Content Everywhere: Streaming gets a sporting chance | Industry Trends

What does this mean for the Content Everywhere suppliers and vendors that provide the technology to support this growing interest in streaming live sports? In the first part of this article, you’ll find views from leading Content Everywhere players about the trends in this space. In the second part, we’ll look at some real-world examples of how Content Everywhere vendors are supporting broadcasters and over-the-top (OTT) providers as they tackle this challenging but exciting opportunity.

Part 1: Sports streaming trends

Monetisation, rights and piracy

Jason Friedlander, senior director of product marketing, media platform, at Edgio, describes live sports streaming as one of the industry’s hottest trends “that shows no signs of slowing down”.

But, as he notes, monetisation “is the number one concern of our customers today, and there’s a lot of experimentation at the moment. Vendors must be able to support each customer’s business rules, which is not straightforward as every instance is different.”

Julien Signes, GM for video network at Synamedia, points to the growing demand for more applications and monetisation techniques. “One trend is augmenting the viewing experience at in-stadium events. Your match ticket has a QR code with an offer to download an app to use in-stadium so you can watch the game from a different part of the stadium, replay a tackle, get statistics, or place a bet,” he says.

Michael Shewchenko, sales director at Accedo, says monetisation remains a huge factor for sports organisations. “There is a relentless drive to seek out new ways to engage with fans and sponsors, and because of this, we’re seeing a lot of innovation in the sports industry right now.”

He adds: “Live sports streaming has become a popular way for fans to access their favourite games and events from anywhere, and at any time. The battle for the rights to live sports streaming is now playing out, and we are likely to see more OTT providers acquiring these rights in the future.”

Indeed, the Deloitte report noted that streaming video providers are spending billions of dollars on live sports rights “in a bid to attract, retain, and monetise an increasingly fickle audience”. Deloitte Global predicts that in 2023, streamers will spend over US$6 billion on exclusive major sports rights in the largest global markets”.

Scott Lunn, head of content at Grabyo, observes that the market for sports rights “remains hugely competitive with new entrants including DAZN and [Amazon] Prime Video competing with established players such as Sky, Warner Brothers Discovery and Movistar.”

According to Rick Young, SVP and head of global products at LTN Global, “the entrance of technology powerhouses into the global rights-buying market is significant. This has created increased competition, causing many players to rethink their strategy on how live sports fit into their plans.”

Young adds: “As a result of this increased demand, rights owners need innovative ways to efficiently scale their live video distribution models to reach audiences across multiple platforms. An IP-first approach can tackle this challenge and support the delivery of high quality live sports experiences tailored for specific platforms and geographies.”

Olga Kornienko, COO and co-founder of security vendor EZDRM, points to the role of Digital Rights Management (DRM) for the fundamental enforcement of business rules alongside complementary security techniques, such as watermarking and VPN detection.

“The business of live sports event streaming is increasingly important as clubs and rights-holders take the fan experience beyond the living room and onto a widening variety of devices inside and outside the home,” says Kornienko. “As the audience shifts from traditional broadcast to streaming services, the ability to support and protect the business model of the streaming service becomes paramount.”

Bart Lozia, CEO of Better Software Group (BSG), says the industry “has an exciting opportunity to further monetise premium sports competitions through the added competition provided by streaming platforms and it would be a huge loss not to benefit from that and offer our market-proven skills.”

However, he adds “have to be vigilant in protecting our valuable live sports content from piracy. By utilising a multifaceted approach that includes building protection barriers and utilising secure playback, compliance, and intelligence, we can proactively safeguard our content and continue to provide engaging experiences for viewers.”

Fragmentation, and D2C

Market fragmentation was cited by a number of Content Everywhere vendors as an inevitable consequence of sports streaming market growth.

LTN’s Young notes that sports broadcasting is aligning with ever-changing viewer behaviours as consumption expands beyond traditional linear TV formats. “With the dominance of OTT digital platforms, fragmentation is marking a fundamental shift in the sports broadcasting landscape,” he says.

Grabyo’s Lunn comments that streaming of live sports means consumers get more choice and can tailor services to their exact needs, but those looking to stream multiple sports could end up paying more than a traditional pay-TV package with subscriptions from multiple providers.

