Pliant Therapeutics: Latest Financials Support Stable Investment In Future Growth (PLRX)

sanjeri/E+ via Getty Images

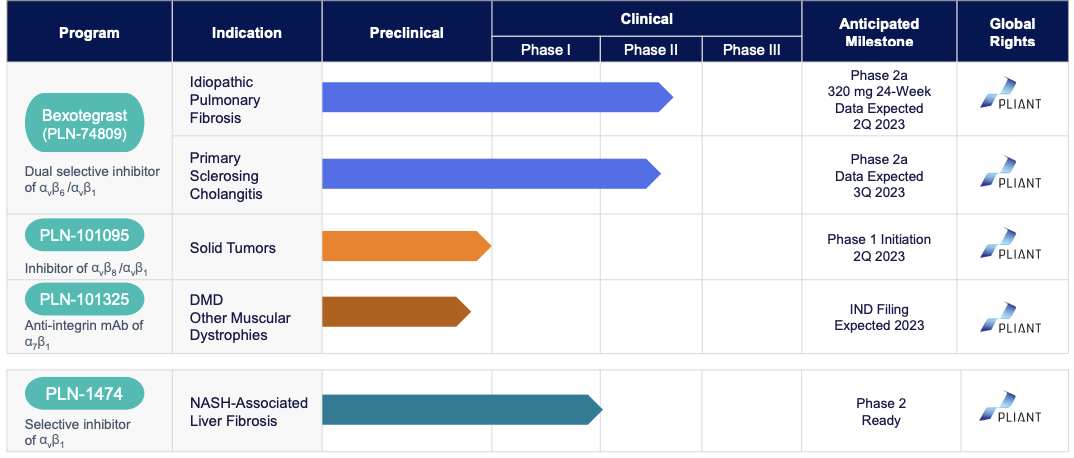

Pliant Therapeutics (NASDAQ:PLRX) is a clinical-stage biotech company that researches and develops novel therapeutics for the treatment of fibrosis and other conditions. Its diverse pipeline includes PLN-74809, an orally administered inhibitor of the integrins αvβ6 and αvβ1, currently in Phase 2a clinical trials to treat idiopathic pulmonary fibrosis and primary sclerosing cholangitis. Additionally, Pliant is developing PLN-1474, a selective inhibitor of αvβ1 for NASH-associated liver fibrosis, and PLN-101095, an inhibitor of the integrins αvβ8 and αvβ1 for solid tumors resistant to immune checkpoint inhibitors. The latter will likely commence Phase 1 clinical trials in Q2 2023.

Pliant Therapeutics presents significant potential for growth within the emerging fibrosis and integrin-targeted drug market. Despite the current unfavorable valuation metrics, its advantageous position makes it an attractive investment opportunity for long-term investors who wish to capitalize on the promising future of the biotech industry.

Q4 Financial Release Paints Stable Picture

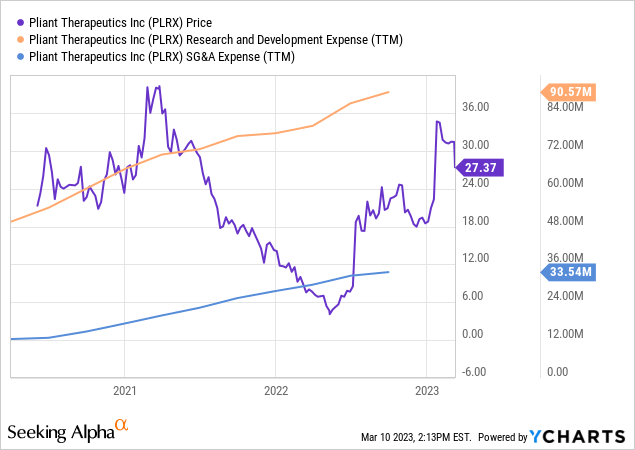

One of Pliant Therapeutics’ financial health indicators is its research and development expenses, which grew from $18.8 million to $25.1 million in the fourth quarter of 2022. This serves as a positive sign for the company, demonstrating a significant investment in its pipeline of therapeutic products for fibrosis. It appears that Pliant has taken action to fuel innovation by allocating resources with the intent to make its products available commercially.

