Veritex Holdings: Navigating Through The Latest Banking Crisis (NASDAQ:VBTX)

PM Images

A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain.“― Mark Twain.

The stodgy old regional banking sector has become front and center of investor concerns over the past week, thanks to the second- and third-largest bank collapses in U.S. history. Today, we post a deep dive on a small bank holding company who has seen some recent insider buying and has a solid dividend yield after the recent pullback. An analysis follows below.

Company Overview:

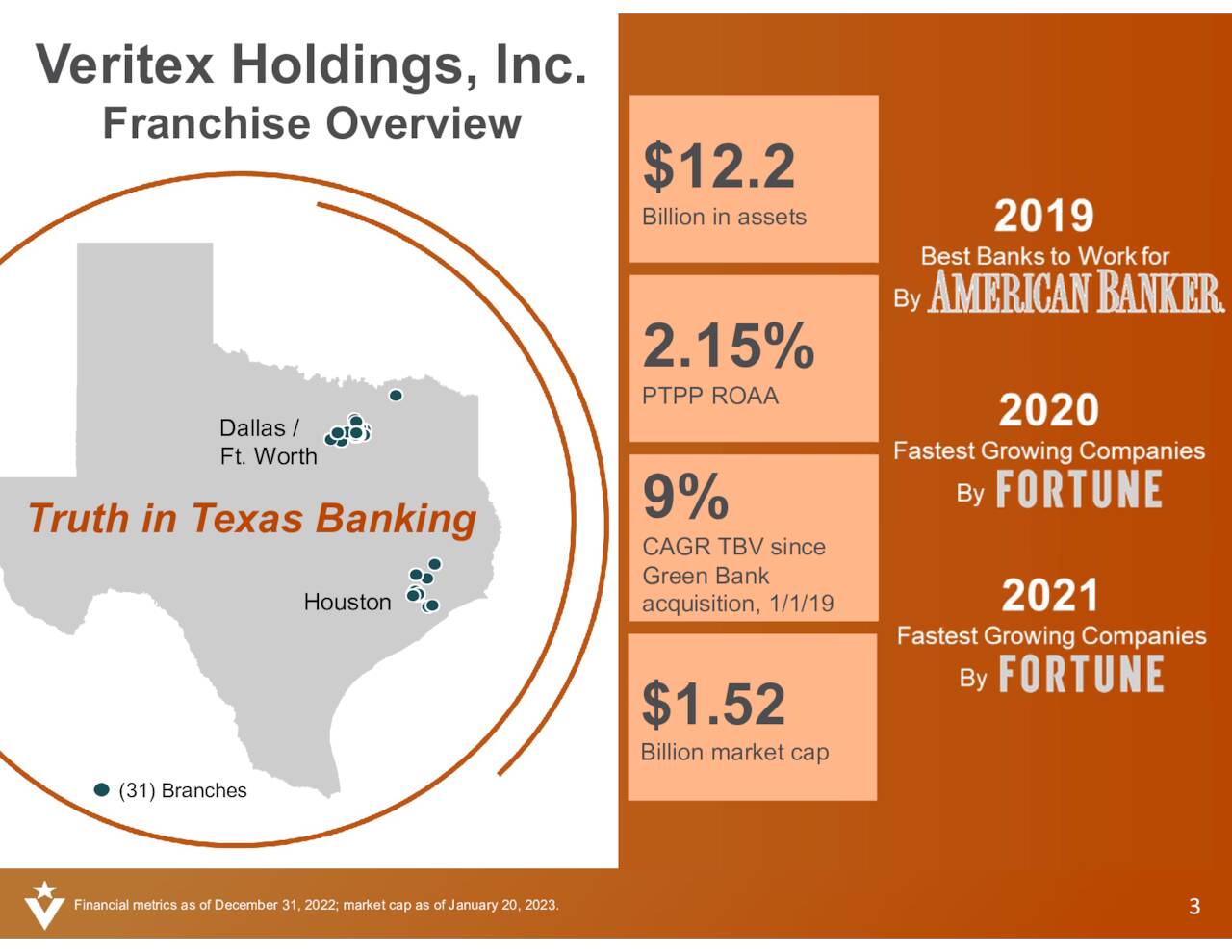

Veritex Holdings, Inc. (NASDAQ:VBTX) is a Dallas based community bank holding company with operations primarily in the Dallas-Ft. Worth metroplex and Houston. The financial intermediary is one of the top 10 in Texas, with 31 branches and $12.2 billion in assets as of YE22. Veritex was formed in 2010 and went public in 2014, raising net proceeds of $35.8 million at $13 per share. VBTX stock trades near $20.00 a share, translating to a market cap of approximately $940 million.

