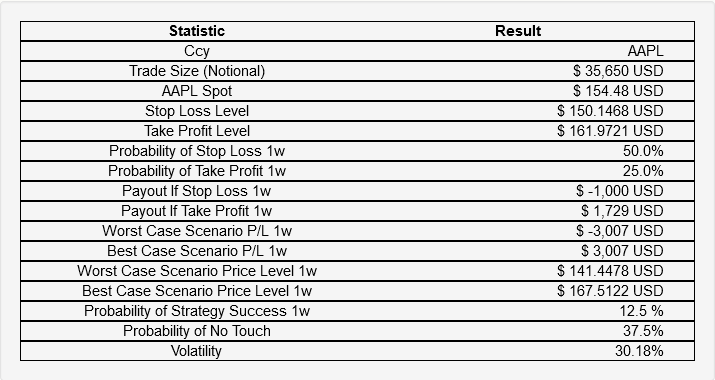

The Volatility Markets software suggests trading structures to profit from market trends. This article discusses a 1-week risky AAPL long trade idea that is designed to take advantage of the trend from the last session, which is accelerating to the upside.

Part 1: The trading idea

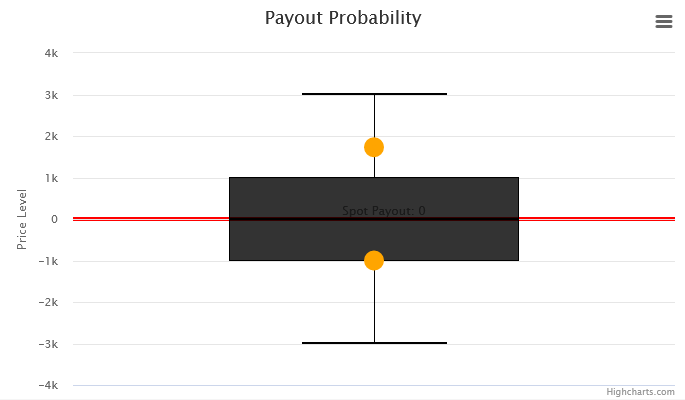

Long $35,650, take profit at $161.9721 with 25.0% chance for a gain of $1,729, stop at $150.1468 with 50.0% chance for a loss of $1,000 over a 1-week time horizon. We have found that the short-term trend is stronger than the long-term trend.

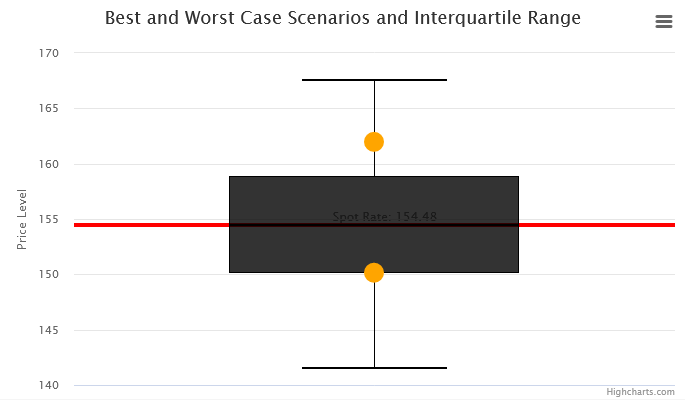

The boxplot below outlines the placement of the trade idea’s take profit and stop loss levels, the interquartile range of expected trade outcomes, and the best and worst case scenario for the whiskers.

Part 2: Market Summary

The central theses:

-

In the last 20 days, the AAPL price is up 9 days and down 11 days.

-

For every positive day there were 1.22 negative days.

-

The average return on days when the price has risen is 1.2797%.

-

The average return on days when the price has fallen is -1.8606%.

-

In the last 20 days, the price has fallen by -8.96% percent.

-

The average return over the last 20 days per day was -0.448% percent.

-

Over the past 20 days, the price has accelerated on average: $0.1347 per day lower.

-

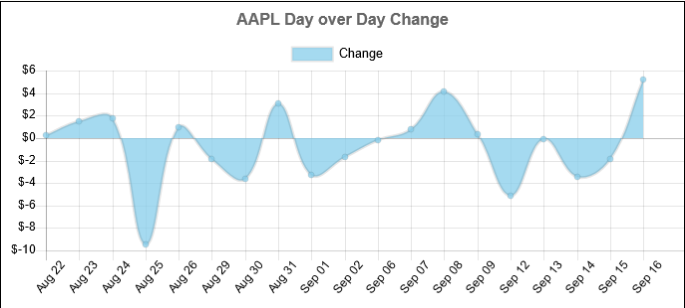

During the last session, the price increased by $5.17.

