XFLT: A Look At The Latest Report (NYSE:XFLT)

Khanchit Khirisutchalual

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published for members of the CEF/ETF Income Laboratory on May 27, 2023.

XAI Octagon Floating Rate & Alternative Income Term Trust’s (NYSE:XFLT) every six months at the latest The report shows that the distribution’s coverage remains strong. While there was some explanation in the most recent quarter compared to a year ago, there was a significant improvement. This was of course thanks to rising interest rates.

I’ve been following XFLT quite closely over the past year as it was a fund that would benefit from higher interest rates in terms of income generation. However, it wasn’t without its downsides either. We are still watching the share price drop, which is also due to higher interest rates and increasing credit risks.

Since our last update, the distribution has increased from $0.073 per month to $0.085. As we noted in the previous update, this increase was to be expected due to regulated investment trust requirements for distributions. Income generation increases, and so does the obligation to pay a higher distribution, regardless of what the actual underlying portfolio is doing.

Increasing the distribution from a fund that already has a distribution yield of ~14% seems a bit crazy, but we have to keep an eye on the numbers. The numbers told us an increase was likely, and in this case, that’s exactly what happened.

XFLT performance since last update (search alpha)

It hasn’t necessarily been that long since our last update, but with a new semi-annual report I wanted to provide an update on the latest figures. The fund has delivered a fairly competitive total return since the publication of our article on March 27, 2023. The fund traded at a slight premium but is not grossly overvalued. That could make it quite an interesting fund for investors to consider at this point.

The basics

- 1-year z-score: 0.75

- Premium: 4.84%

- Distribution yield: 15.53%

- Expense ratio: 4.45%

- Leverage: 40.53%

- Assets under management: $405.233 million

- Structure: Term (expected liquidation date December 31, 2029)

XFLT’s goal is to “target attractive total returns with a focus on income generation across multiple phases of the credit cycle.”

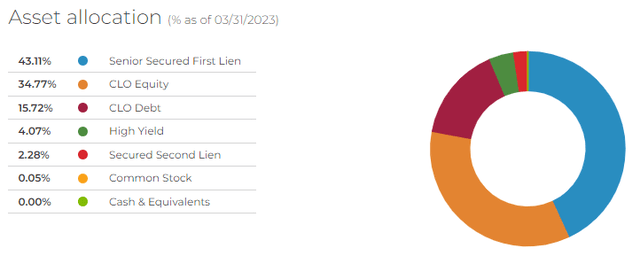

They will achieve this through “a dynamically managed portfolio of adjustable rate debt instruments and other structured credit investments within the private markets.” Under normal market conditions, the Trust will invest at least 80% of assets under management in senior secured loans, CLO debt, etc. Equity.”

The fund is heavily indebted and given the risk of the junk-rated underlying portfolio, we’re definitely looking for a risky fund. This is already a more volatile fund and the CEF structure allows for discounts/premiums that can make it even more volatile. So it’s not necessarily a fund that’s right for everyone.

The fund’s expense ratio rose to 4.45% in the most recent report, from 3.94% last year. When interest expense is factored in, the expense ratio rises to a rather shocking 8.67%. That’s up from 6.29% in last year’s half-year report.

While that’s high, it’s not uncommon for funds with exposure to CLOs. That’s less than what we’re seeing at Oxford Lane Capital (OXLC) and Eagle Point Credit Co (ECC), which are pure CLO funds. XFLT follows the approach of CLOs and Senior Loans.

XFLT asset allocation (XA Investments)

The rising costs here are due to more expensive forms of preferential leverage. The upside, however, is that this fixed rate cost has not increased the cost of borrowing, as is the case with the credit facility, which is funded at a floating rate of SOFR plus 1.45%.

They hold 6.5% 2026 Preferred Stock (XFLT.PA) and 6% 2029 Convertible Preferred Stock. At the end of March 2023, they had $122.35 million outstanding under their leverage facility. The average borrowing rate was 5.45% while the ending rate was 6.25%. This brings us to the point where the preferential interest rate is competitive with the variable interest rate.

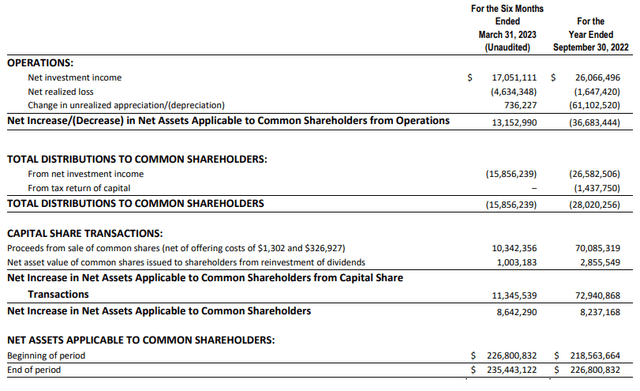

Current half-year report

The most recent half year report tells us that net investment income has increased significantly when we annualize the last six months and compare it to the last financial year. In fact, that would be an increase of almost 31%.

