Wall Street stocks edge higher after Fed’s latest rate rise

US stocks and government bond prices rallied on Wednesday after the Federal Reserve announced another rate hike to fight inflation despite recent problems in the banking sector.

The benchmark S&P 500 index bounced briefly before falling back to a 0.1 percent gain shortly after the decision was announced in Washington, after falling slightly earlier in the day. The tech-heavy Nasdaq Composite rose 0.2 percent.

The Federal Open Market Committee raised the federal funds rate by 0.25 percentage points to a target range of 4.75 percent to 5 percent.

Investors in interest rate futures had tentatively priced in such a rise, but analysts and economists have been unusually divided in their forecasts given the recent market turmoil. The collapse of the Silicon Valley bank and UBS’s takeover of Credit Suisse have caused many investors to lower their expectations of how long the Fed will keep interest rates high.

“There is great uncertainty as to whether the Fed can both tighten and at the same time try to relieve regional banks, among others,” said analysts at SEB Research.

In its statement on Wednesday, the Fed signaled that it still expects another rate hike, but noted that recent developments were likely to “wet economic activity, hiring and inflation”.

Fed Chairman Jay Powell is expected to give further guidance at a press conference later Wednesday afternoon.

The benchmark 10-year Treasury yield fell 0.07 percentage point to 3.54%, while the more politically sensitive two-year yield fell 0.11 percentage point to 4.07%. Lower yields reflect higher prices.

The central bank also released revised forecasts on the monetary policy path to 2025, as well as updated forecasts for growth, unemployment and inflation.

Most officials stuck by their forecast that interest rates would peak between 5 and 5.25 percent, but projected that the rate would fall back to 4.3 percent by the end of next year.

US bank stocks gave up some of their gains after dovish comments from Treasury Secretary Janet Yellen led to a sharp rally on Tuesday. The KBW Nasdaq Bank index fell 1.7 percent. Shares of the First Republic, which was hardest hit among regional banks suffering from massive deposit outflows, fell 3 percent.

“The panic over the banking system has definitely subsided, largely due to the aggressive policy response from the Federal Reserve, the Federal Deposit Insurance Corporation and the Treasury Department,” said Ryan Sweet, chief US economist at Oxford Economics.

European stocks closed higher. The regional Stoxx 600 rose 0.2 percent and the CAC 40 in Paris closed 0.3 percent higher.

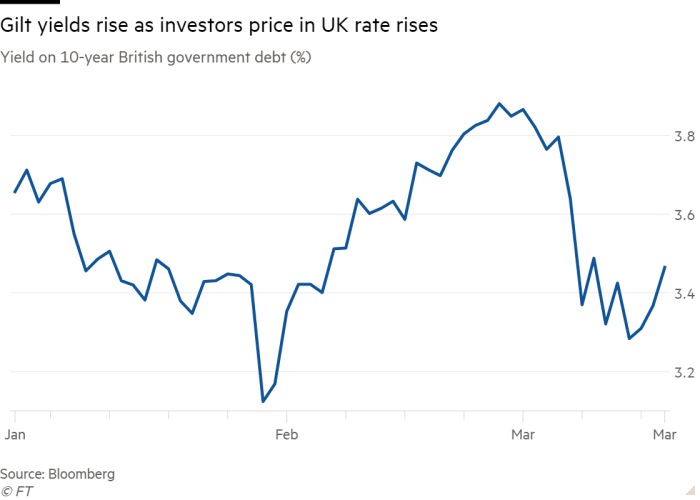

London’s FTSE 100 rose 0.4 percent after UK inflation unexpectedly rose to 10.4 percent in February, bolstering market expectations that the Bank of England would raise its benchmark interest rate on Thursday. Investors are now expecting a quarter-point rate hike from the BoE.

Neil Birrell, Premier Miton’s chief investment officer, said the BoE faces a similar challenge as the Fed. “The equation is raising interest rates to beat inflation, but not weakening the economy and making sure the financial system remains robust — that makes everything harder.”

Sterling rose 0.5 percent against the dollar, nearing a two-month high, while the 10-year gilt yield rose 0.09 percentage point to 3.45 percent. The two-year gilt yield rose 0.2 percentage point to 3.48 percent.

European Central Bank President Christine Lagarde on Wednesday warned of a “hit-to-tat” dynamic between workers and companies, pushing up profit margins and wages and increasing price pressure as both groups try to take a hit by a to avoid higher inflation. Her comments helped propel the euro to a five-week high of $1.084.

Asian stocks rose, with Hong Kong’s Hang Seng index up 1.7 percent and South Korea’s Kospi up 1.2 percent. Japan’s Topix rose 1.7 percent after markets reopened after a day’s pause for the vernal equinox.