Institutional investors own a significant stake of 49% in Big 5 Sporting Goods Corporation (NASDAQ:BGFV)

A look at the shareholders of the Big 5 Sporting Goods Corporation (NASDAQ:BGFV) can tell us which group is the strongest. And the group holding the biggest piece of the pie are institutions with 49% ownership. In other words, the group is exposed to maximum upside (or downside risk).

Institutional ownership tends to carry a lot of weight, especially with individual investors, given the massive amount of funds and research capacity at their disposal. As such, it is often considered desirable to have a significant amount of institutional money invested in a company.

Let’s dive deeper into each Big 5 Sporting Goods owner type, starting with the table below.

Check out our latest analysis for the Big 5 sporting goods

What Does Institutional Ownership Tell Us About Big 5 Sporting Goods?

Many institutions measure their performance against an index that approximates the local market. As a result, they tend to pay more attention to companies that are included in major indices.

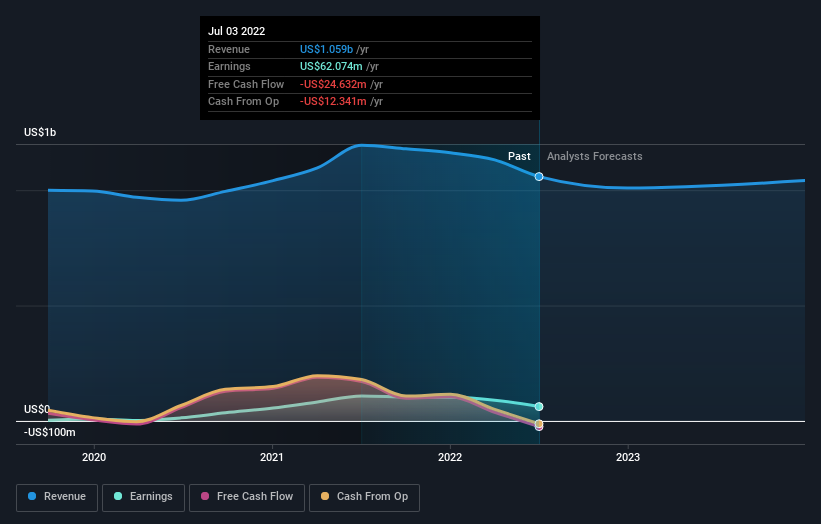

Big 5 Sporting Goods already has institutions on the share register. In fact, they own a respectable stake in the company. This suggests some credibility among professional investors. But we can’t rely on that alone, as institutions sometimes make bad investments, just like everyone else. When multiple institutions own a stock, there is always a risk that they will find themselves in a “crowded trade”. When such a trade goes awry, multiple parties can compete to sell shares quickly. This risk is higher in a company without a growth history. You can see the historical earnings and earnings of the Big 5 Sporting Goods below, but remember there’s still more to be told.

We find that hedge funds have no meaningful investment in the Big 5 sporting goods. Looking at our data, we can see that the largest shareholder is BlackRock, Inc. with 6.4% of the shares outstanding. The Vanguard Group, Inc. is the second largest shareholder with 4.9% of the common stock and Dimensional Fund Advisors LP holds approximately 4.3% of the company’s stock. Additionally, we noted that Steven Miller, the CEO, is allocated 2.6% of the shares.

In examining our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, meaning no single person has a controlling interest.

Studying institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be done by studying analyst sentiment. There’s a little analyst coverage of the stock, but not much. So there is room for more coverage.

Insider ownership of Big 5 sporting goods

The definition of corporate insider can be subjective and varies by jurisdiction. Our data reflects individual insiders and captures at least board members. Management runs the business, but the CEO is accountable to the board even if he or she is a member.

Most view insider ownership as a positive, as it can indicate that the board is well aligned with other shareholders. In some cases, however, too much power is concentrated within this group.

We can report that insiders own shares of the Big 5 Sporting Goods Corporation. It has a market cap of just $276 million, and insiders have $11 million worth of shares in their own names. This shows at least some alignment. You can click here to see if these Insiders have bought or sold.

General Public Property

The general public, who are typically individual investors, own 46% of the Big 5 Sporting Goods. While this ownership may not be sufficient to influence a policy decision in their favor, they can still collectively influence company policy.

Next Steps:

I find it very interesting to see who exactly owns a company. But to really gain insight, we need to consider other information as well. You should find out more about this 3 warning signs we discovered with Big 5 Sporting Goods (including 1 that can’t be ignored).

If you’re like me, you might want to think about whether this company is going to grow or shrink. Luckily, you can check out this free report that includes analyst forecasts for the future.

Note: The figures in this article are calculated using data for the last twelve months, relating to the 12-month period ending on the last date of the month to which the financial statements are dated. This may not match the figures in the full year report.

Do you have any feedback about this article? Concerned about the content? Get in touch directly with us. Alternatively, send an email to the editorial team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your goals or financial situation. Our goal is to offer you long-term focused analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while you help us create better investment tools for individual investors like you. Sign up here