how to protect yourself from meme stock mania

Recent rallies in stocks, which have received publicity on social media, have drawn a growing number of investors into these so-called “meme stocks” in search of quick returns. But while it may seem like a fun game, there are real risks in investing in stocks and other financial products that are becoming popular on social media. And as recessions loom around the world, the threat becomes even more acute.

The term meme stock has traditionally been used to describe any stock that gets a lot of attention on social media. One of the most notable recent examples of a meme stock, retailer GameStop, saw the stock surge more than 10,600% in 2021 following discussions from individual investors on r/WallStreetBets — a popular subreddit on social media platform Reddit. You’ve probably heard of other assets that have become popular on social media recently, including cinema chain AMC and US retailer Bed Bath & Beyond.

Meme stock rallies have also boosted cryptocurrency products such as stablecoins and non-fungible tokens — basically any asset that has hype built up online. And while these new decentralized financial assets are very different from stocks, the way sentiment about these assets is formed on social media tends to be the same.

Recent research I did with colleagues to understand Reddit’s role in the GameStop stock rally included text analysis of 10.8 million comments on r/WallStreetBets and high-frequency GameStop prices. What we found sends a red flag to all meme stock investors: online gossip drives prices higher, but can’t save investors when assets start to collapse.

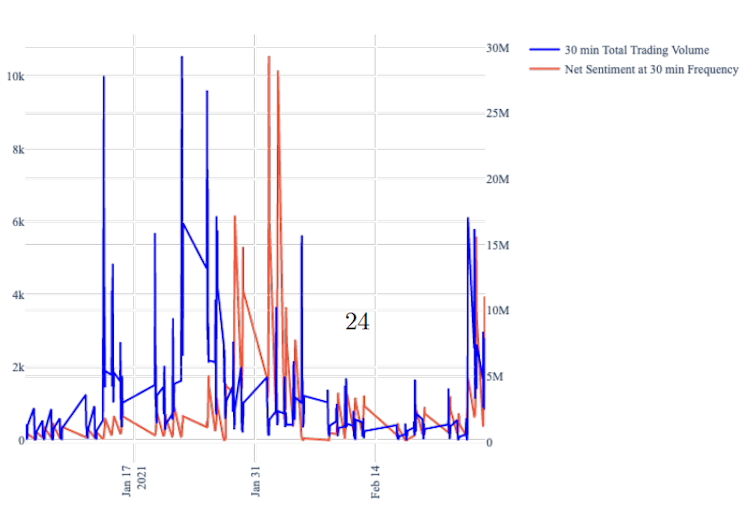

Our analysis showed that online discussions — or “net sentiment,” as illustrated in the chart below — about r/WallStreetBets helped trigger GameStop’s stock price rise and caused an increase in trading volume during the bullish market for this stock when the hype was high.

Author’s chart with data from Bloomberg and Reddit.

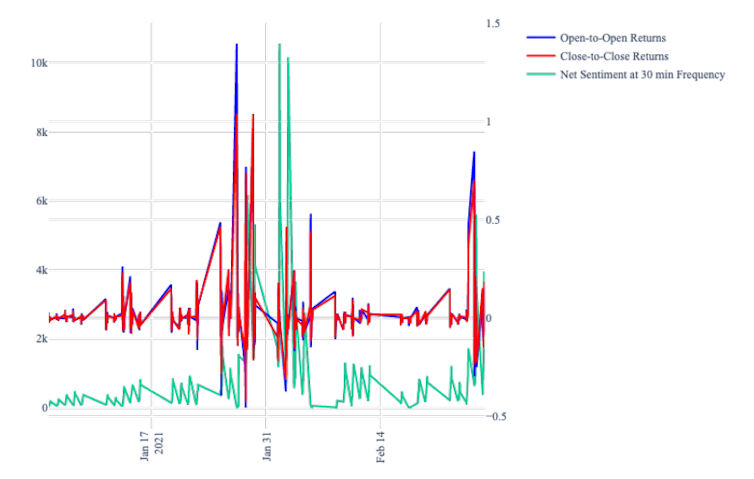

But we found that positive comments from people on Reddit couldn’t stop GameStop from falling once people started selling it. In early February 2021, online sentiment was rising, meaning there were more positive than negative comments about r/WallStreetBets about GameStop, even as investor returns for GameStop stock (recorded at 30-minute intervals for our research) continued to decline and that Trading volume continued to decline.

Author’s own chart using data from Bloomberg and Reddit.

Investors should learn from GameStop’s history. When online commentators try to hype a stock, they often include hashtags like “to the moon” and HODL (a misspelling of “hold” — like “hold stock instead of sell” — which becomes an acronym for “hold on for.” has become). dear life in the world of online trading). But when the price starts falling, no matter how many of these hashtags are in the comments section of a subreddit, our research shows that the broader market reaction to the price drop will outweigh any encouragement on investment forums.

Don’t believe the hype

Social media often encourages both overconfidence and confirmation biases—arguably the most common cognitive biases in economics and finance. When reading investment forums, amateur investors often look for validation of their own decision to invest in a meme stock. These investors then often simply feed each other’s prejudices by sharing information that supports that desirable outcome.

And it’s even riskier to invest in cryptocurrencies than stocks. Crypto markets are volatile and lack sufficient regulation to make them more stable. For example, in the recent collapse of Terra Luna, individual investors lost their savings after investing in the algorithmic stablecoin.

With inflation surging amid an energy and livelihood crisis, the cryptocurrency market has struggled to recover quickly from its recent meltdown, with market leader Bitcoin losing 70% of its value since November 2021. But even these factors haven’t deterred amateur investors from seeking returns in crypto markets.

Aside from waiting for governments to tighten crypto regulation — as is planned in Singapore, for example — there are some steps retail investors can take to protect themselves from meme stock mania.

1. Be careful when something sounds too good to be true

When an asset or stablecoin claims to have low risk but investors brag about huge returns that can be achieved in a short amount of time, that’s a red flag. Such claims are usually too good to be true as there are no risk-free assets that can offer high returns. Investors should review three-month US Treasury Bill yields to set their expectations for potential low-risk returns.

2. Carefully consider a set of information

It doesn’t help to read ten articles supporting your opinion and quickly scan headlines that suggest the alternative. Consumers have learned to be more cautious about promises of unrealistic and scientifically impossible results for all types of products – a similar caution should apply to investments.

3. Pay attention to sources

If an article or analyst opinion was sponsored by a crypto company or exchange, that information is the same as any other paid advertisement. Also, investment forums and social media are not trusted sources for investment advice, they are full of bots and can be used as a cheap marketing tool for crypto companies looking to manipulate the market.

As recent GameStop research has shown, social media is highly effective at igniting extreme rallies in a meme stock, but it doesn’t protect retail investors if the price falls back to its fair value.