Natural Gas Futures Trade Up Following Latest Light Inventory Draw

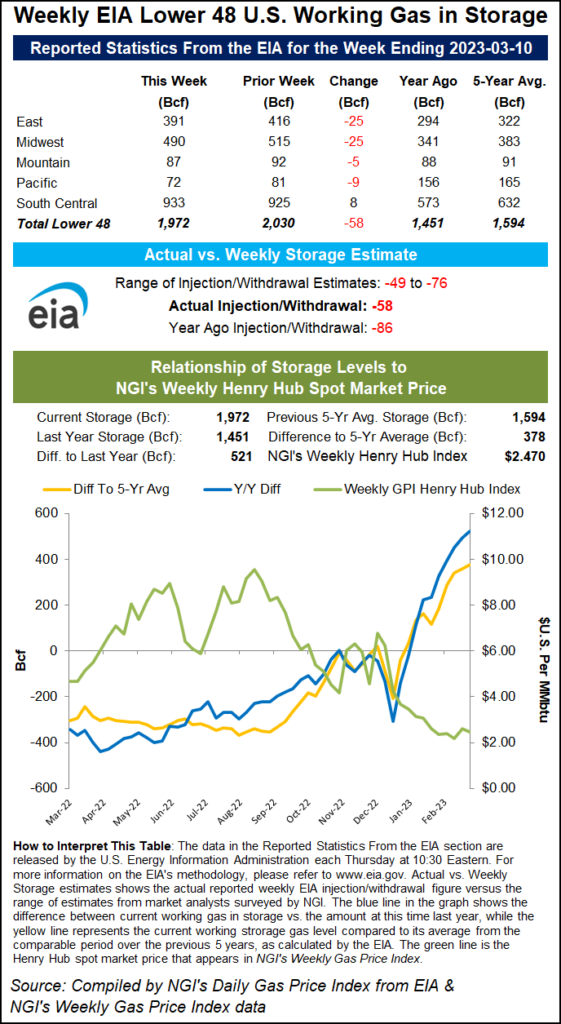

The US Energy Information Administration (EIA) on Thursday reported a withdrawal of 58 Bcf of natural gas from storage for the week ended March 10th. The result was well below comparable values in the recent past, but close to market expectations. Nymex natural gas futures advanced following the EIA result.

Ahead of the 10:30 am ET EIA report, the April futures contract was up 5.9 cents at $2.498/MMBtu. The prompt month was around $2,490 when the EIA data was released.

At 11:00 a.m. ET, it was trading at $2,520, up 8.1 cents from the previous day’s close.

[Get More: NGI’s Forward Look forward curve product provides improved price transparency and insight to help you make better business decisions. Request a trial now.]

Prior to the report, NGI modeled a payout of 64 Bcf. Larger polls gave draw estimates of between 49 Bcf and 76 Bcf. Bloomberg’s poll landed a median pull of 63 Bcf, while a Reuters poll returned a median expectation of 61 Bcf. The Wall Street Journal‘s survey gave an average draw estimate of 62 Bcf.

The five year average for this period was 77 Bcf and a year earlier EIA recorded a deduction of 86 Bcf.

Temperatures during the covered period were much warmer than normal in the southern and eastern parts of the country, with cooler conditions reserved for the western and northern plains, according to NatGasWeather. This extended a trend of overall relatively mild winter weather into 2023.

The recent storage reduction brought inventories down to 1,972 Bcf, leaving shares well above last year’s level of 1,451 Bcf and five-year average of 1,594 Bcf.

By region, according to the EIA, the Midwest and East led with corresponding withdrawals of 25 Bcf. Stocks in the Pacific Rim fell by 9 Bcf, while stocks in the mountain regions fell by 5 Bcf.

The South-Central region, in contrast, recorded an 8 Bcf increase which included a 3 Bcf injection into non-salt plants and a 5 Bcf increase in salts.

Looking ahead to the next EIA print, analysts are generally expecting a bullish outcome as multiple rounds of late winter weather are noted in mid-March. Forecasts predict even more cold for this month.

“The winter that never came has become a season that doesn’t know when to stop,” said a participant on online energy platform Enelyst.

Early estimates given to Reuters for the week ended March 17 ranged from withdrawals of 67 Bcf to 86 Bcf, with an average drop of 80 Bcf.

This compares to a decline of 55 Bcf a year earlier and a five year average decline of 45 Bcf.