Colder Euro Model Trends Boost Natural Gas Futures Ahead of Latest EIA Storage Print

Buoyed by colder forecasts for late February-early March, natural gas futures rose in early trade Thursday as the market prepared to price in the latest round of government inventory data.

The March Nymex contract was up 7.2 cents at $2.543/MMBtu around 8:55 am ET.

For the Energy Information Administration’s (EIA) latest natural gas storage report, scheduled for 10:30 a.m. ET, polls are pointing to another underperforming winter extraction by 100 Bcf.

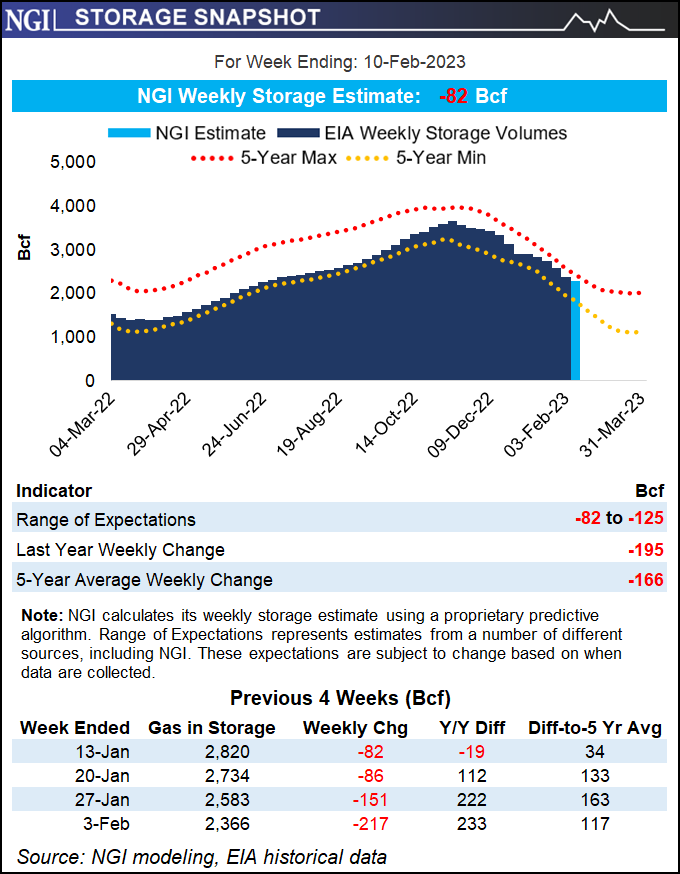

A Reuters poll of 14 analysts put payout expectations between 82 Bcf and 125 Bcf, with a median of 109 Bcf. A Bloomberg poll found a median draw of 96 Bcf, while a Wall Street Journal Survey averaged a withdrawal of 100 Bcf. NGI modeled a pull of 82 Bcf.

A drop in line with surveys would be particularly down from the five-year average withdrawal of 166 Bcf. EIA recorded a deduction of 195 Bcf for the same period last year.

A result that matches estimates would also mark five below-average weekly withdrawals from six total storage reports so far in 2023, historical data from the EIA shows.

“Analyst consensus estimates for this morning’s EIA report cover a broad range of 96 to 109 Bcf, likely due to last week’s significant forecast error adding to heightened uncertainty,” said Eli Rubin, analyst at the EBW Analytics Group, to clients early Thursday.

“While today’s report will likely be a consequence of Northeast linepack’s withdrawal, after four consecutive large-than-expected withdrawals, the market could increasingly be looking for evidence of a tightening supply/demand balance at today’s storage count.”

Temperatures during the EIA reporting period were warmer than normal across most of the country, and this was “particularly the case in the eastern half of the US,” according to NatGasWeather.

The firm forecast a payout of 107 Bcf.

As for the latest forecasts, the European model saw significant colder trends overnight, NatGasWeather said.

Updated runs from both the American and European datasets announced enough cold during the February 23-March 2 time frame to justify bullish weather sentiment, with “frosty air” forecasting “aggressively over the northern US” during the period ‘ said NatGasWeather.

It will be “of great interest” whether the colder trends carry over to subsequent model runs, “especially as weather data has been inconsistent over the past few days,” NatGasWeather added. “Also, freezing temperatures have been forecast several times this winter over the eight to 15 day period, only to recede and become much warmer over time.”