How to get a guaranteed return of 1.3% per year above inflation

TIPS have become an increasingly attractive option for the fixed income portion of your retirement portfolio in recent months.

I am, of course, referring to Treasury inflation-linked securities. They are similar to traditional Treasury bills and bonds, except their quoted yields are above the consumer price index. So real returns.

Right now, 10-year TIPS are yielding 1.29%, which means you’re guaranteed to make at least as much more than inflation over the next decade if you buy them today and hold them to maturity.

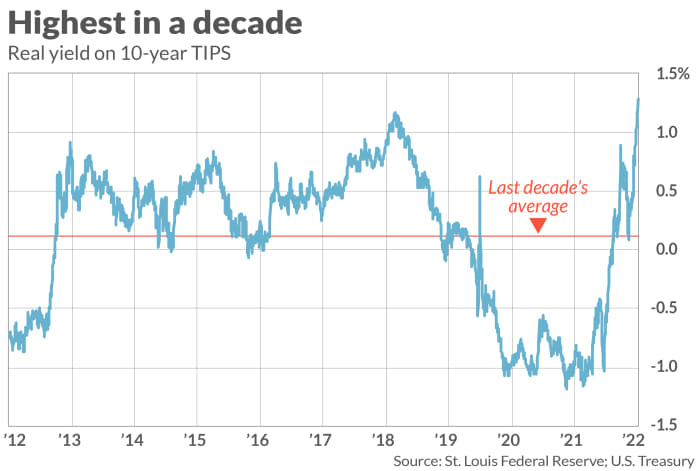

The reason TIPS have become more attractive in recent months is that, after trading at negative real yields for several years, these yields started to rise above zero in May and are now well above 1%. As you can see from the attached chart, the 10-year TIPS yield is currently the highest it has been in the last ten years.

In fact, TIPS’ positive real yield makes them somewhat more attractive than I-Bonds – US savings bonds whose yields are based on the prevailing rate of inflation. I-Bonds’ rates are a combination of the trailing rate of change in CPI and a fixed rate set at purchase. Although the US Treasury could change this fixed rate in the future, it is currently set at zero – meaning the real yield on I-Bonds is exactly zero for now.

With the fixed rate I-Bond never going negative, I-Bonds have been more attractive than TIPS during periods of the last decade when TIPS real returns have been negative. This situation has now reversed.

However, there is no guarantee that TIPS yields will not turn negative again in the future. In this case, however, you would have the opportunity to sell your TIPS ahead of maturity in the secondary market as they would now be trading above face value – and reinvest the proceeds in zero real yield i-bonds where possible.

Sale before maturity

Therefore, the only major risk of investing in a TIPS is the possibility that you may have to sell it before maturity, and its return at that point will be higher than if you bought it. I-Bonds do not have this risk because their value does not fluctuate; After an initial period of not being able to sell without penalty, you can always sell your I-Bonds at the same fixed (real) price that was determined when you bought them.

So what is the risk that TIPS have versus I-Bonds? As the chart below shows, the return on 10-year TIPS is well above the 10-year average. Assuming the return returns to the mean, you could bet that going forward it will be lower rather than higher.

Choosing between TIPS and I-Bonds depends in large part on your risk appetite. As Zvi Bodie, who was a finance professor at Boston University for 43 years, said in an email, “You can lose money on TIPS, but not on I-Bonds. There is no downside risk with I-Bonds… That’s tremendously valuable.”

In contrast, The Finance Buff’s Harry Sit thinks TIPS are preferable at the moment. “When the yield on 5-year TIPS is 1.27%,” Sit wrote in an email, “it’s hard to justify keeping I-Bonds’ fixed rate at 0%.”

In any case, Sit added, “Because I-Bonds have an annual fee [purchase] Limit you don’t have to choose between I-Bonds and TIPS. Buy both and you don’t have to wonder which is better.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]