Beyond Meat: Latest Results Provide Little Clarity (NASDAQ:BYND)

News by Joe Raedle/Getty Images

While the market is bullish on Beyond Meats (NASDAQ:BYND) Fourth quarter results, the results were pretty bad and the stock price rise seems more the result of crowded trading and extremely low expectations. Outside of Meat still has work to do to reach cash flow breakeven and has limited cash reserves. The company is currently focused on Improving gross profit margins and reducing operating costs, which is a difficult task given the price pressure and the decline in sales. Inventory is expected to be a significant source of cash in 2023, but this is a one-time leverage and won’t necessarily position Beyond Meat stock for free cash flow generation on an ongoing basis. Beyond Meat needs to create sustainable long-term growth, but doing so can be difficult without bringing its product closer to cost parity with meat.

manufacturing costs

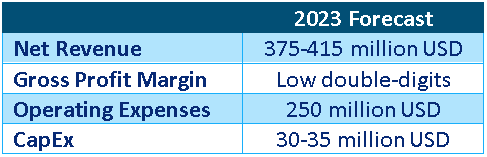

Beyond Meat’s COGS have increased significantly in recent years, which coupled with falling prices has resulted in negative gross profit margins. However, Beyond Meat is not alone here, many companies with insufficiently optimized supply chains that rely on third-party manufacturers have faced the same problem.

Increases in the cost of crafting Beyond Meat have been attributed to the following issues:

- Higher stock reserves

- Higher material costs

- Increased logistic costs per pound

However, supply chain issues have eased significantly in recent months, which should support Beyond Meat’s margins going forward. It may take some time for this to show up on the P&L as Beyond Meat carries a large amount of expensive inventory.

Beyond Meat has sought to offset supply chain issues by improving their operational efficiencies. Measures taken include:

- Correct dimensioning of your production networks

- Restructuring of Certain Agreements

- Insourcing of a larger share of the production volume

- Improved production staffing management during quiet times

Beyond Meat has a highly seasonal business, and managing that seasonality effectively seems to be an ongoing issue. The company has reduced its dependency on co-makers from a peak of eight in 2022 to three today. This consolidation of the production network has reduced Beyond Meat’s exposure to underutilization penalties, which will allow Beyond Meat to save approximately $8 million in 2023.

As a result of these factors, gross margins improved approximately 14% sequentially in the fourth quarter. Production costs are likely to fall further throughout 2023, but profits will be limited in the absence of growth. Insourcing creates leverage in the business, and without a return to growth, Beyond Meat may find it difficult to bring production costs back to where they need to be.

Figure 1: Beyond Meat COGS per lb (Created by the author using data from Beyond Meat)

During the fourth quarter of 2022, Beyond Meat also benefited from actions to restructure certain contracts and operational activities related to Beyond Meat Jerky. This resulted in a $3.6 million cost reduction. Beyond Meat introduced jerky (Original, Hot & Spicy, and Teriyaki) in 2022 through their joint venture with PepsiCo. This was a nationwide launch in 56,000 stores, growing to 80,000 stores in the first few months, so had high expectations. However, the product did not meet these expectations. Beyond Meat Jerky was a strong headwind (5-10%) as Beyond Meat used expensive third-party production to ramp up production quickly.

cash flow

Beyond Meat is targeting positive cash flows from operations in the second half of 2023 and is taking decisive action to achieve this. Significant improvement is expected from the improvement in COGS as supply chain headwinds ease, along with the adjustment in operating expenses. Even if Beyond Meat could return gross margin to over 30%, it would still require significant growth or a large reduction in operating expenses for the company to remain profitable.

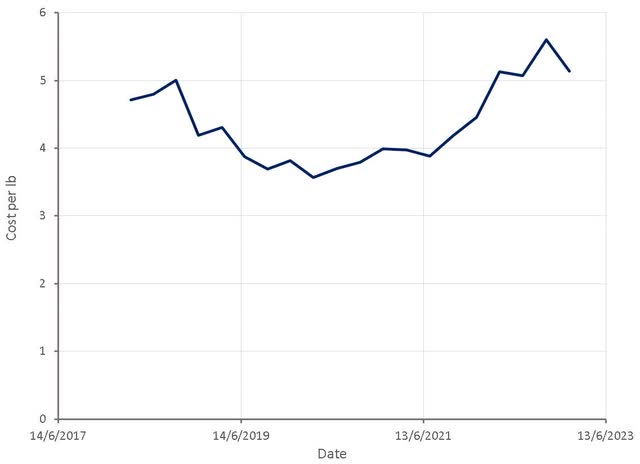

Figure 2: Beyond Meat vacancies (Revealera.com)

