How To Know If This Bear Market Is Ending

D-None

pain in real time

Bear markets are most painful in real-time (vs. hindsight), and this bear market is no different. What makes this bear feel even worse is the breadth of negative returns. From stocks to bonds to real estate to cryptocurrency, everything seems to be down and there’s nowhere to hide.

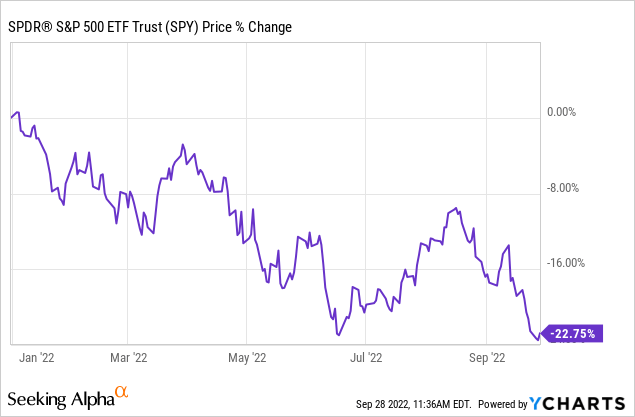

As of September, the S&P 500 has broken the technical definition of a bear market twice this year (-20%). US stocks, as measured by the SPDR S&P 500 ETF Trust (SPY), are down nearly -23% year-to-date.

hoping for a floor

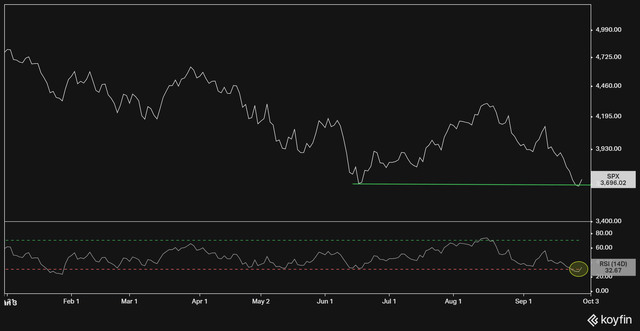

in June, the S&P hit a yearly low and staged a convincing rebound near the 3,600 mark. In September, the market retested this low and made a new one near the same level. Some investors are hopeful this will mark a bottom for stocks.

S&P 500 price levels

koyfin.com

Stocks appear to be oversold and the hopeful sentiment is understandable given the dismal returns this year. Unfortunately, hope does little to help us see the end of this bear market. Here are some indicators that offer better insight.

extent of the drawdown

The technical definition of a bear market starts at -20%, but the average bear market since 1928 is around -30%. There is also a wide range around this midpoint.

The worst bear market on record took place during the Great Depression when the S&P 500 fell more than -80%. 2018 was the mildest when the S&P 500 narrowly missed the mark with a -19.8% decline (assuming we count that as bearish).

At -23% we are on the mild end of the spectrum. We may not end up with the -50% bears of 2000 or 2007. But given the understanding of “what’s up…” and the significant lead to the 2022 top, an average pullback seems reasonable.

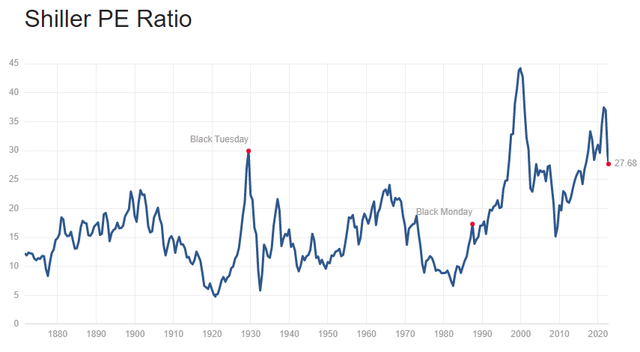

Another way to look at this is by rating. Based on the current Shiller price-to-earnings (CAPE) ratio of 28x, the S&P 500 is still near its second-highest level in history, even higher than before the Great Financial Crisis (GFC) of 2007.

multipl.com

Over the past 150 years, the CAPE has averaged around 17x with a low of 5x and a high of 44x. The CAPE reached about 15 times the GFC bear market. It routinely fell to single digits on previous major lows.

