Kevin Greenard: Top 10 retirement mistakes (and how to avoid them)

Over the years we have helped many people at all stages of life. Here are the 10 most common mistakes we’ve seen when it comes to retirement — and our advice on how to avoid them.

Over the years we have helped many people at all stages of life. Here are the 10 most common mistakes we’ve seen when it comes to retirement — and our advice on how to avoid them.

1. Underestimating the impact of inflation

Inflation affects your purchasing power, and it’s important that retirees don’t underestimate its impact.

The Bank of Canada aims to keep inflation at 2 percent, within a 1 percent control range on either side (ie, as low as 1 percent and as high as 3 percent). Last year, however, Canadians experienced a period of above-average inflation, which hit a 39-year high of 8.1 percent.

So what can you do to maintain your purchasing power?

While investing in the stock market inherently comes with inherent risks, there are many factors to managing these risks with your portfolio manager by determining an appropriate asset mix, optimal number of holdings and position size, ensuring appropriate diversification to manage concentration risk and a disciplined approach to rebalancing and managing your investment time horizon.

2. Underestimating how long individuals will live

The average lifespan in Canada has gradually increased over time. In the last 60 years, average life expectancy has increased by about 11 years, and retirees spend almost as much time in retirement as they do at work.

When we begin working with new clients we ask them for pedigree information as this allows us to have a discussion of genetics and life expectancy which we incorporate into the Total Wealth Plan.

Medical advances are also helping people live longer than before. Because of medical advances and genetics, if you have one or both parents who lived well into their 90s, or are alive and well into their 90s, it’s wise to plan that you, too, live well into their 90s or will live beyond .

In some cases, one parent may have died prematurely while another lived a long and healthy life. In these cases, it’s still wise to plan to live into your 90s or beyond.

3. Overestimation of investment returns and income

When preparing financial plans, we always assume that a 4 percent return is conservative.

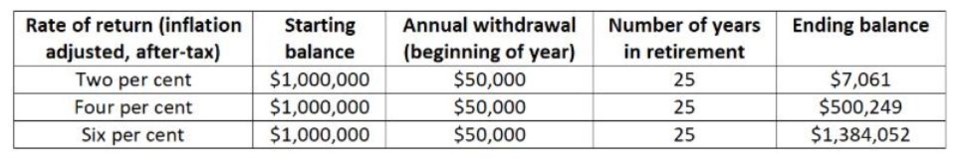

Often we’ll run through a few scenarios to see what it would look like if the after-tax return, adjusted for inflation, was 2 percent, and in another example, 6 percent. While it doesn’t sound like a big difference, it can make a big difference when you reach retirement age.

For illustration, let’s assume you lived 25 years in retirement. They retired with $1 million in the bank, taking $50,000 a year for cash flow purposes. Here’s how much you would have after 25 years assuming you’re still making $50,000 a year based on these different returns results:

As you can see, if you take $50,000 a year and earn an inflation-adjusted return of 2 percent after taxes, it’s very tight. If the individual lives in retirement longer than the expected 25 years and does not earn more, they risk depleting their capital.

We always recommend planning for the most likely scenario; However, it’s a helpful tool for looking at different scenarios to get the full picture. This exercise may show the client that they need to update their annual payout amount or adjust their investment and risk objectives and asset allocation accordingly to achieve the desired results.

4. Be too conservative with investments

Risk and reward are a trade-off, and risk isn’t necessarily a bad word. There are many ways to manage risk through asset mix, diversification, position size, rebalancing and time horizon.

In my opinion, being too conservative with your investments is a risk in and of itself. Two common traits we see in our wealthy clients are the ability to take both risk and the ability to stay the course in times of volatility.

If you just keep your money under your mattress or buy Guaranteed Investment Certificates (GICs), sit back and do nothing while you watch inflation eat away at your hard-earned savings year after year.

The key is to find a happy medium that you are comfortable with and only invest in quality, non-speculative investments.

5. Being too aggressive with investments

On the other hand, being too conservative with your investments means being too aggressive and taking unnecessary risks.

We have seen many scenarios where significant amounts of money have been lost by investing in speculative, risky stocks or by not managing concentration risk by holding excessive position sizes.

