Big 5 Sporting Goods: Staying In For The Dividend (NASDAQ:BGFV)

AndreyPopov

It’s been about 11 months since I announced to the world that I was still a long time ranked in the Big 5 Sporting Goods Corporation (NASDAQ:BGFV), and during that time, the shares posted a loss of about 18.7% for a gain of 8% for the S&P 500. That’s obviously problematic, but it’s time to consider whether this stock makes sense to buy more, hold it, or take my shares and move on. I will make this decision by looking at the financial results that have been released since I last wrote about the name and by looking at the rating. Before doing so, however, I will provide a very brief summary of the most recent earnings call to provide context for the analysis below.

Welcome to the Thesis Statement portion of the program. Here I offer you the essentials In my opinion if it wasn’t clear enough for you from the title and bullet points above. I’m doing this so you don’t have to read the entire article, thus saving you time. You’re welcome. I think the dividend is sustainable here, which supports the price and gives shareholders a predictability they may not always get. At the same time, the shares are currently very cheaply valued. So if I didn’t already have a position here, today would be the day to fix this issue. However, I will not expand my position. The company itself is telling the market that 2023 will be a challenging year and I see no reason not to believe them. I like the risk-free capital structure and reasonably well-covered dividend here, so I’ll stay tuned. For new capital, however, I will find safer, lower-yielding government bonds.

I think some interesting things came up on the last conference call and I’ll offer them to you so you don’t have to read the transcript.

-

The company achieved the mid-range guidance despite a difficult macroeconomic environment.

-

The weather was a bit of a challenge, but the gloomy macro environment was a significant challenge for the company (including the negative impact of the regional banking crisis and lower tax refunds).

-

The company is managing its inventories much better than it was in the pre-pandemic era, resulting in merchandise margins up several hundred basis points compared to that period.

-

The current state of the world remains a challenging environment, and the second quarter got off to a smooth start, with revenue down 11% at the time of the earnings call compared to the year-ago period. Written results for the second quarter revolve around high-volume periods like Memorial Day, Father’s Day and the start of summer, and the company is forecasting a high-single-digit decline from the year-ago period.

As such, I think the combination of difficult comparisons and a challenging macro environment will continue to weigh on this business and impressions of growth potential. I will examine the financials against this background.

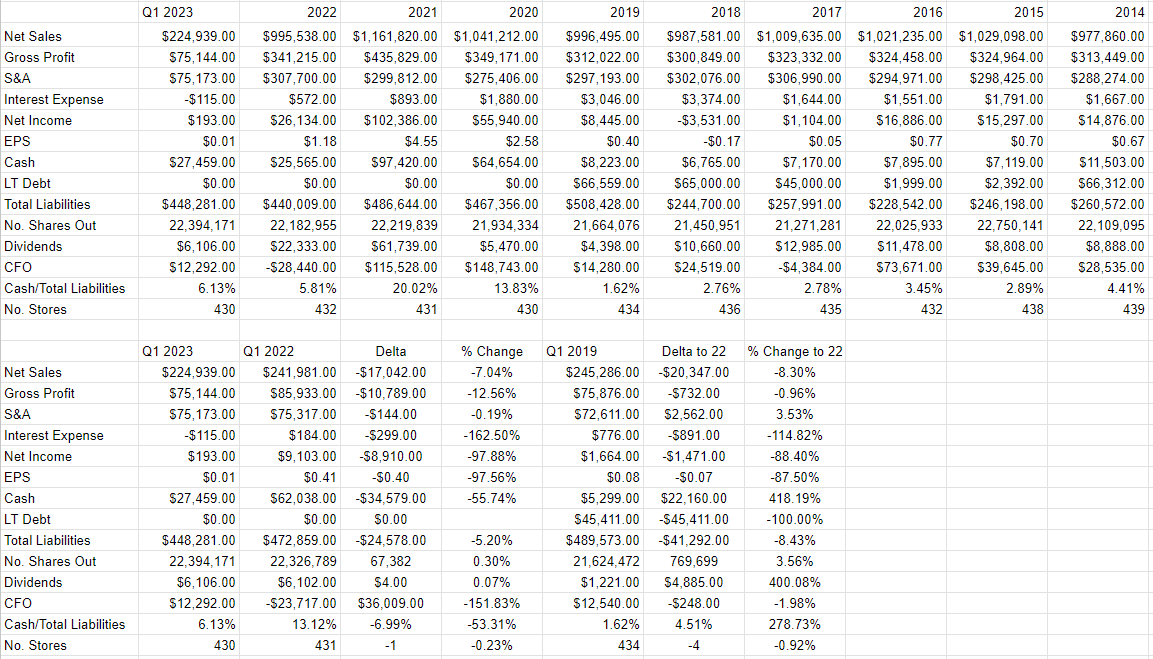

Financial Snapshot

Before I compare the last quarter to the same period last year, I want to write about how 2022 was. I would say that 2022 was a mixed bag or great year depending on your frame of reference. If you compare it to 2021, you’ll be disappointed as sales fell 14% and net income fell a staggering 75%. Full year 2022 was great compared to pre-pandemic times, with net income last year up about 209% from 2019. The capital structure has also improved massively since then, with cash in 2022 up 210% over 2022 in 2019. and total liabilities fell by a whopping 13.5%. So the trend here is either “good” or “bad” depending on where you start the analysis.

