Identity theft: how to protect yourself from fraud | Scams

IIdentity theft occurs when a criminal steals your personal information with the intention of committing identity fraud. “Data is being collected for a nefarious reason,” said James Jones, director of consumer affairs at credit bureau Experian. “They could then use this information to fraudulently apply for credit, goods or services. It may also involve adopting or using an existing product, not necessarily opening a new one.”

Being targeted by scammers can be annoying, while clearing it up can be time-consuming, and the crime can have a direct impact on your personal finances — hurting your credit score and making it difficult to successfully apply for credit cards, loans, or mortgages. So what can you do to protect your identity?

secure information

“The most important thing is the protection of your personal data, be it biographical or login data – for online banking or Amazon or similar. If someone can get access to one of your financial products, it can open up more opportunities for them,” says Jones. “Keep the lid tight on personal information.”

There’s so much about all of us online, says Amber Burridge, head of intelligence at fraud prevention agency Cifas.

“Criminals don’t just look at one source — they look at the connections between the sources and social media accounts,” she says.

“On social media, it’s best to keep settings at the highest privacy level on all accounts, including LinkedIn, which we don’t always think of in the same terms as Facebook.”

Hang up on scammers

“If you get an unwanted call or message pretending to be from a trusted organization, hang up and call them at a number you know is theirs,” Burridge says. And if friends or family reach out to you for financial help, speak up right away—they may have been targeted by scammers.

One of the latest forms of scams is people being contacted on WhatsApp or by text message by crooks claiming to be family members and saying they lost their phone and access to online banking to pay bills.

If in doubt, don’t click

Do not click on third-party links, whether they come from social media posts, text messages or email, or anywhere else. The simple rule is: always check the official website.

Watch out for scam trends

“Scammers are very good at using trends to change their tactics, and right now the cost of living crisis is particularly hot,” says Burridge. “We’ve seen an increase in criminals posing as energy companies claiming they can get a better deal, or supermarkets offering discount coupons.”

Investment scams target those who need to supplement their income. Scammers pose as legitimate companies who ask the victim to remotely share their computer screen so they can collect personal and financial information.

They also posed as a network provider and asked for details of your existing contract so they could give you a better deal. Once they have these details, they can order devices on your behalf.

“When the government announced energy rebates through council taxes, people started seeing messages that said, ‘Click here to set up your payment,'” says Jones. “If you’re not careful, you could give your bank details to a crook.”.

protect passwords

“Password managers like 1Password or LastPass can be a great way to create strong passwords and keep track of them,” says Steve Goddard, fraud and financial crime expert at Featurespace, a company that provides banks with tools to address it aim to stop stolen passwords IDs are used fraudulently.

For example, LastPass generates and stores passwords in an online “vault” that you can access via an authenticator on your phone. There are free and premium versions.

Shopping online

“If you’re looking for a specific store, make sure the URL is correct and starts with https or a little padlock – this means it should be secure. If they’re missing, you might be taking a risk,” says Goddard.

When you search for a store on Google, avoid clicking on the ads at the top of the page, he adds.

“It’s better to find the actual website because these ads are subscription-based and someone could wait for the subscription to expire and take care of it themselves,” he says.

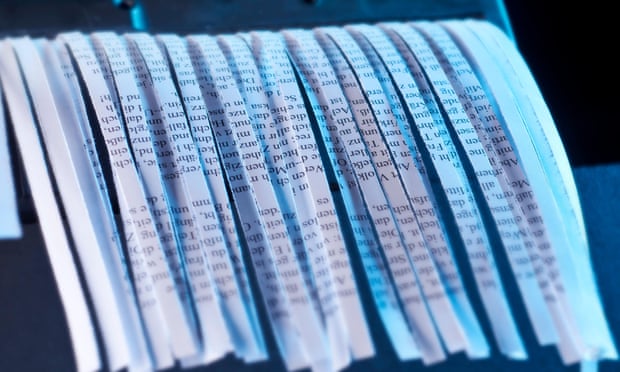

shred documents

Most – but not all – identity theft occurs online. However, caution should still be exercised with letters and other documents. “It’s still good practice to shred every document with your personal information on it,” advises Goddard.

“For example, if you throw away a bill, you send it from a protected area — your home — to a landfill, and it contains your full name, address, contact information, and an account number.

“Someone could take that and pose as a company and say to a victim, ‘You have an outstanding bill, here’s the routing number and the account number to put it into.'”

Update your location

If you’re moving, remember to contact all relevant companies and organizations – from your bank and credit card company to your doctor and dentist – to update them and arrange for your mail to be rerouted.

Make sure that you also provide the electoral roll so that you are not registered at an old address.

Experian’s Jones says, “We include voter roll information on credit reports to help lenders verify your name and address. So you don’t want to be registered in a place where you don’t actually live, because obviously that could help make a fraudulent application look a lot more legitimate.”

Heed the warning signs

According to the Information Commissioner’s Office, if you stop receiving statements from your bank for no reason, or receive letters or reminders for debts that are not yours, or receive receipts in your name for services or items that you did not purchase, could all be a sign that someone has used your identity.

If you are rejected despite a good rating for financial products such as credit cards or a loan, this could be a warning signal.

“It’s a good idea to occasionally take a look at your credit report, which all credit bureaus allow you to do for free,” says Jones.

“Experian gives everyone free access to their monthly credit score, and if you see a sudden nosedive, that can be a good red flag.”

And always report

Report suspicious activity on your account – even if you are not sure it is fraudulent – to your bank, Action Fraud (the national fraud and cybercrime reporting agency) and Cifas.