Bitcoin Margin Funding Rate Jumps Amid Latest Price Spike – Can New Investor Influx Keep Pumping BTC?

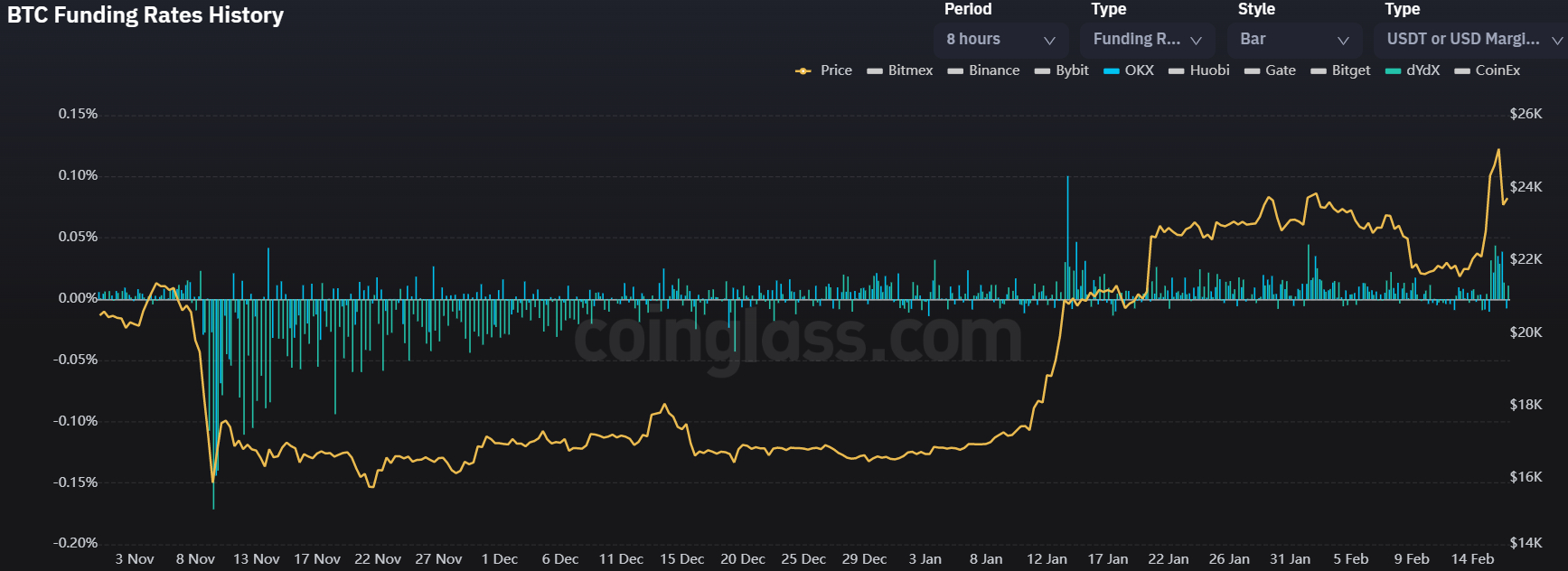

Bitcoin funding rates for margin positions have surged over the past two days to their highest levels in over two weeks, according to data from cryptocurrency exchanges OKX and dYdX presented by crypto analytics website coinglass.com. Positive funding rates suggest speculators are bullish and suggest long traders are paying funds to short traders.

The surge in Bitcoin funding rates follows the cryptocurrency’s recent price jump, which saw it hit new eight-month highs of $25,270 on Thursday, after trading as low as $21,300 earlier this week. Bitcoin has since retreated to the upper $23,000 but is still up over 8.5% this week. The price jump of the past few days has also led to a spike in bitcoin futures short liquidations, according to coinglass.com.

