Big 5 Sporting Goods: Is The Dividend Safe? (NASDAQ:BGFV)

fstop123/E+ via Getty Images

company snapshot

Big 5 sporting goods (NASDAQ:BGFV) is a micro-cap stock whose fortunes are tied to the dynamism of the US sporting goods retail industry, which has reportedly grown at ~7% pa over the past five years. 54% of The product mix consists of durable goods covering durable items such as exercise equipment, baseball gloves, etc. The rest of the product mix consists of soft goods or consumer goods (shoes, shirts, other apparel, etc.). BGFV’s product portfolio not only includes products from well-established brands (such as Nike, Spalding, Skechers etc.), but also includes private labels and branded goods that are manufactured exclusively for BGFV. While the company operates an e-commerce platform, the bulk of its business comes from operating 432 stores across the West Coast region.

The Dividend Angle

I’m not particularly fascinated by that Core story from BGFV, the sporting goods retailer, but it’s hard to remain indifferent to the dividend yield that comes with the stock. From today’s perspective, you’re dealing with a stock that is yielding an impressive 13.6%, nearly double the five-year average return 7.6%!

YCharts

That’s a staggering number at first glance, but what is BGFV’s dividend policy and is the dividend vulnerable to cuts?

First, investors need to understand that BGFV has a fairly one-sided quarterly dividend history; In recent years, we’ve seen periods of no dividends (during the pandemic era) as well as periods when we’ve seen two special dividends (in 2021). Basically, rather than having a set dividend policy linked to, for example, a specific target dividend coverage or cash payout ratio, BGFV’s dividend policy is fluid and left to the “periodic” discretion of the Board of Directors.

Prima facie, since the board has the flexibility to cancel dividends whenever they want, and we also have a pretty patchy dividend history, things don’t bode well. However, let’s try to see if the conditions are in place to sustain the dividend for the foreseeable future.

The financial outlook and the impact on dividends

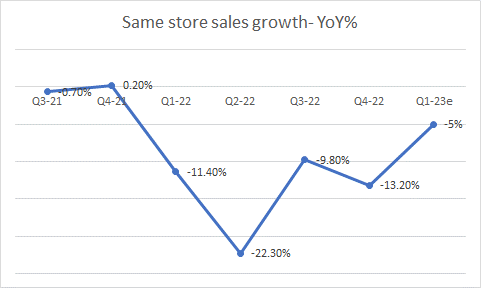

It’s fair to say that BGFV’s top line hasn’t been in the best of shape for a while. First, same-store sales have been down for five of the last six quarters. While the company’s exit rates have likely benefited from some seasonal winter sales, that won’t be enough and Q1-23 could likely be another quarter where BGFV saw negative same-store sales growth (expected at a mid-single-digit decline) .

Transcripts of earnings calls

Nonetheless, with easier comps ahead, one would hope to see positive revenue growth for the remainder of FY23. In fact, the sell-side consensus expects the company to post positive 2.5% net sales growth for the full fiscal year 23.

One reason BGFV may be experiencing volume pressures is that, unlike many other competitors, it is reluctant to engage in high promotions. Ideally, this should bode well for merchandise margins, but note that those margins are still down 129 basis points in the fourth quarter. Meanwhile, BGFV has also limited its momentum on print advertising spend, and you would hope that would have a positive impact on its operating cost base. All in all, consensus believes the company could see an 11 basis point improvement in overall EBITDA margin for FY23.

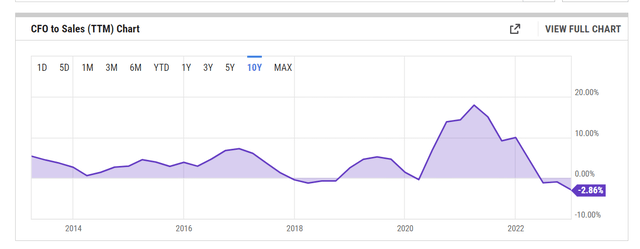

A slightly better operating position should give BGFV a decent foundation to generate positive operating cash flow. After that, much will depend on how BGFV manages its working capital position, which has recently been causing significant pressure on operating cash flow. As noted in the figure below, there have been very few instances over the past decade where BGFV has not been able to convert its sales into positive operating cash flow.

