Hibbett: Still A Sporting Good Prospect On A Change In Fortunes (NASDAQ:HIBB)

Maki Nakamura/DigitalVision via Getty Images

Economic conditions have been very erratic in recent years. After recovering from the COVID-19 pandemic, the world entered an inflationary state caused by supply chain issues largely attributed to the aforementioned pandemic. Most companies have suffered in part. Adaptation is important, however, and one company that has shown impressive signs of adapting to current market conditions is this Hibbett (NASDAQ:HIBB), a company that sells not only sports shoes and related products, but also a wide range of fashion-oriented products. With the data currently available for fiscal 2023, it’s clear that much of the year has proved painful for the company. But the latest data available suggests the worst is far behind him. Although the company’s shares have risen over the past few months, they’re still doing so look attractively priced on an absolute basis, while perhaps being fairly valued compared to similar companies. For this reason, I believe a soft “buy” rating for the company is still appropriate at this point.

The tide changes

The last article I wrote about Hibbett was published at the end of September 2022. At the time, I acknowledged that the company’s shares had been hit hard during the general market downturn up to that point. This was also due in large part to weakness in both the revenue and profit lines. Investors were very bearish on the company at the time, even though the company’s shares looked incredibly cheap on an absolute basis. This affordability prompted me to maintain the “buy” rating I previously gave the company, a rating that expressed my own expectations that the shares should outperform the broader market for the foreseeable future. Since then, the company has developed exceptionally well. Although the S&P 500 is up a robust 13.1%, Hibbett’s shares have generated 38.5% upside potential.

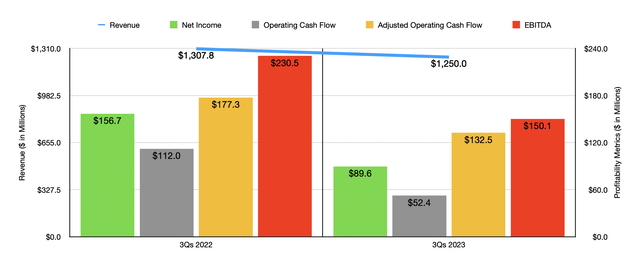

Author – SEC EDGAR data

As you look at data covering the entire first nine months of fiscal 2023, you might be at a loss as to why stocks have risen so much. During that nine-month window, revenue totaled $1.25 billion. That’s actually a 4.4% decline from the $1.31 billion reported a year earlier. Interestingly, this decline came even as the number of locations the company had in operation rose from 1,086 to 1,126 year over year. The big culprit at the time was a 7.4% plunge in comparable store sales. The real weakness for the company came from a 10.2% decline in comparable brick-and-mortar store sales. By comparison, e-commerce sales actually grew 11.2%, soaring to 14.9% of the company’s total sales, compared to the 12.8% they accounted for just a year earlier. This foray into e-commerce has been a strategy for the company for some time, even before the COVID-19 pandemic. And frankly, it will likely create additional value for investors as it moves forward.

The bottom line was that the picture for the company was even worse during this period. Net income plummeted from $156.7 million in the company’s first nine months of fiscal 2022 to $89.6 million in the same period of fiscal 2023. Operating cash flow was reduced by more than half from $112 million to $52.4 million. Even if we had adjusted for changes in working capital, the metric would have decreased, falling from $177.3 million to $132.5 million. EBITDA also declined. Year over year, this metric fell to $150.1 million from $230.5 million.

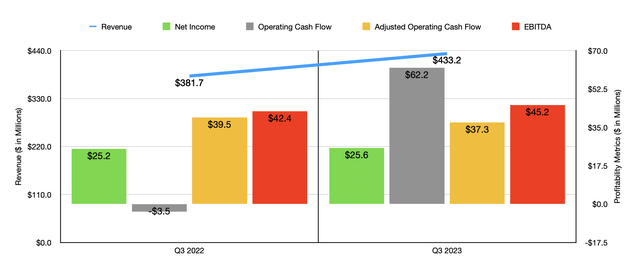

Author – SEC EDGAR data

The real magic for the company came naturally in the third quarter. It’s only when you look at this data that you realize why stocks have performed so well over the past few months. Revenue for the quarter was $433.2 million. That’s a 13.5% increase from the $381.7 million reported a year earlier. Not only did the company benefit from the aforementioned increase in store count, but it also saw comparable store sales increase by 9.9%. Management attributed this to a significant improvement in footwear inventory as well as a shift in focus between footwear and apparel. E-commerce sales soared 22% during that time. This boosted e-commerce penetration to 15% of total revenue for the quarter.

