What Is the U.S. Dollar Index? Definition & How to Calculate

What is the US Dollar Index?

The US Dollar Index measures the dollar’s performance against a basket of currencies. The index, abbreviated USDX, contains six currencies: the euro, the Japanese yen, the pound sterling, the Canadian dollar, the Swedish krona and the Swiss franc. A rise in the index would indicate that the dollar has appreciated relative to other currencies, while a fall would indicate a depreciation.

A Brief History of the US Dollar Index

In 1973, the Federal Reserve established the US Dollar Index to track the dollar’s performance against other currencies after the US government abandoned the gold standard and suspended the Bretton Woods system two years earlier. The USDX contained ten currencies replacing five currencies prior to the introduction of the euro in 1999: the West German mark, the French franc, the Italian lira, the Dutch guilder and the Belgian franc.

The InterContinental Exchange (ICE) has monitored the composition and weighting of the US Dollar Index since 1985, when futures trading began. Options trading began in 1986.

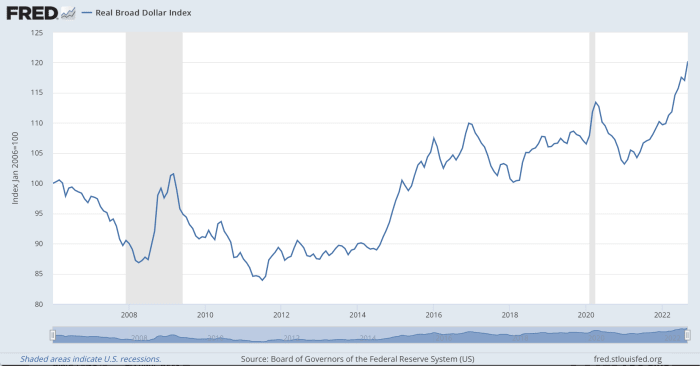

The Fed has its own version of an index that is compared to the currencies of countries that trade heavily with the US. The Nominal Broad US Dollar Index typically tracks the performance of the USDX.

Between 2006 and 2022, the US dollar oscillated between strength and weakness against other major currencies.

Federal Reserve Bank of St Louis

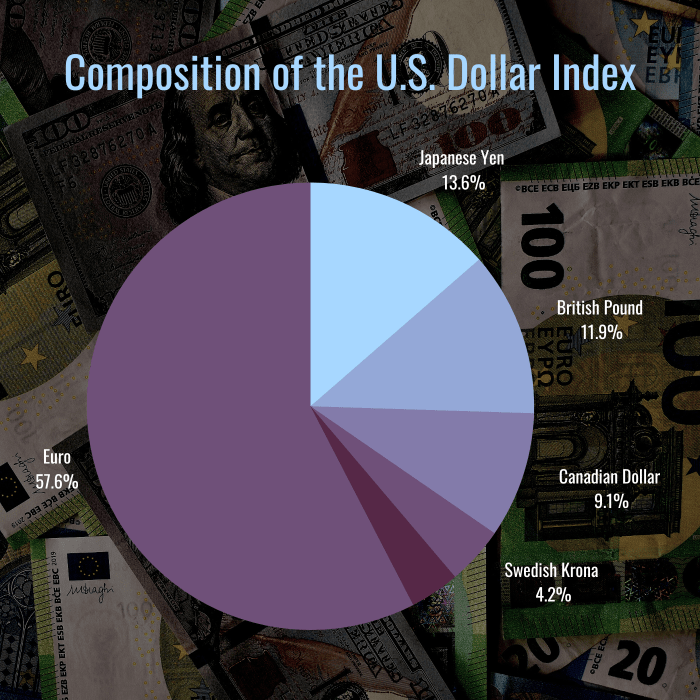

How is the US Dollar Index composed? How is it weighted?

The weighting of the US dollar index is aligned to the euro (57.6 percent) – more than to all other currencies: British pound (11.9 percent), Canadian dollar (9.1 percent), Swedish krona (4, 2 percent) and Swiss francs (3.6 percent).

The US Dollar Index is heavily weighted towards the Euro, the main currency for many countries in Europe.