YCharts

I don’t think the negative operating cash flow position will last too long as the company’s accounts payable position is likely to be a positive cash flow contributor next year ($37M in operating cash siphoned in FY22). Last year, BGFV was unable to effectively stretch its debt as it had to fund its inventory as supply chain problems eased.

Nonetheless, over the past five years, BGFV has turned an average of over 5% of its revenue into operating cash flow. To be careful, if we just use a 4% conversion number for the next year, that would give you over $40 million in operating cash flow on the expected FY23 consensus figure of $1020 million. After spending $13 million on CAPEX last year, management now expects to spend up to $20 million on CAPEX in FY23. That would leave BGFV with about $20 million in free cash flow to fund its dividends.

Despite a drop in the stock price, BGFV’s management has not taken the opportunity to buy shares cheaply, despite receiving over $21 million in buyback authorization from the board (from the $25 million plan, last year they only wagered $4.1 million and made no buybacks in Q3 and Q4). This implies that any excess cash they have will likely go to dividends first.

If we assume a similar quarterly dividend per share of $0.25 with no decrease in outstanding shares, that would result in an annual dividend bill of less than $22 million, giving BGFV approximately $2 million from the FCF related financing would be lacking. They would then have to use their revolver credit facility, which they didn’t use last year.

In summary, if BGFV could bring sales to OCF (operating cash flow) conversion back to historic levels (of +5%) then they should be able to comfortably cover their dividends with internally generated cash flow ( this equates to $30 million in free play). Cash flow considering management’s invoiced CAPEX forecast of $20 million). However, failing to do so makes dividend coverage much more difficult, and taking on debt when the company already has $222 million in sizeable leases doesn’t feel too comforting.

Final Thoughts – Other Considerations

Despite a rather underwhelming FY23 outlook (EPS likely to decline -0.8% to $1.21 in FY23), BGFV’s forward-looking valuation picture looks reasonable enough. Earnings per share of $1.21 translates to an expected P/E of just 6x, which translates to a ~27% discount to the stock’s long-term average P/E of 8.2.

YCharts

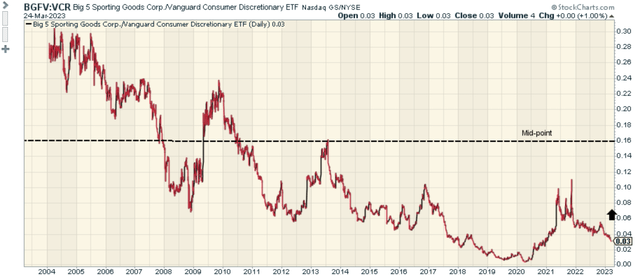

Then, when looking at potential mean reversion opportunities in consumer discretionary, it’s fair to say that the Big 5 sporting goods stock could top the chart. The stock’s relative strength against the Vanguard Consumer Discretionary ETF (VCR) appears to be relatively overextended on the downside, currently trading 5 times lower than the midpoint of its lifetime range.

stock charts

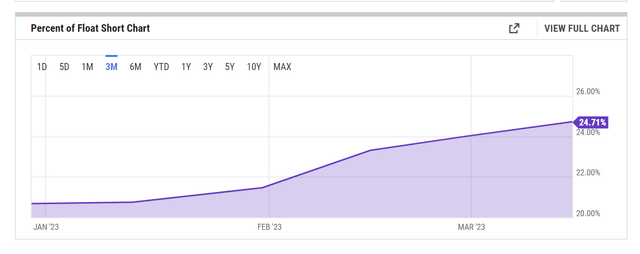

However, looking at BGFV’s standalone weekly chart, there is no sign of a bottom forming just yet; The stock just continues to experience a series of lower lows and lower highs, even as the percentage of the float that is short has continued to increase every two weeks since midDecember. There is a chance the sell will unravel as the stock has recently fallen into an old overload zone (between August/September 2020 the stock spent a few weeks building a base within the $5-$8 range).

Invest

YCharts

Nonetheless, I would not recommend long positions in this name until the price action flattens out.