Stock market today: Live updates

Shares rose on Thursday as investors assessed recent corporate earnings, which came in better than previously feared.

The Dow Jones industry average gained 205 points or 0.6%. The S&P500 0.5% added while the Nasdaq Composite Added 0.7%.

Disney Shares gained more than 2% after the company posted less-than-expected subscriber losses and earnings and revenue that beat estimates. It hurt gains after CEO Bob Iger said he only expects to stay in the role for two years and activist investor Nelson Peltz declared a proxy fight.

PepsiCo was up more than 2% on the basis of fourth-quarter earnings that beat Wall Street expectations.

Investors have been keeping a close eye on the earnings season for a glimpse of how companies have fared amid high inflation and how they are likely to fare going forward. But despite recent corporate reports, Wall Street has viewed this earnings season as lackluster.

So far, 66% of S&P 500 companies have reported fourth-quarter earnings. Almost 70% of these companies have beaten analyst expectations, FactSet data shows. That hit rate is below a three-year average of 79%, according to data from The Earnings Scout.

PayPal, lyft And Expedia will report after market close.

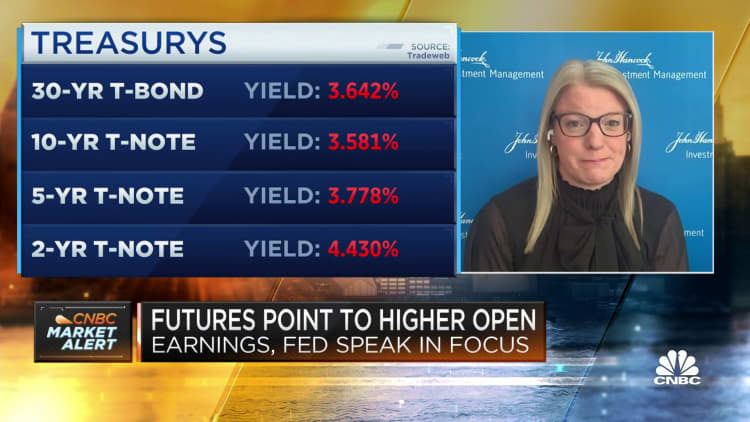

The number of weekly jobless claims reported Thursday rose 13,000 to 196,000, which is more than expected and was at odds with a series of jobs data that suggested the job market remained stubbornly hot. Treasury yields fell after the data as investors bet the job market might cool off enough for the Fed to further slow its rate hike campaign.

Despite a pullback on Wednesday, stocks have rallied in 2023. However, market watchers warn that the rally in 2023 could depend on the Federal Reserve’s next monetary policy moves. Earlier this week, Fed Chair Jerome Powell said inflation was slowing but rates could still rise.

“The next level the rally could go to would be around 4,300, which takes you back to the August high. But once we hit 4,300, we’d be trading at 19.5 times earnings — that’s really, really expensive unless you have a Fed that’s actively easing policy,” said Cameron Dawson, chief investment officer at NewEdge Wealth, opposite CNBC’s “Closing Bell: Overtime.”

“Technology has certainly improved – it’s looking better than ever in 2022 and so we have to respect that – but from a fundamental perspective, we really see a challenge in getting anywhere north of that,” she added.