DICK’S Sporting Goods: Parsing Under The Earnings Report Sustained Our Thesis (NYSE:DKS)

News by Joe Raedle/Getty Images

investment work

Our previous diploma thesis on DICK’S Sporting Goods (NYSE:DKS) concluded that the company faces potential risks from weaker cash flow to support aggressive expansion and historically high debt levels. After the Q4 earnings report, we checked the thesis is on course and Dick’s risks have only increased. We still recommended a sell.

Throwback to the holiday season

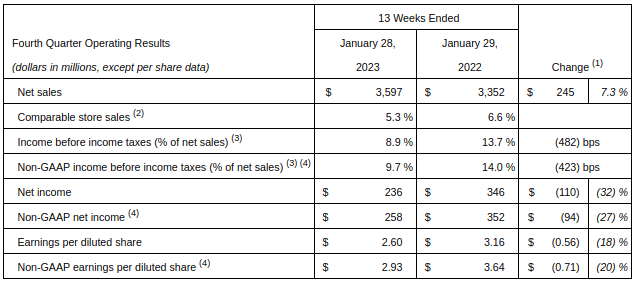

Is this Christmas season a bang? In fact, Dick net sales are up 7.3%, and comparable store sales have maintained a similar pace of growth at 5.3% year over year, compared to 6.6% in the year-ago quarter. However, net income is down 32% and earnings per diluted share are down 18% year over year.

Extract from Dick’s Q4 operating results (publication of company profits)

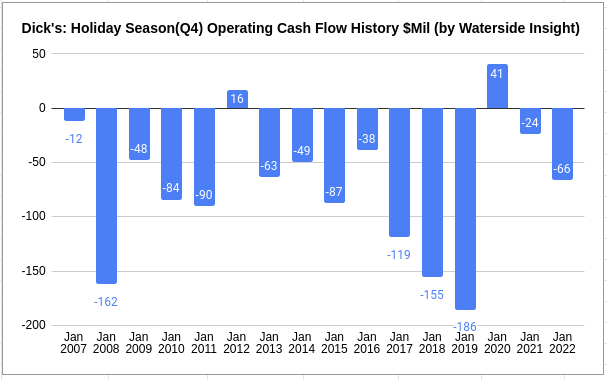

Comparing this Q4 Operating Cash Flow to its own peers shows the total Q4 Operating Cash Flow year since 2007, the past holiday season, at a historical average. In fact, it’s a lot better than either the fourth quarter of 2007 or 2019, but that bar seems too low to justify the stock price jumping to an all-time high.

Dick’s Historical Holiday Season Sales (Recorded by Waterside Insight using company data)

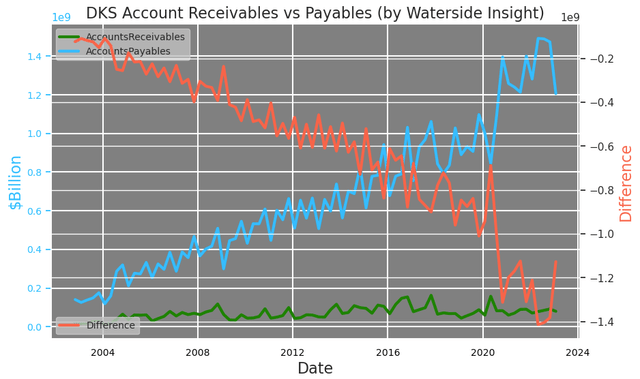

If we look at one of the previously published charts comparing receivables and payables, we can see that improvements have been made to reduce payables. But it doesn’t bring it back to levels until 2021, which is still a notch higher than it was before 2020. It’s a step in the right direction. However, as trade accounts receivable remain at a similar level, the difference between them is still at one of the lowest historical levels.