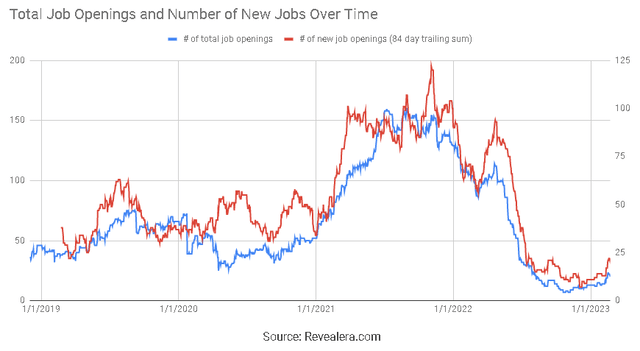

It should also be noted that much of the shift towards positive operating cash flows is likely to come from a reduction in inventories. While this is necessary, it’s a one-time lever that won’t necessarily position Beyond Meat for sustained free cash flow generation going forward. Inventory reduction is expected to be enabled through improved forecasting, product rationalization and a more efficient supply and manufacturing network.

Figure 3: Beyond Meat Inventory Turnover (Created by the author using data from Beyond Meat)

financial analysis

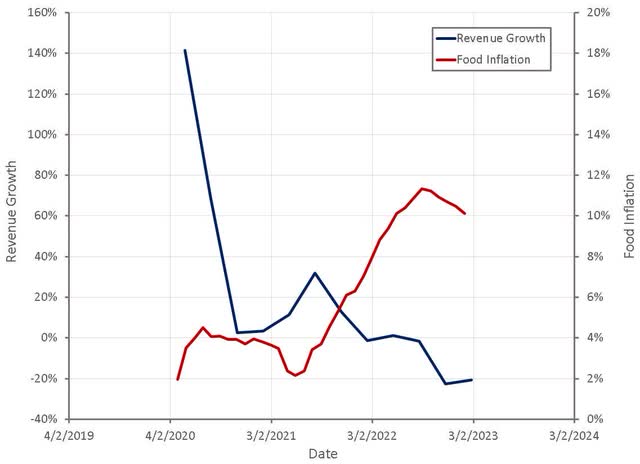

Beyond Meat revenue declined 20.6% year over year in the fourth quarter of 2022. While Beyond Meat faces increased competition, many of its current issues are industry-wide, with high inflation prompting consumers to trade down. This has also been suggested by some retailers and appears to be supported by inflation data.

Beyond Meat tested price cuts to assess the impact on consumption and seems happy with the results. It seems fairly obvious that demand will likely be significantly greater when Beyond Meat’s products are priced with or below meat, but Beyond Meat still has a long way to go to get to that point.

Figure 4: Beyond Meat Sales Growth (Created by the author using data from Beyond Meat and the Federal Reserve)

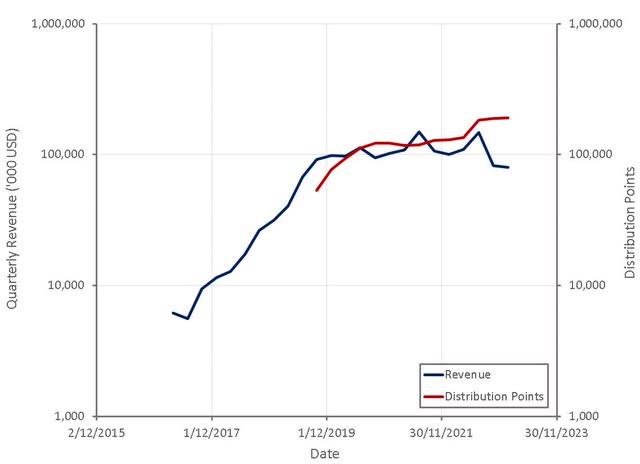

In addition to weak demand in the plant-based meat category, particularly in Beyond Meat’s core refrigerated subcategory, Beyond Meat is likely to face increased competition. Sales have been flat/declining for the past three years, although Beyond Meat has increased the number of products it offers and its distribution footprint.

