Interest Rates Going Up: Here’s How To Maximize Your Yield

JimVallee

As Friday’s price action makes clear, investors are desperate to believe that the Fed is going to cut rates again, allowing the era of cheap money to continue and bolstering the earnings of highly leveraged companies.

Investors Hear What They Want To Hear – Not What Fed Speakers Say

Each time any sentence of any Fed speaker can be interpreted as a sign that a pivot is coming bond yields drop and exuberant investors bid up the prices of stocks again, especially those of Tech stocks, which are more than others dependent on the availability of cheaply borrowed money and stocks with very slow earnings growth whose only appeal is the dividends they pay.

Each time investors draw the faulty conclusion that rate tapering is soon to begin again another Fed speaker will remind them as they have in almost every speech given by any Fed official after that kind of burst of enthusiasm, that:

- The Fed will not lower rates for a long time after reaching their highest level, because the lesson of the 1970s is that doing that refuels inflation and that;

- They are only talking now about slowing the rate at which they raise rates. Not “pivoting” to lower rates.

One example was earlier in this month when Atlanta Federal Reserve President Raphael Bostic told investors,

You no doubt are aware of considerable speculation already that the Fed could begin lowering rates in 2023 if economic activity slows and the rate of inflation starts to fall. I would say: not so fast. Be assured that I am not advocating a quick turn toward accommodation.

Most recently, the cycle began again. In this article, where we read that San Francisco Federal Reserve President Mary Daly said on October 21, 2022,

We might find ourselves, and the markets have certainly priced this in, with another 75-basis-point increase. … But I would really recommend people don’t take that away and think, well it’s 75 forever.

The market once more reacted to this with exuberance, with the S&P 500 rising over 2%. But note, if rates were not raised at .75% at meetings after November’s they may very well rise at .50% at subsequent meetings, or at .25% for the next two years. It all depends, as the Fed officials keep repeating (and keep being ignored saying) on the data. And right now the data shows employment continuing strong, monthly unemployment levels less than analysts forecasted, and corporate earnings coming in robust enough to dismiss the idea that the economy is on the verge of collapse.

Recall that Fed speaker after Fed speaker has pointed out that the dangers of not raising rates to curb inflation outweigh those of raising them. They have also stressed in almost every single speech that they will be guided by the data. That data continues to show the PCE (the Fed’s favorite measure of inflation) rising. Employment remains strong–coming in stronger than expected week after week. And anyone who has shopped for groceries lately has noticed that even though inflation is supposedly only about 8.6% this year, the price of many grocery store staples has surged as much as 30% per item. Overall, the USDA tells us that,

The food-at-home (grocery store or supermarket food purchases) CPI increased 0.7 percent from July 2022 to August 2022 and was 13.5 percent higher than August 2021.

As the old saying goes, “When all you have is a hammer, everything looks like a nail.” The only tool the Fed has to combat inflation is its ability to influence interest rates and keeping inflation under control is Job #1 for the Fed, especially when employment levels remain at historic highs.

If Rates Are Going to Keep Rising You Want to Invest in Short Treasuries

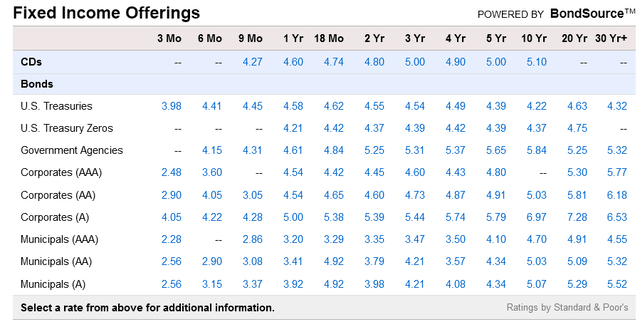

If you have a brokerage account at one of the big brokerages like Fidelity, Schwab or Vanguard, you can easily buy Treasury bills and notes without paying any commission. The table below gives a snapshot of what the bond yields of bonds you could buy at Schwab were on Friday October 21, 2022.