In fairness, valuation is a blunt tool that is not useful for marking timing, short-term trading, or predicting highs and lows. The S&P 500 is up +27% in 2021 despite starting the year with a very high CAPE of over 36.

However, the rating is useful for assessing the potential magnitude of market downturns if they do occur. Extreme valuations up are usually followed by extreme price falls, with the clearest examples being 2000 and 1928.

Interest rates and the Fed

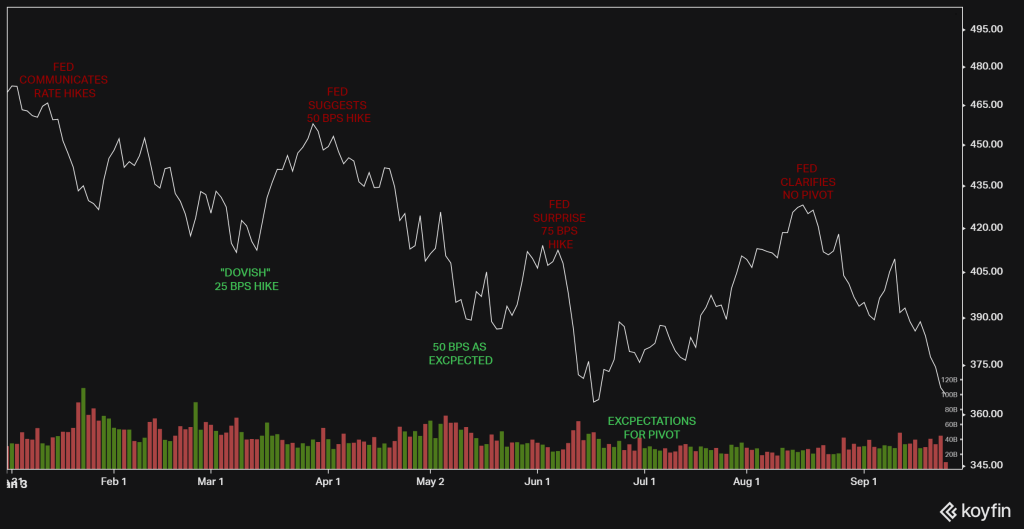

The old market adage “Don’t fight the Fed” is so well known that it’s often ignored. But investors would have done well to heed this in 2022. The stock market has responded to Fed policy throughout the year, summarized in the chart and timeline below.

The Fed vs. S&P 500

koyfin.com

- In January, the Fed telegraphed its intention to tighten monetary policy, leading to widespread market pessimism at the start of the year.

- In March, stocks rallied after Chairman Powell confirmed the Fed was only planning a 25 basis point move, which investors hailed as less hawkish than feared.

- In April, the Fed announced its readiness for more aggressive action, even announcing a possible 50 basis point rate hike for May. That sent stocks to fresh lows, but prices stabilized after the 50 basis points came and went as expected.

- In early June, the Fed surprised with a higher-than-expected rate hike of 75 basis points, sending equities to new lows for the year.

- In late June, near the lows, rumors of a possible “Fed pivot” suggested that the Fed could be less aggressive than expected if inflation eases. Fact or not, it was what investors wanted to hear and enough to propel an 18 percent rally off the lows.

- In August, Chairman Powell clarified that there was no dovish bias and the Fed intended to stay the course. That brought the abrupt risk reversal into play at the end of the third quarter.