Figure 5: Beyond Meat Earnings (Created by the author using data from Beyond Meat)

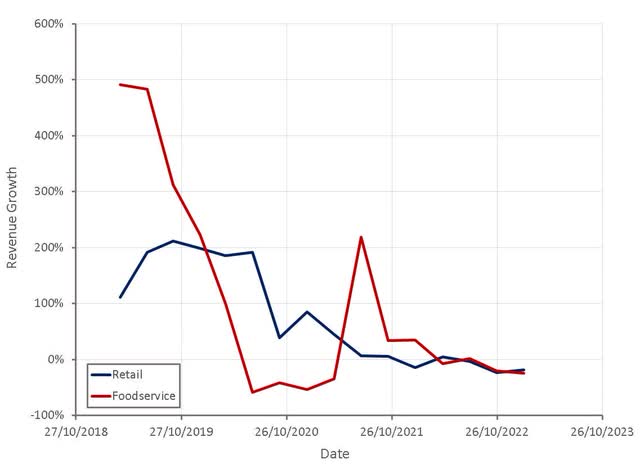

The weakness was broad across all channels and regions. Beyond Meat’s fourth-quarter sales decline was the result of a 16.9% decline in total pounds sold and a 4.4% decline in net sales per pound.

Figure 6: Beyond Meat Sales Growth by Channel (Created by the author using data from Beyond Meat)

The extent to which plant-based meats could create broad demand has always been critical to Beyond Meat’s success, but is also highly uncertain. The hype surrounding these types of products in 2019 made it seem like they might break out, but the past few years suggest it might just be a fad.

Until plant-based meat reaches price parity with meat, this category is unlikely to see widespread adoption. Management’s comments on the fourth-quarter earnings call also indicate that concerns over consumer health have become an issue. Management went to great lengths to highlight the health benefits, ingredients, and manufacturing processes of their products.

Figure 7: “Beyond Burger” search interest (Created by the author using data from Google Trends)

Beyond Meat’s gross profit margin was -3.7% in the fourth quarter. While some of this is due to ongoing price pressure, much of it is due to increased costs.

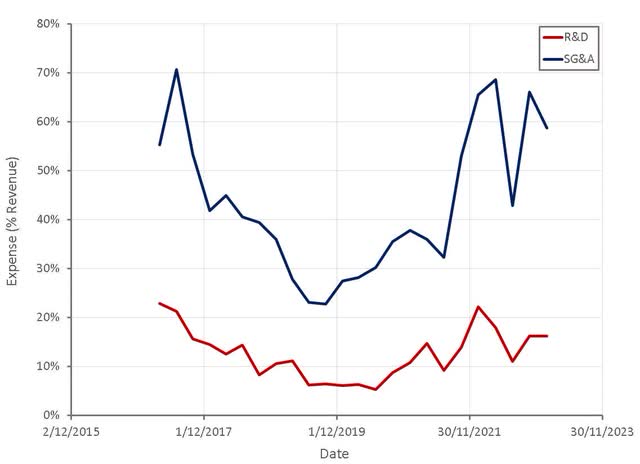

Beyond Meat has acted aggressively to reduce its operating expenses burden, but doing so has been a difficult task given the continued decline in sales. Measures taken include:

- Lower general and administrative costs

- Reduced costs related to production trial activities

- Reduced Marketing Spend

- Reduced labor costs outside of production

- Real estate footprint consolidation

Operating expenses were slightly higher in the fourth quarter due to one-time severance costs related to the Company’s previously announced headcount reduction.

Figure 8: Beyond Meat Operating Expenses (Created by the author using data from Beyond Meat)

Diploma

Beyond Meat’s cost base is currently too high, and this problem is compounded by increased production costs. The company will likely resolve some of these issues in 2023, but without growth, Beyond Meat will struggle to achieve operational profitability. The company continues to expand distribution and introduce new products like jerky and steak, but that hasn’t impacted sales so far. Falling inflation could lead to increased demand for plant-based meat, but Beyond Meat needs to reduce production costs so they can offer products at a more competitive price.

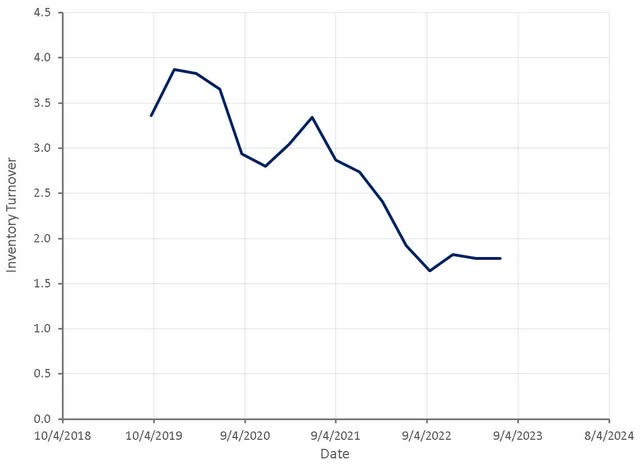

Table 1: Beyond Meat 2023 Forecast (Created by the author using data from Beyond Meat)