Schwab.com

Note that there is no real benefit in buying Treasuries with yields longer than one year right now as they aren’t yielding more and if you tie up your money that much longer you can’t benefit from future rate hikes. That’s one reason to keep your maturities short, by which I mean between one and 6 months.

The other reason to keep them short is that these bond yields have been rising at a rate so fast that I have recently bought a bond in the morning only to see it trading at 5 basis points higher a few hours later. Shorter bonds can be reinvested at higher rates relatively quickly.

Treasury yields have been fluctuating the same way that stock prices have been all this past month. When some phrase of some Fed speaker is misinterpreted to mean that the Fed is going to start cutting rates, yields decline a small amount, only to shoot back up when another Fed speaker repeats that the Fed will continue to raise rates and will not be tapering any time in the near future.

If Rates Drop It Probably Means You Can Buy Stocks at Much Better Prices

Some may argue that it makes sense to lock down those higher rates by buying longer Treasuries. But since most of us are stock investors here I would caution against putting too much of your money in longer bonds. That’s because if rates do come down it will be because we have entered a serious recession that will drag down stock earnings and hence stock prices.

That is the time when you will want to buy the stocks you’ve had your eye on for a few years that were always priced far too high to make sense. It is also when the yields of your favorite high quality dividend growth stocks will revert to their mean. Right now, even with the significant decline in price these stocks have suffered, the yield of many quality dividend stocks is still considerably below their historical yields.

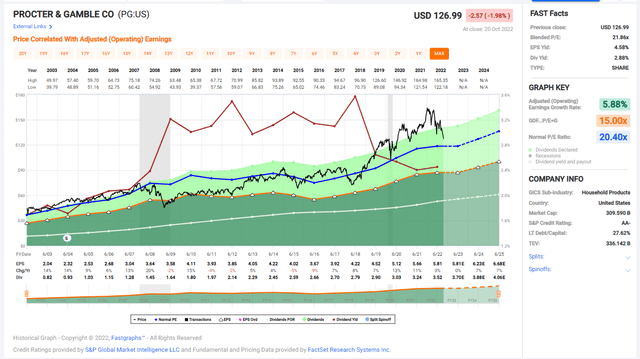

For an example, look at how Proctor & Gamble’s (PG) price surge over the past few years has driven its dividend far below its historical levels.

Proctor & Gamble Dividend History – Brown Line

Fastgraphs.com

When the market tanks, as we are already seeing, it drags down great stocks, even if their earning power is not impaired. Just look at the price action for Proctor & Gamble after the 2008 recession. Though their earnings continued unabated, their price dropped to levels that made them far more attractive to investors.

So keep your bond investments in short term bonds, so that they will mature in a few months. That way, if rates continue to rise you can reinvest the proceeds at the higher yield. If rates drop significantly, it will probably be because a recession bad enough to cause the Fed to backtrack will drag down stock prices and make them a much better buy.

Meanwhile, you will be earning something like 4-4.5% on the money you put in those 3 and 6 month treasury bonds, which is considerably more than you are getting from all but the most risky dividend paying stocks. And you don’t have to anxiously check stock prices every day to see if your investment is sinking.

How To Ladder Bonds

The smartest way to buy bonds is to ladder them. That means dividing up the money you intend to put into bonds into separate batches and putting an equal amount into bonds of different maturities.

You determine how far out you want your ladder to extend. A short ladder might just be a year-long one. In that case you could invest 20% of your investment in 3 month Treasuries (US3M), 20% in 6 month Treasuries (US6M), 20% in secondary market treasuries maturing in 9 month, and 20% in 1 year Treasuries (US12M).

There’s no requirement that the size of your different ladder rungs be the same. If you think bond rates will continue to climb quickly it may make sense to heavily weight the 3 month and 6 month ladder rungs and put only a small amount of money into the longer maturities as insurance in case rates drop over the course of the year. If you think rates will stabilize, it might make more sense to weight the longer maturities more heavily.

