DICK’S Sporting Goods: Appealing As Q4 Earnings Near (NYSE:DKS)

Miosotis Jade

Every time a company reports financial results for the latest quarter, it gives that company an opportunity to uncover the ups and downs of the business. Because this is the prime time that companies provide financial updates, this is the case also the time when the greatest volatility can occur in a stock. One company that has something big to prove when it reports financial results on the morning of March 7th is the sporting goods retailer DICK’S sporting goods (NYSE:DKS). For the most part, the 2022 financial year turned out to be rather painful for the company. However, there was a small bright spot when the company announced financial results for the third quarter of the year. Ahead of the fourth quarter earnings release, analysts appear to have somewhat mixed expectations. But lots of it The guidance isn’t too different from management’s projections. While we face some uncertainty ahead of the earnings release, and we also know that the company’s shares have risen in recent months, I would argue that the business likely still has some additional upside potential. Equities are reasonably cheap, although we expect business activity to deteriorate. So, barring anything significantly outside of expectations, I would argue that investors should be optimistic about the future.

Big returns from mixed performance

Back in early August 2022, I wrote an article that took an optimistic stance on DICK’S Sporting Goods. In this article, I talked about how the company showed some signs of a return to more normal financial results in the wake of the COVID-19 pandemic. Even with that factored in, I acknowledged that the company’s stock looked expensive compared to similar companies. But by and large, stocks were still fairly affordable, and the fact that the company is an industry leader makes it even more attractive. At the end of the day, this combination of factors led me to give the company a Buy rating. This rating reflects my belief that equities should outperform the broader market for the foreseeable future. And outperform the company. While the S&P 500 is down 3.4% since this article was published, shares of the sporting goods retailer have given investors a 38.8% gain.

Author – SEC EDGAR data

Much of that upside, I believe, stems from the financial results that management reported in the third quarter of fiscal 2022. Sales at the time were $2.96 billion. That’s up 7.7% from the $2.75 billion reported at the same time a year earlier. The company’s increase was driven in large part by a 6.5% comparable sales increase at its stores. This was made up of a 3.7% increase in the number of transactions and a 2.8% increase in average revenue per transaction for the company. It also benefited from two additional sites that the company had operational compared to the time last year. The $38.2 million increase in sales was fueled by the company’s new temporary warehouse outlets.

Although revenue increased well, profits declined. Net income increased to $228.5 million in the third quarter of 2022 from $316.5 million in the third quarter of 2021. The biggest contributor to this pain was a decline in the company’s gross profit margin from 38.5% to 34.2 %. That, management said, was largely due to actions the company took to reduce targeted apparel inventory overruns, as well as a higher inventory decline caused by a spike in thefts. Other profitability metrics followed a similar trajectory. Operating cash flow, for example, increased from minus $24.2 million to minus $66.1 million. If we adjust for working capital changes, it would still have fallen from $409.6 million to $332.5 million. Finally, the company’s EBITDA shrank from $499.5 million to $411.7 million.

Author – SEC EDGAR data

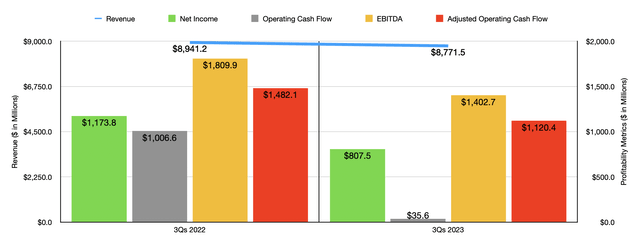

While the company’s bottom line results for the third quarter of the year were very similar to those for the first nine months overall compared to the same time a year earlier, the revenue picture was different. Revenue for the first nine months of 2021 was $8.94 billion. It then fell to $8.77 billion in the first nine months of 2022. Net income plummeted to $807.5 million from $1.17 billion. We saw operating cash flow deteriorate from $1.01 billion to $35.6 million, while adjusted cash flow fell to $1.12 billion from $1.48 billion. Finally, the company’s EBITDA declined from $1.81 billion to $1.40 billion.