January Company Presentation

Assets & Liabilities

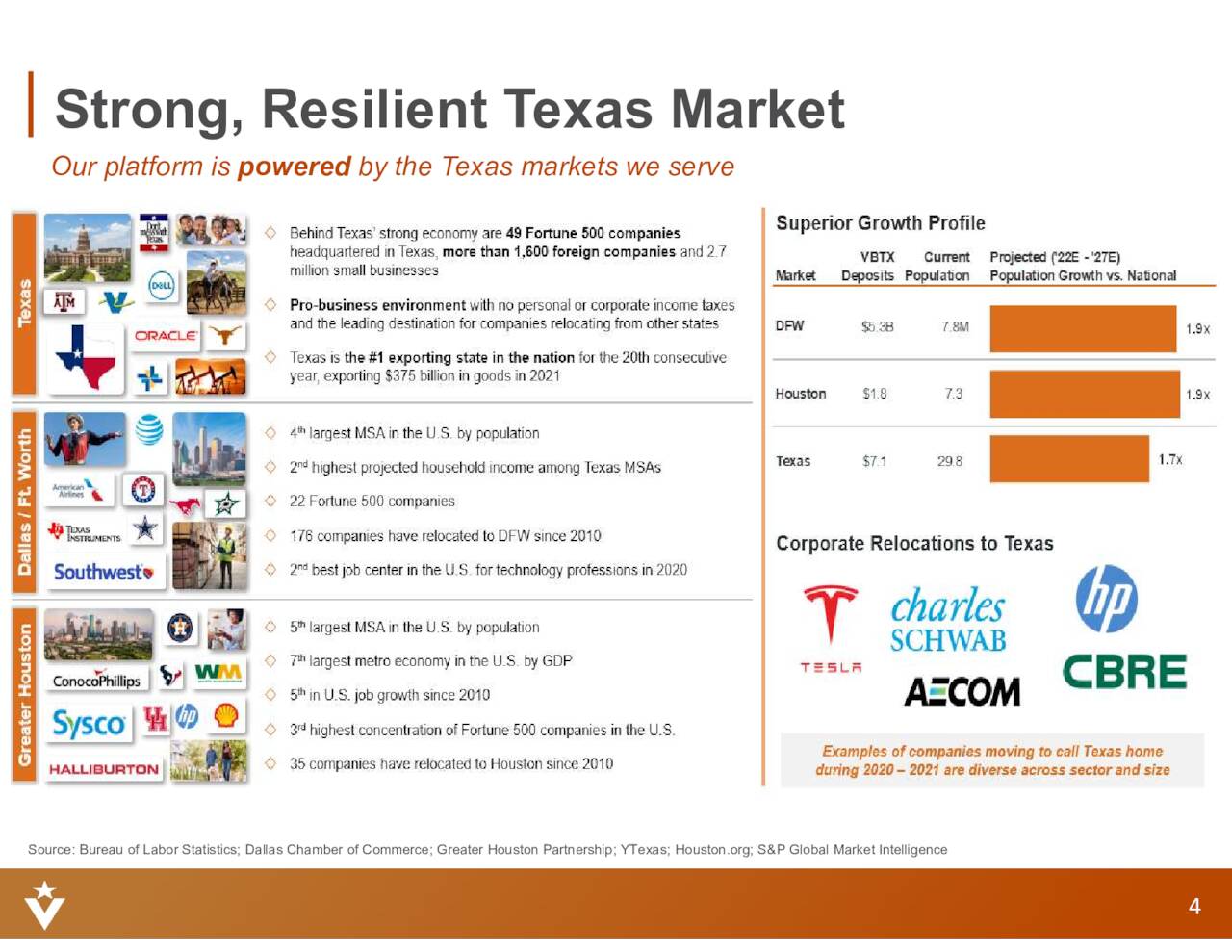

The company’s portfolio consists primarily of construction and land (38%), commercial and industrial (30%), and commercial real estate (17%) loans, which are made to individuals, professionals, and small and medium sized businesses. This composition isn’t surprising considering the economies in Dallas-Ft. Worth (4th largest U.S. metropolitan statistical area [MSA] and Houston (5th largest MSA) are powered by real estate, technology, financial services, manufacturing, health care, and energy. Over 200 businesses have relocated to these two cities since 2010, not to mention other recent Texas additions such as Tesla (TSLA), Charles Schwab (SCHW), and HP Inc. (HPQ).

January Company Presentation

As with most community banks, Veritex’s primary sources of funding are non-maturity deposits followed by advances from the Federal Home Loan Bank [FHLB]. It generates the vast majority of its revenue from net interest income, or the spread of interest income earned on its loans and other investments minus the interest expense on deposits and other borrowed funds.

M&A Approach

Veritex Holdings, Inc.’s management approach has been to grow through acquisition, making seven bank purchases since inception, and in the process making Veritex the largest such financial institution focused on Dallas Ft. Worth and Houston. The team has also made some non-bank deals, acquiring a 49% position in residential mortgage originator Thrive Mortgage, LLC for $54.9 million in a move to diversify into fee income in July 2021. That deal was followed by a $57.5 million purchase of North Avenue Capital in November 2021, making Veritex a leading player in the U.S. Department of Agriculture (USDA) Business and Industry lending program. As with the Thrive deal, North Avenue provided Veritex an opportunity to increase servicing fee income and gain on loan sales.

interLINK Deal

Then, in March 2022, Veritex announced its intention to acquire interLINK, a fintech with a low-cost core deposit gathering platform that automatically sweeps cash from non-interest bearing accounts into ones that earn interest. For a proposed consideration of $91 million ($3 million cash and 2.1 million shares of VBTX), the deal would have provided the bank with access to ~$5.7 billion of highly diversified, stable core deposits from ~420,000 retail accounts (at that time); and thus a multi-year runway for loan growth.

