how to help small businesses survive and become more sustainable

The number of companies in financial distress has risen in parts of the UK to the highest level since the global financial crisis of 2007-8 devastated the world economy. The latest government figures show that in August more than one in ten UK businesses reported a moderate to severe risk of insolvency (being unable to pay their bills). Almost a quarter of these companies say energy prices are their top concern.

Average annual energy bills can start at £3,000 and go up to £5,000 for small businesses in some parts of the UK. And more and more companies – especially smaller organizations – are concerned about the impact of energy costs on business growth.

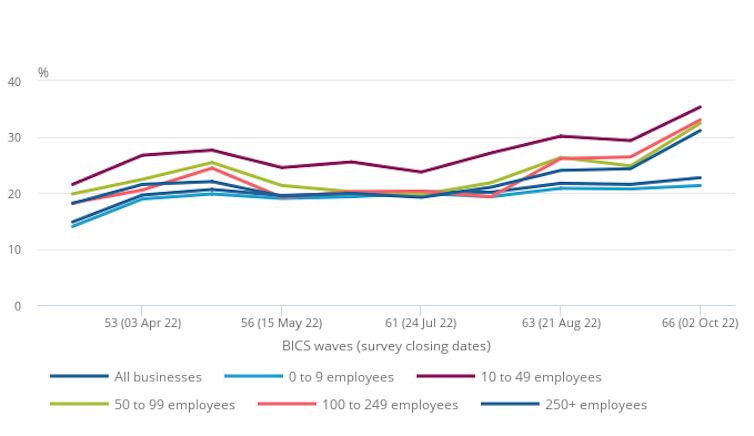

worry about energy costs

Office for National Statistics – Business Insights and Conditions Survey

In this environment, according to the Federation of Small Business, around 53% of small and medium-sized businesses (SMEs or private companies with fewer than 250 employees) in the UK are expected to collapse or downsize.

To address the very real threat of rising energy costs, in September the UK government introduced its Energy Bill Relief Scheme for non-domestic consumers, including SMEs. Over the next six months, the program will support companies whose current gas and electricity prices have increased significantly due to the recent increase in global energy prices.

However, the program may not be enough to help all businesses with their energy bills, especially as it will only run for six months initially. In addition, it could hurt efforts to transition to a more sustainable economy.

Read more: Energy price freezes and business support are sticking plasters – how to protect British families and businesses from future crises

SMEs make up 99% of the country’s business environment and generate about 60% of its commercial waste and more than 43% of its industrial pollution. Therefore, responsible behavior of these companies towards the environment is of crucial importance.

However, recent research shows that the UK government’s green fiscal policy mainly benefits large infrastructure projects. These include the new jobs in the low-carbon sector touted during last year’s COP26 in Glasgow and the government’s plan to create a green industrial revolution by increasing offshore wind capacity, among other things.

Given their pervasiveness in the UK business scene, efforts to keep SMEs growing must be done in parallel with support for sustainable green business models if the government’s net-zero targets are to be met. And this must be part of any discussion of the current energy crisis.

Our research into business recovery from the COVID-19 pandemic has shown that relatively small steps can be part of a recovery model for smaller businesses in tough economic times. Based on that research, here are three ways to protect smaller businesses in the current economic crisis.

1. Consumer: Shop local

Local businesses – online and offline – benefit from our support, as do the surrounding communities. The local economy retains 63p of every £1 spent at an SME, compared to 40p from larger companies.

These larger companies can also reduce their carbon footprint and logistical challenges by sourcing from nearby small businesses. The increased revenue from this additional business could be used by SMEs to invest in green energy sources to meet their sustainability goals.

Suzanne Tucker/Shutterstock

2. Other business: timely payments

Late payments can have a major impact on a company’s finances, especially considering that 77% of SMEs are part of the supply chain of larger companies. But even with the existence of a prompt payment code aimed at preventing delays in billing, businesses were owed £23.4 billion in late payments earlier this year.

The UK’s Small Business Commissioner must be empowered to require on-time payments to help smaller businesses survive. The government is currently examining the results of a consultation on the subject. This ensures that SMEs have enough financial security to invest in their own business, for example by switching to green energy sources.

3. Government: incentives and support

Many SMEs use rented premises. So reducing the use of fossil fuels for heating and electricity means convincing landlords to install renewable energy sources such as solar panels, as well as smart meters and other green technologies. More government incentives for landlords could encourage them to work with SMEs to secure greener, cheaper and more sustainable energy sources.

And for SMEs that own their own premises, the government could introduce green incentives via business tax breaks. A government task force could also support SMEs in reducing and controlling their use of fossil fuels, for example explaining how a VAT-registered company can reclaim energy costs under such a scheme.

Shotmedia/Shutterstock

Any government support should also be tailored. Using a single initiative to support all SMEs requires that all companies experience the energy crisis in the same way. A traffic light system could help identify the most vulnerable companies. These “red light” companies, for example, would receive more short-term government support to survive the energy crisis than those in the yellow or green groups.

Energy suppliers could also use the traffic light system to modify their business models in a way that promotes SMEs. For example, suppliers could maintain contracts with red-light companies that don’t pay bills, knowing that the government has pledged additional financial support to those companies. Suppliers might even consider lowering upfront payments for such companies.

This type of business recovery model will help smaller companies not only weather the energy crisis, but also switch to greener heat and power sources and create more sustainable growth models in this vital sector.