How to Invest in a Recession

A recession is very likely…what our strategy experts say about the sectors that will outperform…where Louis Navellier is putting his money…what the Fed is doing now

We are either in a recession or heading towards it.

This is the conclusion that more and more reputable hedge fund managers, corporate executives, and financial experts are coming to.

The list includes Stan Druckenmiller, Paul Tudor Jones, Jamie Dimon, Leon Cooperman, Ken Griffin, Ray Dalio, David Einhorn, and Mohamed El-Erian to name a few.

And even though President Joe Biden finally conceded that a “mild” recession could happen, these people don’t see it…

Druckenmiller: “I won’t be surprised if it’s not larger than the so-called average garden variety. I’m not ruling out something really bad.”

Dimon: “This is serious stuff…JPMorgan is gearing up and we’re going to be very conservative with our balance sheet.”

Einhorn: “It feels like trying to figure out if it’s better to clear half a meter of snow off the driveway with a soup ladle than with an ice cream scoop.”

Dalio: “…I see it as likely that the inflation rate will remain well above what the people and the Fed want, that interest rates will rise, that other markets will fall and that the economy will be weaker than expected, and that without considering the worsening tendencies in internal and external conflicts and their impact.”

Finally, on a global scale, there’s Pierre Olivier Gourinchas, the International Monetary Fund’s chief economist, who says, “We’re not in a crisis yet, but things are really not looking good.” He added that 2023 will be the “darkest hour.” for the world economy will be.

Keep in mind that all of these listings were made ahead of yesterday’s CPI data, making another 75 basis point hike by the Fed in November a holdout as far as Wall Street traders are concerned. According to CME Group’s FedWatch tool, the probability is now 99.3%.

Conclusion: Interest rates are rising faster than at any time in recent history – and the likelihood of this ending in a recession is high.

So let’s get active.

How do we invest for a recession?

That’s what our tech experts, John Jagerson and Wade Hansen, covered in their latest issue of Strategic trader.

From their Wednesday update:

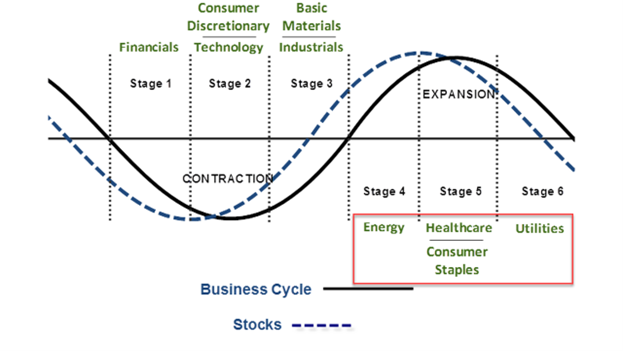

When the U.S. economy begins to contract and the tide begins to recede, not all stocks fare the same. Some sectors tend to outperform while others underperform miserably.

However, the good news for investors during these pullbacks is that the market tends to react in a relatively predictable manner when the pullbacks occur. The same sectors that have outperformed during previous downturns are likely to outperform during the next ones as well.

John and Wade provide the following chart showing the interplay between stocks and the business cycle as well as historical sector performance.

Based on past economic contractions, John and Wade expect the following sectors to outperform:

- energy

- health care

- consumer goods

- Utilities

So how have these sectors performed since Aug. 16, when the S&P hit its recent high?

Back to John and Wade:

If you look at a comparison chart of the 11 S&P 500 sectors and the S&P 500 itself (tracked by State Street Global Advisors through their Select Sector SPDR funds), you’ll see the following performance:

- Energy Select Sector SPDR® Fund (XL): 2.30%

- Health Care Select Sector SPDR® Fund (XLV): -8.19%

- Consumer Staples Select Sector SPDR® Fund (XLP): -10.44%

- Financial Select Sector SPDR® Fund (XLF): -14.32%

- Industrial Select Sector SPDR® Fund (XLI): -14.58%

- Materials Select Sector SPDR® Fund (XLB): -15.23%

- SPDR® S&P 500 Fund (SPY): -16.47%

- Utility Select Sector SPDR® Fund (XLU): -18.29%

- Consumer Discretionary Select Sector SPDR® Fund (XLY): -19.05%

- Communication Services Select Sector SPDR® Fund (XLC): -20.21%

- Technology Select Sector SPDR® Fund (XLK): -22.88%

- Real Estate Select Sector SPDR® Fund (XLRE): -25.62%

Almost all sectors that you would expect to outperform during an economic contraction are currently outperforming.

The only exception is the utilities sector.

As you know, the Fed has been relentlessly raising interest rates for the past few months, which has caused the 10-year yield to surge sharply. In the last 12 months, the yield has exploded by 151%, and as I write Friday morning it’s now at 4%.

Going back to John and Wade to explain why rising yields are hurting utilities:

As government bond yields rise, dividend yields on utility stocks become less competitive.

With strong dividend yields being one of the key factors behind utility stocks outperforming during the economic downturn, we see utility stocks lagging somewhat during this downturn.

John and Wade’s conclusion on where to invest now

Our technical experts favor healthcare stocks and consumer staples stocks and expect them to continue to outperform.

Meanwhile, they warn energy investors:

Energy stocks may not fare so well if crude oil prices continue to rally lower from the downside resistance level it hit on Monday.

Finally, for direction for the broader S&P, John and Wade pointed to the earnings performance of the big banks – notably JPMorgan Chase, Citigroup and Wells Fargo, all of which reported this morning.

In their Wednesday update, they wrote that if these banks can beat expectations, the S&P 500 could potentially jump higher.

It turns out that JPMorgan beat estimates this morning thanks to higher interest income generated by rising interest rates. Citigroup’s net income fell 25% year over year as it increased its loan loss provisions, but revenue beat expectations. Wells Fargo beat expectations despite increasing its loan loss provisions.

All in all, a solid performance by the banks. Hopefully, if John and Wade are right, the S&P can add to that strength in the coming days.

In the meantime, let’s catch up with Louis Navellier for his latest thoughts on what to expect from the Fed after yesterday’s CPI data

Yesterday, the CPI rose 0.4% month-on-month. That’s more than the Dow Jones estimate of 0.3%.

Worse, core CPI posted its biggest 12-month gain since August 1982.

So what does this mean for Fed policy going into the year-end?

Yesterday in his Accelerated Profits market update podcast provided Louis with the roadmap:

Inflation is structural. [The Fed] can’t get rid of it.

So what does that mean?

The Fed will continue to raise interest rates. They will hike rates by 75 basis points six days before the midterm elections.

They will raise prices in December when we are all engrossed in the holidays. Whether they make 75 or 50 basis points doesn’t matter – let’s deal with that. Let’s hope it’s the last.

And then they’ll keep interest rates extra high next year to make sure inflation is dead.

Louis goes on to say that these rate hikes have already killed the housing market. Now look for those higher rates to kill other rate-sensitive parts of the economy.

So where does Louis place his chips in this challenging climate?

regular Digest Readers already know the answer: energy — coincidentally one of the sectors that John and Wade identify as outperformers during a contraction.

But what about John and Wade’s warning about crude oil prices?

Well, Louis doesn’t care about short-term price fluctuations. Big picture, even if oil falls back to $80 a barrel, prices are still high enough for the leading oil companies to post fantastic profits over the next two quarters.

So let’s sum it all up…

It seems we are headed for a recession. With this in mind, keep an eye on healthcare, consumer staples and energy stocks to support your portfolio during tough times.

Have a nice evening,

Jeff Remsburg