Seemingly an excellent strategic fit, the market liked the acquisition enough to absorb a $153.8 million [NET] capital raise at $38.00 a share concurrent to the deal’s pronouncement on March 3, 2022 and bid shares of VBTX above the pre-merger news close of $40.16 for a good part of that month. The deal was expected to close in 3Q22.

Yield Curve Inversion

In the meantime, the treasury yield curve continues to be inverted. For those unaware, an inverted yield curve occurs when yields on short-term securities such a three-month treasury bill or a two-year note rise above yields on longer-term securities such as the 10-year note. The last seven times the yield curve has inverted (i.e., the yield on the two-year note was higher than the yield on the 10-year note), a recession has followed. It’s a signal that the market believes real interest rates are falling and thus the economy is slowing.

In this current environment, it is a result of the Fed aggressively raising short-term rates to disable inflation. This can be negative for banks, who typically borrow on the short end of the curve (e.g., offering 1% interest on savings accounts) and lend at longer durations (e.g., providing a 30-year mortgage at 6.5%). The difference in the rate at which a bank lends and borrows (known as the net interest margin) tends to get compressed in times when the yield curve is inverted. Factor in less business and consumer borrowing, as well as higher risk of default during a (foretold) recession, and it is easy to see how inverted yield curves are very bad for banks.

They normally fight the inverted yield curve dynamic by not raising their non-maturity deposit rates as much as market rates. For example, if market rates rise 100 basis points, banks may only raise their savings or checking account rates by 25 basis points. This correlation (in this example of 25%) is known as a deposit beta. When the Fed raised the Fed Funds rate from 1.00% to 5.25% between 2004 and 2006, deposit betas ranged between 19% and 32% (depending on the account type). From 2015 through 2018, during another Fed interest rate tightening cycle deposit betas averaged ~12%.

One reason for the low deposit betas: banks not aggressively seeking deposits when they may not have enough prudent opportunities to lend the money in a recessionary environment. Also, banking customers for the past two plus decades have grown passively accustomed to low savings, checking, and CD rates and haven’t actively pursued better yielding alternatives.

