How to Read China’s Unwritten Rules and Regulations – The Diplomat

Effective regulation must strike a delicate balance between encouraging innovation while discouraging excessive risk-taking. Too strict regulation can stifle progress; If regulation is too lenient, it may fail to prevent fraud, which can threaten the stability of the economic and financial system. To resolve this trade-off, China relies heavily on flexible implicit rules that complement explicit rules. This reliance on implicit rules sometimes creates ambiguity, which Chinese business culture is quite comfortable with. However, this ambiguity is not synonymous with a breach of the law. On the contrary, it helps businesses and government navigate a fast-paced environment where the enactment of formal regulations cannot possibly keep pace with the rapidly changing landscape.

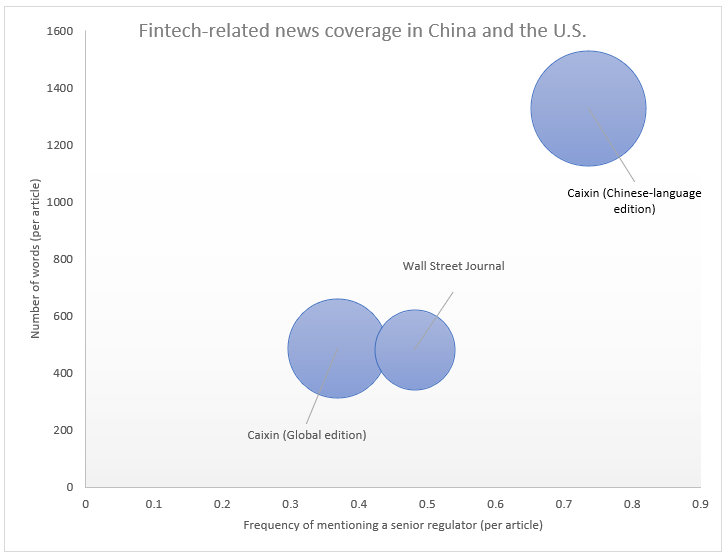

Implicit rules are norms that have not been codified into formal rules but still provide guidance for acceptable behavior. In China, such implicit regulations are often expressed as the opinion of senior government officials. These opinions are much stronger in Chinese news outlets than in their Western counterparts. For example, a comparison of fintech-related news between leading Chinese and US news outlets shows that Chinese-language media are much more likely to mention a senior government official than news articles written for a Western audience. Notably, these differences in coverage exist even between media owned by the same publisher but targeting different audiences (such as Caixin’s Chinese-language and English-language editions). These differences in economic reporting reflect the importance of implicit regulations in China.

This number compares coverage of fintech-related business news in English-language and Chinese-language media. The vertical axis shows the average number of words per article, while the horizontal axis represents the average number of lead regulatory authority mentions in an article. The size of the circles indicates the number of articles that mention the term fintech.

Implicit regulations have the advantage of being flexible, allowing the government to respond quickly to rapidly changing circumstances. However, flexibility can lead to arbitrariness, which in turn can sabotage the very purpose of regulation as a set of rules that everyone must abide by. There are at least two factors that keep the arbitrariness of China’s implied regulations in check. First, the strength of the Chinese government coupled with its overarching focus on economic prosperity is keeping individual regulator stimulus in check. Second, China’s long legal history has created a role for implicit regulations while maintaining the predominance of written regulations.

With Chinese regulators broadly striving to foster economic growth, the interplay between China’s implicit and explicit regulations follows a predictable pattern. Initially, innovation (including financial innovation) is often allowed to develop with few or no explicit rules. When signs of wrongdoing emerge, regulators step in by providing implicit guidance rather than enacting explicit rules. When implicit guidance isn’t enough to curb the excesses government officials are concerned about, explicit (and often harsh) regulations follow.

When explicit regulations are enacted, they create a flood of new rules. While these rules may appear arbitrary to an outside observer, they simply codify the implicit (and therefore publicly disregarded) guidance that preceded them.

A recent example of this regulatory cycle is the development of Chinese peer-to-peer (P2P) lending. P2P outlets appeared in China in 2007, but it wasn’t until 2014 that the very first explicit regulation for this industry was enacted. Initially, senior Chinese officials were positive about the industry. For example, on November 9, 2015, China’s President Xi Jinping gave a speech calling for the development of inclusive finance. As P2P growth accelerated, signs of fraud began to appear and payment defaults increased. However, the government has not outright banned P2P. Instead, it began sending strong signals that financial misconduct and fraud should stop. In a marked shift in the government’s position, Xi named some specific P2P lenders (E-zubao and Zhongjin) and stated that they are involved in fraudulent activities that must be stopped. Finally, in 2019, the government enacted a set of explicit rules that effectively shut down the P2P industry in China.

The history of P2P lending contains lessons about the logic of Chinese regulation in general. First, China’s regulations can change fairly quickly due to a significant implicit component. Second, formal explicit rules usually follow the implicit directions of government officials, but such explicit rules are difficult to reverse once introduced. Third, China’s ability to use implicit regulation rests on state power, which can transform or shut down entire industries if need be (as was indeed the case with P2P lending). This logic applies not only to P2P lending, but also to other fast-moving sectors such as e-commerce, AI, and biomedical industries.

How can western business leaders adapt to China’s unique regulatory environment? First, they have to come to terms with the ambiguity that creates space for innovation in China and allows companies to experiment. Second, business leaders must pay close attention to the spirit of the law, not just its letter. One source of information about the spirit of the law is official statements by government leaders. Third, under no circumstances should companies disregard the written rules: ambiguity in China is not an invitation to break the law.