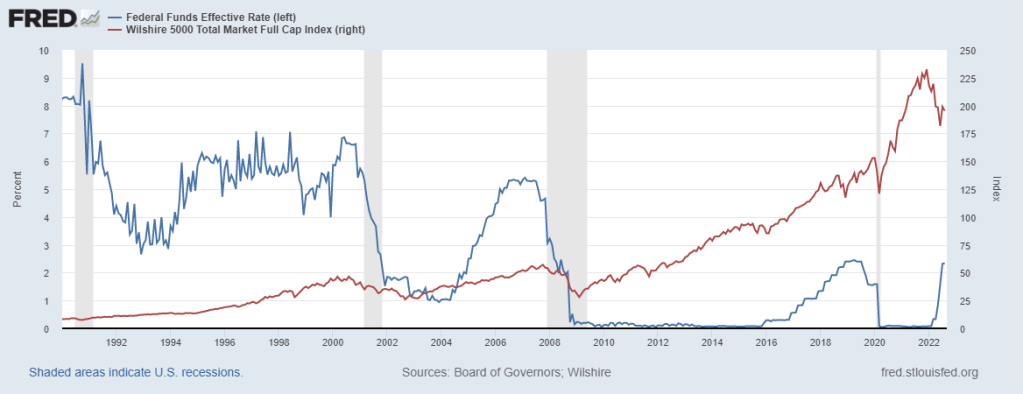

The hoped-for “pivot” markets are important because historically the stock market never bottoms until after The Fed stops raising interest rates and nearing the end the rate cut. The chart below shows the change in the fed funds rate (blue) versus US stock prices (red) since 1990.

Fed funds rate vs. Wilshire 5K

fred.stlouisfed.org

The Fed is determined to keep raising rates and is clearly communicating its plans. That means the stock market hasn’t bottomed yet and we should expect more pain. Fed Chairman Powell basically told us so much in his August statement.

Leading economic indicators

Last but not least, the general economic conditions. Market rallies can start on technical strength, but they need fundamental support to be sustainable. The underlying health and strength of economic conditions provide such support.

In the US, economic conditions peaked last year and leading economic indicators such as housing, PMI readings, interest rates and earnings growth have all deteriorated since then.

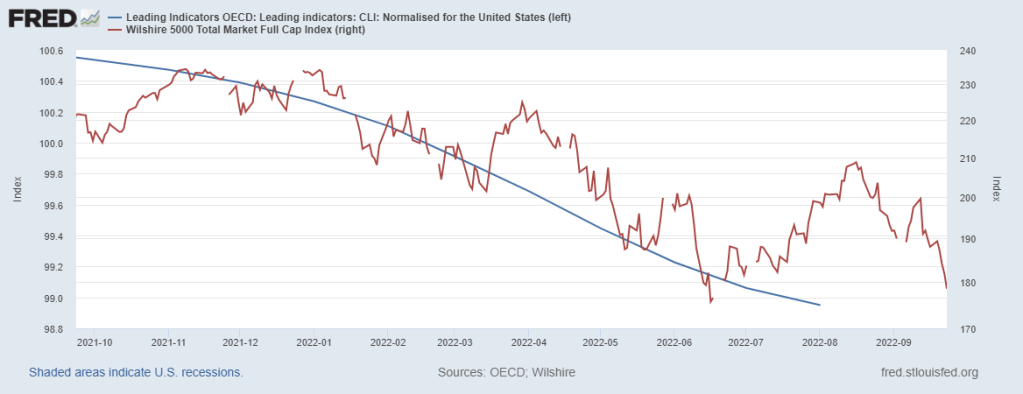

The chart below shows US leading indicators from the OECD (blue) compared to US market prices over the past year. The steady decline in leading indicators suggested that stocks’ rally from June through August was a bear market rally, rather than the formation of a new bull as some were hoping.

OECD CLI vs. Wilshire 5K

fred.stlouisfed.org

The hopeless end result

We’re all hoping for a bottom in stocks, but hope alone won’t help us find it. The markets are difficult to time and I don’t know when this downturn will end. That being said, a number of reliable indicators suggest this bear has more room to run.

Stock valuations, Fed policy and economic conditions are all still a long way from where they typically were near previous bear market bottoms. Furthermore, the debate over whether we have bottomed is itself a counterindicator (though not convincing on its own).

Markets will not reach a permanent bottom until pessimism is so deep and pervasive that no one believes there will be a bottom. A real bottom is a hopeless bottom where there’s no one left to sell.