That mid-amble on deposit betas aside, the yield curve inverting punished banks stocks, and Veritex was not spared, falling 35% from an intraday high of $41.75 a share in mid-March 2022 to $26.99 a share (intraday) four months later. The stock has fallen an additional 30% in aftermath of the collapse of Silicon Valley and Signature Bank (SBNY) over the past few days.

interLINK Deal Fails

However, it could be argued that Veritex was in a solid position, with the Texas economy likely to outperform the rest of the country and with a ton of relatively cheap (albeit now less cheap) dry powder incoming from its impending acquisition of interLINK. However, that deal suddenly fell through when the acquiree unilaterally pulled out of the agreement on September 7, 2022.

interLINK was later acquired by Webster Financial (WBS). Although the financial terms of the deal have not been disclosed, it was likely much higher than Veritex’s offer, the value of which had dropped from ~$91 million at its announcement to ~$61 million when interLINK walked away. In the meantime, interLINK’s retail account base had risen by ~100,000 to ~520,000.

Veritex’s stock initially flatlined after the deal termination news and then rallied in late October-early November 2022 after a solid 3Q22 earnings report. Possibly, the market was relieved that the bank was not going to potentially accelerate loan growth into an uncertain macroeconomic backdrop. Either way, shares of VBTX have retreated 15% since mid-November as the loss of funding source optionality (versus say the FHLB) and a lack of catalysts spur the market to worry about the possibility of much higher deposit betas in this cycle as banks appear to be competing directly with the U.S. Treasury for funds. With 3-month treasury bills yielding just under five percent (as of this writing), it’s enough yield for non-interest bearing depositors to seek interest bearing alternatives, forcing banks to offer more for deposits with one-year CD rates as high as 5.4%. As such, with Fed deposit betas elevated, net interest income growth is going to be significantly more challenging as net interest margins compress.

