DICK’S Sporting Goods: Fairly Valued (NYSE:DKS)

hapabapa/iStock Editorial via Getty Images

DICK’S sporting goods (NYSE:DKS) is a solid company that has done a good job of transforming its business over the last few years. However, the stock appears to be fairly valued.

company profile

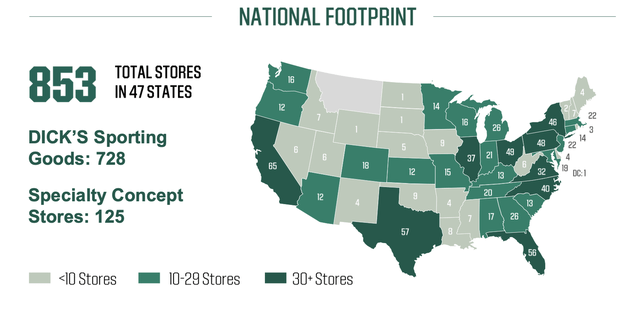

DKS operates a chain of Sporting goods retail stores and related e-commerce websites. The company’s eponymous store sells a variety of athletic equipment, apparel, footwear and accessories. At the end of January, the company had 728 locations in the United States. It also owns Golf Galaxy, Public Lands and Going Going Gone! Specialist dealers as well as DICK’S House of Sport and Golf Galaxy Performance Center. At the end of January, it counted 125 specialist store locations.

company presentation

About 40% of sales in FY22 were hardlines, which include items such as athletic equipment, golf equipment, fishing gear, and fitness equipment. Apparel items accounted for about 34% of sales. Meanwhile, 24% of Revenue came from footwear, including running, basketball, tennis, hiking, and hiking shoes. About 2% of its revenue came from things like services, subscriptions, shipping, and credit card processing.

DKS sells national brands as well as its own private labels. In-house brands include Alpine Design, CALIA, DSG, ETHOS, Fitness Gear, MAXFLI, Nishiki, Quest, Top-Flite, VRST and Walter Hagen. Own brands account for about 14% of revenue in fiscal 2023. Nike (NKE) is its largest supplier, accounting for about 23% of its revenue in fiscal 2022.

DKS also owns the youth sports rating and scheduling app GameChanger.

chances and risks

DKS has done a great job of transforming its operations over the past few years. One of the core parts of its transformation was getting more distributed and unique products from its vendor. Shoes have been a big focus in this regard, as have apparel and team sports.

These items have higher margins and help differentiate DKS from the competition.

And while NKE has been more focused on its DTC efforts and away from wholesale partnerships, DKS was able to merge the two companies’ loyalty programs towards the end of 2021. This allowed customers to link their accounts and receive loyalty perks from both companies. At a conference in March, the company announced that over 1 million people have linked their accounts.

At a Bank of America conference in March, Executive Chairman Ed Stack said:

Our relationship with Nike is at an all-time high. With the investment we’re making in the Nike brand, the investments Nike’s made with us, access to products that we haven’t had in the past for a more closely distributed product, faster rotating, higher…margin product both on both the apparel and footwear side, and we don’t think we’re doing that – we’re seeing that continuing. And we’re very excited about the relationship with Nike. They are certainly the hottest brand out there today, products not only for the lifestyle side of the business but also the performance side of the business, what they make of a running shoe, the new invincible running shoe, what they make that from the cleat standpoint from, from the basketball point of view. So they’re running at full speed in all aspects of their business and we’re really excited about that.”

Another change DKS has made that has improved margins is the way it pulls its legacy merchandise out of its stores. The company now has 13 Going, Going Gone stores and 43 Warehouse Plus stores. This gives it both better margins and faster new, fresh stock in its main stores.

Commenting on this at the BofA conference, CFO Navdeep Gupta said:

This was an important finding that we tested during the COVID timeframe when we were unable to open the 10 stores that used to be directly in front of the stores. We are very satisfied with the results that we have been able to drive in recent years. I think the biggest success factor is actually what Ed said, it allows us to bring the clearance stock out of a regular DICK’S store and make more room for the red stock to be brought into that store. So we’re seeing better recovery rates, not just in the clearance stores, but even in the DICK’S stores. We see that more red products are sold there because the productivity of square meters is higher in DICK’S store. The margin profile is much better. And then, because you’re able to concentrate the entire sale into that small cluster of stores, late last year we had 13 Going, Going, Gone! store and almost about 43 warehouses plus store.