YCharts.com

Pliant Therapeutics’ general and administrative expenses rose from $7.8 million to $14.3 million in the most recent quarter, mainly due to increased personnel-related costs and professional services charges. These expenditures are essential for continuing research and development, which will be critical for future growth.

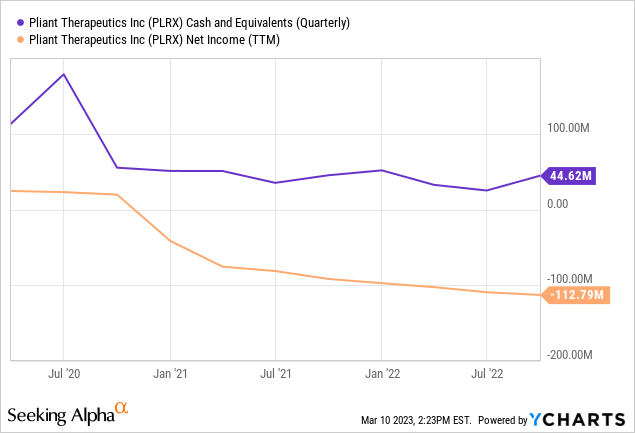

The company declared a net loss of $35.1 million in their fourth quarter financials of 2022 – an increase from their Q4 2021 figure of $24.5 million. This spike in losses is largely attributed to the greater operating expenditure along with temporarily lower revenues from the Novartis collaboration during this time. Nevertheless, Pliant Therapeutics has raised net proceeds of $270 million through its now-closed public offering, giving them ample financial dexterity to execute R&D activities without external financing.

YCharts.com

In the case of Pliant Therapeutics, the company’s cash burn is not an issue because they have access to ample funds to finance their research and development activities without requiring external financing. As mentioned, Pliant Therapeutics has raised over a quarter billion dollars in net proceeds through a public offering, which provides them with significant financial flexibility to fund their operations. Additionally, they have access to $331 million in cash, cash equivalents, and short-term investments as of Q4. With these financial resources, Pliant can continue to fund its operations until late 2026, which provides the company with ample time to bring its drug candidate, Bexotegrast, to market.

Pliant Therapeutics has already covered the majority of research and development expenses for Bexotegrast. The drug successfully completed Phase 2a with positive results, indicating that a significant amount of money has been invested in clinical trials and research. This is an important milestone as it demonstrates safety and effectiveness in a small group of patients. With this result, Pliant Therapeutics can now move forward with Phase 2b/3 trials which require additional funding.

In order to bring Bexotegrast to market, additional funds will be needed for Phase 2b/3 trials and regulatory approval processes. However, due to Pliant’s strong financial position, cash burn is not an issue and they have enough resources to cover these activities without needing extra financing. Therefore, Pliant Therapeutics has the necessary financial resources to realize their goal and launch Bexotegrast.

Pipeline of Integrin-Focused Programs

Pliant Therapeutics Inc. is dedicated to creating innovative therapies for fibrosis and other conditions using a variety of integrin-targeted methods. PLN-74809 has been highlighted as their most promising product. From the FDA it has already gained both Orphan Drug Designation and Fast Track Designation for IPF and PSC. In addition, the EMA has also given it Orphan Drug Designation in both illnesses. Data from Phase 2a studies of patients with IPF treating this medication was positive, and they are currently recruiting participants for a similar trial in PSC so that these developments can continue. This reflects Pliant’s strong commitment to developing treatments for fibrosis and related problems.

r.pliantrx.com

The main focus of the oncology program of the company is to inhibit selectively αvβ8 integrin, which is responsible for activating TGF-β in the microenvironment of tumors. This could cause potential resistance to immuno-oncology therapies such as checkpoint inhibitors through an anti-inflammatory effect. The product candidate of the company for this program is PLN-101325, which is an anti-integrin mAb of α7β1.

Apart from this, Pliant Therapeutics has developed PLN-101325, an antibody that activates the α7β1 integrin, which compensates for muscle cells in patients suffering from muscular dystrophy, including Duchenne muscular dystrophy. By activating α7β1, PLN-101325 has demonstrated recovery of muscle strength and lessened damage in animal models. Although this program is in the preclinical stage, it holds great promise for patients with muscular dystrophy.

