DICK’S Sporting Goods Stock: Playing Defense Ahead Of Q2 Earnings (DKS)

Justin Sullivan

The pandemic has been a major tailwind for many individual sports and for getting out in general. Dick’s Sporting Goods (NYSE:DKS) has undoubtedly benefited from people getting ready to “go out into the world”. Golf, hiking, biking and other apparel are especially important Areas of strength for the company, which also boasts a solid omni-channel presence. Still, like many retailers in this environment, inventory management is a major challenge right now. The stock shows a strong 3-month performance as investors remain bullish on DKS execution. Mixed signals from Nike (NKE) and Adidas (OTCQX:ADDYY) at the start of this earnings season add some uncertainty ahead of next week’s second quarter earnings report.

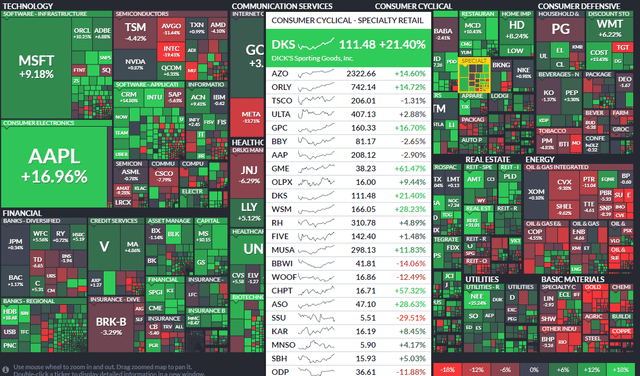

Three Month Performance Heatmap: DKS A Retail Standout

Finviz

According to Bank of America Global Research, Dick’s Sporting Goods, Inc is a full-line sporting goods retailer that offers a diverse line of branded and private label sporting goods, footwear and equipment in a large box store format. The Company also operates standalone golf specialty stores under the Golf Galaxy name and an outdoor specialty store under the Field & Stream banner.

The Pennsylvania-based specialty retailer with a market capitalization of $9 billion in the consumer discretionary sector has a trailing 12-month price-to-earnings ratio of just 8.7, according to data The Wall Street Journal. The dividend yield is 1.7%, about in line with the S&P 500. Importantly, given next week’s gains, the stock’s short-term interest rate ratio is very high at 27.3%. DKS is part of the equally weighted S&P Retail ETF (XRT).

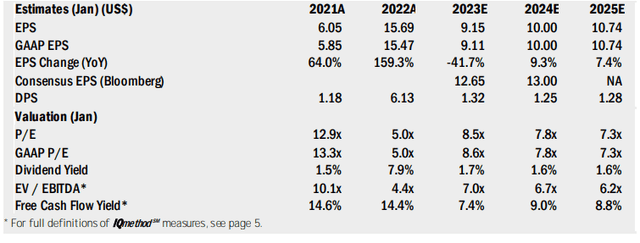

Analysts at BofA expect DKS earnings to rise unusually this year and then decline in 2023. A more steady EPS growth rate can be seen in 2024 and 2025. The company paid a special dividend nearly a year ago, so investors should watch out for another possible payout, but that’s not the forecast. DKS trades at a reasonable EV/EBITDA multiple and is generating solid free cash flow. So the valuation picture looks cheap.

DKS profit, dividend and valuation forecasts

BofA Global Research

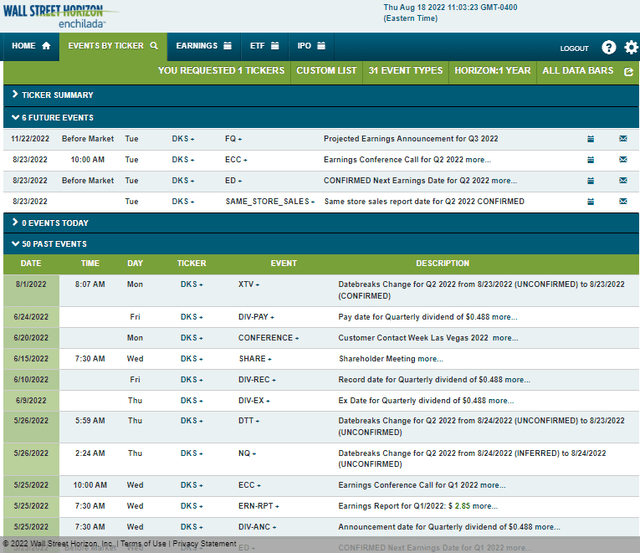

DKS has a confirmed earnings date of Tuesday, August 23 BMO, according to Wall Street Horizon. A conference call begins this morning at 10:00 a.m. ET. You can listen live here.

DICK’S Corporate Events Calendar: Revenue on tap

Wall Street Horizon

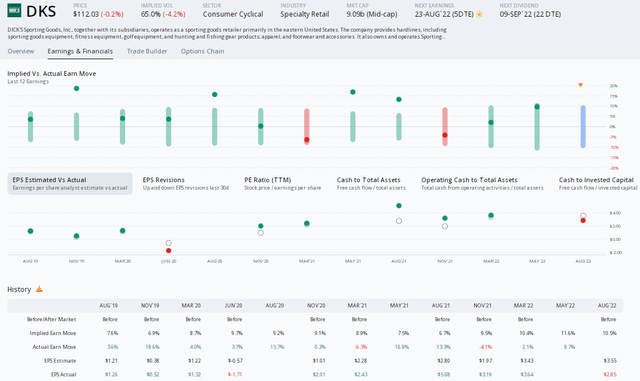

Taking a closer look at Tuesday’s second-quarter earnings report, analysts expect earnings per share to be $3.55, according to data collected by Option Research and Technology Services. Traders have priced in an earnings-related 10.5% stock price swing using the at-the-money straddle on the nearest expiring options. DKS has beaten earnings forecasts based on ORATS data for the past eight quarters.

About DKS options: A big implicit step

ORATES

The technical recording

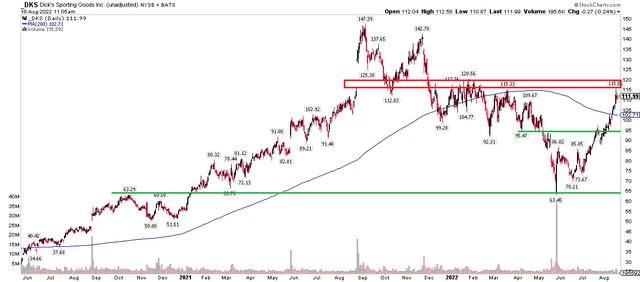

DKS has rebounded impressively from its May low. Stocks have nearly doubled in less than three months, hitting resistance in a congested area from January through February. The break coincides with its October 2021 low. However, what I like is that the stock has climbed above its flattening 200-day moving average. While most stocks have a negatively sloping 200-day moving average, the long-term DCS trend isn’t as bearish.

I see support in the mid-$90s if we see a pullback after the gains. I think the stock will actually pull back on this first attempt to climb above the year-to-date high. For me, however, it’s certainly a ‘buy the dip’ candidate.

DKS: Stocks pause below their 2022 high

Aktiencharts.com

The final result

DKS looks good from both a fundamental demand history and its valuation. Technically, stocks could retrace towards the 200-day moving average if we see negative earnings reaction based on implied moves in the options market.