Big 5 Sporting Goods Gears Up for Earnings Release Amidst Notable Institutional Investor Activity and Dividend Declaration

Big 5 Sporting Goods (NASDAQ:BGFV) is set to unveil its eagerly anticipated earnings data after the close of the market on Tuesday, August 1st. As investors anxiously await this release, the company is offering interested parties the opportunity to register for their conference call by following this link. This development comes as institutional investors and hedge funds have recently made significant changes to their holdings in the organization.

One notable investor that has increased its stake in Big 5 Sporting Goods is FMR LLC. In fact, they have boosted their holding by an astounding 1,561.0% during the first quarter. As a result, FMR LLC now possesses 3,405 shares of the company’s stock with a current valuation of $26,000. Similarly, Great West Life Assurance Co. Can has also raised its position in Big 5 Sporting Goods by an impressive figure of 182.8% during the same period. They now own 1,459 shares worth $26,000 after adding an additional 943 shares to their portfolio.

Another noteworthy institution making waves in terms of investment activity is Quarry LP. They have increased their holdings in Big 5 Sporting Goods by a staggering 145.9% during Q1 of this year alone. Their current ownership stands at 5,782 shares with a value of $44,000 – an increase spearheaded by acquiring an extra 3,431 shares in recent months.

Notably, Covestor Ltd demonstrates confidence in Big 5 Sporting Goods as they purchased a new stake during Q1 valued at $65,000. This marks another positive indicator for those monitoring the company’s performance and potential future growth prospects.

Additionally, First Horizon Advisors Inc., further validating beliefs in Big-5’s potential growth trajectory acquired a new stake worth $70k just within Q1.

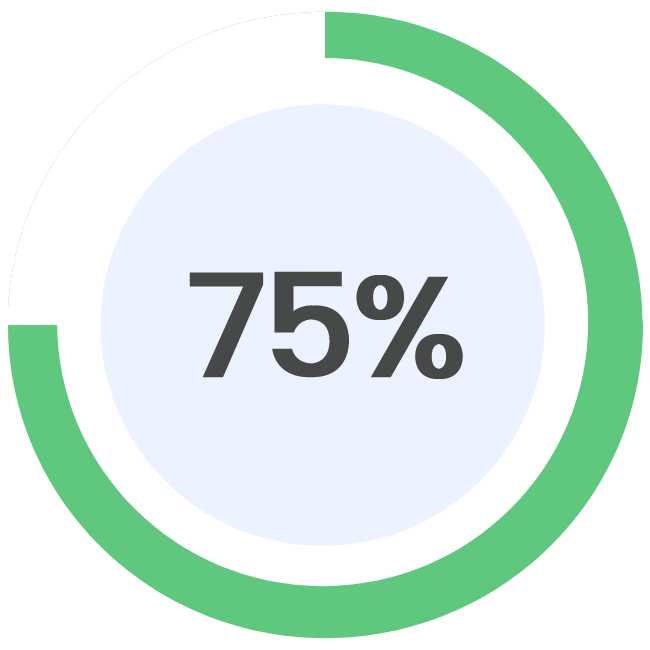

As these influential investors make moves within Big 5 Sporting Goods’ structure and portfolio, it is important to recognize that hedge funds and other institutional investors now hold a significant 41.70% of the company’s overall stock. This suggests a high degree of confidence in its ability to perform and deliver profitable returns.

Furthermore, Big 5 Sporting Goods recently declared a quarterly dividend which was paid out to shareholders on Thursday, June 15th. Stockholders who held the security on Thursday, June 1st enjoyed a dividend of $0.25 per share. With an annualized dividend standing at $1.00, investors can look forward to a generous dividend yield of 10.55%. It is worth noting that the ex-dividend date for this particular payout was Wednesday, May 31st.

In conclusion, as Big 5 Sporting Goods gears up to release its much-anticipated earnings data next week, all eyes are on the company’s performance and growth potential. With notable institutional investors and hedge funds showing increased interest and participation along with the recent declaration of dividends, optimism for future success within this sector remains high. As market observers eagerly await Tuesday’s earnings release, it is clear that Big 5 Sporting Goods has built substantial momentum and continues to be an attractive investment option for many discerning investors in today’s ever-evolving marketplace.

Date Published: July 27, 2023

Big 5 Sporting Goods Reports Quarterly Earnings and Demonstrates Positive Financial Indicators Amidst Competitive Market

In a recent announcement, Big 5 Sporting Goods (NASDAQ:BGFV) revealed its quarterly earnings data on Tuesday, May 2nd. The company reported earnings per share of $0.01 for the quarter, falling short of analysts’ consensus estimates of $0.02 by a margin of ($0.01). Despite this setback, Big 5 Sporting Goods managed to generate revenue amounting to $224.94 million during the same period.

Examining the financial health of Big 5 Sporting Goods reveals a net margin of 1.76% and a return on equity of 6.41%. These figures shed light on the company’s ability to effectively manage its finances and generate profits in a highly competitive market.

In terms of stock performance, Big 5 Sporting Goods experienced an upward surge during trading hours on Wednesday, July 27th, with shares reaching $9.48—a $0.24 increase from previous figures. This coincided with a trading volume of 152,337 shares, compared to the average volume of 284,458 shares.

Taking a closer look at the company’s balance sheet highlights its debt-to-equity ratio of 0.03, indicating a relatively low level of leverage compared to its overall equity position. Additionally, Big 5 Sporting Goods boasts current and quick ratios of 1.64 and 0.24 respectively, highlighting its ability to meet short-term obligations efficiently.

Analyzing stock movements over time reveals that Big 5 Sporting Goods has had a similar trend in both its moving averages—50-day and 200-day—which stood at $8.54 and $8.61 respectively as of the reference date (July 27th). This suggests stability within the market while reflecting investors’ confidence in the company’s future prospects.

The market capitalization for Big 5 Sporting Goods currently stands at approximately $212.26 million, with a price-to-earnings ratio of 11.70. Furthermore, the company has shown a beta of 2.74, indicating a higher level of volatility compared to the broader market.

In terms of recent insider activities, VP Jeffrey L. Fraley and VP Shane O. Starr both made notable sales of Big 5 Sporting Goods shares in May. Fraley sold 3,764 shares at an average price of $7.69, racking up a total transaction value of $28,945.16. Following this sale, Fraley possessed 16,075 shares with an estimated value of $123,616.75.

On the other hand, Starr disposed of 3,752 shares on May 4th at an average price of $7.17, resulting in a total value of $26,901.84. Subsequently owning 17,250 shares valued at approximately $123,682.50 after the sale’s conclusion.

It is essential to note that these insider transactions were disclosed through legal filings with the Securities & Exchange Commission (SEC). Interested individuals can access further details pertaining to these transactions by following the provided hyperlink or visiting the SEC website.

As we examine ownership breakdowns and decision-making processes within Big 5 Sporting Goods, it becomes evident that company insiders hold around 5.40% of its stock—an indication that those involved within the organization have a vested interest in its success.

In conclusion, despite missing analysts’ expectations for earnings per share in its recent quarterly report, Big 5 Sporting Goods showcased strong revenue performance during that period. With continued stability in stock prices and positive indicators concerning financial health and liquidity ratios—backed by relatively low levels of debt—we can observe optimism surrounding Big 5 Sporting Goods’ prospects for future growth and profitability within today’s competitive sporting goods market.