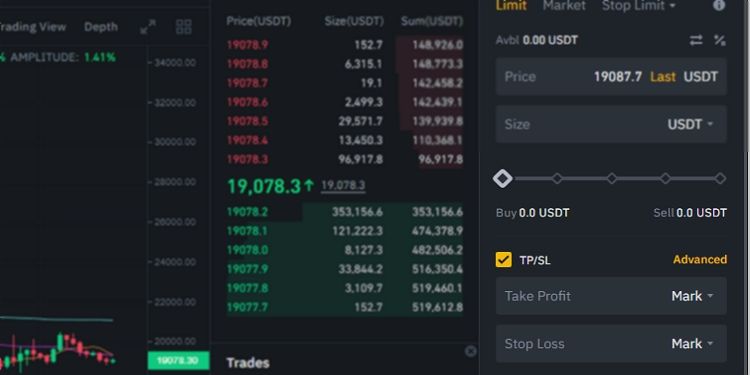

How to Manage Your Trades With Stop-Loss and Take-Profit Orders

Trading crypto involves many risks, so traders need to use different tools to control their risks, reduce losses and lock in profits. Stop Loss and Take Profit orders are also used for risk control, so you need to understand how they work.

If you want to improve your crypto trading game, you should know more about them, learn how to use them and find out the strategies to use when executing.

What are stop loss and take profit orders?

A Stop Loss (SL) is a limit order that indicates how much loss you are willing to take on a trade. It prevents you from making additional losses on a trading position.

A take profit (TP) works as the exact opposite of a stop loss. It gives the price to close a position profitably. If you have a take profit order, the trading platform you are using will automatically close your position when the price level is reached.

Stop Loss and Take Profit orders are both limit orders, which means that they are set at predetermined prices, and when the conditions are met, the orders are triggered. Of course it is also possible that the price never reaches your specified price and the order is not triggered.

These tools are beginner-friendly and are usually suitable for short-term trading.

Why should you use Stop Loss and Take Profit?

There are many reasons to use Stop Loss and Take Profit orders; among them are the following:

To prevent emotional and impulsive trading

Specific stop loss and take profit prices will reduce the tendency to make emotional decisions when attempting to exit trades. It is normal to have situations where trades are losing for a long time and later close in profit. Relying on emotional triggers would often lead beginners to close such trades too early.

Additionally, the lack of a predefined profit target can result in you closing out profits too early or letting a trade run too long. Relying on your gut feeling when closing trades can affect your trading psychology as emotions like fear, greed, doubt, etc. will cause you to take the wrong moves.

For appropriate risk management

Using strategic stop loss and take profit orders when planning your trades also helps maintain a strict risk management strategy. The tools help you define your risk-reward ratio, the amount of risk you are willing to take in trading relative to the potential reward.

To stay out of the market

Instead of staying and watching the market to know the right time to close a trade for a loss or a profit, these tools have come in handy for these purposes. Additionally, you don’t need to monitor the charts all day after the trade execution as you can pre-determine your SL and TP levels at any time and proceed with other activities.

They are completely free to use

The use of SL and TP is usually free of charge. Exchanges have them as free tools for all traders and investors. However, some exchanges may require you to subscribe to a plan to access more complex crypto order types.

Strategies for setting stop loss and take profit targets in trading

Where you set your stop-loss order depends on how much you are willing to lose if a trade doesn’t go in your favour. It should be placed in a strategic point where it doesn’t trigger too early and at the same time not too far away so you don’t lose too much.

You should also not go beyond the level of risk that you have set in your trading plan.

Price volatility and fluctuations are some of the market factors to consider when setting your stop loss. You should not place it in a place where random market fluctuations and noise can easily trigger it.

If you go short (sell), you should place your stop loss above the trade execution point; If you go long (buy), it should be below the execution price.

Generally, traders use their risk-reward expectations to determine their take-profit level. There is no point in setting a profit target that will bring a lower reward than the potential loss.

Additionally, you also need to consider general market conditions using tools like price action, support and resistance, technical indicators and other useful factors to know where the price is likely to struggle or reverse.

With that in mind, we’re going to look at some useful strategies for setting stop loss and take profit levels.

Support and Resistance Levels

The support and resistance levels are key price levels where the price is likely to see a rally. A support level prevents the price from going any further down, while a resistance level stops it from moving any further up.

In a short position, SL is usually below resistance while TP is above support. However, in a long position, you should place SL above support and TP before resistance.

trading volatility

Here you can use market volatility to determine where to place your stop-loss order. This strategy requires you to use the volatility of the market to determine where to place your SL. The Average True Range (ATR) indicator allows you to determine how volatile a crypto market is and place the SL at a point that the market is unlikely to reach.

Knowing the average market movements over a period of time can also help you determine the right place to place a TP.

risk per trade

Having a certain amount you are willing to risk per trade is a simple risk management strategy that can help you place your stop loss. This approach requires you to be willing to risk a certain amount per trade. The amount could be calculated as a percentage of your total capital.

For example, let’s say that you plan to risk only 1% of your capital on every trade, no matter how promising it is. This means setting your stop loss to only lose 1%. So if you have a $5,000 account, you won’t lose more than $50 on a trade.

To set your TP with this strategy, you need to use a price level that gives you a higher profit than the potential loss. Setting your TP according to the ratio is good when you have a certain risk/reward ratio. For example, if your risk/reward ratio is 1:3, you need to set your TP at a price that would earn you a profit that is 3% greater than the potential loss amount.

trading indicators

Traders use various indicators to determine where to place their SLs and TPs. They use Relative Strength Index, Moving Averages, Bollinger Bands and more.

The main idea is that the stop loss should be placed where it cannot easily be triggered and your take profit should be where you know the price is likely to be hit while still taking your risk/reward ratio, your trading goals and consider other market factors.

Be dynamic with your approach

Many short-term traders rely on stop-loss and take-profit orders to exit trades. These orders have proven to be reliable in the crypto markets and other financial markets.

These tools help you focus on your trade exit and risk management strategies. They are also more effective when combined with other risk management practices.

We recommend you to be dynamic when setting your SL and TP. It’s always a good idea to use a combination of strategies based on market conditions. There are no definitive rules as to how you set them, and it’s okay to have a unique strategy as long as it gets you the outcome you want.