Here’s How to Play Tesla When Great Isn’t Good Enough

Electric vehicle maker Tesla (TSLA) on Sunday announced the company’s third-quarter figures for both production and deliveries. The numbers were very good. In fact, the company set a new delivery record in the third quarter. The numbers just weren’t what Wall Street was looking for. The stock took a hit early Monday morning.

For the third quarter, Tesla produced 19,935 Model S and X and delivered 18,672 of them. Tesla produced 365,923 Model 3 and Y and delivered 325,158 of them. That puts total production at 365,923 vehicles and deliveries (which some interpret as a proxy for sales) at 343,830.

The consensus was for shipments of nearly 358,000 according to Bloomberg News and nearly 365,000 according to FactSet. I had heard whispered numbers of up to 370,000 myself.

In the press release, Tesla notes that delivery volumes are historically skewed toward the end of each quarter due to regional batching of vehicles. During the quarter, Tesla transitioned to a more even regional mix of manufacturing each week, resulting in an increase in vehicles still in transit at the end of the quarter.

Readers will recall that production at the Shanghai plant was suspended in July to allow the company to make equipment upgrades. Tesla also reduced headcount in August and brought employees back into the office who worked remotely. A number of them never returned.

merits

Tesla also announced in the press release that third-quarter results would be released after the closing bell on Oct. 19 (now with flashbacks to 1987). The consensus view for the period is for adjusted earnings per share of $1.05 within a range of $0.77 to $1.23. This would equate to sales of $22.6 billion. Expectations there range from $18.4 billion to $25.6 billion. Comparatives a year ago were EPS of $0.62 on sales of $13.76 billion.

Right by consensus, the quarter would be good for earnings growth of 69% on sales growth of 64%.

Wall Street

Interestingly, JP Morgan’s Ryan Brinkman, who has a one-star rating (out of five) from TipRanks, maintained his “sell” rating on Tesla and his price target of $153 in response to the missing deliveries. Brinkman wrote, “We remain cautious on valuation and continue to see major downsides to our price target, including the potential for multiple compression amid rising competition and reduced differentiation from traditional automakers over time.”

On the other side of the token, William Stein of Truist Securities, which has a five-star rating from TipRanks, reiterated his buy rating while also raising his price target to $348 from $333.

Four-star analyst Dan Ives of Wedbush, who also views TSLA as a “buy” and has a $360 price target on the stock, summed it up for the bulls I think… Quarterly chart is very robust and could be approaching massive numbers in the 475K+ range. In short, this quarter was nothing special and Wall Street will be disappointed by the weaker 3rd quarter shipments. However, we view this as more of a logistical speed bump than the start of a softer delivery curve into Q4 2023 and remain bullish on the Tesla story.

My thoughts

I’m long on the stock so my bias is consistent with what Ives said. I build this long position on Monday. So now you know where I stand before you continue.

At the end of the second quarter, Tesla was running at a current ratio of 1.43 and a quick ratio of 1.06 after accounting for inventories. Both relationships are healthy. The company does not populate the balance sheet with “goodwill” or other intangible assets. At that time, long-term debt totaled $2.095 billion while the company’s net cash was $18.915 billion. Regular readers know how much I like a strong balance sheet. Tesla has a very strong balance sheet.

The company ended the second quarter with a tangible book value of $11.51 per share, and this quarter was Tesla’s ninth consecutive cash flow-positive order. The firm is really, really rock solid. In my opinion, the only problem a fundamental investor could have with the stock is valuation, as the JP Morgan analyst said. Despite this discount, the stock is still trading at 61 times forward looking earnings as of Monday morning.

That makes Tesla more of a trade to me than an investment.

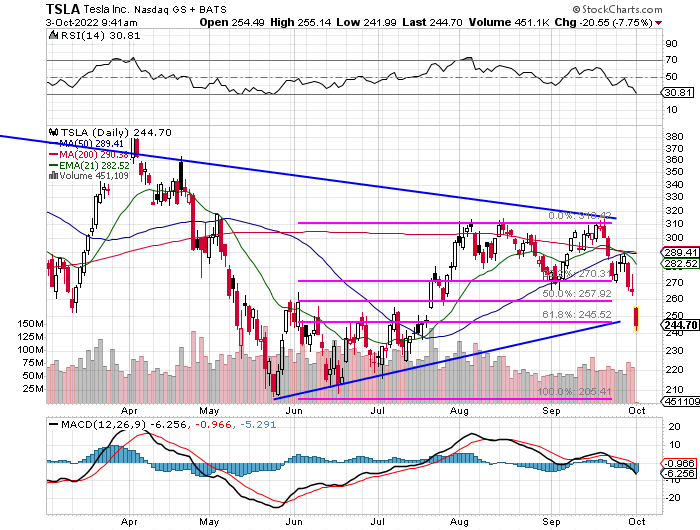

The streak of lower highs since last November and the streak of higher lows since May imply the coming of an explosive move in TSLA.

Technically, it’s somewhat important that the 61.8% ($245) Fibonacci retracement level from May holds up to that triple top at $310. If so, I have a strong feeling I’m on the right side of the ball with this name.

My game is to break the name into that revenue in two and a half weeks unless I’m forced by a serious breakthrough at that level. My target would be the intersection of the 50-day and 200-day SMAs (around $290), but I’m probably out of the name either way after the gains.

Receive an email alert every time I write an article for Real Money. Click +Follow next to my author of this article.