While risk and reward is a trade-off, it doesn’t pay to be too aggressive and take too many risks when it comes to your retirement savings. Don’t invest in something you don’t understand, especially if it’s risky or speculative.

6. Lack of communication about the retirement phase

If you imagine your ideal retirement, what does it look like? What are you looking forward to? What aspects of retirement are you concerned with?

If you have a significant other, you will be together 24 hours a day, seven days a week in retirement. There may be activities you want to do together and some you want to do independently.

Retirement looks different for everyone — for some it involves travel, for others it means staying close to home, spending time with friends, loved ones and hobbies they enjoy, and sometimes it’s a mix from both. However, the key point is to make sure that you and your partner are on the same page.

The early years of retirement are often the best in terms of health and energy. In our experience, couples who have communicated and reached consensus about what they both want to do and get out of their retirement can ensure their retirement goals are met. We’ve also found that the best time to have this conversation is after retirement, but a few years before.

As you realize your retirement vision, speak to your portfolio manager to create a plan that will ensure the necessary cash flows are available. In times of volatility, it’s especially important to make sure you can still achieve your retirement goals without having to sell an investment at the wrong time in the stock market cycle.

7. Not mapping cash flow needs

Keeping cash in your portfolio can bring comfort during uncertain times. One often hears the phrase “cash is king” in down markets.

At the beginning of every client meeting, we ask about their liquidity needs. The cash flow requirement is continuously adjusted depending on what each individual customer needs. Some customers may not require cash flow, others may require a combination of monthly and flat-rate withdrawals.

Whatever the case, a common mistake we see is not forecasting and planning for upcoming cash flows accordingly, and the result is often forced to sell something at the wrong time in the market cycle or fund from a registered plan with to draw tax consequences that could have been minimized.

For our clients, we use a cash-wedge strategy, converting one to two years of cash flow requirements from the investment portfolio into a cash equivalent that is not exposed to market volatility. While it may earn a small amount of interest, it will not lose value.

For clients with significant funds in registered plans, corporate accounts, or unregistered accounts with significant capital gains, we take a long-term view as part of the Total Wealth Planning process to strategize for accessing the funds while minimizing tax levels over the lifetime of the customers paid.

8. Don’t start saving for retirement early

The power of cumulative growth is significant, and the sooner you start saving for retirement, the more cumulative growth your investments will yield.

Let’s say you’re investing $12,000 a year ($1,000 a month) by age 25 and earning an average return of 4 percent. Forty years later, at age 65, you’re retiring with $1,185,918 and a total of $480,000 in cash.

Conversely, say at age 45 you start investing $24,000 a year ($2,000 a month) and earn an average return of four percent. Twenty years later, at age 65, you’re retiring with $743,261 and a total of $480,000 in cash.

Comparing these two examples, the same amount was deposited, but the difference in starting your retirement savings sooner rather than later is significant: $442,658 in this case ($1,185,918 – $743,261)!

If you’ve been putting off saving for retirement, we encourage you to start today. To capitalize on increasing growth, the earlier you can start, the better it is in the long run.

9. Not having an estate plan

Many people seem to devote more time to planning a vacation, buying a car, or even choosing a place to dinner than to estate planning. However, making a will is arguably one of the most important things you can do for yourself and your family. Not only can a will provide legal protection for your loved ones and your assets, but it can also set out exactly how you want your affairs to be handled after your death.

Retirement is a perfect time to do a full estate planning review by looking at all relevant documents (will, power of attorney, agency agreement) and beneficiary designations for registered accounts. If you do not have these documents or if they are out of date, then we strongly recommend updating them to save your loved ones from an inheritance headache.

10. Not having an aggregate wealth plan

Finally, one of the biggest mistakes we see in retirees is not having a total wealth plan.

Having an overall wealth plan and updating it regularly, or when circumstances change significantly, is a helpful tool in formulating a financial roadmap for your retirement. By putting your retirement goals in a plan, you can make sure they are met.

If you don’t have a Total Wealth Plan, talk to your portfolio manager today to start one.

Kevin Greenard CPA CA FMA CFP CIM is Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears weekly on timescolonist.com. Call 250.389.2138, email [email protected] or visit greenardgroup.com.