“This fragmentation creates discovery challenges too, making it harder for fans to find what they want to watch, and managing multiple services is a complex user experience at present,” he adds.

Rémi Beaudouin, chief strategy officer at Ateme, agrees that with more and more companies acquiring rights, “we are seeing an increasingly fragmented market for live sports streaming. Meanwhile, younger generations are choosing other forms of entertainment – including social media and gaming – that take them away from mainstream video content. So service providers need to ensure the best quality of experience in terms of images, sound, and latency, while also offering more engaging experiences that captivate the younger generations.”

Many see the direct-to-consumer (D2C) approach to sports streaming as a good route to take.

According to Rory Renwick, sales and business development director at Accedo, almost all sports organisations are looking for global coverage, and this will come from multiple partners and routes.

“As a result, sports organisations are increasingly exploring launching their own D2C services. One of the challenges they face in doing this is ensuring that the D2C service is agile and flexible, so that it complements rather than clashes with existing broadcast arrangements,” Renwick says.

He adds: “Looking forward, I think the market is going to remain fragmented, so sports organisations need to remain flexible and able to adapt. For many, the subscription model is not going to be sustainable, so FAST channels and AVOD will likely be the best route forward.”

Lunn notes that the biggest sports streaming player in Europe is DAZN, which he says reported 15 million paying subscribers at the end of 2022 and has rights to UEFA Champions League, La Liga, NFL, NBA, UFC and Matchroom Boxing across various territories.

“DAZN has shown you can scale a sports-only streaming service, although this includes broadening its commercial model to support free-ad-supports (FAST) channels, and distribution via pay-TV operators, to broaden its reach on linear TV,” he says.

Lunn adds: “The challenge for the new entrants including DAZN is balancing the cost of media rights with an economic model which is quite different to pay-TV. In the near future, these fears may be eschewed by retaining control of distribution and going the D2C route.”

Alex Lui, co-founder and COO of NETINT Technologies, also notes that as video service providers pay more for rights to deliver sports content to an increasingly fragmented audience, “it’s critical that their live encoding and streaming operations provide maximum output flexibility and operational cost efficiency.”

Lui says this means support for the big three codecs: H.264, HEVC, and AV1 at high quality and ultralow latency. “Using ASICs in traditional COTS server architectures via U.2 or PCIe expansion slots, sports streaming platforms can meet the quality, performance, and flexibility targets that are needed to be competitive today.”

AI, 5G, and the cloud

Gatis Gallis, CEO of Veset, observes that live sports broadcasting is an ever-evolving field that continues to challenge traditional broadcast models.

In his view, cloud-native solutions provide a scalable and flexible infrastructure that can be easily adapted to meet changing requirements. “By leveraging the power of the cloud, sports providers can cost-effectively deliver high-quality streams to a global audience without the need for large investments in hardware and infrastructure.”

He adds: “We’re seeing many sports organisations such as NBA League Pass and NFL Sunday Ticket launching their own dedicated streaming services. With cloud-based broadcasting solutions, it is much easier to launch new channels or to expand into new regions … One thing that is certain, is that sports organisations now have more choice and flexibility about how to deliver content to viewers than ever before.”

Beaudouin from Ateme points to the opportunities offered by 5G, “which makes it possible not only to offer flawless, UHD-quality video at significantly reduced latency, but also to offer interactive and immersive experiences, such as allowing users to view the game in multiple angles, or see instant replays of the best moments in near-live channels… We might well be on the brink of a new revolution in the way people consume video content, with 5G as the enabling technology,” he says.

In order to stand out from the crowd, Vinayak Shrivastav, CEO at Magnifi by VideoVerse, says OTT sports broadcasters are turning to artificial intelligence (AI) to help them create video highlights that capture viewers’ attention.

“One of the biggest challenges for OTT sports broadcasters is to create video highlights that not only show the most exciting moments from a match but also provide context and analysis for viewers. Traditional methods of creating video highlights can be time-consuming and require a great deal of manual effort,” he observes. “AI-powered video highlight solutions and tools like Google Web Stories are helping OTT sports broadcasters to capture audience attention and drive viewership.”

As Jon Finegold, chief marketing officer at Signiant, concludes, “broadcasters, leagues, teams and rights holders need modern tools that make content flow easy, fast and secure”.

