DICK’S Sporting Goods: Fast Expansion With Weaker Cash Flow (NYSE:DKS)

Scott Olson

investment work

DICK’S sporting goods (NYSE:DKS) has experienced strong growth and expansion over the past three years. Although sales and growth remain strong, we see weakness in cash flow with a high level of long-term debt that needs more attention. We favor the company’s sell strategy and are bullish on its growth but believe the market has priced in too high expectations. The current price is above our fair valuation.

company overview

DICK’S Sporting Goods, Inc., headquartered in Coraopolis, Pennsylvania, was incorporated and incorporated in Binghamton, New York in 1948 as Dick’s Clothing and Sporting Goods, Inc. and later changed to DICK’s Sporting Goods. The company carries a full line of products in each category, but focuses on athletic apparel, fitness, footwear, golf and team sports as growth categories. The sales segments to be assigned are hardlines, clothing/softness and shoes.

Strength

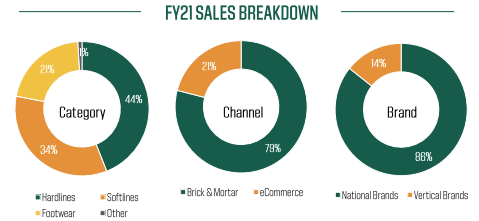

Dick’s leverages an omni-channel sales strategy with stores and e-commerce offering a full range of product sales spanning both national and vertical brands. National brands include Nike (NKE), adidas (OTCQX:ADDYY), Brooks, Columbia (COLM), The North Face, Under Armor (UA) (UAA), etc., while vertical brands are company-owned and exclusive available in its stores, as well as brands it licenses from third parties. The distribution of sales from this strategy shows that hardlines, e-commerce and national brands form the core of the sales volume.

DICK’S FY21 Revenue Breakdown (Q3 Company Presentation)

Among national brands, Nike is Dick’s largest supplier, accounting for 17% of all Dick’s merchandise purchases. In addition, the company continues to deepen its partnership with Nike with its Scorecard membership, also sharing the benefits of Nike products. We will come back to this relationship later.

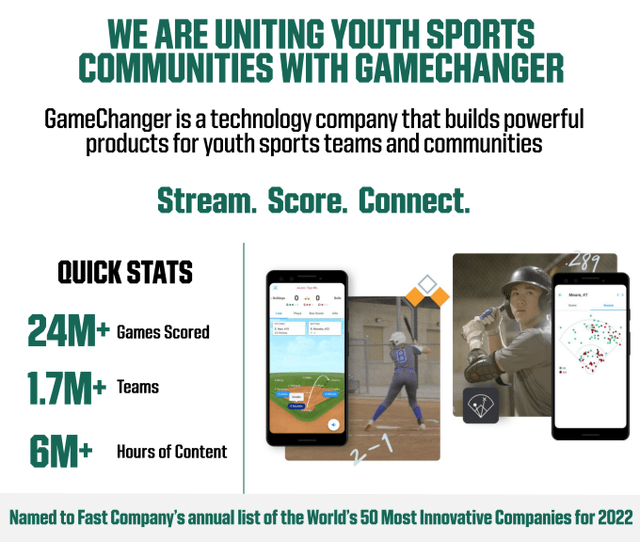

One of Dick’s fastest growing areas is youth team sports. The company has partnered with app provider Gamechanger to help with the teams’ planning, communication and video streaming. It also builds relationships with the local community by sponsoring teams and offering exclusive sales offers. Dick’s has the largest youth sports database in the country. It is indeed an “investment in the future” as these young athletes could later become loyal customers.

DICK’S: Youth Sports (company presentation Q3)

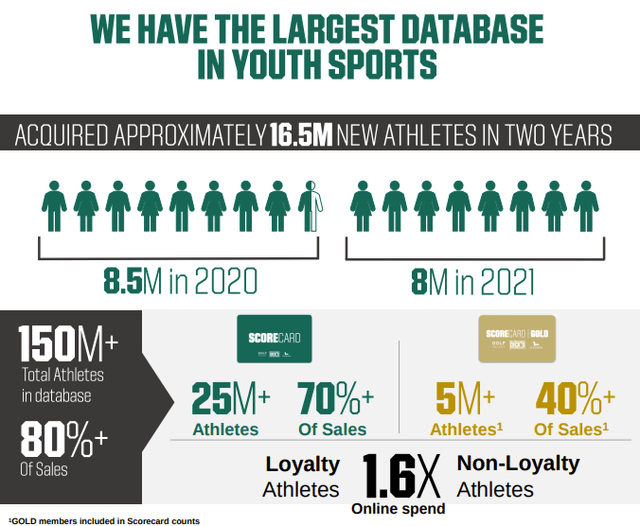

The results of the company’s digital foray into sales and loyalty programs are evident. Not only does it have the largest database in youth sports, but it also boasts a record 150 million+ athletes from its ScoreCard programs.