It will be interesting to see what the company reports for the last quarter of 2022. Management said during the release of third-quarter results that 2022 should be better overall than previously expected. Comparable store sales should be between minus 3% and minus 1.5%. This compares to the negative 6% to negative 2% previously expected. For comparison, analysts are currently expecting revenue of about $3.44 billion for the most recent quarter. That would compare to the $3.35 billion the company reported at the same time a year earlier. From a profitability standpoint, management expects earnings per share to be between $10.50 and $11.10 for the full year. That’s a rise to $10.55 from the $8.85 previously expected. On an adjusted basis, earnings per share for the full year should be between $11.50 and $12.10. Management previously forecast this to be between $10 and $12.00.

For the fourth quarter alone, analysts are currently expecting earnings per share of $2.83, with adjusted earnings per share of $2.89. In the last quarter of fiscal 2021, earnings per share were $3.16. It’s also worth noting that assuming management is correct in its forecasts, for the final quarter of the year we’re expecting earnings per share to be between $2.33 and $2.93 and an average of 2, 63 US dollars should calculate. Adjusted earnings should be between $2.39 and $2.99 with an average of $2.69.

Author – SEC EDGAR data

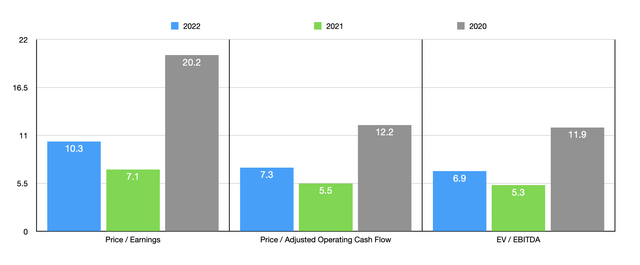

Adding management’s guidance and using midpoint expectations, we should be looking at net income for the full year of 2022 at $1.04 billion. If we convert the results for the first nine months on an annual basis, we’d end up with adjusted cash flow from operations of $1.47 billion and EBITDA of about $1.59 billion. Based on those numbers, the company would be trading at a price-to-earnings ratio of 10.3. The price-to-adjusted-cash-flow-from-operating multiple would be 7.3, while the EV-to-EBITDA multiple would be 6.9. Using 2021 data, these multiples would be 7.1, 5.5, and 5.3, respectively. Even if we assume that operations will deteriorate somewhat and revert to fiscal 2020 levels, shares wouldn’t look unduly cheap. In the worst case, they could be fairly valued in multiples of 20.2, 12.2, and 11.9, respectively.

Finally, as part of my analysis, I compared DICK’S Sporting Goods to five similar companies. On a P/E basis, these companies ranged from a low of 3.9 to a high of 16.8. Four of the five companies were cheaper than our prospect. Using the price-to-operations cash flow approach, the range for the four companies with positive results was 4 to 9.9. In this case, two of the four companies traded cheaper than our prospect. Finally, using the EV to EBITDA approach, the range would be between 4.2 and 8.9, with three of the five companies trading cheaper than our target.

| Pursue | price/profit | Price/Operating Cash Flow | EV/EBITDA |

| DICK’S sporting goods | 10.3 | 7.3 | 6.9 |

| Academy Sport and Outdoor (ASO) | 8.1 | 9.9 | 6.5 |

| Big 5 sporting goods (BGFV) | 4.4 | N / A | 6.1 |

| Hibbett (HIBB) | 9.1 | 9.2 | 7.2 |

| Vista Outdoor (VSTO) | 3.9 | 4.0 | 4.2 |

| Johnson Outdoors (JOUT) | 16.8 | 6.1 | 8.9 |

Bring away

I understand these are confusing times for investors. A mixed financial performance is not a great thing for any company. However, sales numbers reported in the third quarter of 2022, along with analysts’ expectation that sales should be higher than a year earlier, should give investors encouragement. The profits are also forecast by the management, they turn out to be higher than previously assumed. Add to that how cheap stocks are on an absolute basis, even if they’re fairly valued compared to similar companies, and I think some additional upside potential is probably warranted, despite the stock’s surge over the past several months. For this reason, I have decided to maintain the “buy” rating I previously gave the company.