-

During the last session, the price increased by 3.3467%.

-

In the last session, the price accelerated by $3.27. Price today $154.48.

pricing

The last mid price today was $154.48

price changes

In the last 20 days, the price has fallen by -8.96% percent.

market distress

In the last 20 days, the AAPL price is up 9 days and down 11 days.

For every positive day there were 1.22 negative days.

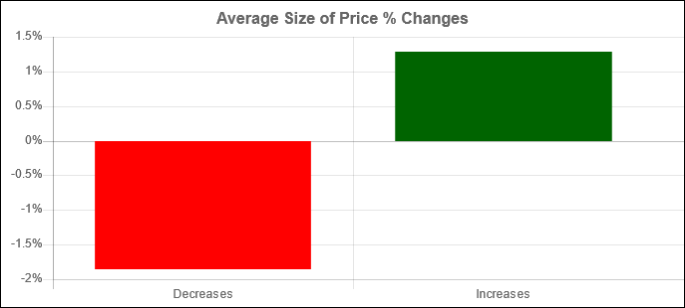

The average return on days when the price has risen is 1.2797%.

The average return on days when the price has fallen is -1.8606%.

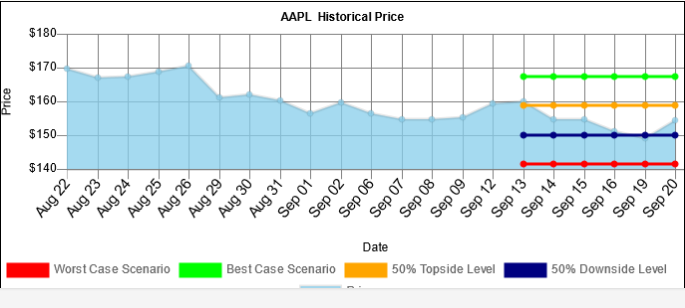

Expected range

Within a week, our worst case scenario where we are 95% confident this level is not trading for AAPL is $141.4478 and overnight best case scenario is $167.5122 . Levels outside of this range are unlikely, but still possible.

We are 50% confident that $150.1468 and $161.9721 could trade. These values are within statistical probability.

Part 3: Trade Idea Specifications

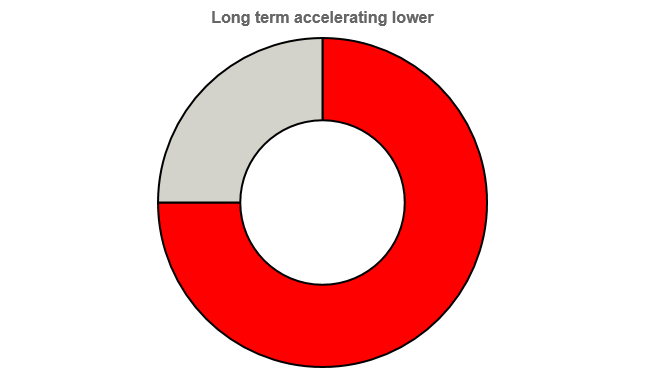

Long-term trend analysis:

This trade goes long when the price has been moving down and accelerating in the last 20 days.

Over the past 20 days, the price has accelerated by $0.1347 per day on average.

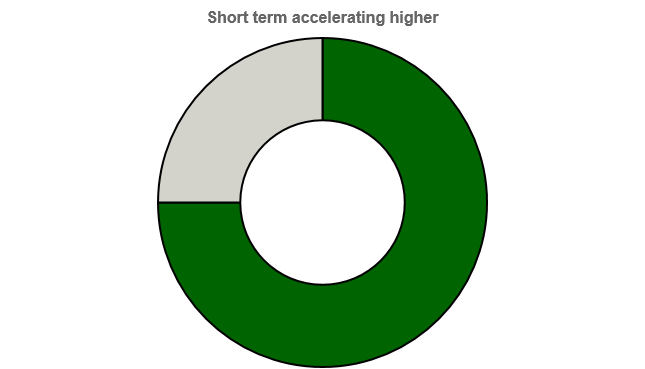

Short term trend analysis:

This trade goes long when the last change was higher and accelerating.

In the last session, the price accelerated by $3.27.