DICK’S Digital Sales Strategy (company Q3 presentation)

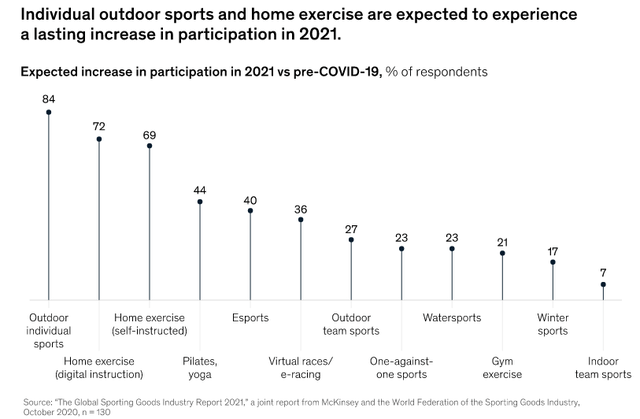

The company also implemented an omni-channel sales concept called Public Lands, which serves outdoor sports enthusiasts with on-site experience elements of a climbing wall. This retail concept could help grow its leading sales segment, Hardlines, as it offers many gear services, including bikes, paddles, and camps. Outdoor sports were generally lackluster before the pandemic, but the landscape has changed a lot. Engagement in outdoor activities had the highest participation rate in 2021 and the trend is expected to continue. These efforts could actively capture this growth in trends.

Increasing individual participation in outdoor sports (McKinsey & Company)

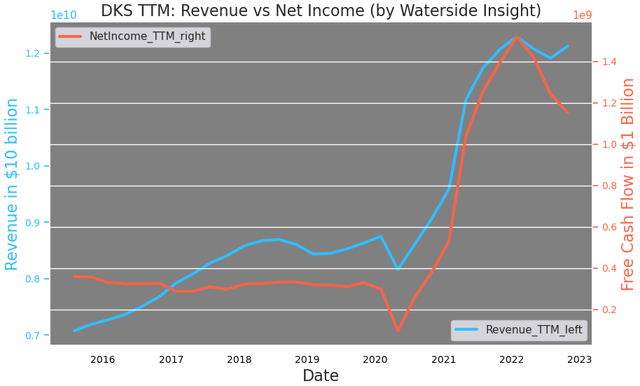

In fact, due to changing consumer behavior, Dick’s had a rapid and sharp rise from the initial dip at the start of the pandemic, climbing to its strongest sales level in history, and it’s still going strong on a TTM basis.

DICK’S: Sales vs Net Income (calculated and presented by Waterside Insight using company data)

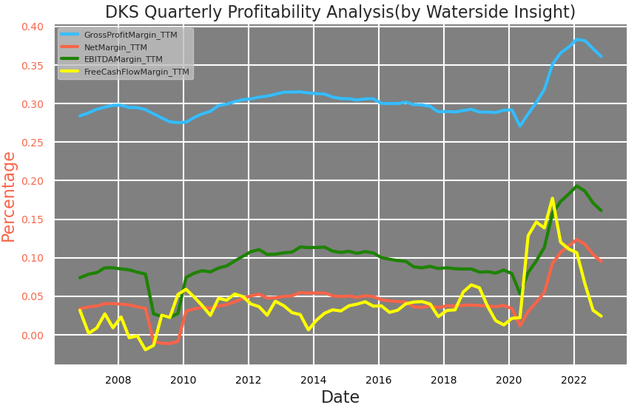

Also, looking at earnings, the company’s gross margin, net margin and EBITDA margin still remain above pre-pandemic levels; only the free cash flow margin has fallen back to historic lows.