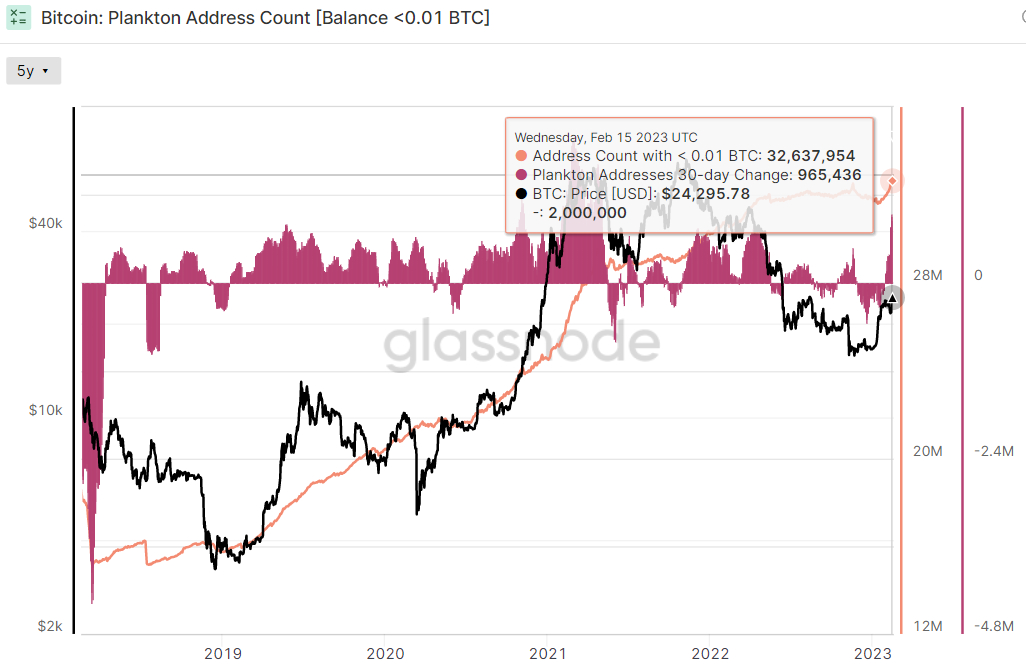

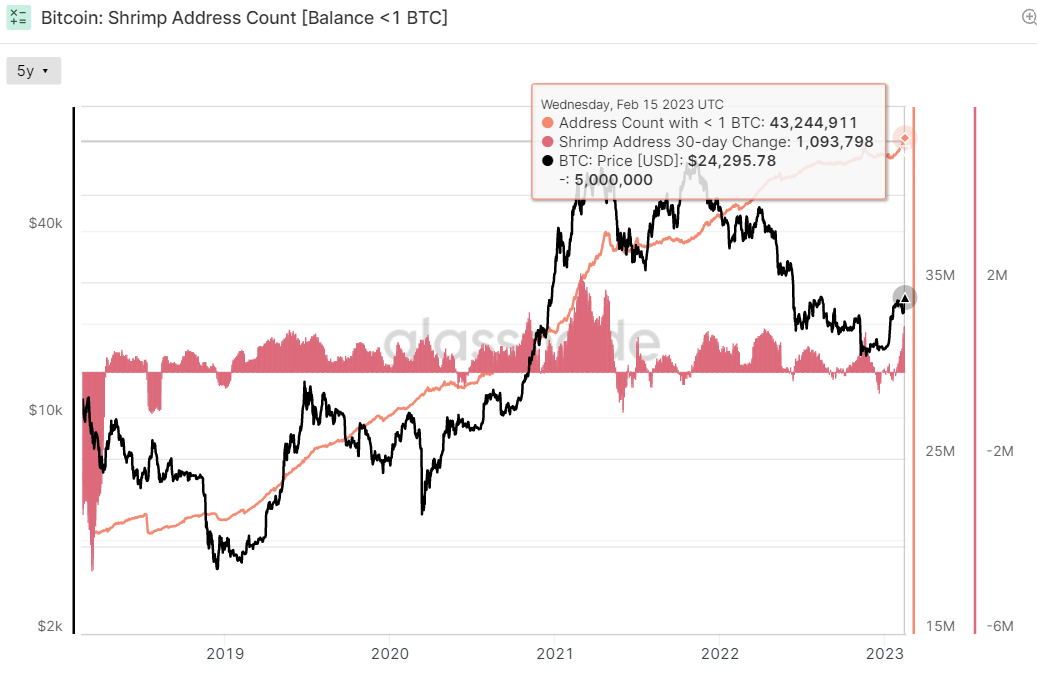

The recent price jump and subsequent rise in the margin funding rate comes against a backdrop of a continued surge in new Bitcoin investors. At least that is the conclusion that can be drawn from analyzing trends in the distribution of BTC holdings across wallets, with the number of wallets with a small balance of BTC (presumably retail investors) increasing rapidly.

Can New Investors Keep Bitcoin Price Higher?

According to crypto data analytics platform Glassnode, the number of bitcoin wallet addresses with non-zero balances recently surpassed 44 million for the first time. This growth was unsurprisingly fueled by an increase in the number of wallets with small BTC balances. So-called “plankton” addresses below 0.01 BTC recently hit all-time highs above 32.6 million.

The number of so-called “shrimp” addresses, defined as ownership below 1 BTC, also recently hit a new all-time high at over 43.2 million. This indicates an influx of new investors, which is likely helping to propel Bitcoin’s recent gains.