Furthermore, the company’s second product candidate, PLN-1474, is a selective small-molecule inhibitor of αvβ1 designed to treat late-stage liver fibrosis in patients with nonalcoholic steatohepatitis (NASH). Integrin αvβ1 activates TGF-β in the liver, causing consecutively, fibrosis followed by potential liver failure. Pliant Therapeutics’ unique approach to target integrin in treating liver fibrosis holds significant potential and may lead to a breakthrough in the treatment of NASH.

Bexotegrast Phase 2a Shows Positive Results

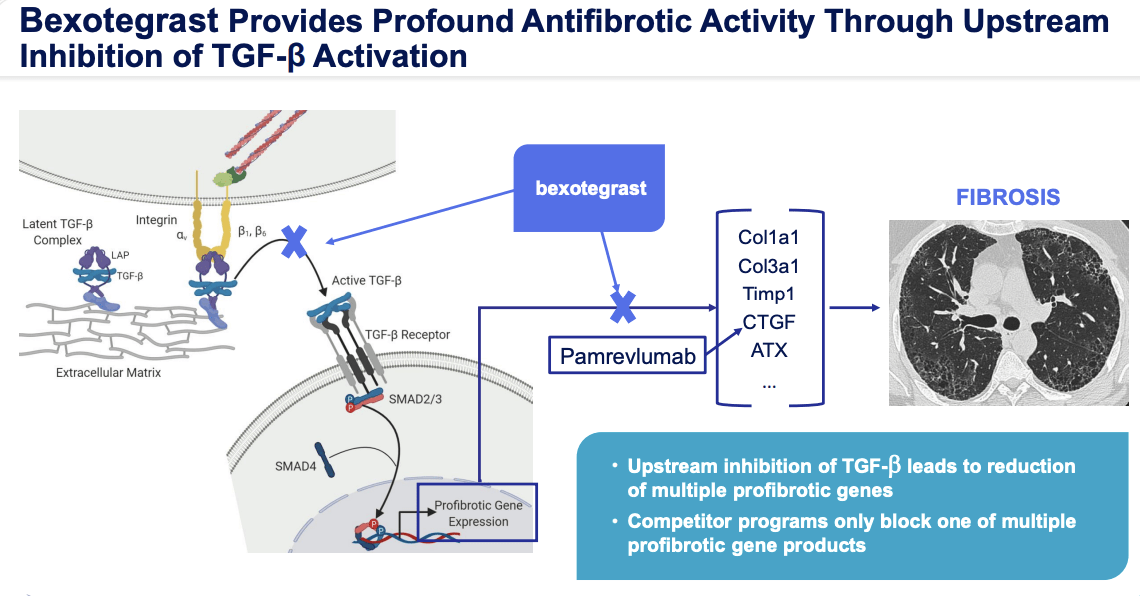

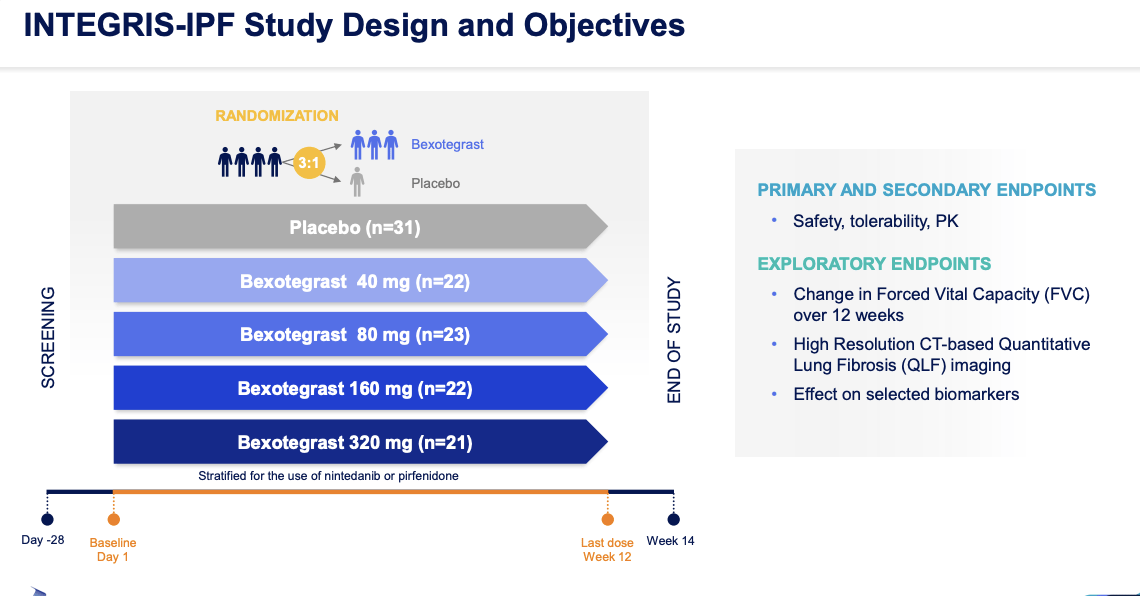

Pliant Therapeutics. has released positive interim data from the 320 mg dosage group of their Phase 2a clinical trial, INTEGRIS-IPF. The trial is a placebo-controlled study of bexotegrast (PLN-74809) in those who have been diagnosed with IPF. The 320 mg group showed a significant increase in FVC (Forced Vital Capacity) from baseline at all time points, with strong results observed for FVC percent predicted, quality of life), and profibrotic biomarkers when compared to the placebo at the 12-week mark. Both the primary and secondary endpoints were met, indicating that bexotegrast was well-tolerated during the 12-week treatment period and had a favorable pharmacokinetic profile.

IPF is a progressive, fibrotic interstitial lung disease that affects approximately 100,000 people in the United States alone. The disease results in scarring and thickening of lung tissue, making it difficult to breathe. Currently, there are no approved drugs to halt or reverse the course of IPF. The positive results from the INTEGRIS-IPF trial demonstrate the potential of bexotegrast to halt the growth of scar tissue in IPF patients.

r.pliantrx.com

The strong dose-dependent treatment effect observed in the 320 mg dose group is unprecedented in clinical trials observed to date. The findings suggest that bexotegrast may have a potential antifibrotic effect that is in line with its mechanism of action and preclinical studies. Final data for the 320 mg group is anticipated to be available in Q2 2023, as the group will continue until all patients have received a minimum of 24 weeks of treatment.