Dick’s Receivables and Payables (Calculated and mapped by Waterside Insight using company data)

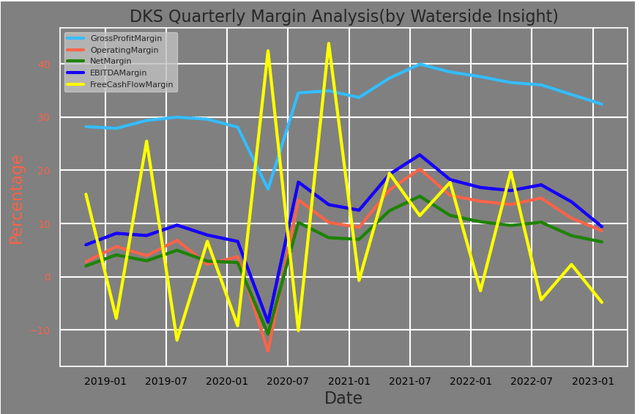

The quarterly margin analysis shows that most of the key margins continued the downward trend, although the gross margin is still at the higher level. The free cash flow margin has fallen significantly to one of the lowest levels. We pointed this out before; its cash flow generation weakened.

Dick’s margin analysis (Calculated and mapped by Waterside Insight using company data)

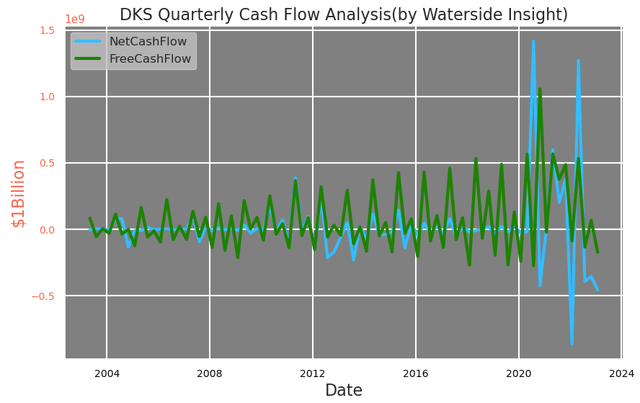

Notably, both free cash flow and net cash flow went negative in the most recent quarter. The company has doubled its dividend payout to $4. This means it will continue to expand its negative cash flow going forward.

Dick’s cash flow analysis (Calculated and mapped by Waterside Insight using company data)

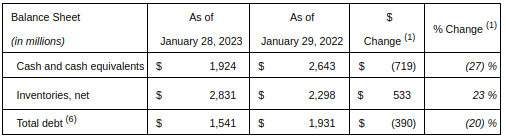

At the same time, the company’s inventories for the quarter grew 23% year over year and total debt fell 20% year over year, according to the earnings release.

Dick’s statement of accounts (publication of company profits)

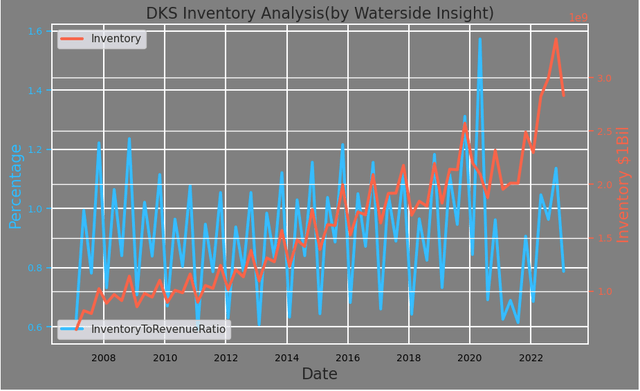

To put this in historical context, his inventory, while having a very high net worth, isn’t that scary when viewed as part of earnings. This quota is only at an average level. And the most recent quarter reduced inventory by 15% sequentially. That’s why we’re not that concerned about it right now, as long as the revenue growth continues.