ICE; canvas

How is the US Dollar Index calculated?

The base value for the US Dollar Index was set at 100 and its range has changed quite a bit since its inception in 1973. The following is the equation for the index with the dollar as the pricing currency at the exchange rates excluding the US dollar euro and the pound where it is the base.

USDX = 50.14348112 × EURUSD^-0.576 × USDJPY^0.136 × GBPUSD^-0.119 × USDCAD^0.091 × USDSEK^0.042 × USDCHF^0.036

| Exchange Rate Agreement | Actual Ratio (Price Currency/Base Currency) |

|---|---|

|

EUR USD |

EUR USD |

|

USDJPY |

USD/JPY |

|

GBPUSD |

GBP/USD |

|

USDCAD |

USD/CAD |

|

USDSEK |

USD/SEC |

|

USDCHF |

USD/CHF |

USDX = 50.14348112 × EURUSD^-0.576 × USDJPY^0.136 × GBPUSD^-0.119 × USDCAD^0.091 × USDSEK^0.042 × USDCHF^0.036

canvas

note: The caret symbol “^” represents the exponent, and the following number is in exponential form.

How Influential is the US Dollar Index?

Investors and analysts follow the US Dollar Index as a useful and immediate indicator of the strength of the dollar relative to other currencies.

In addition to the US dollar, many countries’ central banks tend to hold the currencies included in the index as part of their international reserves. While the US dollar serves as the currency of choice, the euro and yen serve as backup currencies. One risk of holding non-US dollar currencies is that any rise or fall in the relative value of the dollar could mean a weakening or strengthening of those currencies.

How to invest in the US Dollar Index

Investors cannot trade directly in the index itself but can invest through futures, options on those futures and exchange traded funds. Trading in futures and options is usually based on trading in the spot dollar market. For example, a strengthening dollar suggests higher futures prices.

The Bank for International Settlements — a financial institution controlled and banked by central banks around the world — reported that average daily turnover in US dollar-denominated contracts was US$3.3 trillion in April 2019, the latest available data.

Many investors turn to futures and options trading on the US Dollar Index to hedge against inflation. If inflation starts to accelerate, the Fed will consider tightening monetary policy. Interest rates are starting to rise, making dollar investments more attractive to investors.

Futures and Options

Futures on the index are traded 21 hours a day (including weekends) on the ICE platform in three geographic locations: New York, London and Singapore. The value of each contract is the value of the index multiplied by $1,000.

For example, if the index is trading at 115, the value of a single contract is $115,000. Futures trading using quarterly contracts: March, June, September and December. Unlike the futures trading of some commodities, currencies making up the index relative to their weighting can normally be delivered on the third Wednesday of the contract month.

Options on these futures are also traded on the ICE platform.

ETFs

ETFs like the Invesco DB US Dollar Index Bullish Fund, which is benchmarked against the Deutsche Bank Long USD Currency Portfolio Index-Excess Return, offer a way to indirectly invest in the US Dollar Index. Deutsche Bank Index performance is based on US Dollar Index futures.

Although not compared to an index, the WisdomTree Bloomberg US Dollar Bullish Fund is another popular fund that bases its performance on the dollar. The WisdomTree index is heavily weighted towards US Treasuries, but has exposure to some currencies.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions investors ask about the US Dollar Index.

Why are the Swedish Krona and Swiss Franc still part of the US Dollar Index?

When the dollar index was formed in the early 1970s, Sweden and Switzerland were considered stable governments and consequently their respective currencies – the krona and the franc – were perceived as stable currencies.

The general perception is that these countries remain stable and their currencies remain in the index’s weighting. One could argue that other countries have stable governments and stable currencies, but the conservative approach is akin to the adage: if it ain’t broke, don’t fix it.

Why aren’t the yuan and other major currencies part of the US dollar index?

China’s yuan is not traded as openly in the foreign exchange market as the currencies of many other nations, making it an unlikely candidate for inclusion in the US dollar index. The Norwegian Krone could be considered a possible constituent currency due to the stability of the government and its currency. Ultimately, the decision to change the composition of the Index rests with ICE.