Why CATL Is the Global EV Battery Leader and How to Gain Exposure

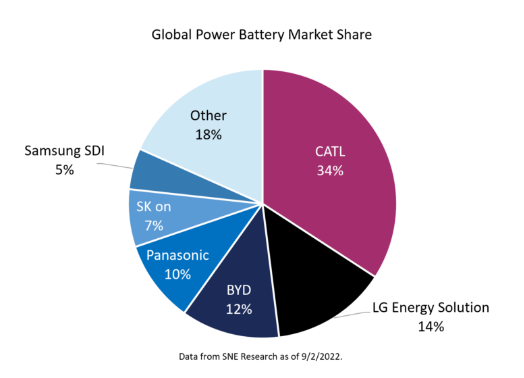

Contemporary Amperax Technology Co., Ltd (CATL) is the world’s leading supplier of batteries for electric vehicles and the main supplier to companies such as Tesla, NIO, Ford, BMW and others. CATL is also a Chinese company and trades on the Shenzhen Stock Exchange, meaning access to it is restricted for most investors and requires access to the China A-share market, which KraneShares offers through various ETFs.

CATL was founded by Yuqun Zeng, who grew up as a poor farmer until good grades on his college entrance exams eventually led him to graduate as one of the top engineers at Shanghai Jiao Tong University, a top school in China. Zeng became the second richest person in China, surpassing Alibaba founder Jack Ma and building his company’s headquarters in the same rural area as his hometown.

The company began producing batteries for consumer electronics in 1999 as a spin-off from Amperex Technology Limited before EVs hit the Chinese market in 2011. Founded in 2012, CATL has grown by leaps and bounds as demand for EV batteries increased in China, the world leader in EV manufacturing and sales, and then spread globally.

The global demand for electric vehicles is increasing

“China is now the world’s largest country for EV sales, with 3.3 million EVs sold in 2021, accounting for about 50% of global sales. CATL gradually expanded its position as the leading provider and now holds almost 50% of the market sharet shares in China,” Derek Yan, CFA Director of Investments at KraneShares, wrote in a newer paper.

Image source: KraneShares

CATL is currently prenact that his Q3 profit could triple as demand for electric vehicles in China continues to grow at a healthy pace. Electric vehicle sales in China accounted for 27.1% of all new car sales in September, according to the China Last Night blog, and production is up 110% while sales are up 93.9%ear-over-year.

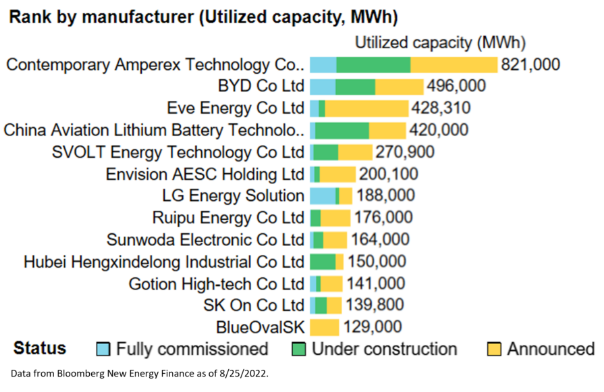

The company is aggressively expanding, building factories in North America and Europe that will allow it to increase its total annual capacity to 500 GWh by 2025 and 800 GWh by 2030. By partnering with companies like Tesla and Ford as a core battery supplier, the company has positioned itself with continued prominence as EVs continue to gain market share.

CATL has built its success on innovation and efficiency: in 2021, its central factory in Ningde was recognized by the World Economic Forum as a Global Lighthouse Factory, recognizing manufacturers for using advanced technologies in their operations. Its factories combine artificial intelligence, advanced analytics, 5G, edge and cloud computing and more to operate efficiently and maximize productivity while maintaining safety and quality standards.

Image source: KraneShares

Why CATL is positioned for success

In a world plagued by supply chain issues, CATL has taken advantage of its home team: China currently has more than half of all battery-grade metal refining capacity in the world for every major raw material used in battery production. This includes cobalt (73% of global supply), nickel (68%), manganese (93%) and 100% of the graphite that lithium-ion batteries use.

However, CATL has gone one step further and looks to the long term.

“The company is also investing in natural resources and battery recycling to hedge against rising raw material costs. CATL’s battery recycling unit, Pubang, can recycle 99.3% of nickel, cobalt, manganese and 90% of lithium from used batteries,” Yan wrote. “From a certain size of the battery market, the industry could rely on recycling for most raw materials.”

CATL is a company that is firmly committed to innovation and stays at the top of the technology curve by spending a significant portion of its revenue on research and development. The company’s research team consists of more than 10,000 people and CATL has filed 4,445 patents worldwide as of 2021.

“We believe that in the next phase of global growth, more local Chinese companies like CATL will become leaders. CATL and other companies listed on the Shanghai or Shenzhen stock exchanges are classified as China A-shares, which are in the process of being fully included in global indices by MSCI,” Yan explained, but most investors only have about them US markets exposure to China or Hong Kong.

“They are under-allocated to China A-shares, even though they account for half of the market capitalization of Chinese stocks. Therefore, China A-shares have very low correlation to global stocks,” Yan wrote.

CATL investment opportunities

KraneShares currently offers access to CATL through various ETFs with different investment strategies. That KraneShares Bosera MSCI China A Share ETF (KBA) invests in China A-shares from the MSCI China A 50 Connect Index, an index of large-cap companies across all sectors in China, and CATL is the second-largest holding with a 7.02% weighting. That KraneShares Electric Vehicles and Future Mobility ETF (NYSE:KARS) provides a good fit for investors looking to capitalize on the potential growth of the world’s major EV manufacturers, and tracks the Bloomberg Electric Vehicles Index, and CATL is in the top 10 with a 3.43% weighting KraneShares MSCI China Clean Technology Index ETF (KGRN) benefiting from clean technology investments in China’s growing economy – CATL is the largest holding with a weight of 8.68%.

For more news, information and strategy, visit the China Insights Channel.