Why You Don’t Want to Buy Bond ETFs or Funds

At first glance, bond funds might seem like a much easier way to take advantage of rising bond rates without having to manage a bond ladder on your own. The Vanguard Total Bond Market ETF (BND) reports a SEC yield of 4.31% right now. The trouble is, that BND, like all bond indexes that track the Bloomberg US Aggregate Bond Index, has a very long duration. Right now it is 6.2. This means that for every 1% that interest rates rise the NAV of BND can be expected to drop at least 6%. And though some might argue that rising rates will help you recover, this is only true if you hold the fund for at least 6.2 years and–and this is what many people miss–it is also only true if rates don’t continue to rise another percent or two or three. That’s because every subsequent 1% rise in rates will knock down the NAV roughly by an amount that matches the ETF’s duration.

Short term bond funds might sound like they might be what you are looking for, but fund providers consider “short term” to mean “1-5 years.” Funds like the Vanguard Short Term Bond ETF (BSV) may have an attractive SEC yield of 4.54%. But BSV has a duration of 2.6 years. That means it drops about 2.6% for every 1 percent rise in rates. That’s why it has already dropped 7.39% this past year, which is far more than the 1.65% interest yield it paid over the same period. Even “Ultra short” bond ETFs like the VUSB-Vanguard Ultra-Short Bond ETF (VUSB) has a .9 year duration and its NAV has sunk by 2.46% which is considerably more than the .96% trailing 12 month yield that it paid its holders over the past year.

Bond ETFs have no Maturity Date But Individual Bonds Do

Remember that Bond ETFs have no maturity date. You can never count on getting back what you put in at a given time. The duration and SEC yield are only momentary snapshots helpful in making rough estimates. But they change every time that yields rise.

The benefit of building your own bond ladder is that you know for a certainty that you will get back the money you invested at a given date. If the bonds are issued by the U.S. Treasury, the chance of default is as near to zero as you can get with any investment.

How Treasury Bills Are Priced

If you haven’t bought bonds before you may be confused by how short Treasury bills are priced. (“Bills” refers to Treasury securities that mature within a year.) They don’t pay you anything until they mature. The interest is generated because they sell at a price below their face value. The difference between what you pay and what you get back at maturity is your interest.

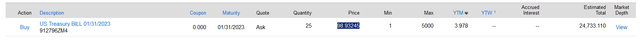

For example, as I write this, the below Treasury bill is listed for sale on Schwab.com.

Schwab.com

The price, which I have highlighted is $98.93245 for every $100 of bill purchased, though the bills are actually sold in multiples of $1000. This bill matures on 1/31/2023 at which time the $1000 bond you bought for $989.32 will pay you $1000. If you buy it in a taxable account, this gain will be taxed as interest, not a capital gain. This annualizes out to a rate of 3.978%. (All rates are quoted as annual rates. For a 3 month bond, you get roughly one quarter of the amount you’d get if you bought one 1 year bill with the same yield.)

Investors also sell older bonds they own, but they will have to adjust the price they ask for them to give you a competitive yield. When these bonds are listed you will see a “coupon rate” which may be very low since Treasuries bought over the last few years were paying less than 1%. But the price you pay now for that Treasury will adjust so that the amount you receive at maturity, factoring in any interest you will be paid before it matures, will produce a total return similar to what recently issued Treasuries are trading at.

Older bonds also may have accrued interest to their current holders. You will have to pay them the interest due at the day you buy the bond, too. All this should be disclosed by your brokerage when you click on a “buy” button for one of these bonds and should be factored into the yield calculation.

It’s Been Years Since Treasury Bonds Were A Sensible Investment; They May be Your Very Best Investment Today

Younger investors have had no reason to buy individual Treasury bonds. Bond yields have been declining slowly over the past 40 years, so that the NAV’s of Bond funds and ETFs pretty much just went up. That made it so that investors who wanted bonds in their portfolio could take advantage of the ease of letting a fund manager buy and sell bonds for them without worrying about losing their initial investment.

But now that bond fund holders have seen their fund’s NAVs decline anywhere from BND’s 17.98% over the past year to iShares 20+ Year Treasury Bond ETF’s (TLT) 34.54% selecting bonds with a known, short maturity date and an attractive yield makes a lot more sense.