“Today’s sports broadcasts leverage an enormous volume of file-based content before, during and after the game. The amount of content used is growing as fast as the number of places that content needs to go,” he says. “These workflows involve people who need to find and access content from anywhere in the world. They involve automated workflows to distribute content to multiple places simultaneously, and increasingly leverage both on-prem and cloud infrastructure. Lastly, they always involve a wide variety of systems that need to interoperate.”

Part 2: Winning ways

So what have Content Everywhere companies been doing to support customers as they move into sports streaming?

Oliver Lietz, CEO of nanocosmos, says Highlight Games and Twain Sports have pioneered the concept of fast-betting with help from the company’s real-time streaming platform nanoStream Cloud. “Fast-betting creates a thrilling atmosphere and adds an element of excitement to the game, following a similar principle to live casinos. As a result, the audience is more likely to tune in to the game, which increases viewership and engagement,” Lietz says.

Venugopal Iyengar, deputy COO, digital, at Planetcast International, says the company has been the technical partner of the world’s premier cricket tournament for a number of years. “A particular challenge and opportunity of cricket is that of un-scheduled breaks. To make the most of this opportunity, we have built some critical technology in Cloud Playout to enable rights holders to include a single ad-break into un-scheduled stoppages such as at the fall of a wicket, or even while a cricketer ties his or her laces,” he says.

Fabio Murra, SVP product and marketing at V-Nova, describes the company’s experience during the World Cup 2022 as “extremely enlightening and promising. We worked with several customers, including Globo in Brazil, to trial delivery of content using new video compression technologies that will enable better consumer experiences as well as delivery efficiencies.”

Murra adds: “Online platforms are already popular with fans wanting to access exclusive content such as interviews, highlights, and behind-the-scenes footage. However, the Qatar World Cup saw the broadcast vs streaming debate really heat up. Certain matches available in UHD HDR with surround sound on streaming platforms were only available in HD with stereo on broadcast channels. On the other hand, a shift to streaming highlighted the latency issues that are still a challenge for this delivery method.”

By applying new compression standards, such as MPEG-5 LCEVC, V-Nova was able to deliver 10-bit HDR experiences to enabled clients while serving all existing clients with the same stream. “We were also able to improve the efficiency of new codecs such as AV1 and VVC, to reduce delivery bandwidth – hence cost – but also computational load in the data centre – hence electricity,” Murra says.

Synamedia cites recent examples of its work with sports streaming companies such as teaming up with beIN to launch a low latency 4K UHD channel for OTT platform, beIN CONNECT, using its Quortex just-in-time processing integrated with Vivid compression technology. It also enabled what it described as broadcast-equivalent latency for Cellcom TV subscribers by deploying its Vivid Workflow as a Service technology to enhance Cellcom’s FIFA World Cup action on its streaming service.

MainStreaming developed the Edge platform to meet live streaming demands and worked on the DAZN Edge initiative in Germany, Italy, and Spain.

Red Bee Media helps deliver major events like the FIFA World Cup to public service broadcasters, while also supporting the launch of new streaming platforms like Sports Tribal. It delivers low-latency streaming for betting operators and offer virtual channels of content when live events are not happening.

Edgio describes its Uplynk product as an orchestration tool that automates much of the process. The company says it can manage more than 740 live events per week with full event support, and more without.

Better Software Group collaborated with Eleven Sports to create an application designed specifically to deliver viewing experiences for well-known and niche fields of sports.

Signiant says brands such as NBC, NFL, NHL, Discovery, Sky, BBC, ESPN, NEP and many others rely on the Signiant Platform to support live sports broadcasts all over the world.

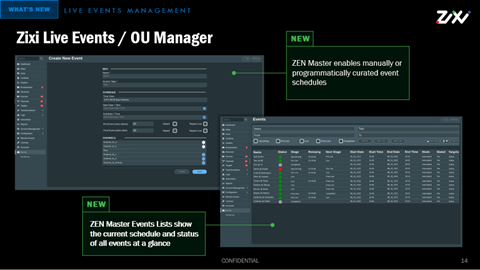

Zixi built and deployed the Live Events Scheduler in Zixi ZEN Master to help customers deal with the overwhelming number of schedules associated with events as sports rights move away from traditional broadcasters to digital first and OTT platforms such as Amazon Video, Paramount Plus, Fubo and Apple TV.