Central banks drove this vital skill out of investor brains. Here’s how to relearn it.

Staying above the turmoil is easier said than done for investors these days.

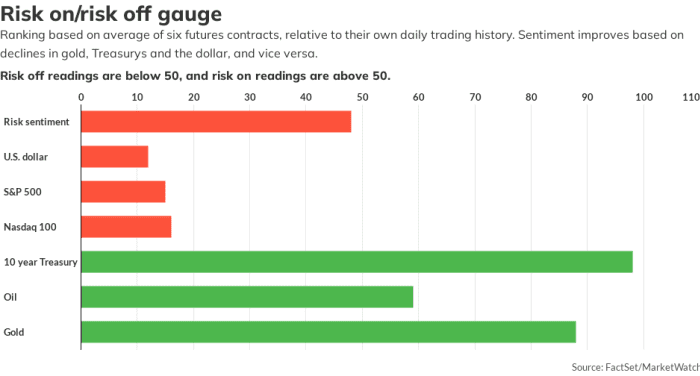

The calm that has settled in global markets after the Bank of England’s unprecedented intervention to support UK bonds appears to be fading, with stocks lower as risk-off sentiment builds for Thursday.

It’s hard to find a major money manager who isn’t worried out there, amid fears that the Fed may “break something” as inflation soars and Europe’s energy crisis deepens.

With central banks – the BoE currently an exception – no longer providing liquidity support to markets, investors must now be more flexible if they hope to preserve their capital or even squeeze some alpha out of their portfolios.

That’s the message from Stock Traders Daily and portfolio manager at Equity Logic, Thomas H. Kee Jr., who wrote in our call of the day says they must learn or relearn a vital skill to survive these turbulent times.

“Unfortunately, many in today’s market have completely forgotten how to manage risk, and for the past decade FOMC has taken Wall Street away from worrying about risk,” Kee said in a recent post he discussed in an interview with MarketWatch.

In short, some investors have mastered the art of not managing risk at all, Kee said. And risk management has been a core part of his Stock Traders Daily strategies from the height of the internet bubble through a decade of economic recovery. Since 2000, he notes, “some of the best times have come during times of widespread fear in the market.”

At its core, risk management “reduces both the temptations that come with greed and the stress that comes with fear cycles,” allowing investment to flow through economic and market turbulence, Kee said.

So how not to be at the mercy of the markets and fear? Forget that buy-and-hold strategy for starters, said the portfolio manager, who has long pursued a strategy of switching between cash and the highly liquid SPDR S&P 500 ETF SPY,

He highlights his stock of the week strategy as an option for small investors, who can be more nimble than the larger institutions that have too much cash to move.

“The approach is to trade one stock each week according to a trading schedule that is aligned with expected market flow over the coming week. The correlation factor is important, but the risk controls associated with trading plans are traditional. They are normal stop losses, but what is not normal is that this strategy also ends in cash every week,” explains Kee.

This means investors can “nap” from market exposure over the weekend as the strategy objective is to trade one stock each week and exit each week

Cash.

And using turbulent environments to an investor’s advantage has worked for them, too, when it comes to a cornerstone stock. Kee bought Apple AAPL,

in May and then sold it near the highs in mid-August along with Invesco QQQ QQQ,

an exchange-traded fund (ETF) that tracks the Nasdaq 100 index, in mid-August.

He has bought back Apple, which had a rough day on Wednesday amid reports of slowing demand for its latest models.

He says investors need to look for stocks that “stand up to the good times and the bad,” he said. “Apple is a trailblazer and you shouldn’t invest in lower quality stocks in such conditions,” he said, adding that the stock’s quality allows it to be held for a month or two.

Read: Apple and Tesla are the “last bastions of hope” for retail investors, these analysts say

The markets

shares DJIA,

SPX,

comp,

are under pressure as bond yields TMUBMUSD02Y,

TMUBMUSD10J,

continue their march higher, along with the Dollar DXY,

which puts pressure on the pound GBPUSD,

and euros EURUSD,

UK Government Bond Yields TMBMKGB-10Y,

at the heart of Wednesday’s financial storm, crawling up again. oil CL.1,

and gold GC00,

the prices go down.

Watch Yuan USDCNY,

as China’s state banks were reportedly told to stock up on the currency for intervention.

The Buzz

Trapped in their homes and 2 million without power. The excavation of one of the strongest hurricanes to ever hit the United States begins in Florida.

Weekly jobless claims fell 16,000 to the lowest since April, while GED revisions showed confirmation of a fall in the first half of 2022. We’ll also hear from James Bullard, President of the St. Louis Fed, and the San Francisco Pres. Mary Daly.

CarMax bearing KMX,

declines after a larger-than-expected profit loss as customer “affordability” issues caused a sharp drop in sales. Larger than expected losses from Rite Aid RAD,

and Bed Bath & Beyond BBBY,

meet these stocks.

Semiconductor group Micron Technology MU,

and sportswear manufacturer Nike NKE,

both will report after the close of trading.

Warren Buffett’s Berkshire Hathaway BRK.B,

bought another 6 million shares of Occidental Petroleum OXY,

after a new login.

Shares in the luxury car manufacturer Porsche P911,

rose on its trading debut after pricing its IPO at the higher end of the range.

No excuses. In her first comments since the UK government’s tax cut plans have sparked market turmoil, Prime Minister Liz Truss has defended herself. Alarmed US and IMF officials have reportedly put pressure on their governments.

Opinion: The BoE’s surprise move was smart – but the government still faces major challenges

The best of the web

Cages stacked floor to ceiling with no light. Humane Society uncovers shocking atrocities on Romanian chinchilla fur farms

As a fourth Nord Stream leak is discovered, here’s what scientists say about the environmental impact

A long-term options trade from the ‘Industry’ show would have paid off on Wednesday

The charts

From the “How bad is it” section…

The tickers

These were the most searched tickers on MarketWatch as of 6:00 a.m. EST:

|

ticker |

security name |

|

GME, |

GameStop |

|

TSLA, |

Tesla |

|

AMC, |

AMC entertainment |

|

AAPL, |

Apple |

|

BBBy, |

bed bath beyond |

|

MONKEY, |

AMC Entertainment preferred stock |

|

NEVER, |

NEVER |

|

AMZN, |

Amazon |

|

TWTR, |

|

|

DWAC, |

Digital World Acquisition Corp. |

Random Reading

President Joe Biden accidentally called for a dead congressman

Former British footballer conscripted into the Russian Army.

Dogs can smell your stress

Gangsta’s Paradise rapper Coolio has died aged 59.

Need to Know starts early and will be updated by the opening bell, but sign up here to have it delivered to your email inbox once. The emailed version will be sent around 7:30am EST.