Looking at the last quarter, I think it’s safe to say that the trend observed above is somewhat continuing. The capital structure in the first quarter of this year was worse in some respects than in the first quarter of 2022. Total debt is down $24.6 million from the year-ago period, but cash is down a full $34.5 million. Nevertheless, the debt-free balance sheet remains absolutely solid at the moment. In my experience, this is currently a rarity. That aside, the capital structure is much, much better today than it was in 2019, with cash up 418% today and total debt down 8.4% from the first quarter of 2019. Revenue and net income were in the first quarter of this year, however weak compared to the same period last year and compared to 2019. Based on what the company said on the conference call, I’m not confident that’s going to change anytime soon.

More important than all that, however, is the sustainability of the dividend. While I’m usually a fan of accrual accounting, when it comes to dividends and their sustainability, I look to cash flow. Given that the company generated $12.3 million in cash from operations for the quarter while only paying out about $6.1 million in dividends, I’m reasonably optimistic. Additionally, I think it’s worth noting that since 2014, the company has generated $424.4 million in cash from operations while paying out $152.8 million in dividends. I’ve also observed that cash flow from operations has been fairly stable, with only two negative years (2022 and 2017) out of the last nine years. With that in mind, I’m actually pretty happy with the dividend payout and would be willing to buy more shares at the right price.

Big 5 financial metrics (Big 5 Investor Relations)

The stock

If you’re one of my regular readers, you know what’s about to happen. I want to reiterate that I think of the stock and the business as different things. I’ve written my argument so many times that I’m afraid of boring my regular readers. However, that won’t stop me from writing it again, because your potential boredom is a price I’m willing to pay. The company makes money by selling sporting goods and accessories. The stock represents an ownership interest in the company, but because it’s crowd-driven, the price moves up and down more than I think is reasonable. In my view, the ups and downs in prices often reflect the mood of the moody crowd rather than having anything to do with the business. Also, when the crowd is reacting to what’s going on in the company, it often overreacts, and I think that overreaction is the source of potential gain.

To illustrate this reality with this stock, let’s imagine that there are two investors who both decide to buy this stock based on exactly the same level of knowledge about what’s going on at the company. One buys on February 17th of this year and currently has a decline in their investment of about 4%. The second person gets distracted and buys exactly a month later and is up about 29% since then. Not enough has happened at the company to justify a 33% change in profitability in one month. The stock is really important, and I don’t want to buy from investors unless they’re relatively shy.

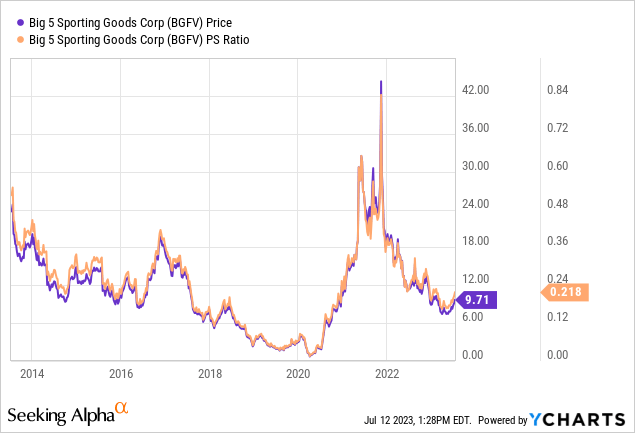

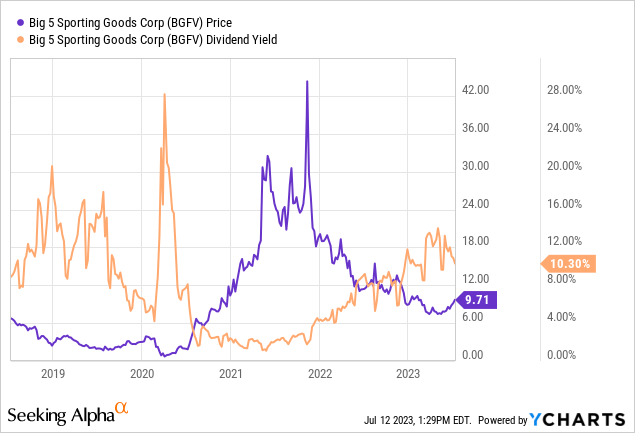

Another word for “relatively timid” is “cheap,” which is why I’m very keen on buying cheap stocks. I measure cheapness in a variety of ways, from the simple to the more complex. At a simplistic level, I like to look at the relationship of the market price to a measure of economic value such as earnings, free cash flow, and the like. I want a stock to trade at a discount to both the overall market and its own history. When I last checked Big 5, the shares were trading at a price-to-sales ratio of about 0.23 and the stock was yielding 9%. Fast forward to the present and here is the current state of the country. In fact, shares are about 5% cheaper and the dividend yield is about 14% higher than before.

Source: YCharts

Source: YCharts

I’m definitely not going to sell as this reasonably safe dividend currently yields about 645 basis points above the 10-year risk-free rate. I think that’s a reasonable premium. As I wrote above, I want to use relatively simple and more complex tools to find out what the market “believes” about the future of a given company. Ratios are one of the easier ways to study this. I also apply a bit of high school algebra to this task, using methods outlined in books like Accounting for Value by Penman and Expectations Investing by Mauboussin and Rappaport. Both books introduce the idea that the stock price itself provides a wealth of information about growth assumptions. The greater the assumptions about future growth, the riskier the investment. Applying this thinking to the Big 5 suggests that the market expects this company to go bankrupt within five years. Now I understand that there will be headwinds, but I think that’s exaggerated.

With that in mind, I will not be selling or adding to my position here. I would like to receive capital and would like to earn the interest rates offered on government bonds. If there was any hope that the Big 5 would experience a major growth spurt soon, I’d add to my position, but the company itself is cautious. Because of this, I’m keeping my Big 5 position and not building it up.