Freeport-McMoRan (NYSE:FCX) Knows How To Allocate Capital Effectively

There are a few key trends to look out for when identifying the next multibagger. A common approach is to try and find a company with returns on capital employed (ROCE), which are increasing, combined with a growing Crowd of the capital employed. This shows us that this is a compounding machine capable of continuously reinvesting its profits in the business and generating higher returns. So when we looked at the ROCE trend of Freeport-McMoRan (NYSE:FCX) we really liked what we saw.

Understand return on capital employed (ROCE).

Just to clarify if you’re unsure, ROCE is a metric used to evaluate how much pre-tax profit (as a percentage) a company makes on the capital invested in its business. Analysts use this formula to calculate it for Freeport-McMoRan:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

0.21 = $9.2 billion ÷ ($50 billion – $5.9 billion) (Based on the last twelve months ended June 2022).

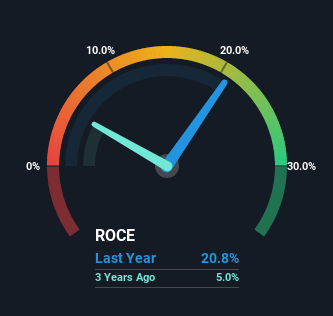

Hence, Freeport-McMoRan has a ROCE of 21%. On its own, that’s a fantastic return on investment, although at 21% it’s in line with the metals and mining industry average.

Try this chances and risks in the US metals and mining industry.

In the chart above, we compared Freeport-McMoRan’s past ROCE to its past performance, but the future is arguably more important. If you are interested, you can see the analysts’ predictions in our free Report on analysts’ forecasts for the company.

The ROCE trend

The trends we’ve seen at Freeport-McMoRan are pretty reassuring. In the last five years, the return on capital employed has increased significantly to 21%. Basically, the company is making more per dollar invested, and it’s now putting 38% more capital to work as well. So we’re very inspired by what we’re seeing at Freeport-McMoRan, thanks to its ability to reinvest capital profitably.

The key to take away

A company that can grow its returns on investments and consistently reinvest in itself is a highly desirable trait, and Freeport-McMoRan has just that. With the stock returning a staggering 106% to shareholders over the past five years, it looks like investors are recognizing those shifts. With that in mind, we think this stock is worth a closer look because if Freeport-McMoRan can sustain these trends, it could have a bright future ahead of it.

However, Freeport-McMoRan has some risks, as we’ve found 2 warning signs in our investment analysis, and 1 of them can’t be ignored…

Freeport-McMoRan isn’t the only stock producing strong returns. If you want to see more check out ours free List of companies that generate high returns on equity with solid fundamentals.

Do you have any feedback about this article? Concerned about the content? Get in touch directly with us. Alternatively, send an email to the editorial team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your goals or financial situation. Our goal is to offer you long-term focused analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

The assessment is complex, but we help to simplify it.

find out if Freeport-McMoRan may be over or under priced by reviewing our comprehensive analysis which includes the following Fair Value Estimates, Risks and Warnings, Dividends, Insider Trading and Financial Health.

Check out the free analysis