The model that we have that’s flexible enough that we can bend it up or down depending on how many stores we need, and concentrating all that freedom into these small locations gives us a much better access to value -Athlete who searches and finds this product and a really good bargain there. Secondly, we are able to liquidate this product much more efficiently and are making much better margins than before, both online and in stores. We’re very happy with the strategy.”

Meanwhile, DKS will lean on its new House of Sport concept as it looks to grow. The company had opened 3 in mid-March and plans to open 9 this year. The stores will be between 100,000 and 120,000 square feet, with athletic fields for teams to train alongside them. Inside the stores will be things like batting cages and a climbing wall, as well as a health and wellness area. The company expects to add between 75 and 100 of these store concepts over the next 5 years. DKS attaches great importance to the experience aspect of these places and makes them a real destination.

DKS also has the opportunity to further expand its private label business. With 14% of sales, DKS has done a good job building these brands. They now have 600-800 basis points higher margins than national brands. A further expansion of the share in this area will also benefit the margins.

On the risk side, the biggest risk right now is the economy. While people spend money on sports gear, there are certainly more discretionary items that DKS sells. DKS appears to have largely managed to avoid the over-ordering that has hurt many retailers. Inventory levels are still up about 23% year over year, though up 29% compared to 2019, on a 38% increase in sales over the period. However, there is still something to see.

And while his increased exposure to NKE is positive, his ties add some risk. NKE is a large supplier that continues to account for a growing share of DKS’ sales. It’s also a company that has historically wanted to focus more on DTC sales to improve its own margins.

Evaluation

DKS stock currently trades at just under 7.5 times consensus fiscal 2024 (ended January) EBITDA of $1.91 billion. It is trading at 7.3x based on analyst estimates for FY25 of $1.96 billion.

It is trading at a forward PE of 10.5x the FY24 consensus of $13.44.

The company is expected to grow fiscal 24 revenue by 3.1% to $12.7 billion.

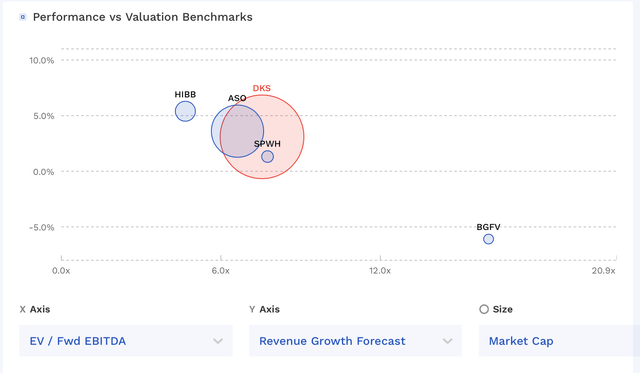

The stock trades about halfway where other sporting goods retailers are trading.

DKS rating compared to peers (FinBox)

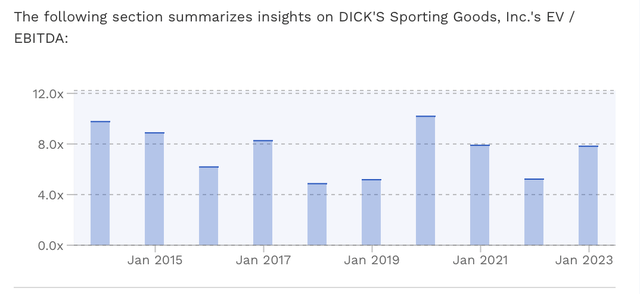

The stock has traded between a 4.9x and a 10.2x EV/trailing EBITDA multiple for the past 10 years.

DKS rating compared to peers (FinBox)

Diploma

DKS is a solid company that has done a great job in transforming their business operations. Its margins have improved nicely over the past two years, and I think the combination of more exclusive and less mainstream items, along with increased penetration of its in-house brands and its clearance strategy, will likely keep them solidly higher than in the past. barring a recession.

I also like the House of Sports strategy and their increasing commitment to NKE, including the joint loyalty program. Given that the shares are trading near their historical 10-year moving average, I think it’s more of a solid hold at this point.