DICK’S profitability (calculated and presented by Waterside Insight using company data)

Weakness/Risks

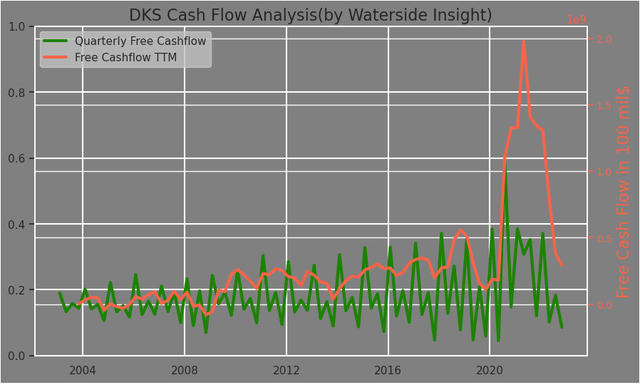

If we look at free cash flow, it’s been weak for a couple of quarters.

DICK’S Free Cash Flow (calculated and presented by Waterside Insight using company data)

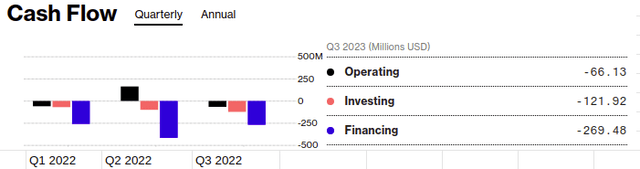

In fact, all three components of cash flow turned negative last quarter, with financing being the biggest drag.

DICK’s Cash Flow Breakdown (Bloomberg)

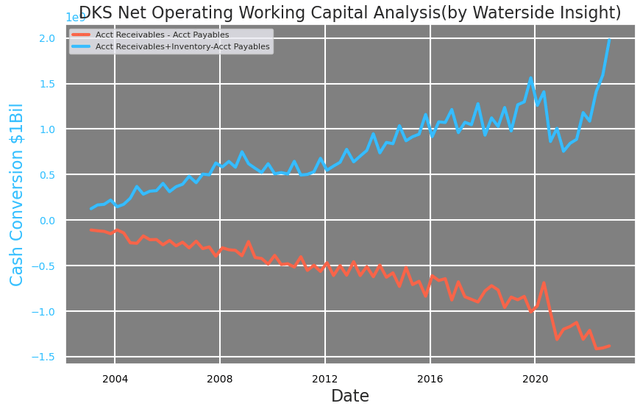

The company’s operating working capital with and without inventory shows the widest disparity ever recorded.

DICK’S Net Working Capital (calculated and presented by Waterside Insight using company data)

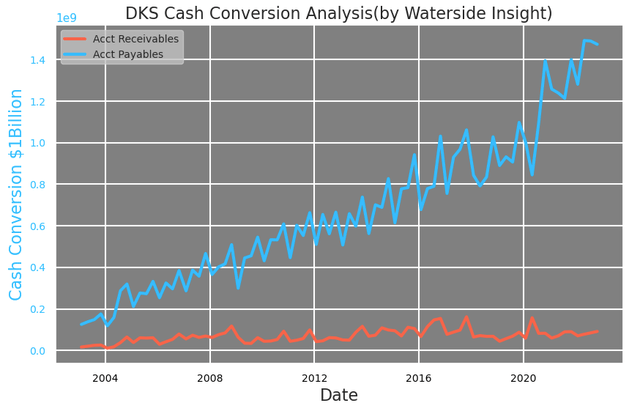

This is mainly because inventories are rising, but also note the biggest difference between accounts payable and accounts receivable.

DICK’S Cash Conversion (calculated and presented by Waterside Insight using company data)

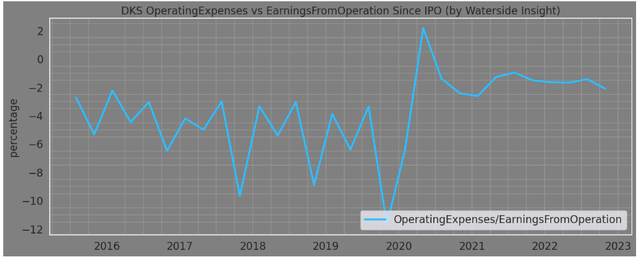

In the meantime, operating costs as a percentage of operating income have fallen back to almost pre-pandemic levels.

DICK’S operating costs vs. operating income (calculated and mapped by Waterside Insight using company data)

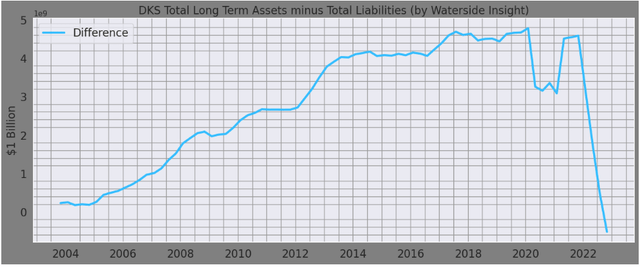

And while that’s not an immediate problem, the company’s long-term debt is on track to catch up with its long-term assets for the first time in a long while.

