Bears Snag Victory in Latest Battle for Natural Gas Futures, but Power Burns Supporting Cash

Natural futures fell midweek on strong production and a mostly dovish outlook for the rest of the month. The March Nymex gas futures contract was down 9.6 cents at $2.471/MMBtu and the April contract slipped 9.7 cents to $2.555.

At a glance:

- Power burns strong

- slowdown in excess growth

- El Paso Line 2000 returns

However, spot gas prices gained ground as the lower price environment drives the shift from coal to gas in the power generation sector. Spot Gas National Avg. rose 32.0 cents to $3,010.

The sustained warmth that has weighed on futures and cash prices alike over the past few weeks is showing little sign of a sustained trend reversal based on the latest weather data. Models continue to show only a brief period, Feb. 22-26, where significant cold weather could boost demand. The rest of February should be characterized by moderate temperatures and thus slight demand at the national level.

NatGasWeather noted that while current data suggests cold air would retreat to the Canadian border on February 27-28, it is far enough away in time where changes are likely, and potentially onto the colder side. This makes every new model run important for significantly colder or warmer trends. Long-term weather charts were also inconsistent for March 1-7.

Bigger picture: After the next two government inventory reports are factored in, surpluses are expected to rise to more than 260 Bcf before the cold spell hits the lower 48 around mid-next week (22 Feb).

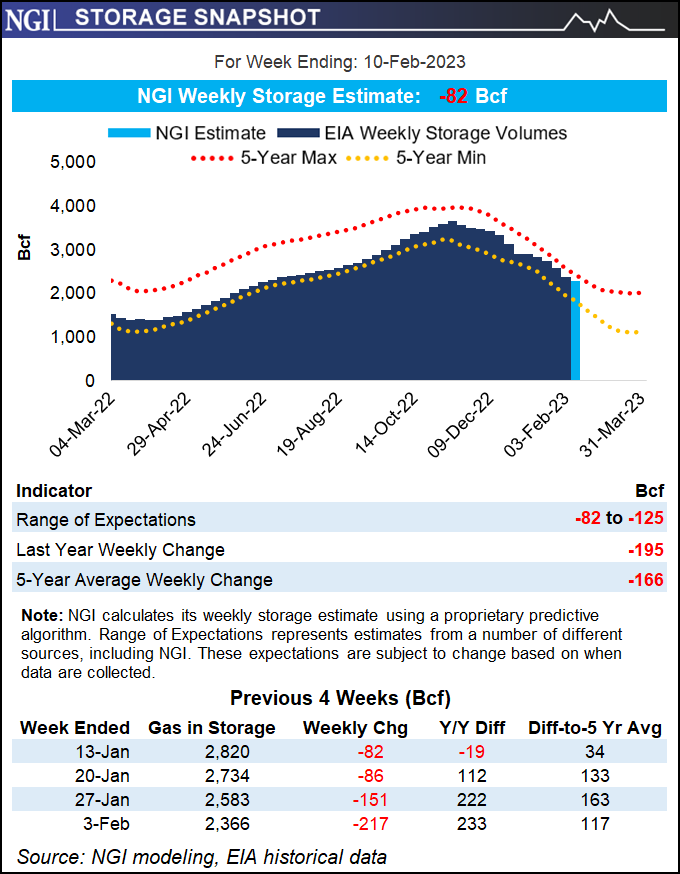

For the forthcoming Energy Information Administration (EIA) report, due for release Thursday at 10:30 a.m. ET, withdrawal estimates ranged from 82 Bcf to 125 Bcf.

That was the range in a Reuters poll of 14 analysts, showing a median draw of 109 Bcf. A Bloomberg poll found a median draw of 96 Bcf, while a Wall Street Journal Survey averaged a withdrawal of 100 Bcf. NGI modeled a pull of 82 Bcf.

A draw anywhere within that range would fall well short of last year’s 195 bcf draw for the similar week and the 166 bcf five year average draw.

Which winter?

Inventories are already above historical levels after a winter that has produced only a few episodes of prolonged cold. The Schork Group found Tuesday that Boston residents can count on two hands the number of significant, or 5% above seasonal trend, heating degree days (HDD) the city has experienced this winter.

While Beantown only released 10 significant HDDs this winter, last winter it reached that level 49% of the time, ie one every other day.

“The situation is just as bad in the Midwest,” said Schork analysts. They noted that this is particularly bad for bulls since the region is the largest market for gas stoves in the Lower 48.

