Academy Sports Stock: Great Read From DICK’S (NASDAQ:ASO)

matimix/iStock via Getty Images

The retail sector has had a rough ride this year as some of the e-commerce surges have picked up during the COVID wrap-up while retailers are overstocking. The sporting goods sector has held up better than most Retailers with Academy Sports and Outdoors (NASDAQ:ASO) actually traded back at the highs supported by a strong report by peer DICK’S Sporting Goods (DCS). my investment thesis is actually bullish on the stock based on the cheap valuation and signs the company doesn’t need to trim its targets.

Source: FinViz

Strong results from peer

Academy Sports reported results for FQ1’23 back on June 7th with solid results. The company slightly forecast fiscal ’23 results to be in the range of $6.55 to $7.25 per share, with comparable sales falling as much as 6% due to the slowing economy.

With shares trading in the $30 range at the time, Academy Sports was not correctly priced for earnings potential, even with a small reduction in guidance. In addition, a significant reduction in comp. turnover puts the sporting goods retailer on an easier hurdle in the next financial year.

The company reported results through the end of April, so Peer DICK’S updated results through the end of June provide a timely overview of the sector. Given retail weakness in May and June with rising gas prices, the market expected most retailers to reduce their numbers. Instead, DICK’s actually raised its EPS estimates for the year from $10.43 to $11.00 midway through. The company even narrowed what was originally a very wide range of $2.55 per share.

DICK’S has far more confidence in the business than Academy Sports at the end of August than it reported in early May. The big fear was that the results would diverge further, but DICK’S has narrowed the competition. Sales range of -6% to -2%.

The sporting goods sector has benefited from the increase in sales without the need for additional labor spending. Merchandise margins have increased even with higher supply chain costs.

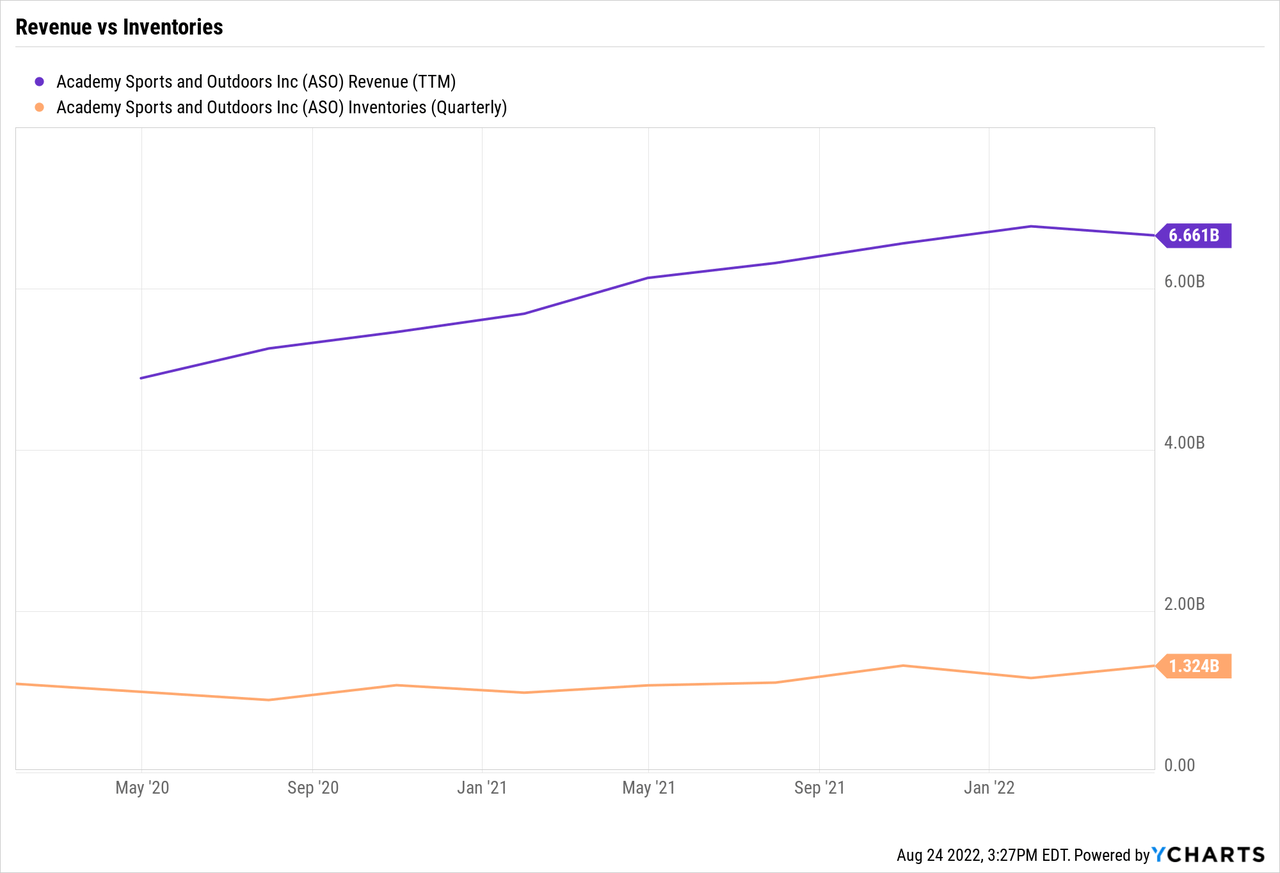

Academy Sports ended the April quarter with inventory of $1.3 billion, up 8.8% from Q1 2019. The sporting goods retailer now has a lot more sales, but higher inventories have been the overall downfall of apparel retailers in this environment that calls for aggressive promotions.