r.pliantrx.com

The positive results from the INTEGRIS-IPF trial demonstrate the potential of bexotegrast to be a groundbreaking treatment for IPF patients. With no approved drugs to halt or reverse the course of IPF, there is a significant unmet need in the market. The results also show the potential of bexotegrast to be a significant driver of revenue growth for Pliant Therapeutics, Inc. if it receives regulatory approval.

PLN-101095 IND Has Now Cleared

Pliant Therapeutics Inc. has announced that the FDA has cleared the IND application for PLN-101095. A Phase 1 first-in-human study is projected to begin in the second quarter of 2023. The company has high hopes for PLN-101095, which represents Pliant’s third program to advance into clinical development.

In the Phase 1 trial, patients with solid tumors will receive PLN-101095 to assess its safety, tolerability, pharmacokinetics, pharmacodynamics, and initial antitumor activity. This study will allow researchers to explore the potential of combining PLN-101095 with ICIs in patients who have not had a satisfactory response to ICIs. Investors can look forward to more news on the progress of this exciting drug candidate.

Threats to Growth

While Pliant Therapeutics has a promising pipeline of potential treatments, there are several risks that investors may not initially consider.

Turning towards future prospects, many distinct trends could shape the development of the fibrosis and integrin-targeted drug market potentially introducing benefits for Pliant Therapeutics. Additionally, one aim is finding a way to combine therapies with select integrin-targeted drugs e.g., immunotherapies, possibly improving results for patients. Companies dealing with similar areas might collaborate, also helping Pliant Therapeutics.

One significant risk is the potential for drug resistance in patients. While Pliant’s integrin-targeted approach shows promise in treating fibrosis, there is a risk that some patients may develop resistance to the drugs over time. This could limit the effectiveness of Pliant’s treatments and impact their market share.