While the late February cold snap could slow further expansion of the surplus, cold temperatures are needed from February 27th to March 3rd.

“Here the weather data is not as convincing as it should be when it should be expected,” said NatGasWeather.

sign of support

However, there are some positive influences lurking in the market.

Freeport LNG is on the verge of a full resumption of operations. The LNG export terminal has seen increased activity over the past few days and is awaiting federal approval to ramp up all three liquefaction units at the Quintana Island, TX facility.

Although there aren’t quite as many headlines, rising power burns are also supporting prices. EBW Analytics Group LLC said the collapse in gas prices is leading to an increase in the shift from coal to gas in the power sector and boosting gas demand in the power sector. From virtually nothing at the end of December, coal price displacement has approached 3.2 Bcf/d by early February, according to the company.

The recent string of four consecutive EIA withdrawals, which were larger than consensus, may reflect even higher gas burns in the power sector than anticipated, EBW said. Especially in the states served by PJM Interconnection Inc. and the Midcontinent Independent System Operator, the warm February weather may offer even more opportunities to crowd out coal-fired power generation than normal.

“More switching from coal to gas remains pricing contingent: if natural gas prices rise too fast, demand can slack off quickly,” said Eli Rubin, senior energy analyst at EBW. “This increased price responsiveness of demand may further limit price volatility into spring.”

Stronger cash prizes

In a possible indication that power burn could be stronger than anticipated, cash prices rose across the board on Wednesday despite little change in the demand picture. With spring-like temperatures in the South Central Region and record-breaking highs on the East Coast, heating loads are modest at best, making the rise in spot gas prices significant.

However, gains outside the West have been modest.

In that region, the vast majority of price increases have been more than $1.00 per day in response to a winter storm expected to unleash a large swath of snow from the Four Corners to the lower Great Lakes later in the week.

At El Paso S. Mainline/N. Baja gas rose $2.825 the next day to average $7.695 for Thursday’s gas day. In the Rocky Mountains, Northwest Wyoming Pool cash climbed $2,030 to $6,905.

Several pipelines in the region braced for the storm. The Colorado Interstate Gas (CIG) and Wyoming Interstate Co. (WIC) pipelines issued operational flow instructions in anticipation of possible power outages and higher system demand. They came into effect on Wednesday until further notice. The Northern Border Pipeline (NBPL) said it was monitoring system integrity because of high pipeline pressure.

“These fears could be amplified with sub-zero temperatures forecast for parts of the Upper Rockies along the NBPL path,” said Amanda Fairfax, an analyst at Wood Mackenzie.

Meanwhile, there was big (if not entirely unexpected) news of a major pipeline in the region. El Paso Natural Gas (EPNG) said in an updated maintenance plan for February that all Line 2000 restrictions would be lifted effective the Wednesday cycle. The restrictions have been in effect since August 2021, when a deadly explosion occurred along the line near Coolidge, AZ.

Wood Mackenzie discussed the extent of the pipeline outage in a note to customers on Wednesday. Analyst Quinn Schulz said looking at the nominations data highlights how the force majeure has significantly tightened California’s inventory.

For example, “Ehrenbrg” discharges for the 2021-2022 winter (October-March) averaged 83 MMcf/d below the winter average for the past three years. In addition, the “Ehrenbrg” discharges in the summer of 2022 were on average 134 MMcf/d below the average of the previous three summers. Likewise, summer 2022 average net injection/withdrawal activity averaged nearly 100 MMcf/day below the same baseline average.

Both the decline in reserves during the winter of 2021-2022 and the reduced summer revenue of 2022 as a result of this force majeure have pushed Southern California Gas (SoCalGas) toward inventory minimums of the past five years toward this winter.

Recent loosening of the SoCalGas system has improved the storage situation, and the return of Line 2000 should further increase inventories, according to Schulz. “For context, the current SoCalGas inventory at this time is 8 Bcf higher than the average for the last five years, but 5 Bcf lower than the minimum inventory for the last five years.”

Upstream in the Permian Basin, prices also firmed, but gains were far more muted. Waha, for example, added just 15.5 cents to an average of $2,110 for Thursday’s gas delivery.

Elsewhere in the country, spot gas prices for Thursday’s gas day rose about a penny or so higher. Chicago Citygate is up 4.5 cents to average $2.385, while Eastern Gas South is up 8.5 cents to average $1.885.