Climate investor who made right Exxon bet on how to beat the market

A view of the Exxon Mobil refinery in Baytown, Texas.

Jessica Rinaldi | Reuters

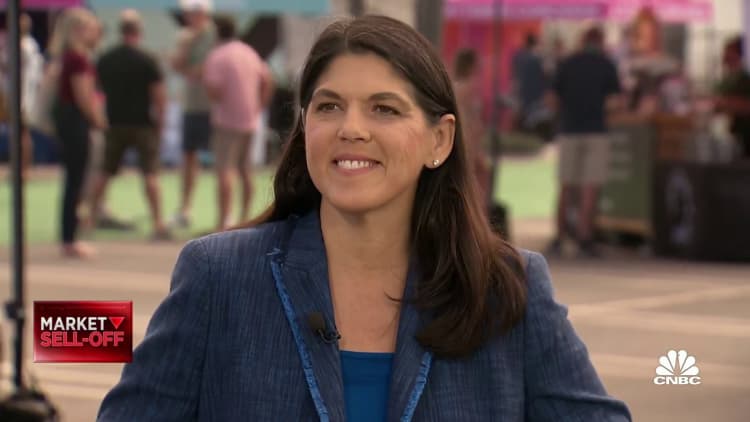

Jennifer Grancio was one of the leading companies at Engine No. 1, the burgeoning investment firm focused on climate and energy transitions that beat ExxonMobil in a 2021 proxy contest few saw coming. What engine no. 1 decided next was perhaps just as surprising: to move away from the activist investor approach that has worked so well to win seats on the oil and gas giant’s board of directors.

Current CEO Grancio wants the company not to be defined by the Exxon headline, but by a long-term investment approach that is a blueprint for how companies think about big system changes like the energy transition and how investors should access the value provided by the Businesses are created that sustain it, and transformed businesses scale.

“Investing is something you can do in the very short term, but for the vast majority of wealth owners … they’re all looking for long-term performance,” Grancio said Thursday at the CNBC ESG Impact virtual event. “The market can get confused when it comes to investing purely for ideological or extremely short-term reasons, but Engine #1 digs deep into companies and primarily looks at the business model and how it needs to change over time to create value for shareholders. “

ExxonMobil’s campaign addresses the big issues: the right governance to see companies through major system changes, making the right investments and avoiding the wrong ones. “We came to Exxon as an investor because we knew if it’s smart and has the right management for the energy transition and how the company will be valued after the energy transition, that’s going to be great for shareholders,” she said. “We think ExxonMobil’s campaign is about governance and long-term capitalism,” she said.

Grancio shared some of her key ideas for investing in the future and staying ahead of the market at ESG Impact.

Lots of tech, but no tech stocks

“As investors, we like to talk about Google and Amazon, but where the returns will really be in the next decade, let’s look at agriculture, autos and energy,” Grancio said.

Engine #1 is doing a lot of work on cars it’s publicly reported on, including an investment in GM, which it describes as a long-term transition.

“People know Tesla, but they forget GM and Ford,” Grancio said.

“We’re going to have this huge transition and it needs scaling, and that’s millions and millions of cars, and there’s a huge space for incumbents like GM and Ford to get involved in creating and fulfilling all of that demand,” she said . That doesn’t mean Tesla won’t be a winner, she added, but GM and Ford will be, too, Grancio said.

Don’t just be an index fund investor

Engine #1 has a passive index ETF – Grancio was a senior executive at the BlackRock iShares ETF business before joining Engine #1 – but she warns investors that they are equally focused on Tesla and Forget the rest of the auto sector, they will miss out on major investment opportunities if they stick to the index portfolio weights.

“If you leave your money in a passive index fund or just buy the supergrowth stocks, you have a huge problem in your portfolio,” she said. “Investors underweight the big transition ideas when they’re included in the indices,” she added.

Grancio said that keeping the market in an index fund allows investors to use their shareholder voting rights to drive results, which it did by joining forces with many large institutional shareholders to take on Exxon, but many of the biggest transitional moves , from energy to transportation, are underweight for the majority of investors due to the use of index funds.

Another great example she gave is agriculture, and one company she says is right: Deere. “It gets tractors and tractors dirty, but if we flip that and think about the impact and the global food crisis and how it’s resolved, Deere’s moves into precision ag are better for the climate and for farmers’ yield and financial performance,” said you. Deere is building a company to solve a huge systemic problem that also has an impact investing perspective, she said.

Still investing in Big Oil and expecting the energy transition to take “a little longer”.

Grancio says the collaboration between Engine No. 1 with Exxon is a sign that ESG investing is working. “Look at the appreciation of various energy companies and Exxon more than doubled, significantly outperforming its peers, and it wasn’t just the price of oil,” she said.

She also cited Oxy (formerly Occidental Petroleum), which has been a leader in the energy transition and more than doubled in size in 2022, “because it’s different than its peers,” she said. “We believe these are fundamentally investment issues,” she added. Another key factor that sets Oxy apart from its peers: Warren Buffett’s massive investment in the company.

Engine #1 continues to be an active owner of energy companies, working on many of the same issues as Exxon, albeit not through proxy warfare: managing capital allocation, setting clear emissions targets, and investing in the green energy business.

But the past year, in which oil prices have skyrocketed due to the war in Ukraine and critical energy shortages in Europe have been exposed, means that the energy transition “will probably take a little longer”.

“People are using fossil fuels and we haven’t made that transition yet and if we need fossil fuel assets they need to be managed by the biggest companies in a way that they are also looking for new technologies to maintain value after the transition, whenever we want to have more demand for renewable energy and carbon capture,” she said.

Therefore, she continues to see large energy companies as an investment opportunity. “They know how to do these things on a large scale. We need to deliver energy to the world today, but when we get to the other side of the energy transition it will require how they deal with these issues to still be great business,” she said. “We think there is a lot of room to work constructively with companies on these issues.”

Moving production to the US should be a new focus

While it doesn’t exactly fit into an ESG box like climate, Grancio said one of the biggest future investment opportunities she’s pursuing will be American companies in manufacturing, transportation and logistics, which are seeing a huge resurgence in domestic ones Production and manufacturing are linked.

“Investors don’t own railroads and don’t expect cars or chips to be made in the US,” she said.

On Thursday, President Biden announced a plan by IBM to invest $20 billion in the New York-based chip manufacturing facility, two days after Micron Technology announced up to $100 billion in semi-manufacturing investments in the state.

Without giving details, she said engine no. 1 will create an investment in the future around the opportunity to invest in the US supply chain. “We’ll do something,” she said.

The revival of domestic manufacturing in the US is a form of “system change” in a sense, as the globalization of previous decades is interrupted. And that fits with the overall discipline of Engine No. 1. “We truly believe that in order to make good decisions, you need to understand systems and businesses at a deep level. Investing should never be ideological. It should be about understanding these companies and how industries are changing,” she said. And at a time of serious policy backlash against ESG investing, mostly focused on energy companies and climate change, she added: “Hopefully we don’t let theater get in the way.”