4Q22 Earnings & Outlook

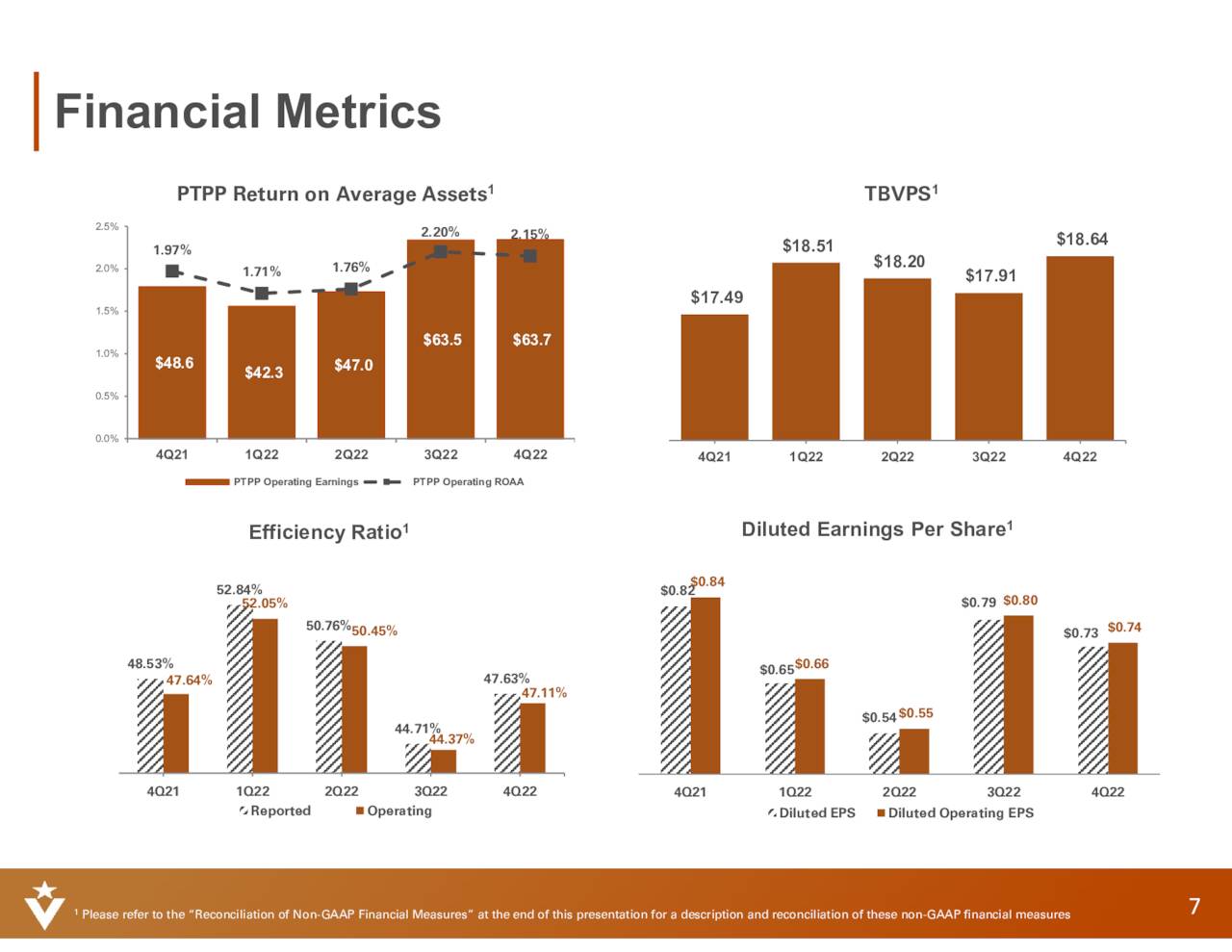

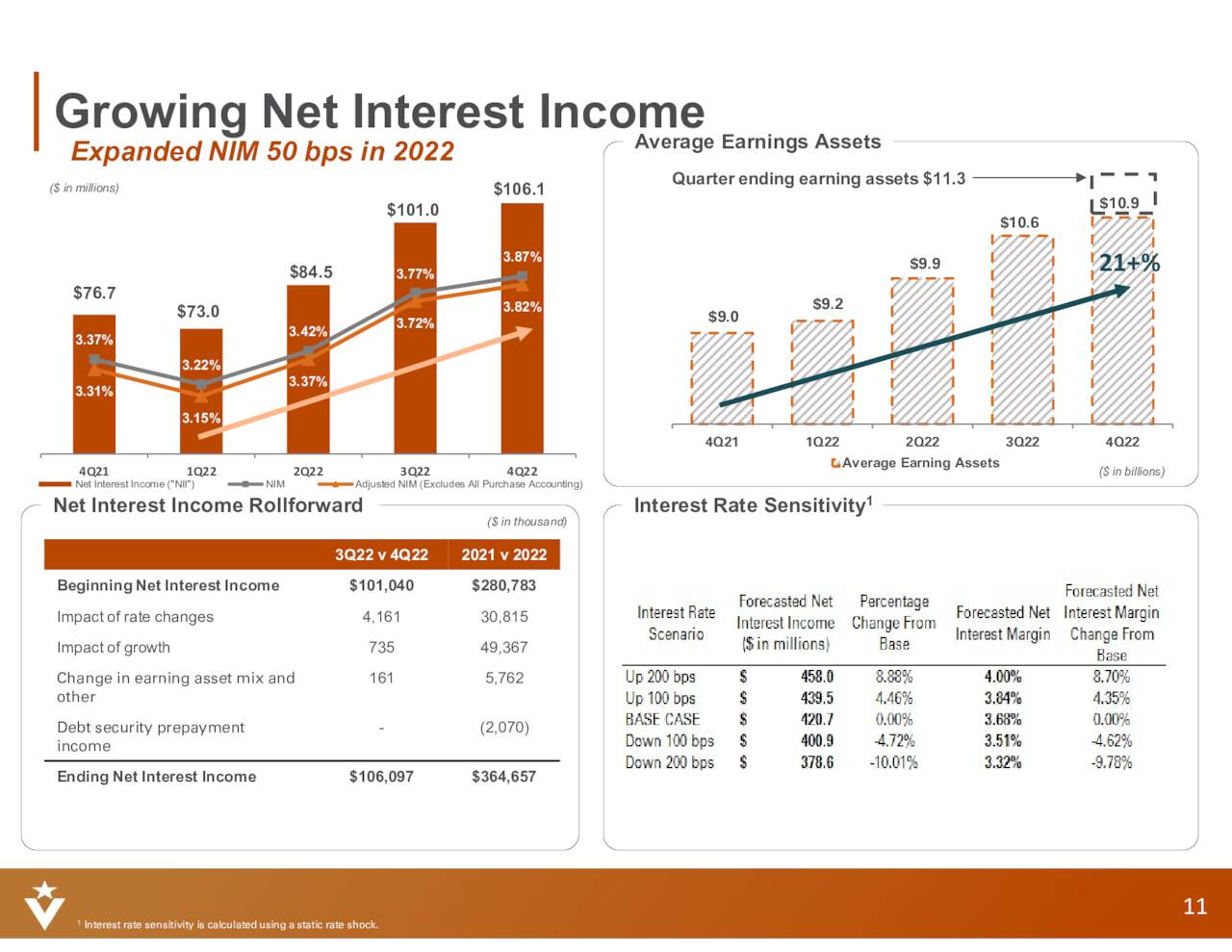

However, these deposit beta concerns have been partially offset at Veritex due to its loan portfolio being 70% variable and 6% hybrid and predominantly pegged to short-term rates. In other words, even though its average cost of deposit has risen from 17 basis points in 1Q22 to 146 basis points in 4Q22, it has been more than offset by a rise of 195 basis points (to 5.98%) in average loan yield over the same period.

January Company Presentation

That said, its deposit beta is 52% as measured by the cumulative change in interest-bearing deposit costs over the cumulative change in average effective Fed Funds rate since 1Q22. And it is getting worse: spot rate for total deposits (which includes non-interest bearing deposits) at YE22 was 1.98%, yet the average in 4Q22 was 1.46%. Also, its Thrive mortgage business is shrinking in terms of both volume – decreasing 38% 4Q22 vs 4Q21 to $414.2 million – and gain on sale margins, which cratered 171 basis points to 1.89%. That said, North Avenue had an excellent quarter, closing $75 million of USDA loans in 4Q22.