Dangers to Drug Approval

Despite gaining Orphan Drug Designation and Fast Track Designation from the FDA and Orphan Drug Designation from the EMA for both IPF and PSC, there is no guarantee that the drug will be successful in larger clinical trials. While Phase 2a studies showed positive results, these studies involved a comparatively small number of patients, and larger studies may reveal unexpected side effects or a lack of efficacy. Additionally, the mechanism of action of PLN-74809, which targets integrins, is not fully understood, and there may be unknown side effects that could prevent the drug from being approved.

The potential resistance to immuno-oncology therapies such as checkpoint inhibitors through an anti-inflammatory effect is a significant risk associated with this drug. While inhibiting αvβ8 integrin may have anti-inflammatory effects, it could also cause problematic effects on the immune system and decrease the effectiveness of immuno-oncology therapies. This could limit the usefulness of PLN-101325 as a cancer treatment.

Similar to PLN-74809, the success of PLN-1474 in treating NASH is not guaranteed. While the drug targets integrin αvβ1, which is involved in activating TGF-β in the liver, there may be unknown side effects or other factors that could prevent the drug from being effective. Additionally, there are several other drugs in development for the treatment of NASH, and competition in this market may be fierce.

Comparison to Competitors

One of Pliant’s closest competitors in the fibrosis drug market is Galecto Biotech (GLTO). They are also developing drugs that target fibrosis, but they have different approaches than Pliant.

Galecto Biotech is concentrating its efforts on creating small-molecule inhibitors of galectin-3, which is a protein that relates to fibrosis. Their primary drug possibility, GB0139, is currently in Phase 2b clinical trials as a treatment for IPF and is being researched further as a possible treatment for other diseases related to fibrosis. While Galecto Biotech is developing drugs for the treatment of fibrosis, Pliant has several advantages that set it apart from its competitors.

First, Pliant’s lead drug candidate, PLN-74809, is a dual-selective inhibitor of both integrins αvβ6 and αvβ1, which are both involved in the fibrotic process. This broad approach to targeting integrins has the potential to be more effective than targeting a single integrin.

Second, Pliant has demonstrated positive results in clinical trials for PLN-74809, including a Phase 2a trial for the treatment of IPF. The drug showed a statistically significant increase in FVC compared to the placebo, a key measure of lung function in IPF patients. Galecto Biotech’s GB0139 has also shown promising results in clinical trials, but the drug is still in Phase 2b trials and has not yet been approved by the FDA. Finally, Pliant has a strong pipeline of drug candidates in development, including PLN-147 and PLN-101095. This diversified portfolio of drugs in development gives Pliant a competitive edge over Galecto Biotech and Morphic Therapeutic, which have fewer drug candidates in their pipelines.

Limits of Valuation

Valuation metrics for biotech companies, such as Pliant Therapeutics, are typically unfavorable given the high cost of research and development and the long timelines associated with bringing a drug to market. Thus, investors often prioritize growth potential over traditional valuation metrics like price-to-earnings ratios.

When considering Pliant Therapeutics in particular, the growth thesis is backed up by its promising pipeline of drugs targeting fibrosis and integrin-mediated diseases. The company has several drug candidates currently in clinical development.

Although traditional valuation metrics may appear unfavorable for biotech companies such as Pliant, their growth potential through technology and drug pipelines creates an excellent case for long-term investment. If the drugs developed by Pliant prove successful in clinical trials and obtain regulatory approval, they could generate substantial revenue – making current valuation metrics far less important in terms of overall success.

Final Thoughts

In conclusion, Pliant Therapeutics is a promising clinical-stage biotechnology company with a strong pipeline of potential treatments for fibrosis. The company’s innovative technologies, such as its proprietary platform for developing integrin inhibitors, give it a competitive advantage over its peers in the industry. Recent clinical trial data for bexotegrast and the FDA clearance of the IND application for PLN-101095 demonstrate the potential for success in the company’s future endeavors. Additionally, partnerships with major pharmaceutical companies such as Novartis provide validation for Pliant’s technology and a potential avenue for future revenue.

The financials of Pliant Therapeutics may not be perfect yet, but the tremendous growth potential in the biotech industry and their innovative technologies offer a great investment opportunity for those looking in the long term. Pliant has established itself at the forefront of fibrosis treatment and integrin-target therapies, and with continued success in clinical tests, will reward its shareholders over time.