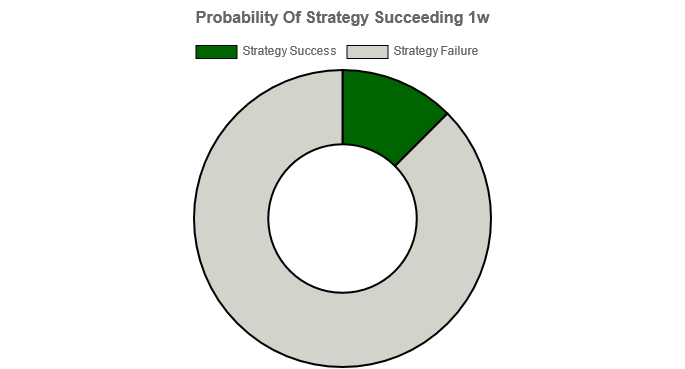

Part 4: Scenario Analysis

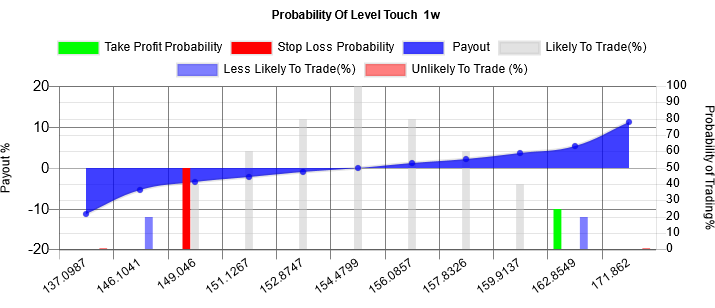

Probability vs Payout Chart:

This chart plots the percentage payout for holding a position versus the probability of the payout occurring. The red and green columns represent the probability of folding and taking profits and the associated payouts.

Scenario Analysis:

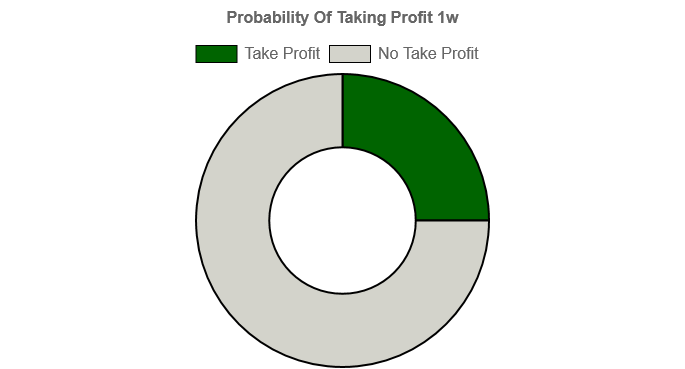

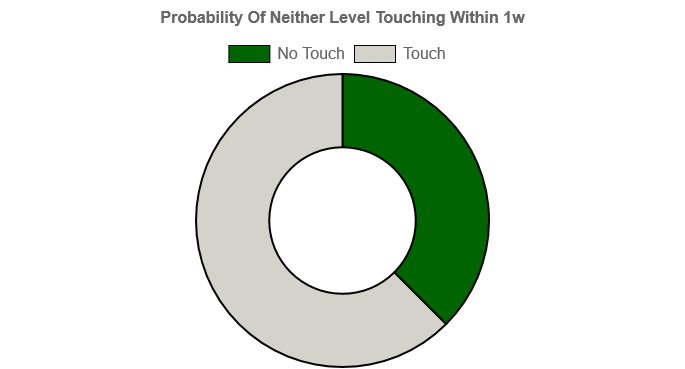

There is a 25.0% chance of the Take Profit level trading independently over the 1 week timeframe.

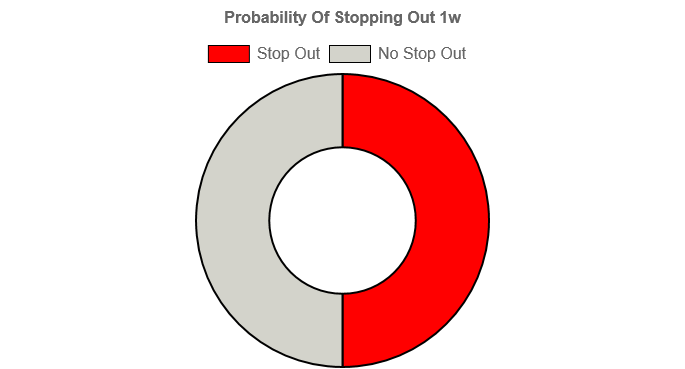

There is a 50.0% chance that the stop-loss level is trading independently over the 1-week timeframe.

There is a 37.5% probability that neither the Stop Loss level nor the Take Profit level will trade independently over the 1 week period.

There is a 12.5% probability that the strategy will be successful if the Take Profit level touches and the Stop Loss level does not touch over the 1 week time frame.