Most likely, this trend will continue for the foreseeable future. I say that because the company continues to invest in its digital transformation efforts. For example, in early December last year, management announced a strategic investment it made in both Heady LLC and Heady Digital Products. These investments will help the company accelerate digital transformation efforts, with Heady providing full-service strategy, design, full-stack development and growth marketing services for Hibbett, while Heady Digital Products provides omnichannel digital experience, among other things – Management software for Hibbett will provide leading brands. That doesn’t mean the company will ignore its brick-and-mortar business. In fact, brick-and-mortar sales rose well last quarter, skyrocketing 7.9% on a like-for-like store basis.

Given the inflationary pressures Hibbett and similar companies have faced, the business has performed reasonably well from a profitability standpoint. Net income during that time was actually $25.6 million. That’s slightly more than the $25.2 million reported at the same time a year earlier. Operating cash flow increased to positive $62.2 million from negative $3.5 million. However, if we adjust for changes in working capital, it would have decreased slightly from $39.5 million to $37.3 million. Meanwhile, the company’s EBITDA increased slightly to $45.2 million from $42.4 million.

For 2023 as a whole, management has been a little vague on guidance. They expect the company’s overall sales to increase in the low single digits, with comparable store sales to range from flat to low single digit increases. That would mean a very strong final quarter for the fiscal year. Between 30 and 40 new stores should contribute to this, of which 29 had already been opened by the end of the third quarter. Earnings per share should be between $9.75 and $10.50. Halfway through, that would result in a profit of $134.7 million. No guidance was given for other profitability metrics. But if we annualize earnings to date, an approach that would be rather conservative given what the company is likely to report for the most recent quarter, we would find adjusted operating cash flow of $157.4 million and EBITDA of 164 Received $.8 million.

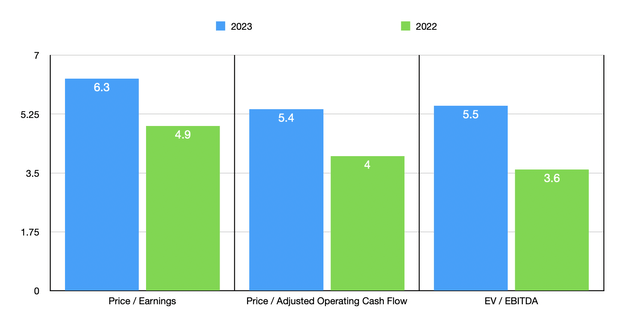

Author – SEC EDGAR data

Based on these numbers, Hibbett is trading at a price-to-earnings multiple of 6.3. The price-to-adjusted-cash-flow multiple should come in at 5.4, while the EV-to-EBITDA multiple should come in at 5.5. Conversely, if we were to use the 2022 data, these multiples would be lower at 4.9, 4, and 3.6, respectively. As part of my analysis, I compared the company to five similar companies. On a P/E basis, these companies ranged from a low of 4.7 to a high of 11.9. Two of the five companies were cheaper than our prospect. Using price to operating cash flow approach the range was 5 to 123.6 with only one of the five firms being cheaper than Hibbett. Finally, using the EV to EBITDA approach, the range was between 2.6 and 8.1. In this case, three of the five companies were cheaper than our prospect.

| Pursue | price / result | Price / Operating Cash Flow | EV / EBITDA |

| Hibbett | 6.3 | 5.4 | 5.5 |

| Dick’s Sporting Goods (DKS) | 11.9 | 21.6 | 5.9 |

| Big 5 sporting goods (BGFV) | 5.2 | 5.0 | 2.6 |

| Sportsman’s Warehouse Holdings (SPWH) | 4.7 | 5.7 | 3.1 |

| Academy Sport and Outdoor (ASO) | 8.5 | 11.1 | 5.4 |

| Escalade (ESCA) | 8.5 | 123.6 | 8.1 |

Bring away

Though much of the company’s fiscal 2023 was troubled, Hibbett showed relatively strong results in the third quarter of its fiscal 2023, particularly on the sell side. Most likely, we will see continued strength in the business in the near future. On an absolute basis, the company’s stock looks very cheap, despite the fact that it has risen so much since I last wrote about it. On a relative basis, however, they look closer to fair value. For those drawn to this area, I would say that Hibbett offers additional upside from here, enough, at least enough, to justify a soft buy rating at this point.