This big tech stock looks way oversold. Here’s your best strategy for buying it now in this volatile market.

Amid hopes of a bear killing October, a mixed start is underway for Monday, with tech under pressure.

That’s because Tesla shares tumble in the premarket after underperforming quarterly sales. Meanwhile, investors appear mildly impressed by the UK government’s efforts to quench a market conflagration it recently unleashed as another crisis looms over the health of a major European bank.

Certainly, an endless supply of crisis headwinds can cause the S&P 500 SPX to

Work harder to find his real reason. Which brings us to ours call of the dayby Matt Maley, Chief Market Strategist at Miller Tabak + Co., who sees Google’s parent Alphabet GOOGL,

as one of the top oversold names to start buying now.

He admits the overall market isn’t looking cheap just yet, while Alphabet faces some headwinds, but its search business “is still a monster … with ad sales growth of more than 13% last quarter.”

The stock trades at 17 times forward earnings and 18 times reported earnings, he notes. “Since the company went public in 2005, it’s only been cheaper at the bottom of the Great Financial Crisis and after two dips in 2011 and 2012 during what was then the European (Greece) crisis,” Maley said.

Mueller + Tobacco

How do you do that? Maley suggests gradually buying Google’s parent company over the coming months, similar to the “dollar-cost-average” — investing a fixed amount in a security or asset on a regular basis, regardless of how the market is performing.

This strategy works well when companies are going cheap and is great for bear markets, “especially after the ‘bear’ has already done a lot of damage,” Maley said. But a good company’s stock can still get cheaper before it hits the bottom, so they have to buy in increments — for retail investors, that might mean once a month for nine to 12 months.

Alphabet’s median price — down nearly 34% year-to-date — should look good one year from now and even better in three to five years, as decent names dumped in a bear episode often rebound faster than the broader market the years after, he adds.

Note that the strategist is adamant that more foam needs to come out of this market, potentially another 15% into the low 3,000s for the S&P 500 SPX.

The market has become too expensive compared to the economy, which has been “pushed to levels it could not sustain without steroids.”

“It needs to be brought back into line with the underlying economy… and the underlying economy needs to be brought back into line with the growth it can sustain without artificial liquidity.” Don’t fight the Fed,” Maley says.

Read: After the worst September for equities since 2002, October could bring the following

The markets

stock futures YM00,

ES00,

are choppy, with those for the Nasdaq 100 NQ00,

falling, with Treasury yields stable TMUBMUSD10Y,

TMUBMUSD02Y,

The British Pound GBPUSD,

has risen and Gilt gives TMBMKGB-10Y,

are in the red following the UK government’s U-turn over a heavily criticized budget measure. oil prices CL.1,

BRN00,

raise hopes for cartel production cut this week, with petrol prices RBZ22,

also shoot higher, but natural gas prices NG00,

Low.

The Buzz

The Organization of Petroleum Exporting Countries and Moscow-led allies, also known as OPEC+, could cut production by more than 1 million barrels a day on Wednesday – the largest since the pandemic began.

The star Kim Kardashian was fined $1.26 million by the SEC for promoting a crypto without disclosing that she received payment.

Tesla TSLA,

reported record quarterly shipments on Sunday. but the number still disappointed analysts. Shares are down over 4%.

Credit Suisse Equities CS,

CSGN,

tumbled after worrying headlines about the health of the Swiss bank following a surge in credit default swaps on Friday.

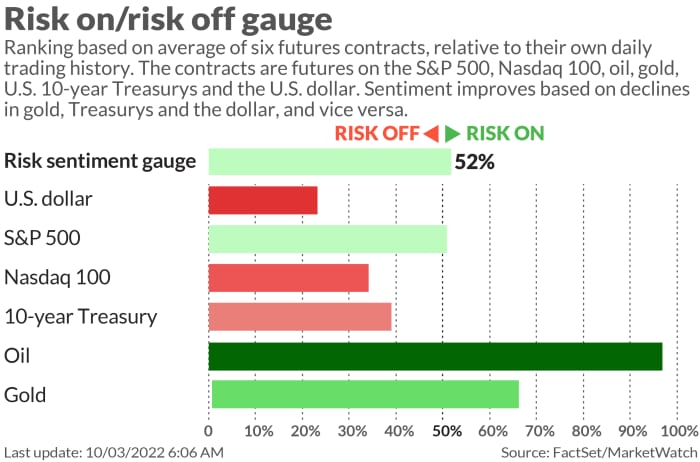

Citigroup lowered its S&P target for the end of 2022 to 4,000 (from 4,200). You’re seeing a risk-on rally over the last quarter, driven in part by depressed sentiment.

A big week for data ends with non-farm payrolls. For Monday, we get the Institute for Supply Management’s manufacturing index and construction spending, both at 10:00 AM ET. Auto sales and a speech by New York Fed President John Williams are also on the agenda.

Two cracks in Europe’s Nord Stream pipeline appear to have halted natural gas leaks, Danish authorities say. But a global energy body has warned Europe could face “unprecedented” natural gas shortages this winter unless consumption is cut by 13%.

The best of the web

Indonesia is awash in grief after a soccer stampede killed 125 and injured hundreds

Russian soldiers with “blank eyes” narrowly escaped the Ukrainian town of Lyman

In the midst of war, nuclear threat and famine, Nobel Prize season begins

The graphic

Our diagram of Matt FoxFounder/President of Ithaca Wealth Management, discusses key S&P 500 levels to watch. It was published in The Chart Report (h/t Howard Lindzon) who had the following to say:

“Matt notes that it is currently testing its 200-week moving average for the first time since the pandemic. We actually closed slightly below that today [Friday], so buyers need to show up soon if we’re going to have a 2011 or 2018 scenario. If we stretch underneath it will be a big red flag. In any case, keep an eye on how this test develops in the coming weeks.

The tickers

These were the most searched tickers on MarketWatch as of 6:00 a.m. Eastern Time:

|

ticker |

security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC entertainment |

|

AAPL, |

Apple |

|

NEVER, |

NEVER |

|

AVCT, |

American virtual cloud technologies |

|

BBBy, |

bed bath beyond |

|

TWTR, |

|

|

DWAC, |

Capturing the digital world |

|

CS, |

CreditSuisse |

Random Reading

Fastest marathon as a vampire and 17 other Guinness records broken in London

The little device that stops LA’s wealthiest wasting water

Need to Know starts early and will be updated by the opening bell, but sign up here to have it delivered to your email box once. The emailed version will be sent around 7:30am EST.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.