The latest jobs report was red-hot, but ominous LinkedIn data tells a different story about the economy

Despite layoffs and hiring freezes at big tech companies like Amazon and Meta, the job market has proven incredibly resilient. The US economy added 517,000 jobs last month, beating economists’ estimates and pushing the unemployment rate to a 53-year low of 3.4%.

Forecasters weren’t expecting the robust jobs report amid the Federal Reserve’s year-long rate hike campaign to fight persistent inflation that typically leads to higher unemployment. Even Fed Chair Jerome Powell said Tuesday at the Economic Club of Washington, DC that the report “was stronger than anyone I know was expecting.”

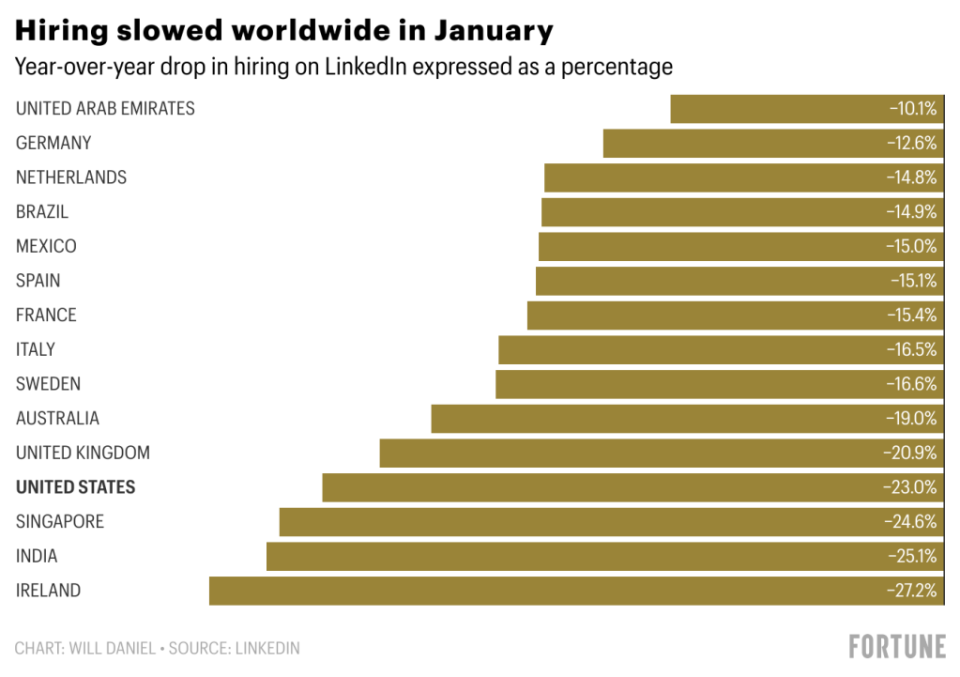

But new data from LinkedIn shows the strength of the job market could be weakening. Hiring through the employment-focused social media site fell 23% in the US in January from a year earlier.

“The US job market is beginning to normalize, with slowing hiring, firing and wage growth,” said Rand Ghayad, head of economy and global labor markets at LinkedIn, in an article Tuesday. “Companies have started to tighten their belts and be more cautious about recruiting.”

While hiring on LinkedIn fell “in almost every country” in January, the US hiring rate slowed more than most other countries – only Ireland (-27.2%), India (-25.1%) and Singapore (–24.6%) recorded worse results. LinkedIn derives its country-level hiring metric by dividing the number of users who added a new employer to their profile in the month their new job started by the total number of users in that country.

LinkedIn also scrutinized user posts for signs that the strength of the job market is flagging, and the recent data isn’t pretty. The number of posts mentioning the words “layoff” or “savings” on LinkedIn increased by 37.7% between December 26, 2022 and January 22, 2023 compared to the four weeks prior. And posts mentioning “open to work” increased by 18.5% over the same period.

“There are indications that the labor market is cooling, apart from the continued announcements of layoffs from sectors that have seen massive over-hiring during the pandemic (i.e. real estate, technology, information and media, etc.),” Ghayad noted.

The economist pointed to the “gradually declining” ratio of vacancies to active applicants in recent months as evidence of companies’ hiring slowdown. However, he also noted that labor market conditions vary by industry, as the impact of COVID-related disruptions is still being felt by some businesses today. The technology sector, for example, has returned to its “pre-pandemic baseline” in hiring, while Ghayad said it’s still “very much a job seeker’s market” in other industries like energy and healthcare.

“The US workforce is currently 3 million net short of people since the pandemic began. The sudden drop in labor availability has created an uneven recovery across industries,” he said. “While conditions have cooled significantly in some industries, some are still struggling and cannot be fully staffed again.”

But despite the US hiring slowdown in January — and warnings from his business peers — Ghayad doesn’t predict an outright recession.

“The economy is expected to slow further in 2023, while inflation is expected to ease as labor markets soften and wage pressures ease. Although recession risks remain elevated, the likelihood that the Fed will steer the overheated economy to a soft landing has increased in recent months,” he wrote.

This story was originally featured on Fortune.com

More from Fortuna:

5 side hustles that can make you over $20,000 a year — all while working from home

The 5 most common mistakes lottery winners make

That’s how much money you need to make annually to comfortably buy a $400,000 home

The billionaire tax: how much the ultra-rich could pay under Biden’s new plan and what it means for your tax bill