A major key to the DICK’S Q2’22 Earring report was no sign of any promotions in the sporting goods sector. Even in a recessionary environment, the company has given up only a small part of the sales boost while mostly maintaining higher margins.

Great facility

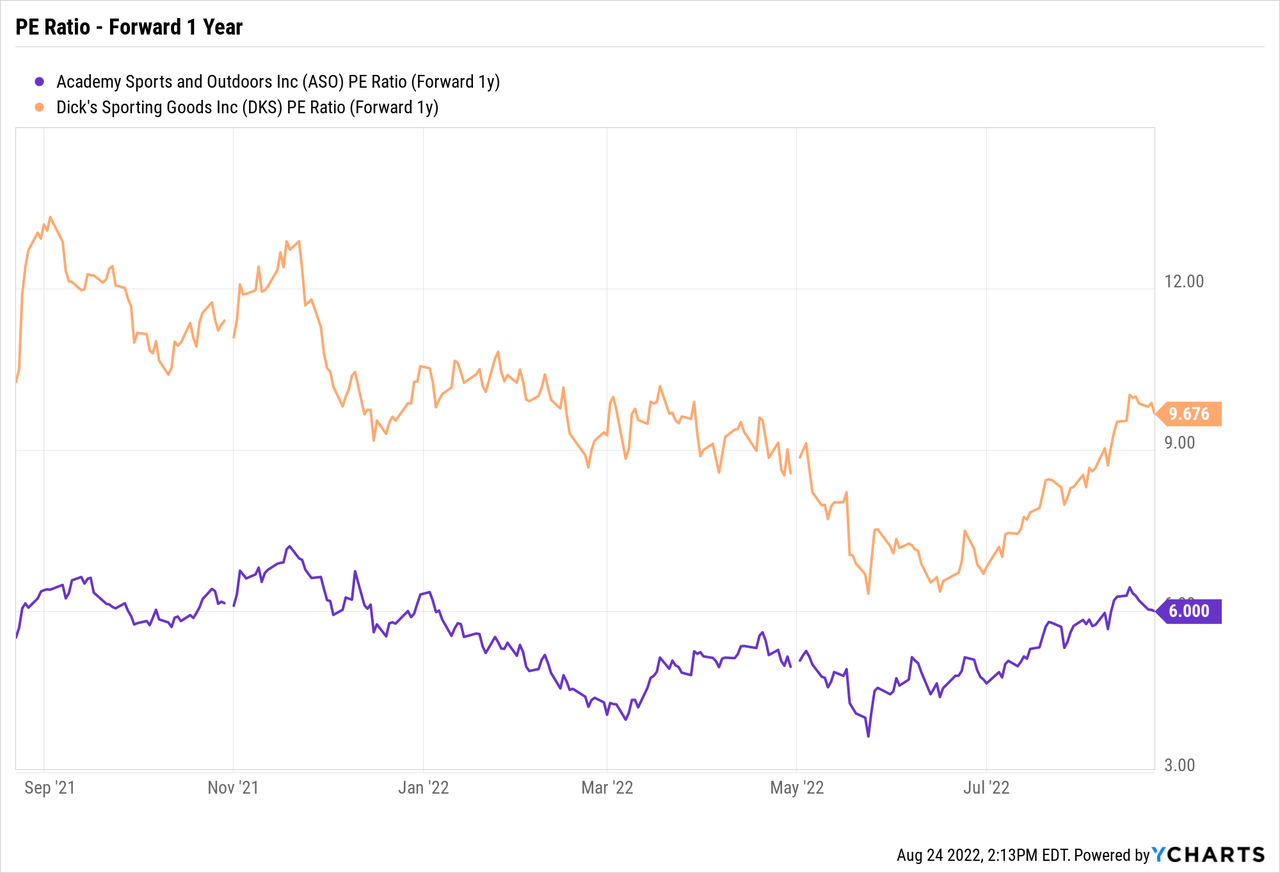

Academy Sports is trading near the all-time high of $51 following its 2020 IPO. The market probably doesn’t want to rush into the stock to the highs, but Academy Sports is trading at just 6x expected EPS. DICK’S is trading closer to 10x EPS estimate

Both stocks are incredibly cheap considering they can survive this year’s weak retail environment. Now, Academy Sports can use free cash flows with a $6+ profit stream to buy back stock.

The company bought 2.3 million shares for $88.5 million in Q1 2023 while paying a dividend yield of 0.7%. Academy Sports reduced its diluted share count from 96.5 million last FQ1 to just an average of 88.6 million shares last quarter.

As long as the stock is insanely cheap, management can continue to reduce the share count by as much as 10% per year, giving a big boost to earnings per share. At $7 per share, Academy would generate $600 million in earnings and potentially higher cash flows due to high depreciation costs and optimized inventory levels.

Bring away

The key takeaway for investors is that Academy Sports is further de-risked after solid numbers from DICK’S Sporting Goods. The sector is being overlooked by the market anticipating a major pullback at Comp. Selling after the Covid surge and not fully appreciating the better operations of the management teams.

Investors should keep buying Academy Sports, even at the highs.