Oil Rigs Drop Again as U.S. Count Slides in Latest BKR Data

A third straight weekly decline in the oil field, which overshadowed gains in natural gas drilling, caused the US rig count to fall four units to 749 for the week ended Friday (March 3), according to the latest tally from Baker Hughes Co. ( BKR).

Domestic net changes for the period included a decrease of eight rigs in oil-driven rigs. The week before, US oil rigs were down seven rigs, with a more modest decline of two rigs the week before.

To counter the losses in the oil field, three natural gas-focused rigs were added next to another rig every week in the United States. Land drilling declined two units overall, along with declines with one rig in the Gulf of Mexico and inland waters. Horizontal rigs declined by three, vertical rigs by two. Partially offsetting was a net gain from a directional rig.

The combined 749 active US rigs on Friday compares to 650 rigs operating in the same period last year, according to BKR figures, which are based in part on data from Enverus.

According to BKR, Canada’s rig count increased by two units week-over-week – both natural gas-driven – to 246, up from 217 a year ago.

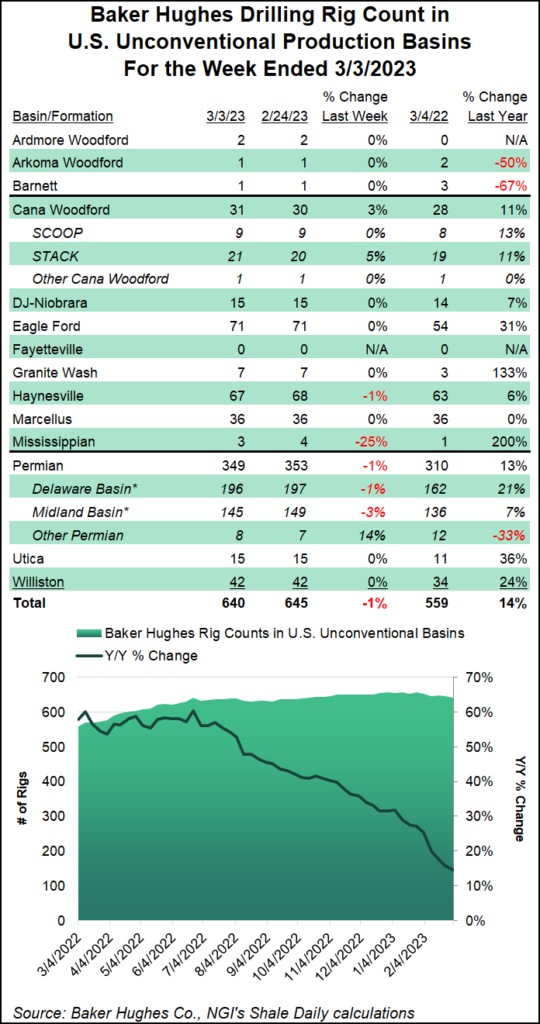

Counted by major drilling regions, the Permian Basin recorded a decline of four rigs for the period, bringing its tally to 349 from 310 in the same period last year. Haynesville Shale and Mississippian Lime each declined one rig during this period, while Cana Woodford added one rig.

State by state, Texas saw a four rig decline during that period, with Louisiana’s tally down two and Oklahoma losing one rig from its total. On the other side of the ledger, Wyoming added two rigs to bring its total to 20, up from 14 a year ago.

US crude oil production remained at 12.3 million barrels per day for the week ended February 24 as US exploration and production companies remained active to bolster domestic supplies and help meet global demand, according to updated statistics from US Energy Information Administration (EIA) showed earlier in the week.

Production for the period was at its highest level since March 2020, when the pandemic was declared. According to the EIA, US production also remained at this level until January and the first half of February.

US commercial crude inventories for the period ended February 24, excluding those in the Strategic Petroleum Reserve, rose 1.2 million barrels from the previous week. Inventories were 480.2 million bbl, 9% above the five year average.