DICK’S Long Term Assets vs. Liabilities (calculated and presented by Waterside Insight using company data)

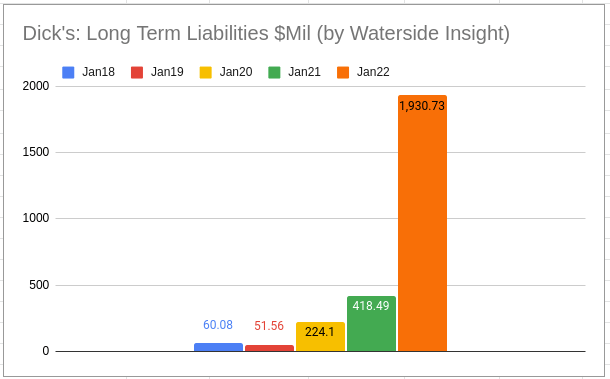

This is mainly due to the significant jump in recent years, when the company went on an expansion course. Although the Company mentioned in its forward-looking statements that it will repay the Senior Convertible Debentures with excess cash, most of its long-term debt is included in its operating lease liabilities. All of the company’s stores are leased, and the number of stores increased by almost 40% in 2021.

DICK’S Long Term Liabilities (represented by Waterside Insight using company data)

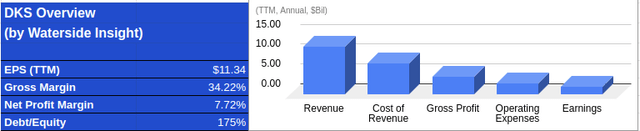

Financial overview

DICK’S financial summary (calculated and presented by Waterside Insight using company data)

Evaluation

Over the past five years, Dick’s price action has underperformed slightly, but has closely tracked Nike, the largest supplier, as we mentioned earlier. The gap has been increasing since mid-2021. Currently they have their biggest difference in the last five years.

DICK’S vs Nike (Trade View)

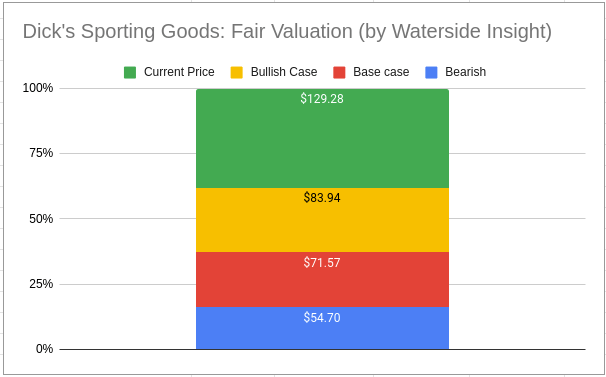

Without getting into Nike’s valuation, let’s see if Dick’s serve can be justified by assessing his fair valuation considering all of our analysis above. We consider all of our above analysis and use our proprietary models to generate and score a ten-year forward forecast. In our optimistic case, the fourth quarter of last year will be worse than the fourth quarter of 2021, while 2023 is also forecast to be weaker year-on-year; it recovers later and maintains a stronger cash flow compared to the past decade; In this scenario, it was valued at $83.94. In our bearish case, resumed cash flow growth after the recent slowdown has been far from resilient as the company grapples with higher debt and more normalization in consumer spending; it was estimated at $54.7. In our base case, we still consider slower cash flow growth in 2023 but a strong recovery similar to the bullish case; it was valued at $71.57. The current price is much higher than our top estimates.

DICK’S Fair Valuation (calculated and presented by Waterside Insight using company data)

Diploma

In addition to selling sporting products that meet consumers’ changing lifestyles, DICK’S Sporting Goods also has deep roots in the communities it serves, particularly in youth sports, an American favorite. We are pleased to see that the company has significantly increased both sales and profits over the past few years. However, the company sidesteps some weaknesses in its cash flow and cash conversion cycle. The expansion of DICK’S Sporting Goods since 2020 has resulted in the company’s liabilities increasing to such an extent that more detailed plans may need to be developed to reduce them over the next few years. The current price is too high for our fair evaluation. We recommend selling at current levels and looking for a better valuation to participate in.