Dick’s Inventory Analysis (Calculated and mapped by Waterside Insight using company data)

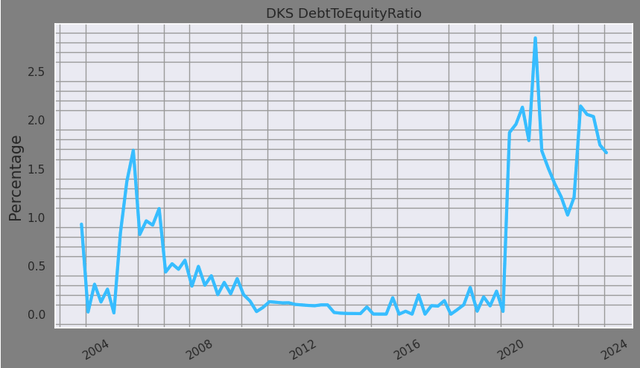

But its debt-to-equity ratio is still at one of its historically higher levels, even though the company has started paying back some of it.

Dick’s leverage (Calculated and mapped by Waterside Insight using company data)

In our previous article on Dick’s, we indicated that it was in an expansion mode, but the number of stores hadn’t grown much at the time. Since then, the company has announced plans to expand by approximately 9 new stores in 2023, 20 new stores in the US in two years, and 100 more new stores in five years, in addition to the recently announced acquisition of Moosejaw. It shows that we were right and early. Expanding aggressively when both interest rates and inflation are higher is an undertaking, to say the least. And, what’s more, aggressive expansion, when most margins are weakening and weakened cash flow must support not only high debt but also increased dividend payout, carries the risk that the current market price won’t settle. Our previous thesis remains valid: Dick’s will have to settle the expansion bill with weaker cash flow. Dick’s could see more revenue growth from that expansion, but it also has to foot the bill. As we mentioned earlier, most stores are leased, so there are large fixed components in the cost. If the expansion doesn’t go as expected, the impact could be larger than the market anticipates.

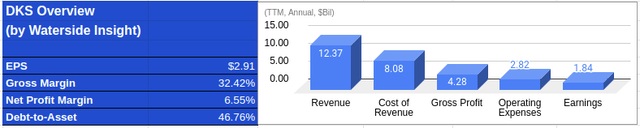

Financial overview

Dick’s financial overview (Calculated and mapped by Waterside Insight using company data)

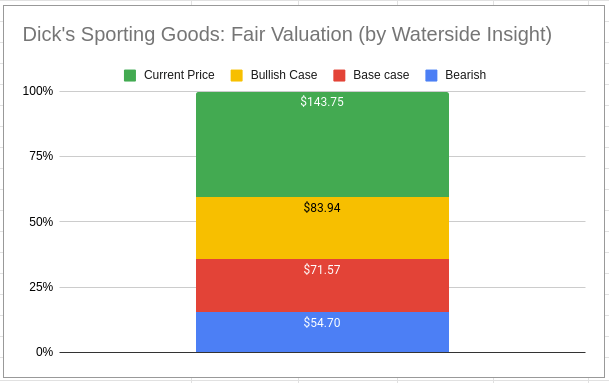

Evaluation

Since then, we have maintained our previous assessment of the company in terms of its fair valuation latest The quarterly result confirmed our expectation of continued cash flow and margin weakening. The current price is well above our highest estimate. One of the scenarios that could fulfill the current market price is that the company’s cash flow and earnings could grow in the mid-teens over the next five years and in the high single digits over the next five years without a downturn for the year comes. Given the macro environment, the company will have a hard time reversing its currently flagging margins in about a year. To achieve this kind of growth over the next five years, the company must literally more than double its revenue growth and achieve large reductions in costs and expenses every year for at least five years. We think that’s unlikely.

Dick’s fair review (Calculated and mapped by Waterside Insight using company data)

Diploma

Dick’s Sporting Goods is one of the largest retailers of sportswear and accessories in the country, with a market share of over 14%. And the company has captured and sustained the growth of the fitness and outdoor sports trend fueled by the pandemic lockdown in America. The company has an ambitious expansion plan for the next five years, but its current margin and cash flow are on a weaker trend. It’s showing steady revenue growth, but the market has priced in too much optimism that will be difficult for the company to realize as it expands. We believe this high valuation will not be maintained and recommend selling DKS shares.