The latest in mortgage news: uninsured posted rates at decade-highs

Uninsured positions at Canada’s Big 6 banks have skyrocketed over the past year, according to Bank of Canada data.

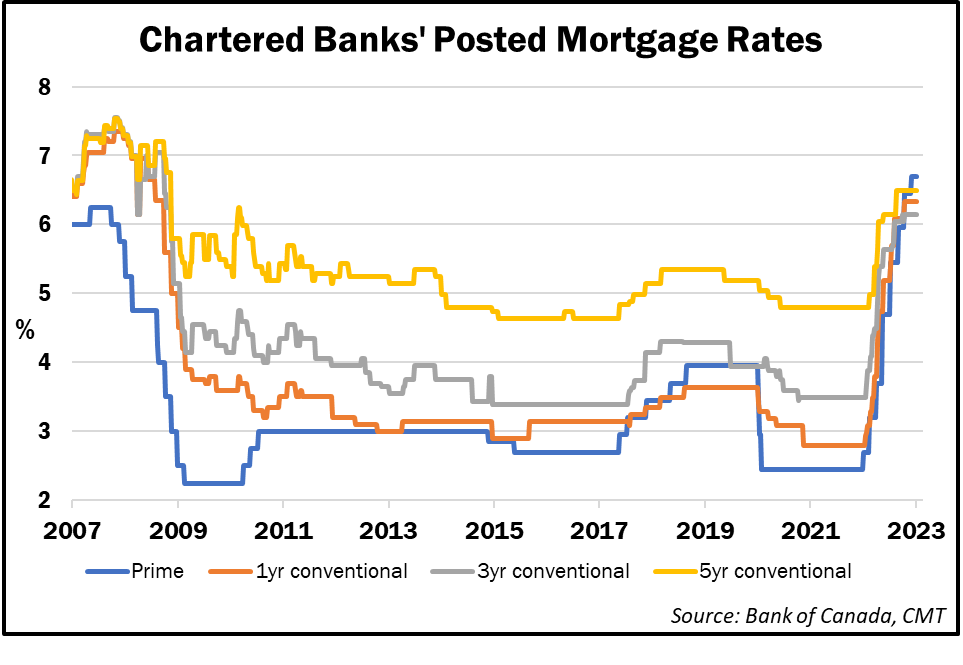

The average 5-year conventional interest rate rose from 4.79% in March 2022 to 6.49% today – a jump of 170 percentage points. Shorter 1- and 3-year maturities have seen a similar surge, rising in line with policy rates, which have risen 425 basis points since the Bank of Canada began raising rates a year ago.

Prices were last this high in early 2009.

The Bank of Canada’s data monitors show interest rates from the Big 6 banks that are generally higher than the discounted rates that most well-qualified borrowers can actually obtain.

Bond yields plummet

The Canadian government’s 5-year bond yield — which typically leads fixed-rate mortgage rates — has fallen nearly 50 points since early March and is down 40 basis points this week alone.

At the time of this writing on Friday morning, the 5-year bond yield was hovering around 3.17%.

So, what’s behind the strong move lower?

There are several reasons, according to Ryan Sims, a mortgage broker at TMG The Mortgage Group and a former investment banker.

One of them is the recent remarks from Fed Chair Jerome Powell, who said this week: “Recent economic data is stronger than expected, suggesting that the final rate level is likely to be higher than previously expected.”

Powell’s comments “made it abundantly clear (or should have made clear) that the Fed will hike rates far higher than A) the market thought, B) longer than the market thought, and C) faster than the market thought,” Sims told CMT .

The continued slide following the release of Friday morning’s payrolls data suggests that “far too much optimism was baked into the 5-year yield,” he added.

Bond yields tend to lead fixed mortgage rates, but don’t expect large movements in mortgage rates as long as yields remain volatile.

“I would expect the 5-year yield to dance around the range, but no bad news [for yields] like lower inflation, lower employment etc. will pull towards the lower end of the 3.00% range and any good data like higher inflation, higher employment etc. will pull rates towards the 3.60% range,” said Sims, explaining that higher interest rates are “actually a good thing” because the economy then runs at full speed.

“Look out for a ‘re-rating’ of bonds, yields, CAD and any economic forecasts coming out in the next 3-4 weeks.”

February jobs numbers ‘still too high’ for BoC

Canada’s economy added another 22,000 jobs in February, according to employment figures released by Statistics Canada on Friday.

All jobs added in February were full-time, up 31,000 from the previous month, while part-time jobs were down 9,300. The unemployment rate remained unchanged at 5%.

The February reading was above expectations but well below the blockbuster 150,000 positions created in January.

“For the Bank of Canada, headlines may be more ‘normal’ compared to previous months, but they’re still too high,” noted TD Economics’ James Orlando. “Given that the

“The BoC is in wait-and-see mode with its conditional pause, believing it is only a matter of time before a slowdown in the broader economy begins to show,” he added. “But with today’s job report, that will have to wait a while.”

The BC budget includes $4.2 billion in investments in housing

The British Columbia government last week presented its 2023 budget, which included $4.2 billion in funding for housing.

It is the largest three-year housing investment in the province’s history and aims to tackle homelessness and increase rental supply. Of this investment, $1.7 billion will be allocated over three years to build additional homes through the BC Builds and Building BC programs.

“We need to do more with the housing plan and this budget will do that,” said Treasury Secretary Katrine Conroy.

Other housing-related initiatives announced in the budget include:

- A new property tax incentive to encourage the construction of new purpose built buildings.

- A pilot project that offers funding incentives to encourage homeowners to develop new second suites on their primary residence lot for rent to long-term renters.

- Additional support and protection for renters, including a renter tax credit. The loan would be income-tested, with a maximum of $400 per year for households with adjusted incomes up to $60,000. This amount is adjusted for inflation each year.

- A plan to develop more homes through new housing development while reducing the time and cost of local government approval processes.