XFLT Half-Year Report (XA Investments)

However, this fund may issue shares through a public offering and its dividend reinvestment plan. In addition, the Fund has conducted two-share offerings. Since these were made at a premium to the net asset value, this has historically led to an increase on the basis of the net asset value per share. However, such things can somehow obscure the NII numbers when we look at them on an absolute basis. The idea is to raise more capital, and more shares will obviously increase income generation. It really comes down to whether we’re making additional earnings per share.

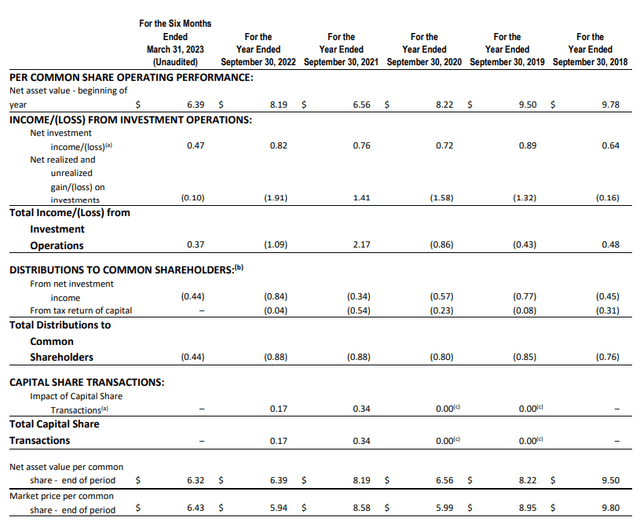

So by looking at the per-share data, we can get a better idea of what types of gains or declines we’re watching more closely.

XFLT Half-Year Report (XA Investments)

Here we see that the last half-year reading is $0.47. If we extrapolate this number to the previous financial year, we see an increase again. This time, it’s a 14.63% increase over the previous full-year period. This is positive for investors as rising interest rates have caused the fund’s NII to rise.

Likewise, if we look at the previous semi-annual report for the six months ended March 31, 2022, we see that the most recent report is trending in the right direction. At that point, it was $0.39, up 20.51% over the comparable six-month period.

It’s not necessarily all good news, however. One might notice that $0.47 on an annual basis yields only $0.94 compared to the annual payout of $1.02. This shows that coverage has dropped to just 92.16% in the last report.

This happened as the payout increased and the NII fell in the most recent quarter. We know the last quarter was down as the financial reporting for the fourth quarter of 2022 reported a NII of $0.26 per share. This was for the three months ended December 31, 2022. At $0.47 for the past six months, we know we saw a slowdown to $0.21 in the last quarter.

The good news here is that quarter after quarter; There may be discrepancies as the payout dates of the underlying investments differ. The longer periods of six months and a full year are better suited to give a more comprehensive picture.

Also, since they have increased the payout, it would be reasonable to assume that they have no plans to decrease it anytime soon. We should assume that their assumption is based on the information currently available and that they can continue to support it in the future.

This actually wasn’t uncommon either, given what we’ve seen from their CLO peers. OXLC reported a NII of $0.22 for the most recent quarter, down from $0.26 in the previous quarter. They also increased their distribution when they announced their latest quarter.

ECC also posted an NII of $0.35 for the most recent quarter, down from $0.37 in the previous quarter. The $0.37 was taken from the NII of $1.53 reported at the end of 2022 versus the nine month rate of $1.16 reported at the end of September 30, 2022.

Both OXLC and ECC rely on providing non-GAAP numbers such as “Core NII” or “NII and Realized Capital Losses/Gains.” So it may not be directly comparable, but the general assumption is that the most recent quarters were all down on a GAAP NII basis.

Diploma

Earnings and reporting will be tracked in subsequent reports. We’ll see if this slowdown continues or if we can restart the trend towards higher earnings. There will be a particular focus on it now that they’ve expanded their distribution, but the latest quarter would show that it’s not covered now, although previously it was fully covered.

With a distribution yield of nearly 16.5% on a NAV basis and operating expenses of nearly 4.5%, it’s almost amazing that coverage is as high as it is now. Because they had sufficient coverage beforehand, they were able to prepare for the payout expansion at all.

There could be a temporary slowdown in the last quarter and an acceleration in the following quarter. The Fed has continued to raise interest rates since this report, which could lead to an increase in the NII. While a Fed pause was widely expected, the latest data shows that we could see another 25 basis point hike in June. This could potentially benefit XFLT coverage provided we don’t reach the level where damage is too great and defaults are higher.

If we go into recession and the Fed cuts rates, that’s another risk going forward. Not only because of credit risks, which would increase during a recession, but also because of lower interest rates, yields on currently held debt stocks could fall. Put simply, the benefits of rising interest rates that we have seen would be reversed. This would likely be another factor that would weigh on the Fund’s returns.

Overall, this is an interesting fund to play high yield with some high yield play risks. Generous leverage and mostly sub-investment grade exposure, along with the fund’s rebate/premium mechanics inherent in a closed-end fund, mean there are many moving parts to consider before investing.