How to Tweak Your W-4 to Get a Bigger Tax Refund (and Why You Probably Shouldn’t)

It’s always great to get a big check, like when a big tax refund arrives In 2022, the average American got more than $3,000 back from the IRS with a tax refund.

Making your tax refund bigger every year can be easy, and it only takes minutes once you’ve got the paperwork in hand. The IRS even bakes the process in one easy step on its tax forms.

However, a larger tax refund may not be as big as it seems. After all, it’s your money that the government is holding onto – and you may have ideas on how to use it. Learn how to customize your IRS W-4 tax form to get a larger tax refund and all the factors to consider before you do so. For more information, see new state child allowances, whether or not your student loan debt relief is taxableand the Best tax software for 2022.

What is a W-4 form?

A W-4 form is a federal tax form from the IRS that tells your employer how much money to withhold from your paycheck for federal taxes. The IRS website states that taxpayers “should consider filling out a new Form W-4 each year and as your personal or financial situation changes.”

The W-4 form has been revised for the 2020 tax season to “reduce form complexity and increase the transparency and accuracy of the withholding system.” Withholding tax allowances—or exemptions that reduced the amount withheld—were abolished and replaced by calculations of additional untaxed income and expected tax deductions.

How do I change my W-4 to get a higher tax refund?

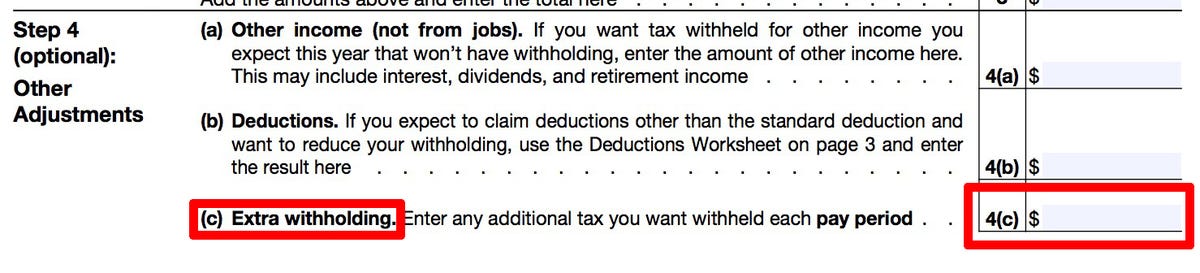

If you want to get more money back from your tax refund each year, you can choose to withhold a larger amount from your paycheck. It’s easy – just enter the additional amount you want to withhold from each paycheck Line 4(c) of your W-4 form. The line is marked “Additional withholding tax”.

To request more money from your paycheck, enter the amount on line 4(c) of the W-4 form.

IRS/Screenshot by Peter Butler/CNET

If you owe taxes to the IRS each year, adding the correct amount of additional withholding taxes on line 4(c) of your W-4 can reduce your tax liability to zero each year. Simply divide the amount you normally pay in federal taxes by the number of paychecks you receive in a year to find out how much extra should be withheld from each pay period.

While it may seem crazy for financially disciplined people to lend your money to the IRS for 12 months or more, it’s undeniably a bulletproof way to save money. You may not earn interest, but you do not spend it.

Why shouldn’t I increase my withholding tax to get a bigger tax refund?

Quite simply, it’s your money and the IRS will hold it with no interest for up to a year. You could spend that money, invest it to keep up with inflation, or whatever you want to do with that money…because it’s yours!

While it’s nice to get a big tax refund check in the spring, Inflation is still at 8.5% over the past year. That means your $100 as of September 2021 gets you about $92 worth of stuff these days. If you put the money in a Series I Savings Bond Instead of leaving it to the IRS, you could get it 9.62% on your money back immediatelythereby eliminating inflation losses.

How can I set my W-4 to get this more Money back into my paycheck?

As previously mentioned, in 2020 the IRS eliminated withholding allowances, so withholding less money isn’t as easy as increasing the number of allowances on your W-4 form.

Also note that the US has a pay-as-you-go tax system. You may not completely eliminate withholding tax and pay your tax bill every April – there is a penalty for underpaying taxes.

However, if you get a big tax refund every year and would rather get that money back sooner in your regular paycheck, you have a few options, the biggest of which are deductions.

Take a look at your existing W-4 and deductions from your most recent federal tax return. Increase the deductible amount on your W-4 form to meet the amount on your income tax return. Be sure to look at student loan interest and IRA contributions, which are included in addition to your estimate of deductions.

If you had no tax liability in the previous year, you may not have to pay any tax in the current year. According to the IRS, to claim exemption from withholding taxes, you must “have had no tax liability for the prior year and must expect to have no tax liability for the current year.”

If both conditions apply, write “Exempt” in the box under step 4(c) on Form W-4, according to the IRS. Perform steps 1(a), 1(b) and 5, and then stop.

Also importantly, according to the IRS, the “W-4 Application for Exemption from Withholding Taxes is valid only for the calendar year in which it is presented to the employer. To remain exempt from withholding tax next year, an employee must submit a new Form W-4 claiming exempt status by February 15 of that year.

When can I customize my W-4?

You can always customize your W-4 form as you see fit. As previously mentioned, the IRS recommends reviewing your W-4 form once a year, but you should also update it on certain events:

- Birth of a child or new dependent

- marriage or divorce

- New job for you or your spouse

- Buying a home or other major tax changes

Your employer must implement your new W-4 information by the start of the first payroll period ending on or after the 30th day after filing an updated W-4.

note: Speak with a tax professional to discuss your personal tax situation before customizing your W-4 form. Local IRS offices offer expert advice at various times by appointment.