January Company Presentation

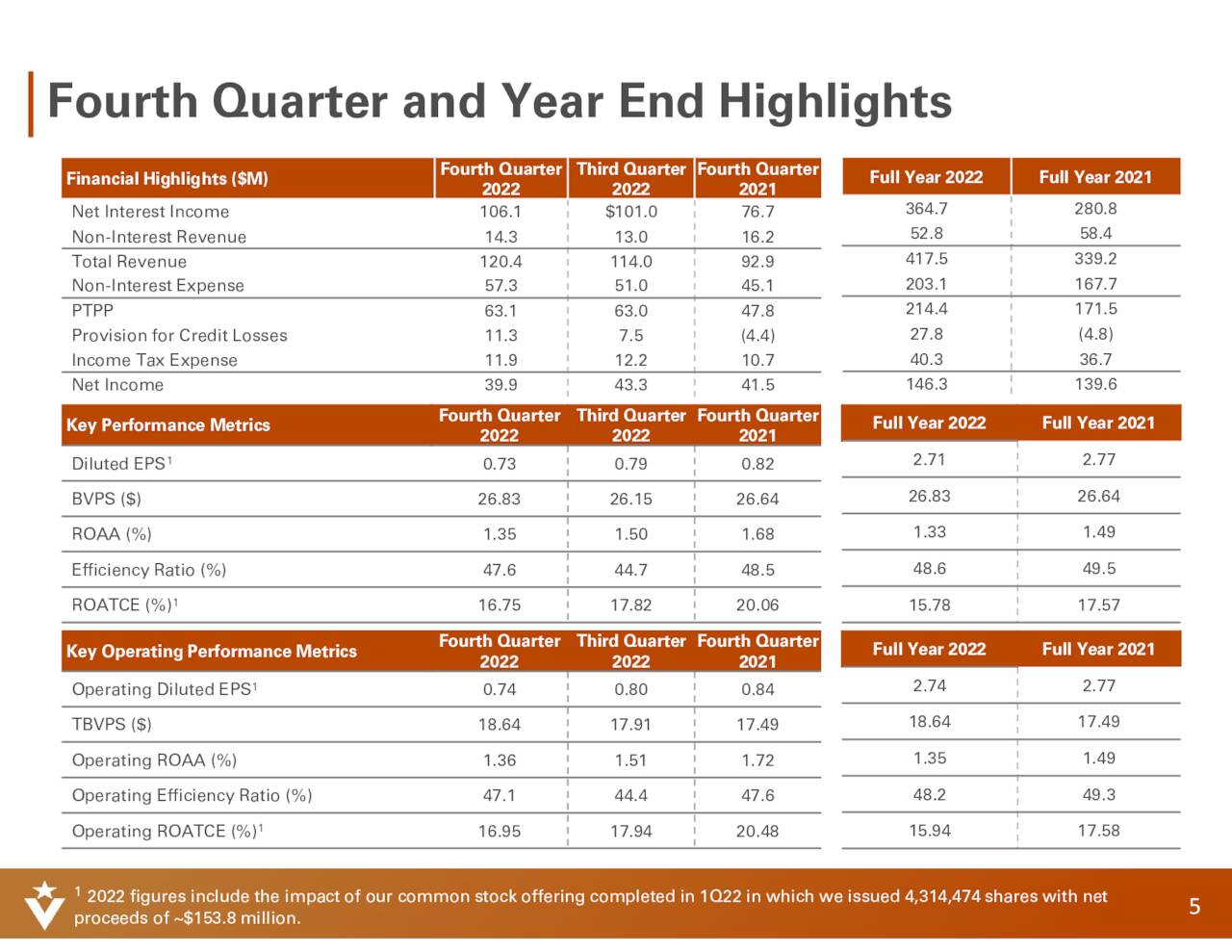

All of this amounted to 4Q22 non-GAAP EPS of $0.74 a share on total income of $120.4 million (net interest income of $106.1 million) versus $0.80 a share non-GAAP on total income of $114.0 million (net interest income of $101.0 million) in 3Q22. Net interest margin grew 10 basis points sequentially to 3.87%. However, owing to the aforementioned funding pressure, the triggering of a performance fee at North Avenue, and higher salary expenses, these results were below expectations, with its bottom line $0.14 a share under Street consensus. As a result, the market sold shares of VBTX off 7% in the subsequent trading session (January 25, 2023) to $26.38. However, that’s been its lowest close since.

January Company Presentation

Balance Sheet & Analyst Commentary:

