Orica Limited’s (ASX:ORI) latest 4.4% decline adds to one-year losses, institutional investors may consider drastic measures

Important Findings

-

Given the institutions’ large holdings in the stock, Orica’s stock price could be vulnerable to their trading decisions

-

A total of 10 investors hold a 50% majority stake in the company

-

Analyst forecasts along with ownership data serve to provide an informed idea of a company’s prospects

A look at Orica Limited (ASX:ORI) shareholders tells us which group is the most powerful. The group with the most shares in the company, around 61% to be precise, are institutions. In other words, the group will gain the most (or lose the most) from its investment in the company.

And institutional investors saw their holdings fall 4.4% last week. It goes without saying that the recent loss, compounding shareholders’ one-year loss of 5.2%, may not go down well with this category of shareholders in particular. Institutions, often referred to as “market makers,” wield significant power in influencing the price dynamics of any stock. Therefore, if the decline continues, institutional investors could be pressured to sell Orica, which could hurt individual investors.

In the table below we approach the different ownership groups of Orica.

Check out our latest analysis for Orica

What does institutional ownership tell us about Orica?

Institutional investors often compare their own returns to the returns of a commonly tracked index. As such, they typically consider buying larger companies that are included in the relevant benchmark index.

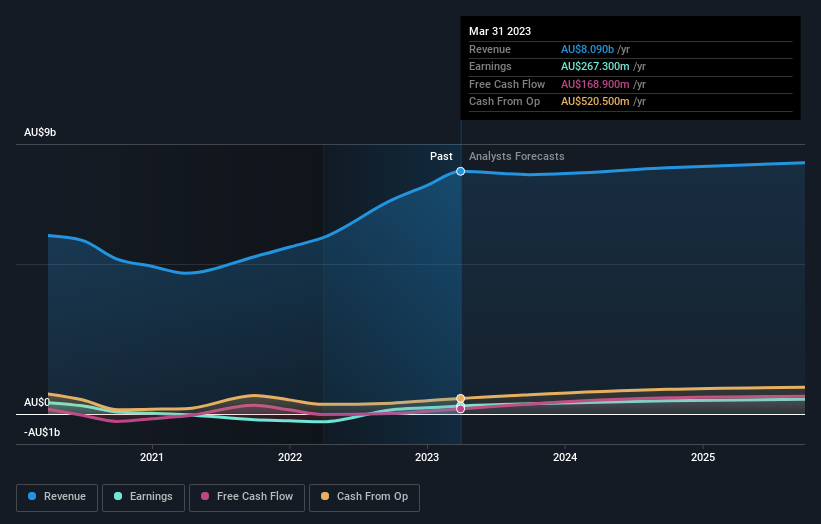

We can see that Orica has institutional investors; and they hold a majority of the company’s stock. This means that the analysts at these institutions have looked at the stock and like it. But just like everyone else, they could be wrong. When multiple institutions own a stock, there is always a risk that they will find themselves in a “crowded trade.” If such a trade fails, multiple parties may compete to sell the shares quickly. This risk is higher in a company without a growth history. Below is Orica’s historical earnings and sales, but remember there’s always more to the story.

Institutional investors own more than 50% of the company, so collectively they likely have a lot of influence over board decisions. We find that hedge funds have no meaningful investment in Orica. Australian Super Pty Ltd is currently the company’s largest shareholder with 15% of outstanding shares. For comparison, the second-largest shareholder holds about 5.5% of the outstanding shares, followed by the third-largest shareholder with 5.0%.

We’ve also observed that the top 10 shareholders make up more than half of the share register, with some smaller shareholders balancing the interests of the larger shareholders to some extent.

While it makes sense to examine institutional ownership data for a company, it also makes sense to examine analyst sentiment to find out which direction the wind is blowing. There are many analysts covering the stock, so it might be worth seeing what they’re forecasting as well.

Insider ownership of Orica

While the precise definition of an insider can be subjective, almost everyone considers a board member to be an insider. The management of the company is subordinate to the board of directors, which should represent the interests of the shareholders. It is remarkable that top managers sometimes sit on the board themselves.

In general, I think insider ownership is a good thing. In some cases, however, it becomes more difficult for other shareholders to hold the board accountable for decisions.

Our latest data shows that insiders own less than 1% of Orica Limited. Because it is a fairly large company, it would be possible for directors to own a significant interest in the company without owning a large proportionate interest. In this case, they own around AU$15 million worth of shares (at current prices). It’s always good to see at least some insider owners, but it might be worth checking to see if those insiders have sold.

General Public Property

The general public, who are typically individual investors, own a 39% stake in Orica. While this group isn’t necessarily in charge, it can certainly have a real impact on how the company is run.

Next Steps:

It’s always worth thinking about the different groups that own shares in a company. But to better understand Orica, we need to consider many other factors. For example, we discovered it 2 warning signs for Orica what you should be aware of before investing here.

If you’re like me, you might want to think about whether this company is going to grow or shrink. Luckily, you can check out this free report that shows analyst forecasts for the future.

Note: The figures in this article are calculated using data for the last twelve months, relating to the twelve-month period ending on the last day of the month in which the financial statements are dated. This may not tally with the figures in the annual report for the full year.

Do you have any feedback about this article? Concerned about the content? Get in touch directly with us. Alternatively, you can also send an email to editor-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We provide commentary based on historical data and analyst forecasts solely using an unbiased methodology and our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your goals or financial situation. Our goal is to provide you with long-term focused analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for an hour of your time and help us create better investment tools for individual investors like yourself. Login here