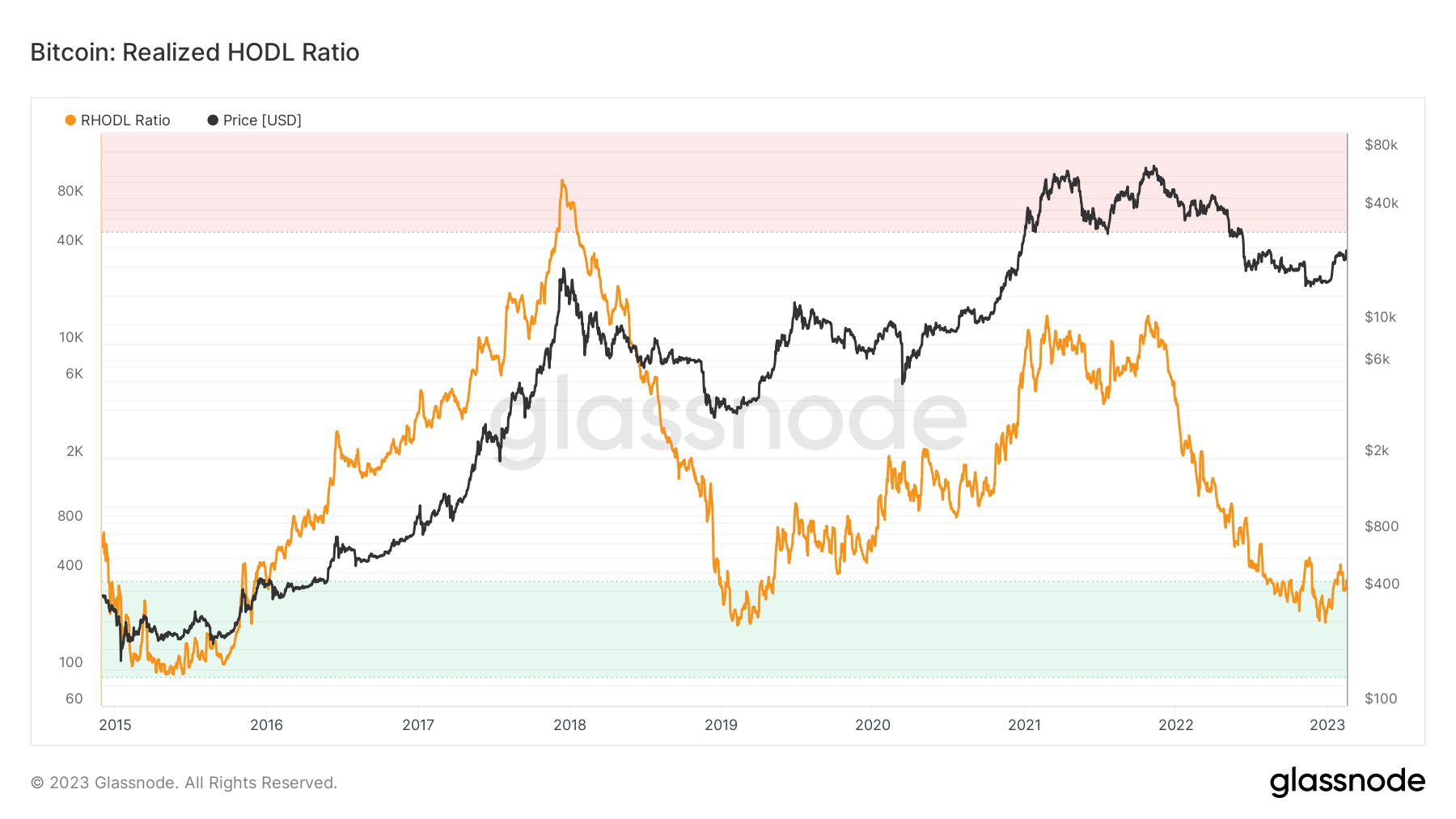

Historically, during a Bitcoin bear market, the balance of BTC wealth is concentrated in the hands of investors who are likely to have higher conviction. Classically, when this BTC asset concentration starts to reverse, it has been an early indicator that a new Bitcoin bull market is beginning and that new investors are returning to the market. This trend can be seen in Glassnode’s Realized HODL Ratio indicator.

The RHODL ratio takes the ratio between the 1 week old coins and the 1-2 year old coins (i.e. when the coins were last moved). When it rises, it suggests more coins are moving, indicating an influx of new buyers. When it falls, it suggests that coins are accumulating in wallets that are no longer willing to sell, which usually happens when weak investors sell to stronger investors during a bear market.

As can be seen in the chart above, the recent bottoming and tentative uptrend on the balance sheet of BTC wealth suggests that Bitcoin may have bottomed this cycle. Bitcoin bulls will hope that an influx of new investors can push the price higher amid growing macro headwinds.