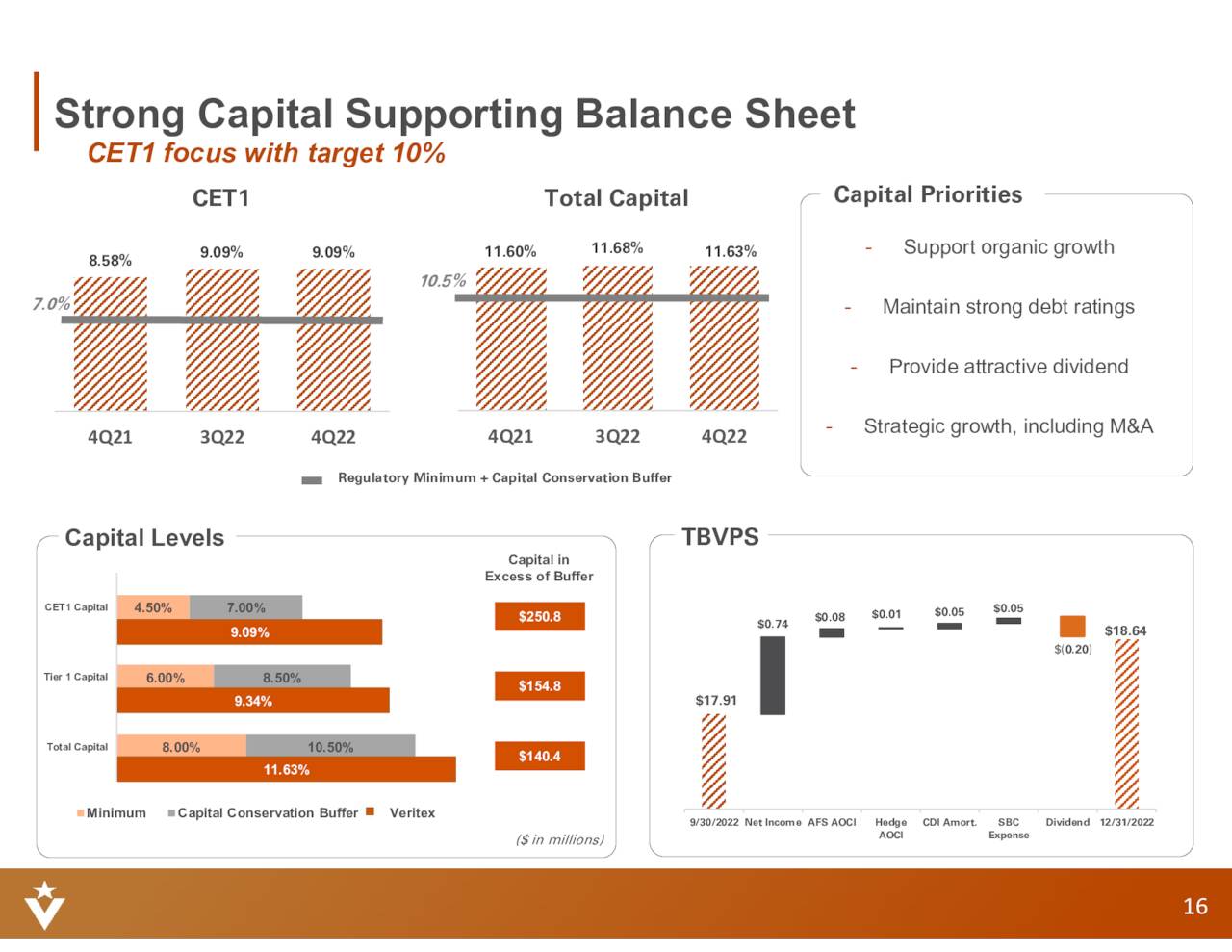

That is partially because Veritex is in sound financial position with CET1 capital steady at 9.09% versus a 4.50% minimum (7.00% with the capital conservation buffer). Allowance for credit losses increased $6 million sequentially to $91.1 million but nonperforming assets as a percentage of total are still very low at 0.36%. The bank’s tangible book value rose $0.73 sequentially to $18.64 to close out FY22. It entered 2022 at $17.49. Aided by the proceeds raised in its March 2022 secondary, Veritex held cash and equivalents of $436.1 million.

January Company Presentation

The bank pays a quarterly dividend of $0.20 a share for a current yield of 3.6%.

Street analysts are a small mixed bag, featuring one buy and one outperform rating versus two holds and a median price objective of $31.50. Raymond James downgraded the stock in early January 2023, citing impending macro headwinds and a lack of catalysts. On average, they expect Veritex to earn $3.19 a share (non-GAAP) on total income of $493.1 million in FY23, followed by $3.32 a share (non-GAAP) on total income of $514.8 million in FY24 – after earning $2.74 a share (non-GAAP) in FY22.

Board member John Sughrue invested $100,000 into his bank’s stock at an average price of $27.36 a share on February 10th, 2023. Over the past year, insiders have bought just over $1.8 million of shares in aggregate compared to less than $200,000 in insider sales.

Verdict:

It appears as if Veritex’s net interest margin has peaked for now. After achieving 3.87% in 4Q22, management’s base case for FY23 is 3.68% (vs 3.59% in FY22), translating to net interest income of $420.7 million (vs $364.7 million in FY22) assuming its volume assumptions are correct. Which is hard to have a hard feel for given the massive turmoil in the market and financial system over the past few days.

That said, the variable rate nature of its loan portfolio should insulate Veritex to a certain degree from further deposit beta increases. There is nothing wrong with Veritex and it seems cheap at less than seven times projected earnings with a solid dividend yield.

Veritex does not seem a bad bet if one believes the volatility in the small and regional banking sector soon ebbs and the past few days are not the start of another banking crisis. I personally am playing this is not the end of world’ theme in the banking sector with some new covered call positions this week in the SPDR S&P Regional Banking ETF (KRE). This strategy gives an investor a lot of diversification across the “not too big to fail” banking space, additional downside protection, a good yield and a surprisingly good return if this is not the end of the world and/or not the total collapse of the regional banking system.

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”― Henry Ford.